Over the past two decades, Pakistan has emerged as a dynamic landscape of digital financial innovation, navigating a complex journey of regulatory evolution and technological disruption. The transformation began in 2008 with the introduction of branchless banking—a pivotal moment that laid the groundwork for a comprehensive digital financial services ecosystem.

The central bank’s strategic interventions have been instrumental in this metamorphosis. The National Financial Inclusion Strategy (NFIS) initiated a systematic approach to expanding formal financial services, while subsequent regulatory frameworks dramatically reshaped the digital payments landscape. Key milestones include the 2019 introduction of Electronic Money Institutions (EMIs), the 2021 Payment Service Provider licenses, and the 2022 launch of the micro-payment gateway “Raast”—each representing a calculated step towards digital financial democratization.

The results have been striking: digital payments by value surged from a mere 6% in 2020 to 17% in 2024, signaling unprecedented growth. However, this journey is far from a straightforward success story. While pioneers like JazzCash and Easypaisa have thrived, the EMI segment reveals a more nuanced narrative of opportunity and challenge.

Only a handful of EMIs, such as Sadapay and Nayapay, have successfully navigated Pakistan’s complex digital financial terrain. Multiple entrants have been forced to exit, underscoring the sector’s volatility. Yet, the recent in-principle approvals for new players like Toko Lab and PayMob suggest an enduring belief in the market’s potential.

So, is the EMI sector destined for failure, or a dormant goldmine awaiting strategic unlocking? Profit explores. The content in this publication is expensive to produce. But unlike other journalistic outfits, business publications have to cover the very organizations that directly give them advertisements. Hence, this large source of revenue, which is the lifeblood of other media houses, is severely compromised on account of Profit’s no-compromise policy when it comes to our reporting. No wonder, Profit has lost multiple ad deals, worth tens of millions of rupees, due to stories that held big businesses to account. Hence, for our work to continue unfettered, it must be supported by discerning readers who know the value of quality business journalism, not just for the economy but for the society as a whole.To read the full article, subscribe and support independent business journalism in Pakistan

The convoluted space of EMI regulations in Pakistan

In 2019, the State Bank of Pakistan (SBP) introduced Electronic Money Institutions (EMI) regulations to accelerate financial inclusion and digital payments. The framework allowed non-banking entities to offer digital financial services like e-money issuance and digital wallets, aiming to create a more innovative and accessible payment ecosystem.

Institutions like Sadapay and Nayapay emerged as early success stories, offering customers seamless digital account opening and international debit card services. Initially, EMIs were viewed as catalysts for a financial revolution, promising to rapidly digitize payments.

However, the sector’s promise quickly dimmed. Over the past two years, many enthusiastic EMI license holders either voluntarily withdrew, sold their operations, or had their licenses revoked by the regulator, revealing the challenging nature of this emerging market.

The story begins with TAG’s pilot operations being revoked by the SBP in October 2022, owing to regulatory violations and a variety of other issues. Afterwards, Checkout, a UK based company, let go of its EMI license due to deteriorating macroeconomic conditions and painfully long bureaucratic procedures to commence commercial EMI operations in the country.

In August 2023, CareemPay followed a similar suit and voluntarily abandoned its license while in October 2023, Finja signed a deal with Opay International for its EMI operations and the latest addition to the list is Paymax, the only commercially live EMI which exited the market in July 2024.

Acquiring an EMI license and operating commercially in Pakistan is a long and taxing journey. The SBP grants an EMI license to entities in three stages, in principle approval, approval for pilot operations and, final approval for commercial operations.

As of now, only five EMIs have been granted licenses for commercial operations, which include Nayapay, Sadapay, Finja, AFT, and E-Processing Systems Ltd. The complicated web of regulatory procedures and lethargic red tape have certainly contributed to the ouster of several prospective EMIs. However, there are other factors, which coerced several entities to either exit the market or recalibrate their strategies.

Limited revenue sources for EMIs

EMIs in Pakistan have typically earned revenues through two sources of income, the first is investment in government securities like T-bills, which were offering a return of up to 23% in 2023, however, it has fallen to around 13% now. EMIs are allowed to invest up to 75% of the trailing three months’ daily average outstanding e-money balance in the government. securities, which was only 50% until June 2023. Moreover, as elaborated by experts like Umair Sheikh, Managing Director at Innovate 47, EMIs don’t have full control over their deposits as they require a trustee, which is a commercial bank to operate.

