When we envision futuristic technologies, our minds often leap to space travel, AI, and robotics. Yet, just a few decades ago, electric vehicles (EVs) were part of that forward-looking list. Today, while not yet the dominant form of transportation, EVs have steadily moved from science fiction to everyday reality.

The rise of electric vehicles is unmistakable, with consumer familiarity and adoption growing consistently. A Bloomberg Green analysis highlights a significant shift in the automotive landscape: by the end of last year, 31 countries had crossed a crucial EV tipping point, with purely electric vehicles accounting for over 5% of new car sales. This milestone is considered the gateway to mass adoption, often followed by a rapid transformation in consumer preferences.

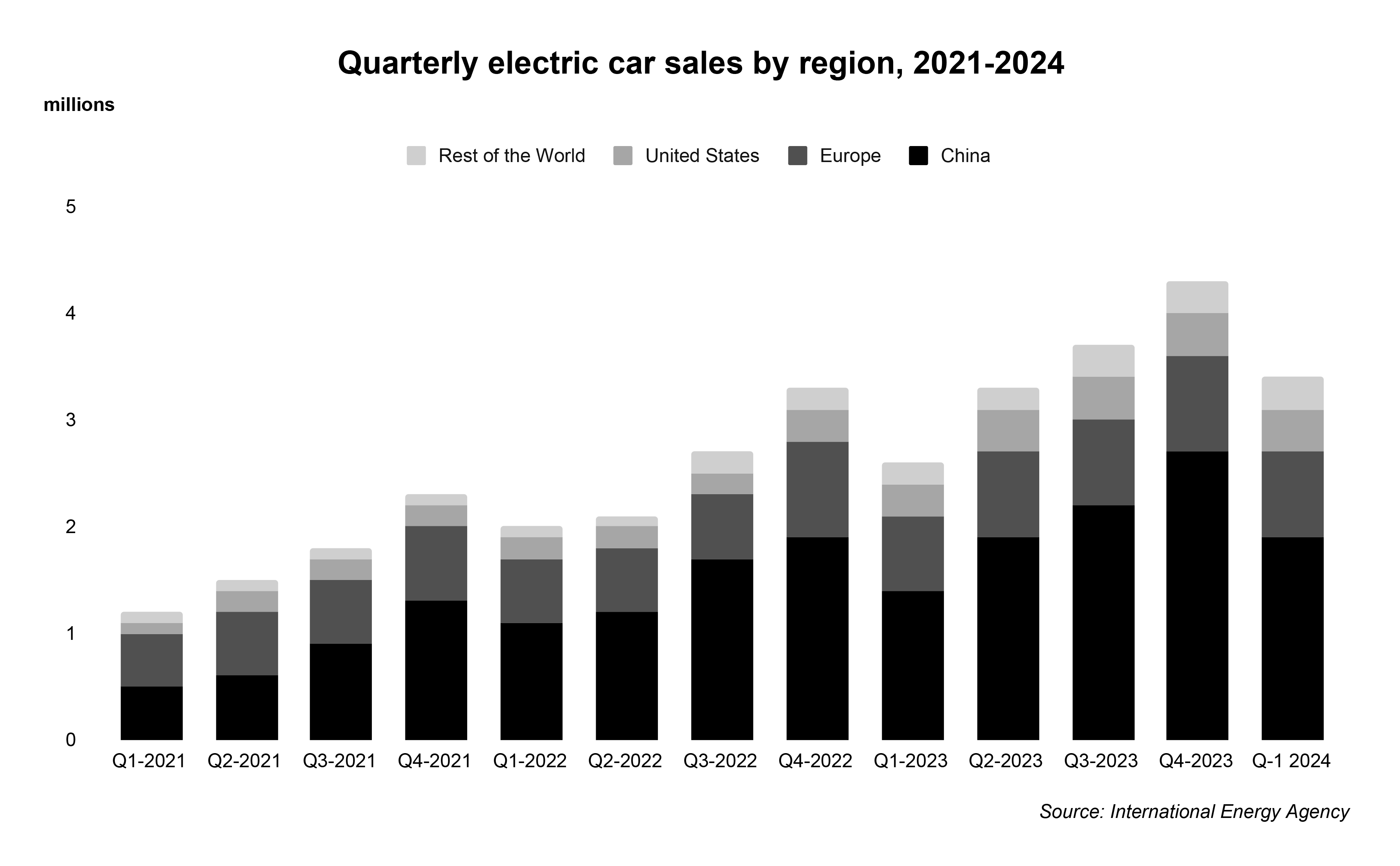

Despite this progress, the EV segment faces its share of skeptics. Sales, while on an upward trajectory, haven’t accelerated at the pace many industry insiders anticipated. Around 95% of electric car sales are concentrated in only three regions, China, Europe, and the United States, which have market shares of 60%, 25%, and 10%, respectively. This gap between expectations and reality has led to some pessimism about the sector’s short-term prospects.

However, it’s important to view this transition in context. The shift from traditional combustion engines to electric powertrains represents a fundamental change in transportation technology, one that inevitably faces hurdles and resistance. As with any transformative technology, the path to widespread adoption is rarely linear.

The current state of EVs mirrors a critical juncture: poised between breakthrough and mainstream acceptance. While challenges remain, the increasing global focus on sustainability and technological advancements in battery technology suggest that electric vehicles are likely to play an increasingly significant role in our automotive future.

After considering the global EV landscape, you might naturally wonder: What about Pakistan?

In 2020, Pakistan took a significant step by drafting its National Electric Vehicle Policy, setting ambitious targets. The policy aims for EVs to constitute 30% of new car sales by 2030 and an impressive 90% by 2040. However, the current pace of adoption suggests these goals may be challenging to achieve.

This disparity between policy ambitions and market reality raises a crucial question: Despite government initiatives promoting EVs, do they make financial sense for Pakistani consumers compared to traditional Internal Combustion Engine (ICE) vehicles or hybrids?

