It seems that Financial Year 2025 is going to be a mad scramble for revenues for the Federal Board of Revenue (FBR). With the International Monetary Fund (IMF) demanding a higher collection target, the FBR will look down the avenues of options that are present to it.

Considering the brain power at the FBR, it can be expected that some of the same sources of income will be squeezed further. Up till now, some of the measures that are expected are aimed at salaried class, general sales tax, dividend and capital gains. Lo and behold! The same sources which are milked every year round.

In other words, more of the same that has been carried out in the past. It seems that the tax babus sitting in their air conditioned offices are looking to hand out the same treatment that they have done in the days gone by. Why are these sources always singled out? The ease that they provide. Under the Income Tax Ordinance 2001, the FBR has designated withholding agents. The task of these agents is to collect tax on their behalf and then deposit it with the relevant banks. A swish of the wand and suddenly tax collections go up with little to no effort on the part of the tax walas.

Companies are mandated to cut salary at source which means the salaried class does not even get to see their whole salary. As these rates are changed at a whim, the company has no other choice but to apply the tax that is applicable to it. The plight of the salaried class has long been ignored as they are made target number 1 when any tax reform (read increase) is required.

Recently the Prime Minister did instruct the Finance Ministry to request the IMF to drop the proposed tax hike on salaried individuals. This would be a huge sigh of relief for everyone. However, the Finance Ministry has started considering these orders as more suggestions so don’t rest too easy.

The second easiest option is to increase the general sales tax that is charged. From a toffee to a life saving drug to a luxury car, all of these things are seen as being equal in terms of the tax regime and sales tax is collected from each of these items. Ismail Industries, for example, manufactures a pack of Cocomo. Regardless of the fact that it has 3 or 4 inside a packet, the company tags on the sales tax when it sells it to the wholesaler. As the packet of Cocomo goes from the wholesaler to a child or a childish adult, the sales tax has flowed upwards from the customer to the wholesaler that they had earlier paid.

The simplest job in this whole process is of the FBR. The FBR sees the total amount of Cocomo sold by Ismail Industries and then slaps the sales tax on that. This means that for every packet of Cocomo sold, the company is liable to pay the tax and then collect it from the other participants in the supply chain.

Why are these sources of revenues used? Well it’s the fact that they are automated, onerous to someone else and tax officers have to do the least bit possible in order to show an increase in their tax collection. They have to do so in order to justify buying plazas which cost exorbitant amounts of money on Main Boulevard Gulberg with the government footing the bill.

The last two sources that have been mentioned are strictly applicable to investors on the stock exchange. The attraction of these two sources is again the same. There are participants in the market who have to deduct and collect this tax and then show it as a part of tax collected by the government.

Capital Gains Tax

In 2011, the government came up with an application of Capital Gains Tax (CGT) in the stock exchange. The goal of this tax was not to limit or curb any behavior of the people. The purpose was to boost the tax collections by applying a taxation mechanism on another source of income that had been left untouched in the past. How successful has the system been?

Quite simply, a capital gains tax is a tax that is levied when an investor earns a profit or makes a capital gain. An investor buys a share for Rs 100 and sells it for Rs 110. He earns a profit of Rs 10. Capital gains tax would deduct an amount from these Rs 10 and give the remaining amount to the investor. The beauty of the system is that it is automated and the tax is deducted without much hassle or issues for the investor.

On a daily basis, millions of shares are traded which have trading value that easily goes into the billions. Imagine a boffin sitting with sheets of trade and calculating the tax liable on each and every investor. To save time and effort, there is National Clearing Company of Pakistan (NCCPL) in the middle. Imagine an investor buying shares for Rs 100. As soon as the trade is carried out, the shares are taken in the account of the buyer at that cost. 9 months down the line, he sells the shares for Rs 110. The tax applicable would mean that he has to pay Rs 1.5 as capital gains tax against this. The NCCPL will deduct the amount from the client’s account automatically and will deposit this tax with the FBR at the end of the year. With the volume and value of trade being carried out, the whole system automatically calculates and deducts this tax on a monthly basis.

This differs from the CGT applicable in real estate as real estate does not have a central clearing system which clears all the trade. The deals carried out in the real estate sector are carried out informally in many cases which means that the buying and selling prices are not disclosed or recorded in any record book. Even in cases where values are allotted, District Collector (DC) rate is used in order to determine value of the properties and then these rates are used to determine CGT.

Till a few years ago, there was a huge discrepancy between the stock market and real estate market as real estate was seen exempt from any such taxes. Recently, steps have been taken to narrow this gap and in the last budget, the capital gains tax was brought in line with the real estate taxes. Even though there is still a gap in terms of valuation and determining value of a real estate project against a stock, this is a step which has looked to narrow the gap between the two.

