On 12 June 2024, Finance Minister Aurangzeb presented the budget for fiscal year 2024-2025 in parliament. Before the budget, just like other sectors, the banking sector was also anticipating new taxes. The only question was what shape these taxes would take.

Industry experts seemed to have their eyes peeled on what would become of three taxes in particular:

- Tax on lower Advance Deposit Ratio (ADR)

- A 10% Super Tax

- Tax rates on government securities i.e. T-Bill/PIBs

All three of these are taxes that banks have had to deal with in recent years. Not so long ago Muhamaad Aurangzeb himself, then the CEO and President of HBL, would have been hoping the banking sector would avoid these taxes. So how did they come out in the budget? Profit looks at what the banking sector gained and lost from this year’s budget.

ADR — additional taxes to deal with

The ADR has been a contentious issue for the past couple of years. Very basically explained, a bank’s business is to accept deposits from customers and lend funds to other customers. But over the past few years, the interest rate in Pakistan has been so high that banks have found it easier to accept deposits compared to lending money.

So what do the banks do? They lend to the one entity that does constantly need money no matter what: the government. This proved a pretty good system for the banks which have been making huge profits. But the government felt this was bad business. In a bid to force banks to lend more rather than just buy government-backed securities, the government placed an additional tax on any bank with an ADR lower than 50% in 2022. ADR is basically advances (lending) divided by deposits. Banks had to pay a 10% additional tax if the ADR is between 40% and 50%, a 16% additional tax if the ADR falls below 40%, and no additional tax if the ADR is above 50%. This additional tax was applicable on income from federal government securities.

This was seemingly a way to encourage banks to lend more and encourage business at a time when the economy has been in the doldrums. But a lot went down behind the scenes, and the banks were able to window dress their accounts to avoid these taxes despite successive finance ministers doubling down on it. That is why the policy did not last too long. In 2023, banks were exempted from this tax as announced in the fiscal year 2024 budget, so that banks had enough liquidity to lend to the cash-strapped government.

However, analysts were anticipating that the banking sector will not be exempted from this tax in 2024 in the fiscal year 2025 budget. Yet, as per a report by Dawn, the banking industry was hopeful that the upcoming budget would eliminate the Federal Board of Revenue (FBR)’s ADR-linked tax policy. As per the report, the Pakistan Banks Association (PBA) had remained engaged with the finance ministry and the FBR on the ADR-linked taxation and other levies on the banks in recent weeks. PBA chief executive officer (CEO) Muneer Kamal was hopeful that the “serious discussions” with the FBR would yield results and lead to a solution.

However, contrary to the hopes of the sector, in the budget, the government stayed mum on the ADR-based tax and did not eliminate the tax for the fiscal year 2025. And similarly, there also seems to have been no change when it comes to the Super Tax, which the government actually imposed to avoid the situation that arose with the ADR-based tax back in 2023.

Continuation of super tax

Similarly, the super tax previously levied on the sector will remain applicable to banking companies for the tax year 2023 and subsequent years, in accordance with analyst expectations. This tax was imposed on the sector in fiscal year 2023.

The banks have long felt that this Super Tax is not quite fair. The Pakistani banking industry is already highly taxed. In 2021, the corporate income tax on banks was a steep 35%. That is 6% higher than the 29% figure imposed on non-banking-businesses. Afterwards, the tax rate was further increased to 39%. And the 10% Super Tax on incomes of over Rs 300 million was imposed on top of all this.

Disallowance of Provisions as Expenses

A new measure introduced by the government significantly impacting the banking sector is the disallowance of “substandard” or “doubtful” bad debts as expenses. Previously, banks could classify these provisions as expenses, which reduced their taxable income. Now, under the new rule, these provisions cannot be deducted, inflating taxable income.

In layman’s terms, banks lend to individuals and entities, including the government. They set aside provisions for loans they might not recover, classifying them as substandard loans or doubtful debts. These provisions, recorded in the income statement, are now excluded from allowable expenses, leading to higher taxable income.