To shed light on this important issue, we’ve conducted a comprehensive comparative analysis. Our study examines three vehicle types – electric, hybrid, and ICE – to determine which option offers the best financial value for Pakistani consumers.

Current Landscape of the EV industry in Pakistan

Pakistan has a nascent EV industry with limited manufacturing. Some of the electric cars locally manufactured are Seres 3 (DFSK & RP) and Honri EV (BMW).

However, numerous electric cars are imported and sold in Pakistan. Some of the leading imported automobiles in the country are Audi e-tron, MG ZS EV, BMW i4, and Hyundai Ioniq 5. As of 2024, approximately 5 million cars exist in Pakistan, however, only a fraction of them are electric. This indicates that Pakistan’s EV industry is not only fledgling but needs government support to flourish.

Nevertheless, the absolute size of the Pakistani market makes it a mouth-watering opportunity and a testament to that is Build Your Dreams (BYD), an EV giant based out of China. The company has decided to partner with Mega Motors Company Pvt. Ltd., an associated company of HUBCO, to manufacture electric vehicles in Pakistan.

Its presence in the EV industry is likely to boost local manufacturing and expedite the expansion of EVs in Pakistan. Moreover, this new entrant will intensify competition and deliver alternatives to consumers previously unavailable. Although details about prices, models, and battery ranges of cars have not been unveiled, the company will certainly target affluent customers, considering the steep prices of EVs.

Preview of Cars for Analysis

Pakistan is a lower-middle-income country with a GDP per capita of $1,680. It is an undisputed fact that luxurious electric, hybrid or even ICE-based cars are inaccessible to the majority of the population. Thus, this analysis is intended for discerning consumers who are considering and are financially capable of purchasing EVs. We have chosen top-of-the-line SUV Crossovers for each category, which encompasses, Honda HR-V VTi-S 2024 (Petrol), Toyota Corolla Cross 1.8 HEV X 2024 (Hybrid), and MG ZS EV MCE Essence 2024 (Electric). Let us analyze them one by one in detail.

Honda HR-V VTi-S 2024 is one of the most advanced ICE cars in Pakistan. It can be purchased for PKR 7.899 million ($28,413). The car has an engine of 119 HP and a seating capacity of 5 persons. Its top speed touches 200 Km/h; while its fuel tank has a decent capacity of 40 litres. However, it has a low mileage of only 13 Km/l in the city and a high maintenance cost of PKR 25,000 per 5000 Km. Its operating cost comes down to about PKR 21.20/Km, considering its mileage and the price of petrol.

