As Pakistan stands on the precipice of another promised transformation, the threads of socio-economic problems, political unrest, and environmental challenges weave a complex narrative.

The country was able to sign a three-year deal worth $7 billion with the IMF. But how does that improve Pakistan’s business and economic outlook for the upcoming years? International rating agency Fitch published a comprehensive country risk report answering these questions but are those questions fully answered?

To put this report in the political context of Pakistan, Profit analyses how the numbers fare in the coming years, after the IMF deal. Is it as good as the ruling party claims or is it as bad as the opposition would have the country believe?

There are a host of factors that are taken into account when a country is put to risk assessment. Following is a list of those factors for Pakistan and an estimate of how well does the country fare in these metrics.

The Shadow of Politics on the Market

The Pakistan Stock Exchange (PSX) has recently experienced a significant plunge, losing over 1,100 points due to heightened political noise and uncertainty. One would assume that after the IMF deal passed through, the confidence in the country’s financial markets would be strengthened if anything.

However, contrary to that, the market moved the opposite direction in the coming days. And there is only one way in which we can explain this peculiar behaviour.

The stock market may not be the best indicator of the economy but it is possibly one of the best indicators of investor confidence. And the country;s political landscape does not induce confidence, despite financial security.

To tell this story, the reader needs to have some context of what has been happening on the political front in the last few months. While discerning readers can skip these details, following is a short summary of what the Pakistani political musical chair has been up to.

In a recent conversation on record, Maryam Nawaz, the CM of Punjab asserted that the PML-N government will complete its five-year tenure despite various challenges. The assertion comes as a meek attempt at what seems to be another episode of political unrest not unlike 2022. The supreme court of Pakistan in a majority ruling ruled that the PTI is a parliamentary party of Pakistan and is hence allowed to have reserved seats. This step alone makes the PTI the single biggest political party in the upper and lower house of the parliament, meaning an end to the rule of PMLN and coalition parties.

Moreover the judicial commission has put forward a list of names to appoint ad hoc judges to the apex court of Pakistan, despite the quorum of judges in the SC being full. The JCP and the government state that the appointment of ad hoc judges is to reduce the massive backlog of 57000+ cases pending at the SC. Meanwhile, the Pakistan Tehreek-e-Insaf is almost certain that the decision is being made to revert the reserved seats decision, which is currently 8-5 in the favour of PTI. According to calculations shared by senior PTI leader, Taimur Khan Jhagra on social media, it will take two ad hoc judges more than 114 years to end the backlog of SCP cases.

The political landscape is further complicated by regional security issues, as exemplified by a recent blast in South Waziristan targeting a Taliban commander, incidents of terror and civil unrest in Bannu and yet another sit-in orchestrated by the TLP in the country’s capital.

As the judiciary remains a battleground, with the Supreme Court facing intense scrutiny over its decisions on reserved seats and ad hoc judges. The PTI’s open letter to the Judicial Commission of Pakistan (JCP) rejecting these appointments highlights the deep-seated divisions within Pakistan’s political and judicial systems. These conflicts not only stall legislative progress but also undermine public confidence in democratic institutions.

IMF Conditionalities and Economic Reforms

While all this happens in the country causing concerns at a national level. Negotiations with the International Monetary Fund (IMF) continue to dictate stringent fiscal measures. While these measures aim to stabilise the economy, they often come at a high socio-economic cost.

The IMF has finally agreed to releasing the funds but the sustainability and inflationary shocks that these funds are going to bring about is expected to be unprecedented, as forecasted by experts. The petroleum levy and electricity duties, sales taxes and taxes on salaried classes have been revised upwards, several times to comply with Pakistan on its international debt obligations.

The government has increased appellate tribunals for tax cases to 100 to improve fiscal discipline. However, it remains to be seen how effectively these tribunals will function amidst bureaucratic inefficiencies and political interference.

Industrial Prospects and Foreign Investment

In the shadow of all of this, the industrial environment of the country suffers where the exporter and manufacturer find no respite in the increased taxes. Be it the increased withholding charged on the local manufacturer or the Normal Taxation Regime employed on the exporter.

While in an interview with Reuters, the finance minister Muhammad Aurangzeb said that Pakistan needs foreign direct investment to move forward and deposits from friendly countries will no longer cut it.The question that arises is that is pakistan ready to facilitate the FDI and protect the interest of the foreign investors in this high taxation environment.

In this respect, the upcoming installation of a plant by the world’s largest bus maker “Yutong” in Karachi marks a positive stride. This development, expected to be completed within the next year, promises to boost local employment and enhance industrial capabilities. However, sustainable industrial growth requires consistent policy support and a stable economic environment, factors that are currently in flux.

Climate Crisis and Urban Struggles

The Fitch report on Pakistan’s risk profile highlights one thing that is of extreme importance. A heatwave in the last month has led to calls for exemptions from traditional black coats for lawyers, underscoring the country’s urgent need for climate-responsive policies. This situation is a microcosm of the broader environmental challenges Pakistan faces, including water scarcity, air pollution, and the impacts of climate change on agriculture.