Moreover, from calendar year 2024 onwards, banks had to implement International Financial Reporting Standards (IFRS) 9. As the name suggests, IFRS are global standards that set the rules for drafting financial statements. The standards are adopted by many countries including Pakistan, to ensure the uniformity of financial reporting to allow for comparability of financial statements and investor reliance.

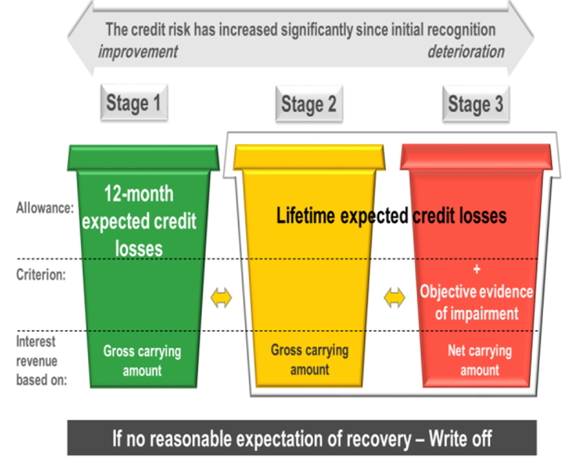

IFRS-9 governs the treatment of financial instruments including assets and liabilities. Under IFRS 9’s Expected Credit Loss (ECL) Model, banks periodically assess the recoverability of their loan portfolio, recording appropriate provisions based on the credit risk stages.

If a portion of it is deemed unrecoverable, an appropriate provision should be recorded or in simple terms a loss should be booked.The quantum of the loss depends on the stage of the assessed credit risk. So, initially the loans are placed under stage 1 which doesn’t imply a significant risk of default. However, if there is a significant increase in credit risk like amounts being rescheduled or categorised as non performing loan, the loans are moved to stage two and three, and additional amounts are provided for.

However, with the new measure introduced, the banks will no longer be able to deduct these provisions from income. “All provisions under Prudential Regulations and IFRS 9, except ‘loss category’ will not be allowed as an expense”, reads a JS Global Budget ‘FY25: Preparing for ambitious targets under the new IMF program’ report. This would overstate the income.

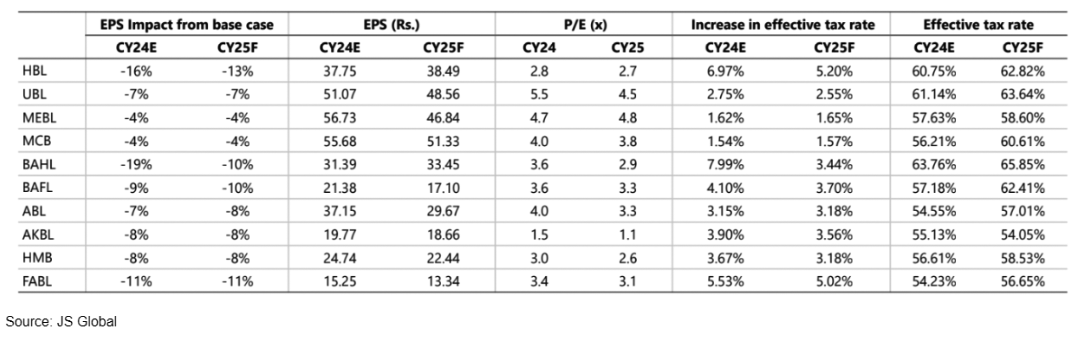

This would, consequently, result in higher effective tax for the banks. “The sector will witness a higher effective tax rate, given the 39% + 10% tax (Corporate + Super Tax) will be applicable on (profit before tax) plus provision expenses,” added JS Global Budget ‘FY25: Preparing for ambitious targets under the new IMF program’ report.

“This will negatively affect the sector as it will increase the effective tax rate of banks by 1-7% and cause profits to fall by 2-10% in our view,” stated Topline Securities in its fiscal year 2025 budget analysis report.

As the calculations from JS Global below shows, the effective tax rate for the banks, as a consequence of this measure, has increased and banks would have to pay an effective tax rate of 55%-65% in 2024 and 2025.