Toyota Corolla Cross 1.8 HEV X 2024 is an advanced hybrid vehicle, it utilizes two power sources, an Internal Combustion Engine and an electric motor powered by a Lithium-ion battery pack. The electric motor enhances the efficiency of the car, resulting in better fuel average and lower carbon emissions. This car is available in Pakistan for PKR 9.849 million ($35,428). It offers an engine of 96 HP and a seating capacity of 5 persons. The top speed of the car is 180 Km/h and its fuel tank has a capacity of 36 litres. It can be maintained by spending PKR 15,000 per 5000 km. It is highly efficient and provides a mileage of 25 Km/l in the city. The operating cost of this car, considering all factors is PKR 11.02/Km. It means that although it is more expensive than Honda HR-V VTi-S 2024, it is more affordable to maintain and drive.

Lastly, MG ZS EV MCE Essence 2024, is a top-notch fully electric vehicle. It is the most expensive out of the three and costs around PKR 12.99 million ($46,726). It is a car suitable for a family of 5. Its features include an engine of 174 HP and a maximum speed of 180 Km/h. This car possesses a battery of 51.1 kWh, which takes around 5 hours to fully charge, assisting the car to cover a distance of approximately 340 Km. Assuming the buyers of this car consume more than 700 units of electricity, the rate of electricity offered to them will be PKR 71.43, which will roughly translate to an operating cost of PKR 10.74/Km. It has a low maintenance cost of PKR 5,000 per 5000 Km. This means that it is the most expensive out of the three but the most economical one to maintain and drive. Furthermore, electric cars don’t have any direct carbon emissions.

