Many of today’s tech giants began their journey in the most humble of settings, transforming small-scale operations into global powerhouses. A startup that started in an apartment can draw inspiration from the success stories of Amazon and Google, both of which began with modest beginnings and grew exponentially through innovation, determination, and strategic vision.

Amazon, for instance, was founded by Jeff Bezos in 1994 in the garage of his rented home in Bellevue, Washington. With a clear vision of leveraging the internet’s potential to revolutionize retail, Bezos started Amazon as an online bookstore. Despite the limitations of space and resources, Bezos meticulously planned his operations, focusing on customer satisfaction and building a robust logistics network. This relentless focus on scalability and innovation allowed Amazon to diversify its offerings rapidly, moving from books to a wide array of products and services. Today, Amazon is a global e-commerce and technology giant, symbolizing how far a startup can go with the right vision and execution.

Similarly, Google’s inception in a garage is now legendary. In 1998, Larry Page and Sergey Brin, then Stanford University Ph.D. students, launched Google from a friend’s garage in Menlo Park, California. Initially a research project, their search engine quickly gained traction due to its superior algorithm that provided more relevant search results. The modest garage setting did not hinder their ambition; instead, it fostered a culture of creativity and innovation. As Google grew, it maintained its startup ethos, continuously evolving its technology and expanding into new domains like advertising, cloud computing, and hardware. Today, Google is synonymous with internet search and has diversified into numerous tech fields, illustrating the potential for massive growth from small beginnings.

Why do these examples matter? Because for a startup that is originating in an apartment and has since come a very long way in a very short time, these stories are powerful examples of how visionary thinking, strategic planning, and an unwavering commitment to the cause it has dedicated itself to can drive exponential growth. By leveraging limited resources wisely, focusing on solving real problems, and scaling operations thoughtfully, such a startup can carve out its path to success. This startup is PostEx which had very humble beginnings in a shabby apartment in Lahore’s Barkat Market.

The humble beginnings become all the more important when you have achieved success. PostEx has been significantly successful in what it set out to do: logistics and fintech for small, medium and large businesses. And it has been able to do that in a very short period of three years.