The tax in the stock market was put into place 14 years ago with different slabs being implemented at different times. The tax has come into focus again this year as there are talks that this rate may be changed. The relevance of the tax is based on the fact that the index has shot up by 73.6% from where it was at the start of July. The index is currently trading at almost 76,000 points while it was hovering around 43,500 points at the start of the financial year. As there are rumors that tax rate can be increased in the coming budget, investors might look to sell and book their profits at a lower rate of taxation. The new regime will be expected to come in from 1st of July 2024 and investors have an opportunity to book their profits within this year.

There can be measures that can be put in place in the next budget where the rates applicable can be increased by one step in order to increase tax collection. It is an easy way to boost tax revenues with little to no effort required from the tax authority. In addition to that, investors who have invested in the market will not suddenly look to take out their investments foreseeing a rise in the tax rates. Their behavior is not conditioned on the tax rate. Their interest is more in relation to earning a good return on their investment.

The market might see some selling before June 30th where investors will book their profits at a lower rate but they will weigh this against buying these shares later and going upwards in terms of the holding period of their investment. An investor bought the shares two years back and wants to sell these shares in order to decrease his tax liability. When he buys the shares again after June, his holding would have reset and now he will have a share he bought in July 2024 rather than one that he had two years ago.

The government needs to realize that any forecast on such a tax is risky. Even though the government would expect the market to stay in an upward trajectory, there is no guarantee that it will happen. Setting budgets on a tax which can be reversed in a matter of days will mean that the government is banking on a source of tax which can easily disappear.

Going back 14 years, the rationale behind the tax being put into place was that the investment horizon in the stock market was less than one year. Investors looked to buy a share and then sell it within one year earning a profit. In order to discourage this behavior, the tax was put into place which would have meant that investors would hold their stocks for more than one year and then save their profits from being taxed.

Over time, this rationale became distorted. What started off from one year has now become 5 years. In order to waive off the capital gains tax being implemented, an investor has to hold shares for 5 years. It seems that the government has changed the design and functionality of the tax in order to create a system which provides the maximum amount of revenues to it rather than encourage or discourage any behavior.

The tax on dividends is much the same as the tax on capital gains. When a company announces a dividend to be given out, the company is liable to withhold a specific amount from the dividend and the remaining is given to the investor. A company, for example, can give out a dividend of Rs 10. When the dividend is deposited in the investor’s account, the company has to deduct Rs. 1 from this and give Rs 9 to the investors. This is again an easy source of income as the company is responsible for the tax.

What should the government focus on?

In the face of easy solutions, the government needs to have a more stringent approach in terms of tax reform. There is a need to formalize and document all of the economy rather than squeeze out the formal portion of it. There are calls from all the participants of the economy that the real estate and agriculture sectors need to step up and pay their fair share of taxes. This would also mean that much of the cash based economic system is shunned and better banking channels are developed. This will further add to the taxable base of the economy.

Digitization and automation of the economy has shown that it is easier to calculate the tax liability and income from different sources and processes can be placed which deduct taxes automatically at different phases.

Experts in the stock market feel that it is the best avenue for foreign investment. Investors in foreign countries can easily invest in the Pakistani market by buying shares. They are able to make a liquid investment in a matter of days and can monitor these investments on a daily basis. Currently all investors are seen as the same. The new budget can look to reduce or even eliminate taxation of foreign investment in order to promote more investment from outside its borders. This tax relief exists on government of Pakistan securities in relation to their dividends and capital gains already. This can be expanded to the whole market to bolster the market and foreign investment.

The government also has some skin in the game in this regard. Recently, the stock market listed the government debt securities and sukuks in the market which can be bought by foreign investors easily. By tapping into this source of funds, the government can get better rates on their bonds while the foreigners can be exempted from profit on debt and capital gain tax that might become liable on them. As foreign investors invest in the market, local investors also gain confidence while investing by themselves.

There is also a blanket approach which is used when CGT is applied in the stock market. The CGT is applied on the shares, the futures market, the mutual funds, Real Estate Investment Trusts and Collective Investment Schemes. All these different investment vehicles have different functions and a tax regime should be applied which maximizes the utility of each of these investments rather than look at all of them as a monolith. In the past 14 years, the CGT has gone through many revisions as well. Market participants feel that this should be eliminated and the government should have consistent and long term policies to give certainty. The normal course of action has been to chop and change policies on a whim and there needs to be a long term focus on policies. This will allow market participants and investors to plan and charter a path for themselves rather than react to each and every change.

Beating the same old drum again

And here we end as we always do with stories that have to do with taxation. After all, why not? If the FBR and our tax babus can insist on having the same old tired ideas, then we can keep making the same point over and over again too.