Let’s Crunch Some Numbers

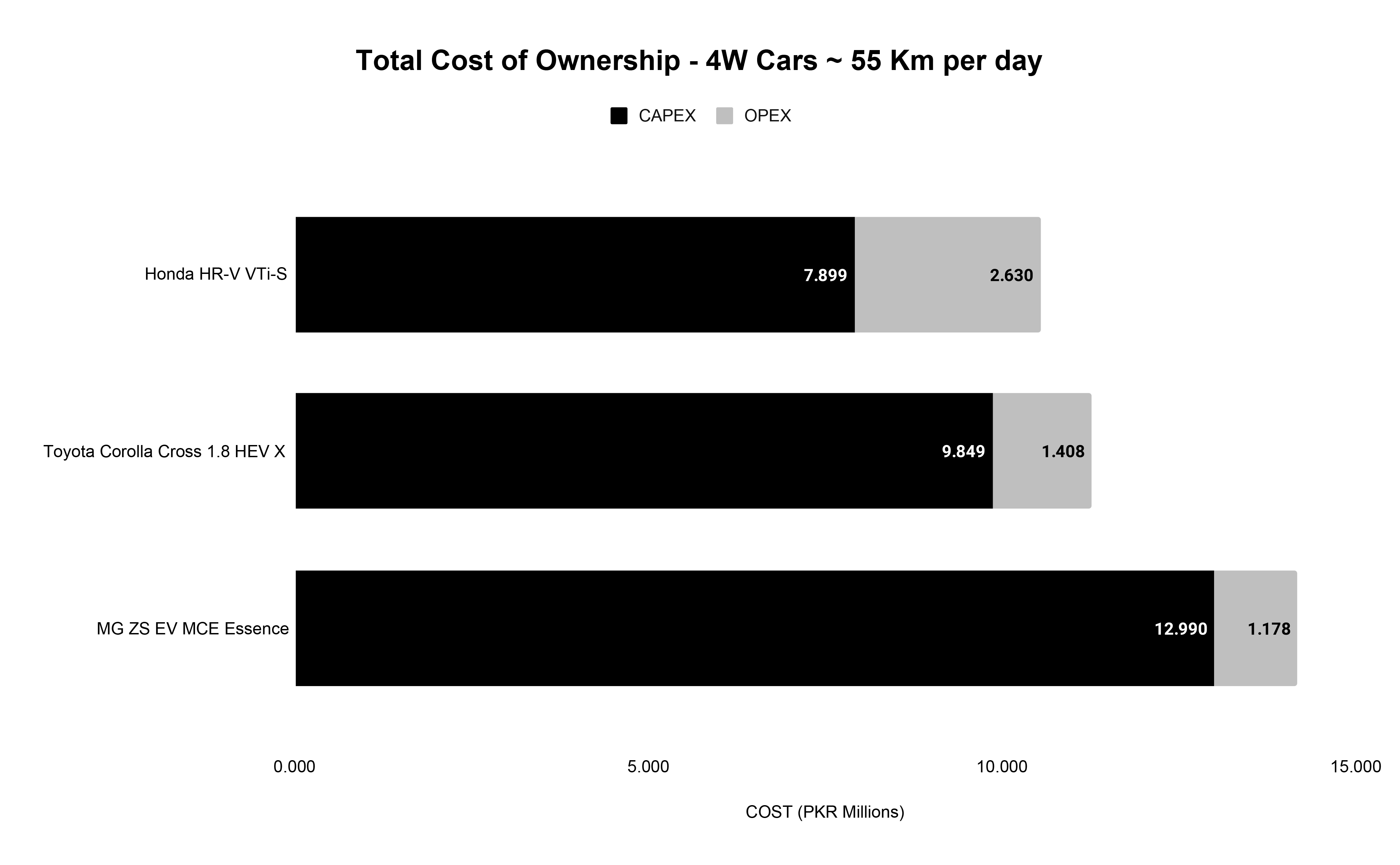

The above section briefed you about the nature of cars, features, and operating costs. However, we will compute the Total Cost of Ownership (TCO) of all three cars in this section, as it will enable us to compare all three cars holistically. While determining the TCO, two components have been considered, CAPEX, the price of the car, and OPEX, which is the sum of maintenance cost and operating cost of 5 years.

TCO = CAPEX + OPEX

We have bifurcated the analysis into two scenarios, which will allow us to conclude systematically.

Scenario 1:

In this scenario, let’s assume each car covers an average distance of 5000 Km every quarter, approximately 55 Km a day. In this case, the TCO of cars will be as follows:

Honda HR-V VTi-S 2024

The CAPEX spent on the Honda HR-V VTi-S 2024 is PKR 7.899 million, whereas its OPEX for the next five years will total around PKR 2.630 million. The sum of both of these values is PKR 10.529 million, which is the TCO for Honda HR-V VTi-S 2024.

Toyota Corolla Cross 1.8 HEV X 2024:

The CAPEX of Toyota Corolla Cross 1.8 HEV X 2024 is PKR 9.849 million, while its OPEX will be PKR 1.408 million over the next five years. If we sum both OPEX and CAPEX, we get a TCO of PKR 11.257 million.

MG ZS EV MCE Essence 2024

In the case of MG ZS EV MCE Essence 2024, CAPEX comes to around 12.990 million, while its OPEX represents a sum of 1.178 million. If we add them together, we get a TCO of PKR 14.168 million, which is the highest in comparison to the rest of the cars.