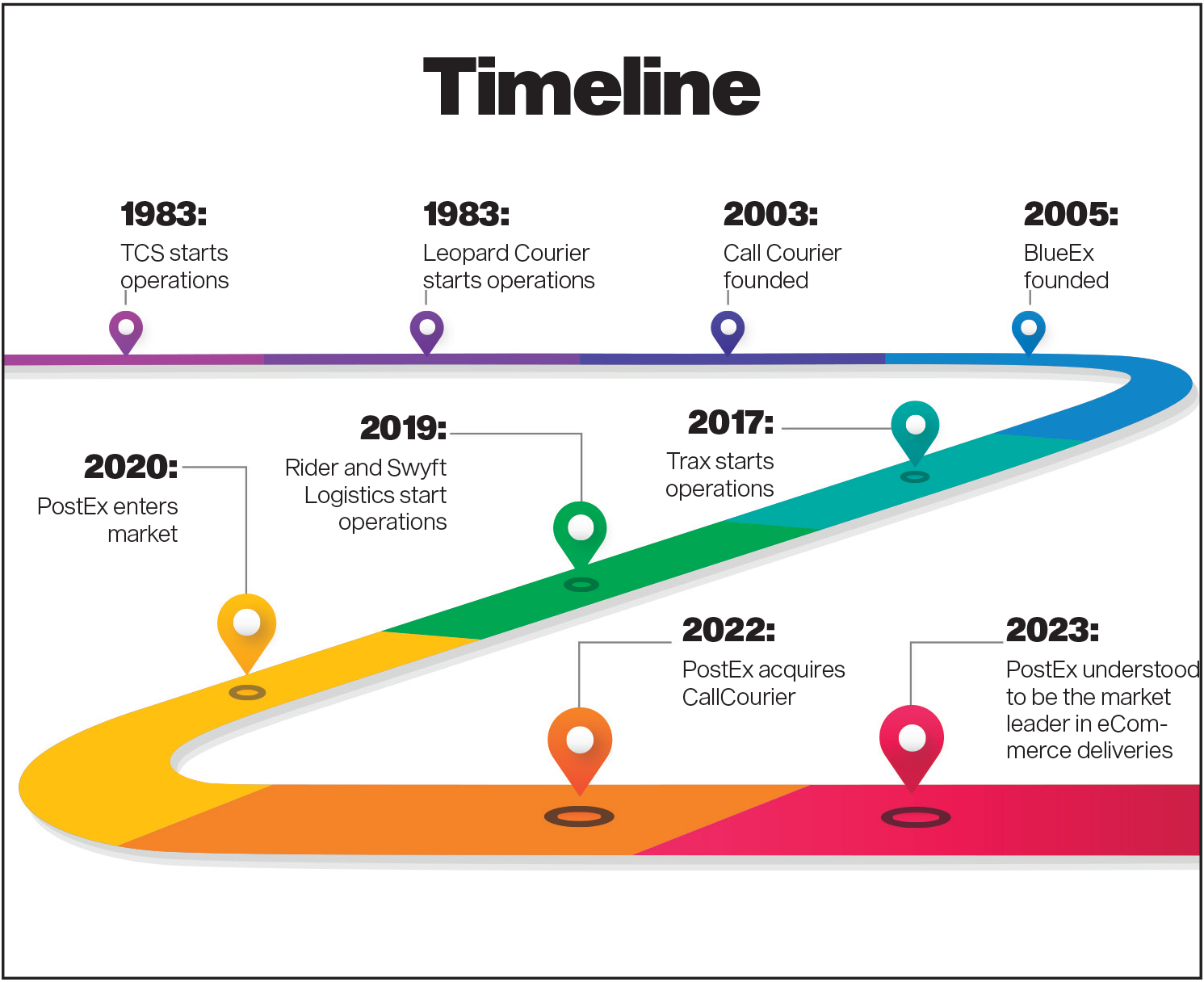

Founded in 2020, PostEx has been able to come at the top, overtaking many of the established eCommerce delivery companies in the market such as Leopards Courier and even TCS, according to data from Data Darbar. One of its competitors among startups, Swyft Logistics, is practically dead while others maintain a small scale. Thanks to an acquisition, PostEx was able to get to the top spot in a short time.

The eCommerce landscape that was

The eCommerce logistics sector in Pakistan, though still in its infancy, is poised for significant growth. With a population exceeding 220 million and a growing shift towards digital transactions, the potential for eCommerce is enormous. Currently, the eCommerce market in Pakistan is estimated to be around $6 billion, a small fraction of the total retail market, with eCommerce sales accounting for only 1-2% of the total retail transactions. This is in stark contrast to the global average of around 15% pre-COVID.

The major companies in the market included TCS, which is the largest and most established player. TCS has been operational since 1983 and has a vast infrastructure built primarily for delivering letters and documents. Despite its traditional focus, TCS has been investing heavily in eCommerce logistics, leveraging its extensive network and experience.

Leopards Courier is another significant player with a large network, which has also been adapting its services to cater to the eCommerce sector.

Like TCS and Leopards, M&P has a long history in logistics and is expanding its services to include eCommerce deliveries.

In the mid-tier logistics companies, we have BlueEx, CallCouriers. Initially focused on document deliveries, these companies have pivoted towards eCommerce logistics, capitalizing on their early entry into the market. They have made notable progress but trailed behind the major players. CallCourier has been acquired. And fintech Abhi, which is also a competitor to PostEx, acquired a stake in BlueEx.

Then we have startups PostEx, Rider, Swyft Logistics Trax and. These newer companies were making waves with their tech-driven approaches to eCommerce logistics. Unlike the traditional companies, these startups are designed specifically for eCommerce deliveries, offering more accurate and customer-friendly services. Out of these, Swyft Logistics has met an unfortunate ending with the company deciding to shut down at the beginning of this year.

The competition among these players was fierce. The major companies like TCS and Leopards have the advantage of established infrastructure, experience, and lower costs. However, they are trying to adapt their traditional models to fit the needs of eCommerce, which is a different ball game altogether.