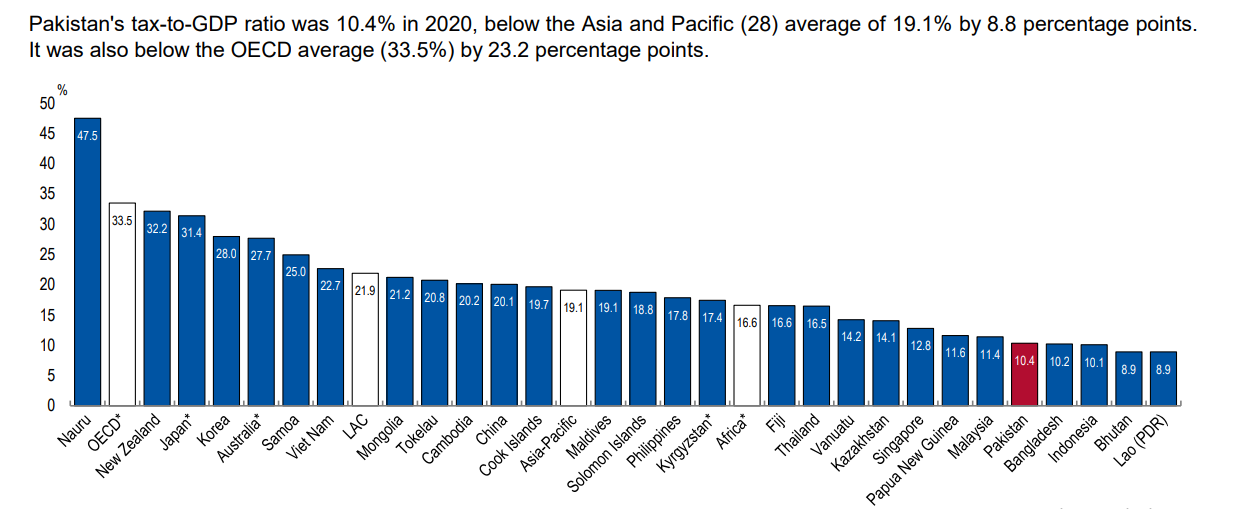

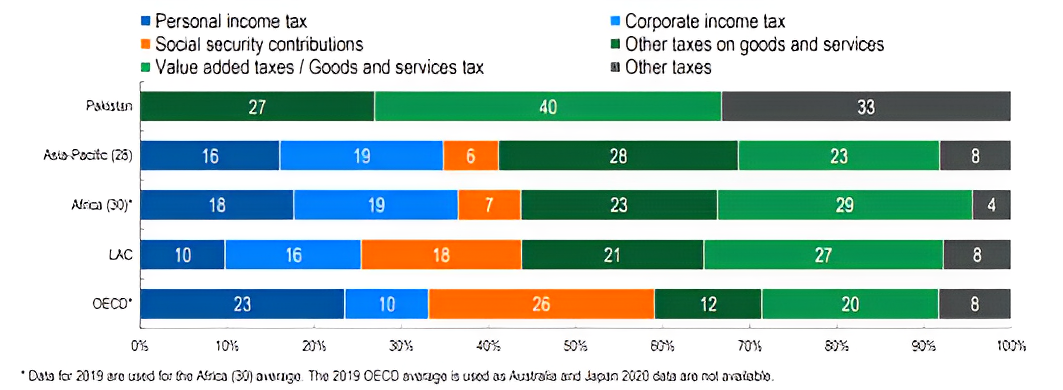

No measures of this sort will matter unless Pakistan fixes its taxation philosophy, and fixing it is easy because we are not currently taxing in the spirit of our constitution. The real problem is that Pakistanis are taxed unfairly and those that should be paying the lion’s share end up paying nothing. Just take a look at Pakistan’s tax structure. Tax structure refers to the share of each tax in total tax revenues. The highest share of tax revenues in Pakistan in 2020 was derived from value added taxes / goods and services tax (39.8%). The second-highest share of tax revenues in 2020 was derived from other taxes (33.3%).

In comparison to Pakistan, countries in the Asia-Pacific region only collect about 23% of their taxation from goods and services taxes — meaning Pakistan’s average is almost double. Why is this the case? The biggest reason of course is that taxation in the country is centralised. The FBR collects almost all taxes (even the ones that should be collected by provinces under the 18th amendment) and then those collections are then given to the provinces in the form of the NFC award leaving the federal government with very little spending money. In an earlier interview former Finance Minister Dr. Hafiz Pasha, while talking to Profit, lamented that, “We as a country have failed to implement the beautiful 18th amendment. The implementation has been slow and weak.”

Since the share of the provincial governments, under the NFC awards, over the last few years has been increased from 40% to around 57%, it has provided the provinces with very little incentive to develop their own revenue sources. Despite having access to the two biggest cash cows, services and agriculture, the share of provincial tax revenue is close to 1% of the GDP. “You would be surprised to know that the corresponding number for Indian provinces is around 6% of the GDP, with similar fiscal powers,” says Dr. Pasha.

The solution of course is right in front of us: devolution. More than just being a third tier of democracy, having a local bodies system means having a new economic process. In essence, it is not just a new administrative stratification, but also involves the dispensation and spending of money. Things such as education and health that people automatically look towards the provincial government for would now be handled by local representatives. Perhaps most crucially, the ability of local governments to collect taxes and release their own schedule of taxation allows them to make their own money and spend it on themselves rather than waiting for the benevolence of the provincial or federal government.