Note: Prices of cars have been sourced from Pakwheels.com

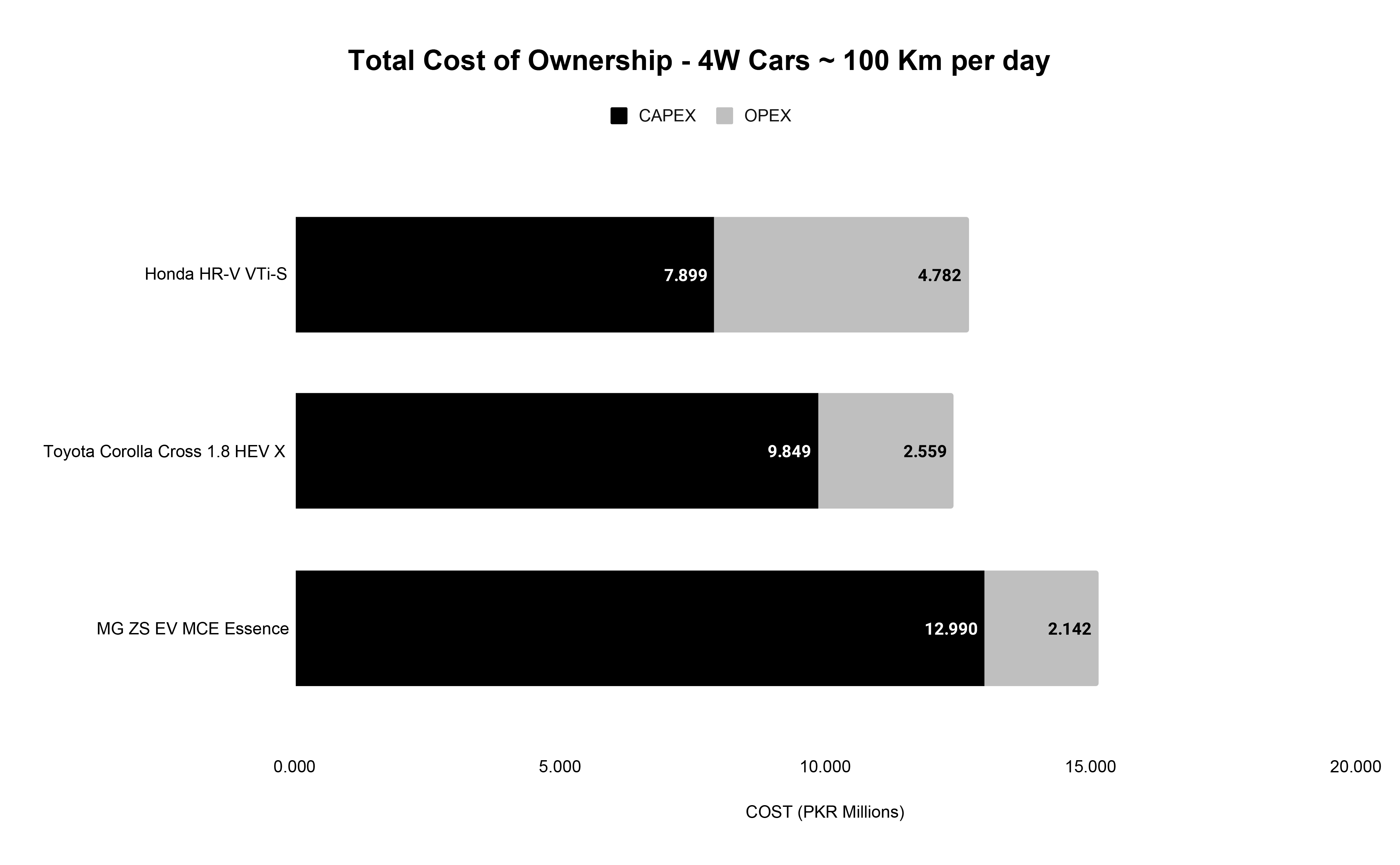

Scenario 2:

In the second scenario, the assumption is that each car travels a distance of 100 Km a day or 9000 Km per quarter, almost double the distance compared to the first scenario. The TCO of cars in this situation is given below:

Honda HR-V VTi-S 2024

The CAPEX for Honda HR-V VTi-S 2024 will remain stable at PKR 7.899 million but its OPEX will jump to 4.782 million, ballooning its TCO to PKR 12.681 million.

Toyota Corolla Cross 1.8 HEV X 2024:

The CAPEX for Toyota Corolla Cross 1.8 HEV X 2024 will remain PKR 9.849 million but its OPEX will become 2.559 million, making its TCO jump to PKR 12.408 million. Its TCO in this case is slightly less than the TCO of Honda HR-V VTi-S 2024.

MG ZS EV MCE Essence 2024

The CAPEX of MG ZS EV MCE Essence 2024 will remain unchanged at 12.990 million but its OPEX will rise to PKR 2.142 million. This will make its TCO equal to PKR 15.132 million.

