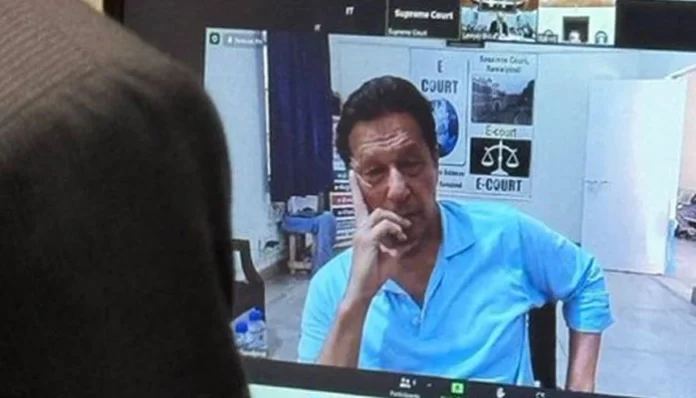

It was supposed to be a big day for Imran Khan. For the first time in more than eight months, the former prime minister was going to make a public appearance. Not only would he be visible, albeit through a video link, he was supposed to have had the opportunity to speak his mind.

The occasion was a hearing of the five-member bench of the Supreme Court deliberating on a case regarding the powers of the National Accountability Bureau. In the end, the anticipation of Mr Khan finally being able to speak ended in disappointment. The hearing was not broadcast on a live stream as it has been since Justice Qazi Faez Isa took over as Chief Justice. On top of this the court’s proceedings were adjourned without Mr Khan getting to speak.

But what exactly is the case that the Supreme Court is hearing and how does it involve the former prime minister? The mountain of legal challenges facing Mr Khan often makes it hard to keep track of just which case he is getting bail in, which one he is getting sentenced in, and which one he is appealing. Amongst the dozens of cases he is involved in, however, this one is different because Mr Khan is the petitioner.

Back in 2022, Imran Khan had filed a petition challenging amendments to the National Accountability Ordinance made by the then PDM government in parliament. The amendments in the ordinance had severely clipped the wings of NAB and had in turn given relief to a number of prominent politicians including Prime Minister Shehbaz Sharif, his brother Nawaz Sharif, and President Asif Ali Zardari amongst others. In his petition Mr Khan claimed that the government was using its position in a weakened parliament to pass legislation that would benefit its leaders.

How has the case proceeded up until this point? What are the powers of NAB that were clipped in the process? Why did Imran Khan not get to speak and could we expect him to get his day in court soon? The content in this publication is expensive to produce. But unlike other journalistic outfits, business publications have to cover the very organizations that directly give them advertisements. Hence, this large source of revenue, which is the lifeblood of other media houses, is severely compromised on account of Profit’s no-compromise policy when it comes to our reporting. No wonder, Profit has lost multiple ad deals, worth tens of millions of rupees, due to stories that held big businesses to account. Hence, for our work to continue unfettered, it must be supported by discerning readers who know the value of quality business journalism, not just for the economy but for the society as a whole.To read the full article, subscribe and support independent business journalism in Pakistan