The country is vulnerable to any kind of environmental disasters with the most recent example being the 2022 floods. In 2023, Pakistan got the global community to pledge upwards of 10 billion USD in climate action aid, however that money is nowhere near being realised.

Demographic Pressures

The projection that Pakistan’s population is likely to double by 2050 adds another layer of complexity to the country’s socio-economic fabric. This demographic surge will place immense pressure on infrastructure, healthcare, and education systems, demanding proactive and sustainable planning from policymakers.

With the development budget facing cuts year in and year out and the rest of it being used to fulfil political goals. This is probably going to be one of the most concerning aspects in the decades to come, adding to the potential risks for long term investment.

Human Rights and Social Justice

The recent murder of journalist Hassan Zaib has sparked international outrage, highlighting the perilous conditions under which journalists operate in Pakistan. Sadly this is not the first time the country has been found to shun human rights injustices.

While Pakistanis may have desensitised themselves from these occurrences, the international investor does pay heed when something like this occurs. This incident is part of a broader pattern of human rights abuses that include enforced disappearances, extrajudicial killings, and restrictions on freedom of expression. Addressing these issues is crucial for Pakistan’s democratic health and international standing.

The recent murder of journalist Hassan Zaib has sparked international outrage, highlighting the perilous conditions under which journalists operate in Pakistan. Sadly this is not the first time the country has been found to shun human rights injustices.

While Pakistanis may have desensitised themselves from these occurrences, the international investor does pay heed when something like this occurs. This incident is part of a broader pattern of human rights abuses that include enforced disappearances, extrajudicial killings, and restrictions on freedom of expression. Addressing these issues is crucial for Pakistan’s democratic health and international standing.

International Relations:

Pakistan-China Relations

For a long time, Pakistan has been looking at China as a strategic partner. Be it debt rollovers, investments and grants. It is assumed that the stream that is the Pakistan-China friendship is not likely to run dry soon, which is one thing that provides some confidence to Pakistan.

The celebration of the 97th anniversary of the Chinese People’s Liberation Army at Pakistan’s General Headquarters exemplifies the strong bilateral ties between Pakistan and China. COAS’s remarks on the resilience of this relationship amid strategic challenges magnified its importance for Pakistan’s foreign policy. This alliance is pivotal not only for economic cooperation, such as the China-Pakistan Economic Corridor (CPEC), but also for regional security dynamics.

Global Diplomatic Engagements

However, Pakistan’s diplomatic engagements extend beyond China, as evidenced by recent interactions with various international entities. According to the IMF, these relationships must be balanced with domestic priorities and geopolitical realities. Effective diplomacy will be crucial in navigating the complexities of regional conflicts, global economic trends, and international trade dynamics.

Conclusion

Despite all these challenges, the biggest risk over the years has been Pakistan’s financial risk. The country has entered its 3rd and biggest IMF bailout program in the last few years, possibly stabilising the balance of payments crisis for now.

Against what the government forecasts, the global rating agency Fitch also predicts that the country’s GDP is expected to go up by more than 3%.

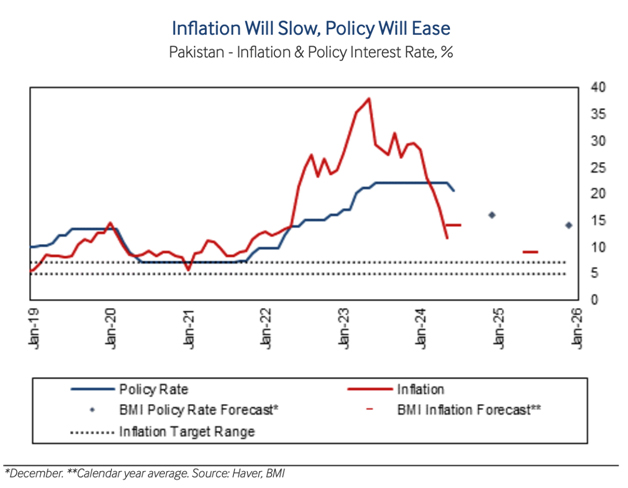

There is also a predicted policy easing in late 2024 and into 2025 by Fitch. With inflation slowing, the State Bank of Pakistan will continue to loosen monetary policy. The policy rate is expected to come down to 16.00% by December 2024 and to 14.00% by December 2025. On the other hand the IMF has asked the government to keep on tightening the fiscal policy.

The IMF expects that the authorities will use increased disbursements from the World Bank and the IMF to protect spending on social programmes and growth-boosting capital investments. In June 2024, for instance, the World Bank approved another USD1.0bn for the DASU hydropower project.

Pakistan is at a critical juncture, with its future hinged on the effective management of economic policies, political stability, social reforms, and international diplomacy. The government’s efforts to tackle financial mismanagement, foster industrial growth, and maintain robust foreign relations are steps in the right direction. However, addressing environmental concerns, ensuring social justice, and safeguarding democratic processes are equally vital for sustainable development. Things that Pakistan has often overlooked in the myopic political or financial interests

The challenges are formidable, but so are the opportunities. This journey requires the resilience and adaptability of its institutions and people, whose collective efforts will shape the trajectory of the economy in the coming years.