Note: Prices of cars have been sourced from Pakwheels.com

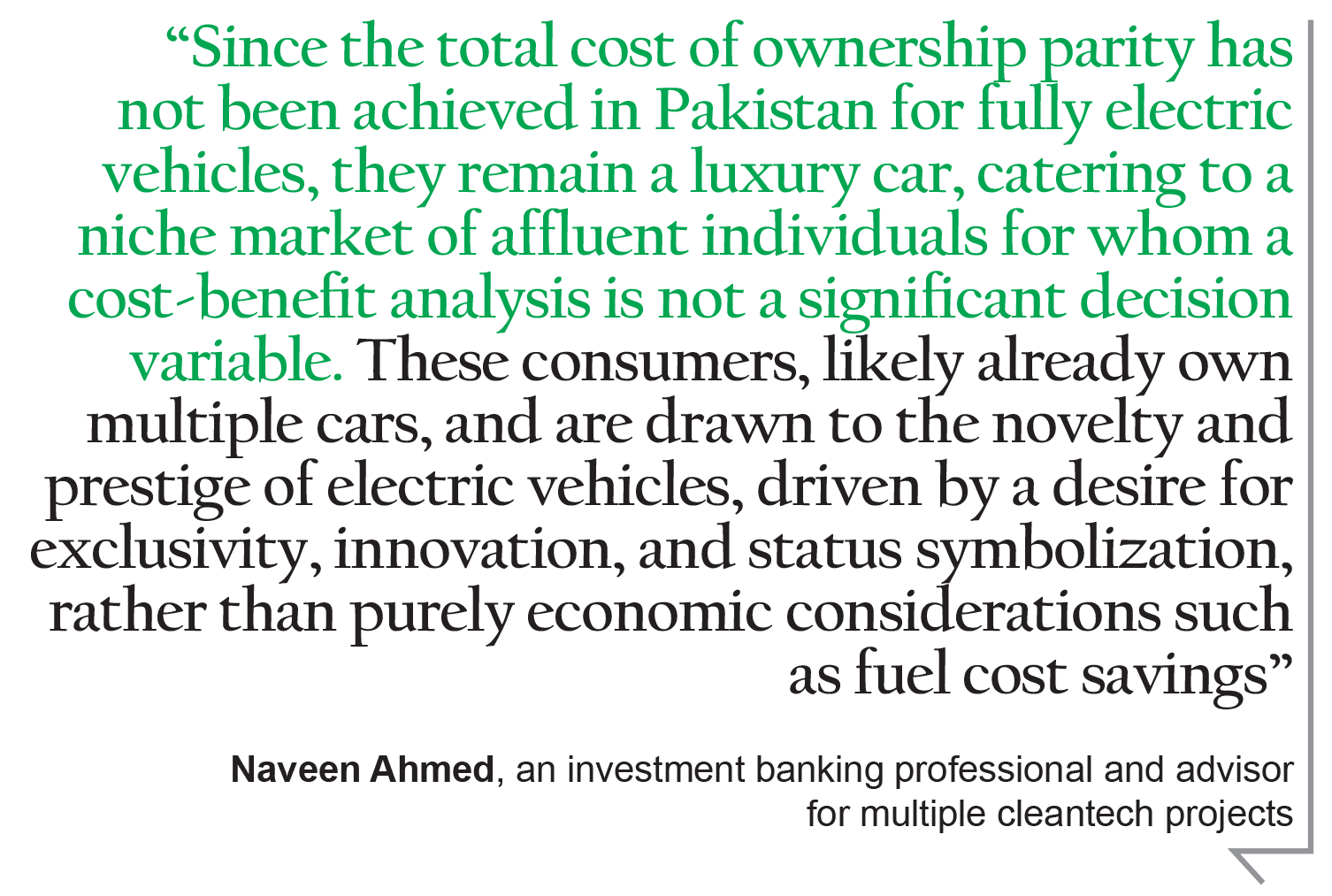

The methodology of Total Cost of Ownership suggests that electric 4-wheelers are not economically viable for customers in Pakistan at this point in time. They not only have to pay exorbitant prices for electric 4-wheelers but their operating costs are only marginally better than hybrid 4-wheelers.

Nevertheless, the operating costs of both electric and hybrid 4-wheelers are half of ICE-based 4-wheelers. If you travel excessively or cover large distances, like 100 Km a day, then the TCO of hybrid 4-wheelers will become less than the TCO of ICE-based for you due to low operating costs.