Thus, EMIs need to establish a partnership with commercial banks and require their approval to invest in government securities. However, despite those efforts, it still provides EMIs with limited revenue due to their low deposit base and modest interest rates. As of Sep 2024, EMIs had a deposit base of only Rs 5.7 billion, whereas scheduled banks held about Rs 31.3 trillion.

The other income source for EMIs is transaction fees earned through payment transactions like those for e-commerce or point-of-sale, where they typically charge merchants 1% to 2%. However, their merchant acquisition remains limited, contrasting sharply with players like JazzCash, which has boarded over 300,000 merchants through QR installations and captured a significant market share.

Moreover, the SBP has regulations in place that allow customers who have completed their biometric verification from NADRA to transact only up to Rs. 400,000 a month, although it could be enhanced to 1 million in certain cases. This further inhibits EMIs in Pakistan from earning substantial revenue from this income stream as it limits their transactions.

Traditional banks generate approximately three-fourths of their income from interest-bearing sources such as government securities and loans, with around a quarter coming from fee-based income. In contrast, Electronic Money Institutions (EMIs) are structurally prohibited from lending and, as a result, rely primarily on fee income as their main source of revenue.

To access lending and generate interest-based revenue streams, EMIs can obtain a non-banking financial institution (NBFI) license from the Securities and Exchange Commission of Pakistan (SECP), a path already explored by Finja.

Further, EMIs in Pakistan operate in a restricted segment, where they aren’t truly able to differentiate themselves from the rest of the financial institutions like commercial banks and microfinance banks as customers can make digital transactions and receive debit/credit cards from them as well and now we even have digital retail banks, which would offer the same services and more in the future.

However the agility of EMIs sets them apart from traditional banks. EMIs are perceived to offer a more refined customer experience, with a strong association with speed and convenience. This model has resonated particularly well with urban youth, including Gen Z. While this approach has helped EMIs like Sadapay and Nayapay scale, relying solely on fee income may not be sufficient for long-term sustainability. To ensure their growth, EMIs will need to diversify their offerings and engage in strategic partnerships with other key ecosystem players.

The target market for the EMIs

EMIs were introduced in Pakistan to promote financial inclusion and digital payments by focusing on the unbanked population in Pakistan, which doesn’t have access to formal financial services like people who engage in informal labor and conduct all of their transactions in cash.

However, almost all of the EMIs have ended up focusing on a completely different segment – urban middle and upper class. They have made a negligible impact on the second and third-tier cities. All of their marketing campaigns are in English and their social media strategy makes it abundantly clear that their niche is the upper echelons of society.

As of December 2023, Pakistan’s financial sector includes more than 200 million accounts across banks, Microfinance Banks (MFBs), branchless banking institutions, and EMIs, indicating a high degree of financial inclusion. However, a leading financial services consultant pointed out that many customers hold multiple accounts, which may give an inflated impression of the number of active bank accounts.

As of FY 2024, 91 million unique customer accounts were recorded of the approximately 140 million adult population (aged 15 years and above) according to the State Bank of Pakistan (SBP). These accounts include those held with scheduled banks, MFBs, Development Finance Institutions (DFIs), and EMIs. The term “unique customer account” refers to an individual having multiple accounts at the same or different institutions, but each customer is counted only once. This raises questions about whether EMIs have accurately assessed their market size and whether they will be able to generate significant revenue by targeting only the middle and upper-income segments.

In contrast, Jazzcash and Easypaisa have focused on reaching the unbanked population through their branchless banking (BB) services, achieving notable progress with their extensive network across the country. As of March 2024, the total number of BB agents in Pakistan had reached 276,889, allowing these services to open more than 117 million accounts, of which approximately 60 million remain active. Furthermore, their operations extend beyond digital payments, with both Jazzcash and Easypaisa providing nano- and micro-lending services to their customers, where industry analysts elucidated they earn an annualized return of more than 200% on their lending products. Although micro-lending is still a relatively new concept with a non-traditional lending structure whose performance remains to be fully assessed.