On the other hand, startups like PostEx, Rider, Swyft, and Trax were leveraging technology to offer better accuracy and customer experience, crucial factors in the eCommerce world. Their challenge lies in scaling up quickly and managing costs to compete with the established giants.

Understanding PostEx

PostEx isn’t your usual eCommerce delivery company that delivers parcels; it has redefined the logistics landscape by integrating an innovative financial service model. Beyond traditional delivery services, PostEx offers invoice factoring for small and medium-sized enterprises (SMEs), addressing a critical gap in the market. Invoice factoring allows SMEs to convert their outstanding cash on delivery (COD) invoices into cash in a very short duration, providing them with the liquidity needed to manage operations, pay suppliers, and invest in growth. To understand this, think of yourself as an online eCommerce store. When an order is placed on your website, the time between the delivery of the order to the customer and reimbursement of cash to you could take days. The long cash flow cycle is make or break for small businesses that would ideally want that cash to be reimbursed to them as soon as the order is placed. This can happen when customers pay for the purchase digitally via a debit or a credit card. But cash is the dominant form of payment in Pakistan, forming about 80% of the total volume of eCommerce.

With a large volume of payments stuck with customers for days, you as a merchant would face delays in paying your bills and purchasing new inventory, leading to limited growth. PostEx settles the value of invoice upfront giving the merchant relatively quicker access to cash. PostEx charges a percentage to merchants for upfront invoice financing and recovers the money when the customer pays in cash. PostEx does this form of financing under an NBFC license.

On top of that PostEx gives the merchant access to its fleet for deliveries to customers. By combining logistics with fintech, for SMEs, this means streamlined cash flow management alongside reliable delivery services. This dual approach not only enhances PostEx’s service portfolio but also supports the financial health of its clients.The ability to access funds quickly through invoice factoring can be a game-changer for these businesses, enabling them to seize new opportunities and scale more efficiently. This innovative business model positions PostEx as a key player in the logistics and fintech industries, showcasing how versatile and adaptive strategies can drive success in an evolving market landscape.

PostEx scaled this hybrid model until 2022 on its own on the back of significant funding raised in 2021. In the November of that year, PostEx completed an $8.6 million raise in seed funding, making PostEx’s seed round one of the largest in Pakistan.

The CallCourier acquisition

With abundant capital but a downturn around the corner, PostEx did something daring: it acquired CallCourier in 2022. It was a daring move given that PostEx acquired a company larger than its size and scale, meaning increased financial liabilities when the funding winter was setting in. According to BlueEx Information Memorandum (IM) at the time of its GEM Board listing in 2021, Call Courier’s market share was 10%, making it the fifth largest third party logistics company in Pakistan. PostEx was then not even mentioned in the IM.

“We were scaling, we had a product, it had a demand and we had made the tech and all,” says Omer Khan, the founder and CEO of PostEx. “We knew there is a lot of demand coming in and we had to scale it quickly.”

Omer explains that at the time of the acquisition, PostEx recognized a critical need to expand its delivery network to new cities to better serve its existing merchants and attract new ones. The company had a clear product-market fit and a fintech product that thrived on the scalability of logistics.

However, their limited presence in only a few cities meant their market share was restricted in logistics as well as fintech, with an estimated 50-60% potential, according to Omer, even if their merchants were fully committed. The competitive landscape in 2022 was intense, with numerous active players vying for dominance in the same markets. TCS and Leopards Courier had a formidable presence. Swyft Logistics, Trax, Rider, all of these had brought in their A-game and were well funded as well.

This fragmented approach, where merchants used multiple courier services, posed a significant challenge. Without nationwide delivery capabilities, PostEx couldn’t guarantee comprehensive service coverage, making it difficult to secure 100% of merchants’ delivery needs.

The acquisition was necessary because the only viable way to rapidly scale and ensure full coverage was either to organically expand into new cities or to partner with an established player through merger or acquisition. Given the competitive pressures and the need for immediate scale, opening new cities on their own would have been time-consuming and resource-intensive. On the other hand, an acquisition would provide instant access to a wider network, established infrastructure, and experienced personnel. By acquiring CallCourier, PostEx could leverage its existing logistics network and operational efficiencies, allowing for a seamless integration that would immediately enhance its market position.