Notwithstanding, electric cars won’t be able to achieve TCO parity even in this case due to their inflated prices or CAPEX. This indicates that customers who cover a distance of 55 Km or less each day and are driven by cost-benefit analysis should opt for ICE-based 4-wheelers.

However, customers who frequently travel intercity and drive more than 100 Km daily should prefer hybrid 4-wheelers. Therefore, experts believe that the government’s priority should be to make the hybrid segment the preferred choice of consumers at large for the next five to six years as it can utilize the existing infrastructure with minimal modification.

Although electric 4-wheelers fail to make economic sense at the moment, nevertheless, they should not be ignored. There are several advantages to electric 4-wheelers such as significantly lower operating costs, negligible carbon emissions, improved efficiency of cars, and convenience of home charging.

Therefore, customers who don’t priortize financial analysis should consider purchasing electric 4-wheelers. The demand for electric 4-wheelers by affluent members of society will provide stimulus to the local EV industry, spurring it to commence mass production of EVs at better prices, leading to a growth in demand.

“Since the total cost of ownership parity has not been achieved in Pakistan for fully electric vehicles, they remain a luxury car, catering to a niche market of affluent individuals for whom a cost-benefit analysis is not a significant decision variable. These consumers, likely already own multiple cars, and are drawn to the novelty and prestige of electric vehicles, driven by a desire for exclusivity, innovation, and status symbolization, rather than purely economic considerations such as fuel cost savings,” remarked, Naveen Ahmed, an investment banking professional and advisor for multiple cleantech projects.

Can Electric Vehicles Ever be Affordable?