The dynamics of EMI business in Pakistan

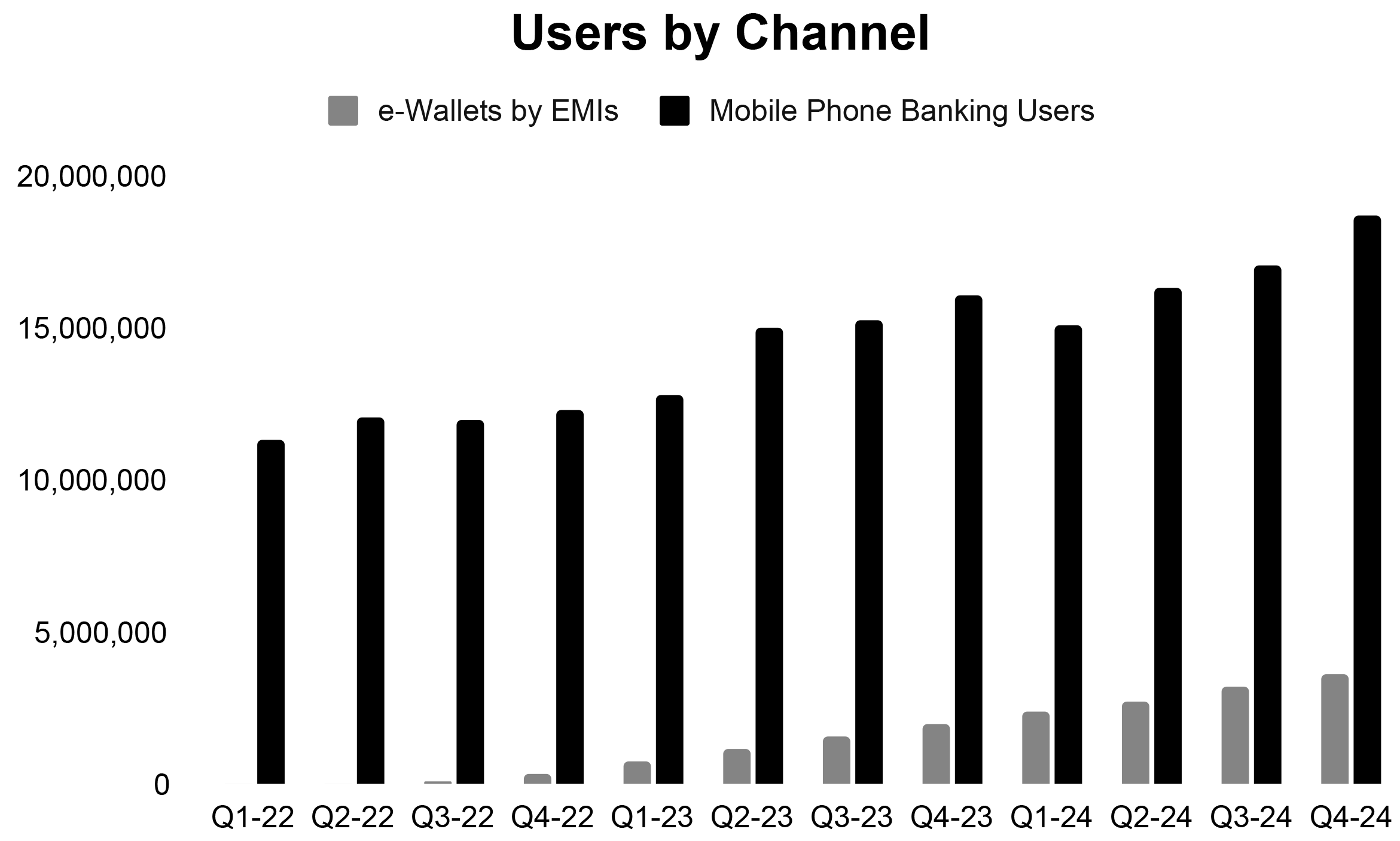

EMIs have definitely gained traction in Pakistan since the beginning of FY22 as the number of e-wallets has mushroomed since then. The number of e-wallets in the country stands at 3.671 million, which is a remarkable achievement as three years ago there were no e-wallets in the country. Although this achievement is meaningful, the number of e-wallets still lags behind the number of mobile phone banking users by a mile. The number of mobile phone banking users currently stands at 18.678 million, 5x the number of e-wallets in the country.

Moreover, if we look at the distribution of transactions conducted by customers through both platforms, there is a stark difference in how customers move funds through each channel. Customers typically utilize EMIs to move funds from their wallets to another wallet or another bank account.