Additionally, the acquisition was a strategic move to gain a competitive advantage. With numerous players in the market, being present and active in every city was crucial. PostEx needed to ensure that it could offer 100% delivery coverage to its merchants, eliminating the need for them to rely on multiple courier services. This comprehensive service offering would not only attract more merchants but also foster stronger loyalty among existing ones. By providing a one-stop solution for all their logistics needs, PostEx could differentiate itself from competitors and secure a larger market share.

The decision to acquire CallCourier was also influenced by industry insights and relationships, says Omer Khan. Being in the logistics sector, PostEx had a good understanding of the market dynamics and knew the strengths and weaknesses of other players. CallCourier was identified as a strategic fit due to its established presence and alignment with PostEx’s growth objectives. The acquisition provided the perfect synergy, combining PostEx’s fintech capabilities with CallCourier’s logistics expertise, resulting in a powerful hybrid model poised for growth.

Is it sustainable?

It has turned out to work really well for PostEx. According to Omer Khan, the post-merger growth has been fourfold, roughly translating into over 40 lakh deliveries on a per month basis. This is nothing short of astonishing, really. A startup which was set up only three years ago, had surpassed TCS in market share by 2023.

According to a report by Data Darbar, by April 2023, PostEx had achieved a scale of an estimated 1.45 million shipments per month, securing a significant market share of 23.2%. In comparison, industry veterans TCS and Leopards each had approximately 1.15 million shipments, translating to an 18.4% market share for both. Trax held an 11.6% market share, while BlueEx and Swyft each captured 7.6%, and Rider trailed with 6%. The acquisition of CallCourier has undeniably fueled PostEx’s impressive growth, enabling it to outpace traditional logistics giants and establish a commanding lead in the market.

However, the question remains whether this growth and the underlying strategy are sustainable in the long run. Sustainability is a crucial consideration for any rapidly growing company. While the acquisition has provided immediate scale and market share gains, maintaining this growth trajectory requires continued investment. The logistics sector is capital-intensive, and the need to expand infrastructure, technology, and human resources could strain financial resources. Furthermore, the challenge of managing a larger, more complex organization might pose risks to service quality and operational coherence.

The answer on the sustainability front is that PostEx has been able to turn profitability. Founder Omer Khan did not disclose numbers pertaining to profitability and only disclosed that the company was doing $21 million in annualized recurring revenue combined from both logistics and fintech operations.

“Our net profitability gives us unlimited runway as well without worrying about the funding dry down,” says Khan.

The logistics segment is likely the bigger contributor to revenue as well as profitability for PostEx, benefiting significantly from economies of scale. In contrast, the fintech product, while promising, requires substantial investment to achieve similar profitability levels, something that PostEx is holding back on for now. Khan explains that the demand for the product is there and it is open for everyone but we are not allowing everyone to take this facility. 4 million deliveries in a month translates into thousands of merchants which can not be financed all at once because it would require a lot of capital. “We recognize the importance of systematic and strategic investment in fintech, ensuring that growth in this area is sustainable and well-managed.”

What’s next?

PostEx has successfully completed a fundraising round, securing the capital needed to fuel its expansion plans. The amount was not disclosed by Khan but he disclosed that this capital was sourced from existing investors rather than external sources. With this financial backing, PostEx is focused on scaling its operations and enhancing its market presence not only in Pakistan but in the region, with the company set to expand in the Middle Eastern markets.

Notably, PostEx is setting up operations in Dubai and Saudi Arabia on the back of the new funding raised. Both are very tough markets, given the abundance of capital for SMEs already in these markets and multiple players offering similar services.

Omer recognizes the challenges associated with moving into such markets and says that they want to enter difficult markets. “We have teams in Pakistan that have executed well. We are on track in Pakistan, hence the initative to go outside. We are going there to lead it. It is not to compromise operations in Pakistan.”