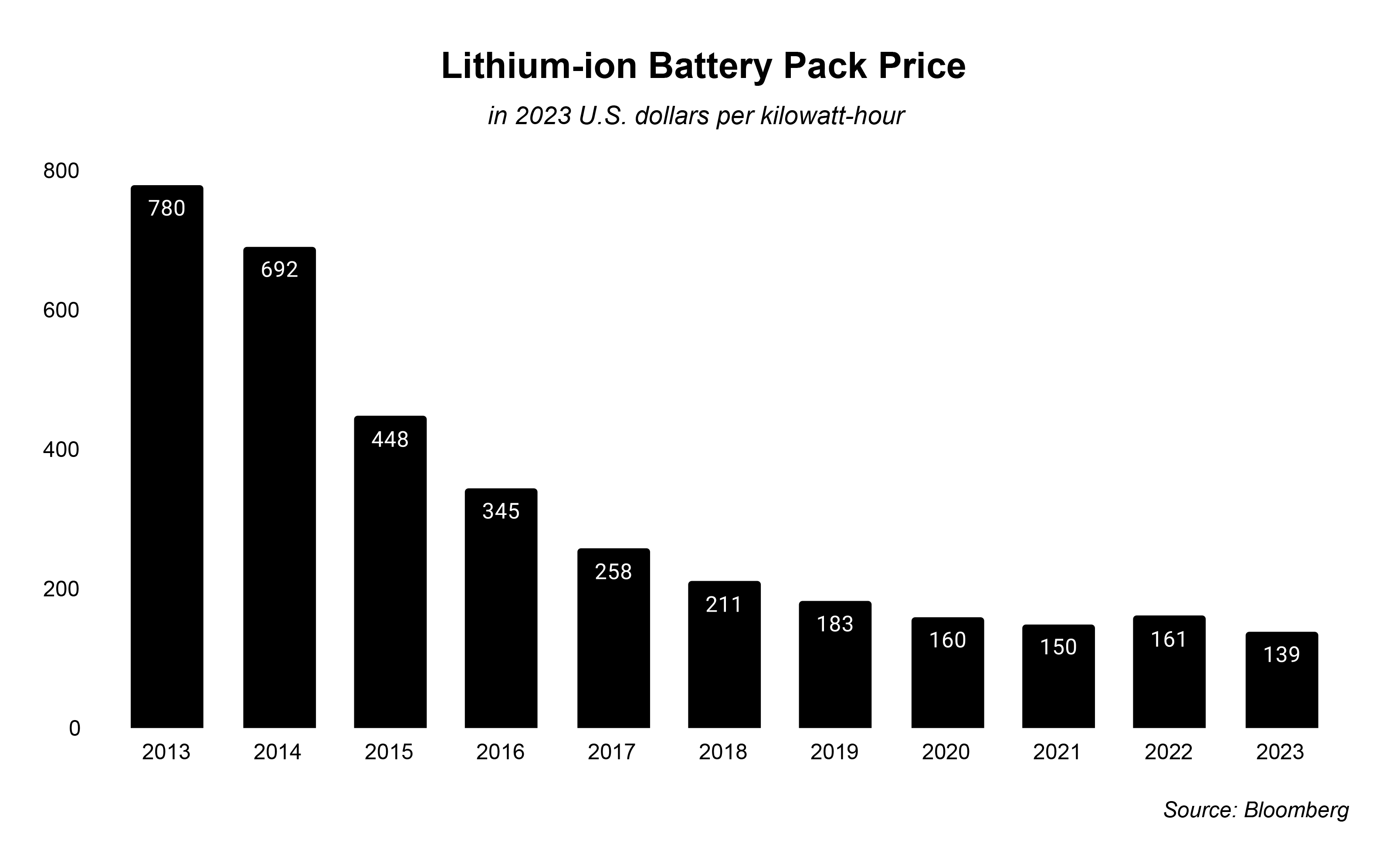

The most essential component of an electric vehicle is the Lithium-ion battery pack, which plays a pivotal role in determining its price. The price of Lithium-ion battery packs has declined by more than 80% over the past decade and is expected to decline further. Khalil Raza, an EV expert elaborates that electric 4-wheelers will become economical once the price of Lithium-ion battery packs drops below $70/kWh.

“The Lithium-ion battery pack is the most critical part of an electric vehicle, and its price significantly influences the overall cost of the vehicle. The price of Lithium-ion battery packs has dropped below $120 per kWh and is expected to continue declining in the future. However, it needs to drop below the $70 per kWh mark to make electric cars competitive with ICE-based cars globally as well as in Pakistan,” he reiterated.

Scientists and engineers are relentlessly researching to develop Graphene-based and Sodium-based batteries for electric vehicles. According to preliminary research, batteries developed with these materials are cheaper and perform better. Unfortunately, Pakistan is not capable of contributing towards this research and will most likely be an end-user of this technology. However, Pakistan is capable of establishing a rudimentary charging infrastructure for electric vehicles and conceiving standardized processes for local manufacturing of EVs, which will advance their adoption.

Raza believes that facets like EV adoption and infrastructure are intertwined. “Low EV adoption and absence of infrastructure for EVs, serve as a chicken and egg problem, there is no infrastructure because EV adoption is low and vice versa. Thus, the government should erect a basic infrastructure for EVs but not squander by establishing extensive networks, as it requires massive investment,” he opined.

The Policy Paradox: Govt. vs the Govt.

There is also a dearth of consistency within the government as it seems to be contradicting itself. On one hand, it introduced a profound framework like the National Electric Vehicle Policy 2020 with ambitious targets for the evolution of the local EV industry, on the contrary, it has retracted several customs duty exemptions on luxury EVs that cost north of $50,000. This rollback of exemptions appears to be an impetuous decision of the government, which should have been delayed for a few years until the nascent EV ecosystem began to flourish in Pakistan.

CEO of a local automobile company censured the government’s policies by stating, “The government has increased duties and taxes on EVs in the Budget 2024-25, which would adversely affect their popularity in Pakistan. If the government wanted to increase import duties on EVs, it should have confined its policy to used EVs and excluded new luxury EVs, as the current proposition will be pernicious for automobile companies with a local presence.”

While electric cars seem promising for improving energy efficiency and reducing carbon footprint in Pakistan, significant advancements are required to achieve TCO parity with ICE-based cars and become the preferred mode of transportation in the country.

Furthermore, the restricted EV infrastructure, inconsistent policies, and whimsical economic landscape have exacerbated the situation, hindering a widespread transition to electric cars. Pakistan has made some progress in the realm of EVs but achieving the targets of the National Electric Vehicle Policy of 2020 is nothing short of a far-fetched dream.