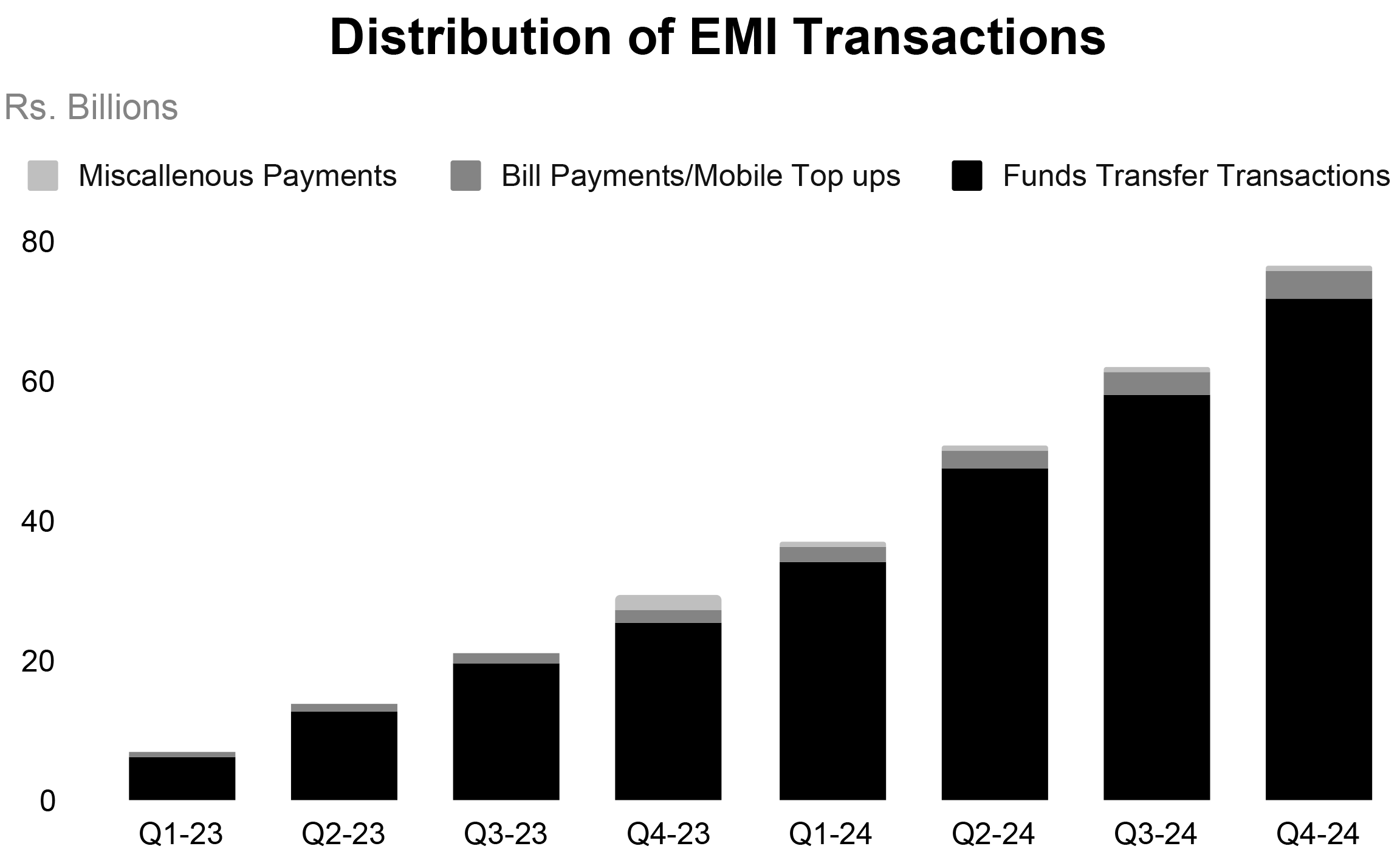

They made around 26.9 million transactions in Q4-24, which amounted to Rs76.7 billion. Around 75% of the transactions were initiated for funds transfer, which represented a value of Rs72.1 billion, while the rest of the 25% included transactions for miscellaneous payments, bill payments, and mobile top-ups, amounting to Rs4.6 billion. These funds transfer transactions have enabled EMIs to scale to such an extent, however, effectively, they don’t make money off these funds transfer transactions.

Customers usually use EMIs to pay for online services like food delivery, e-commerce purchases, and ride-hailing services which have small ticket sizes while they utilize their bank accounts for bigger payments and transactions. The average size of transactions for EMI during 4Q24 was Rs. 2,851.

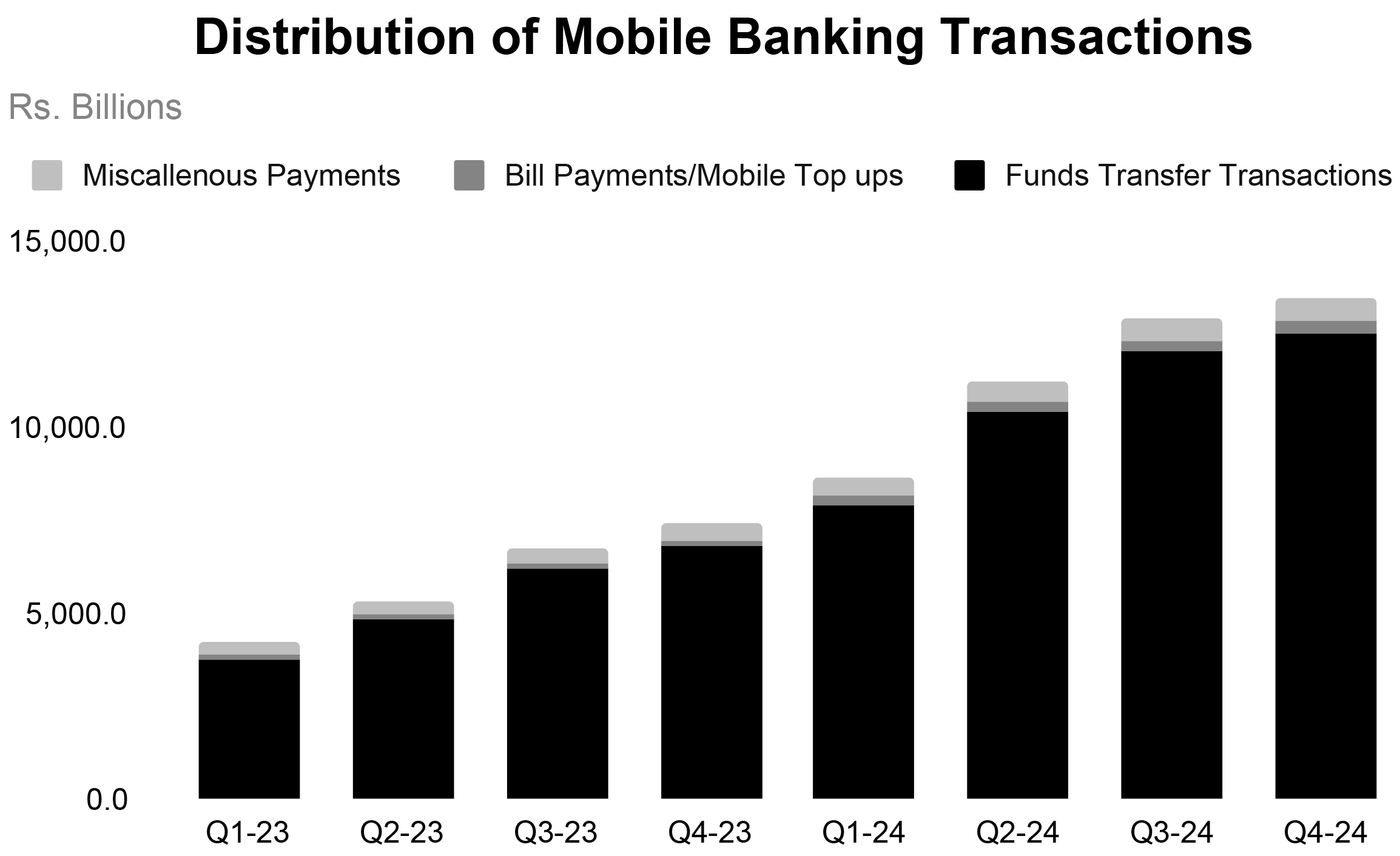

On the contrary, we have mobile phone banking which is used by customers a lot more frequently, around 324 million transactions were made through mobile banking channels during 4Q24, which represented a gigantic sum of Rs13.5 trillion. Interestingly, 85% of transactions were for funds transfer, which amounted to Rs12.6 trillion, however, these funds transfer transactions are a substantial source of revenue for banks, unlike EMIs. The remaining 15% of transactions represented miscellaneous payments, bill payments, and mobile top-ups, which corresponded to a sum of Rs950 billion. Mobile banking constituted a mean transaction value of Rs41,723.

On the contrary, we have mobile phone banking which is used by customers a lot more frequently, around 324 million transactions were made through mobile banking channels during 4Q24, which represented a gigantic sum of Rs13.5 trillion. Interestingly, 85% of transactions were for funds transfer, which amounted to Rs12.6 trillion, however, these funds transfer transactions are a substantial source of revenue for banks, unlike EMIs. The remaining 15% of transactions represented miscellaneous payments, bill payments, and mobile top-ups, which corresponded to a sum of Rs950 billion. Mobile banking constituted a mean transaction value of Rs41,723.

What lies ahead?

While EMIs have a very real income stream constraint, all is not dark and gloomy as the SBP revised the EMI regulations in June 2023, which broadened the scope of an EMI license.

An EMI is now capable of offering new payment services such as payments aggregation, bill/invoice aggregation, escrow services for domestic e-commerce transactions, services via APIs to financial institutions/fintechs, and inward cross-border remittances.

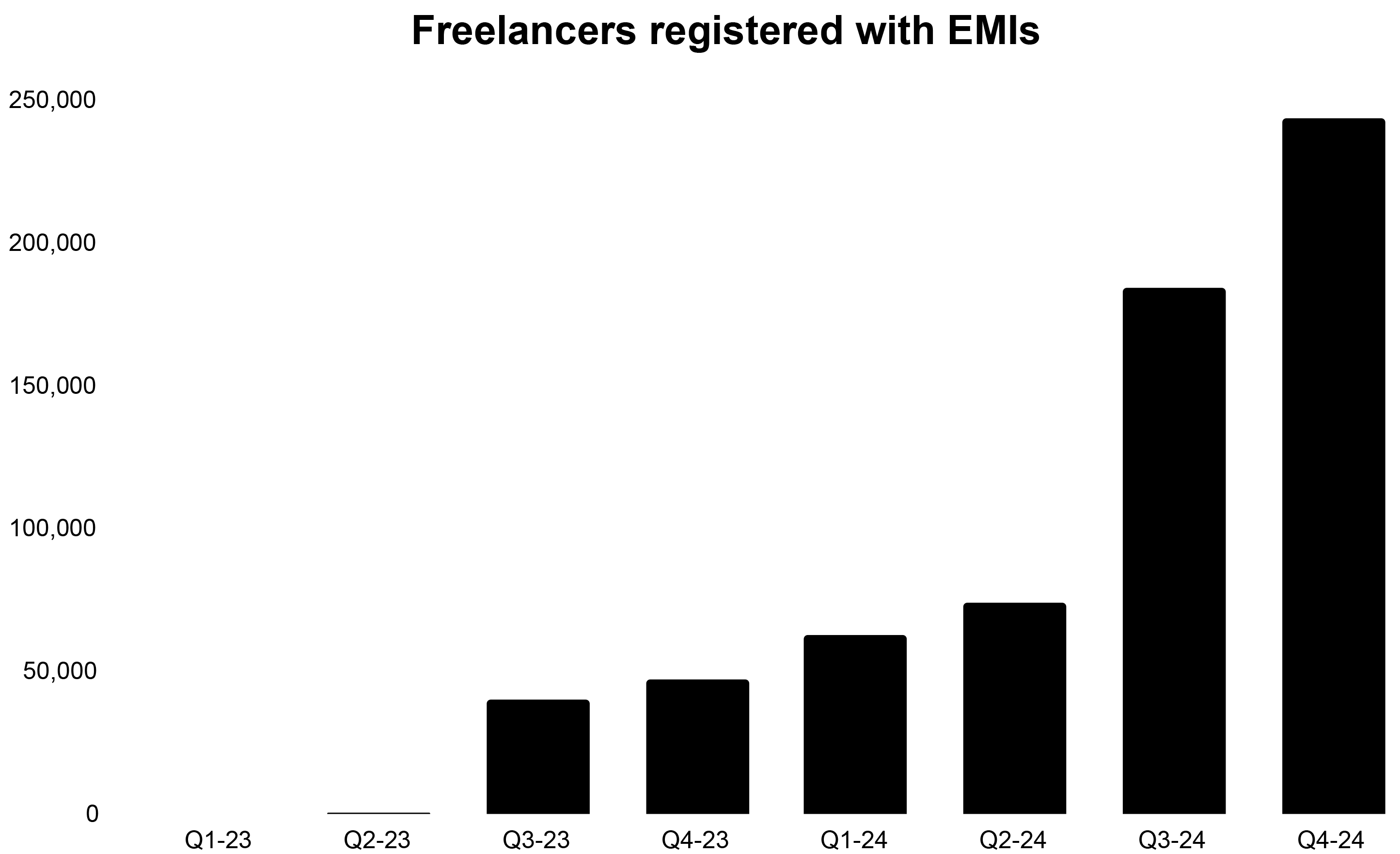

This revision in regulations has enabled them to commence offering services to freelancers as well. Freelancers make up a significant chunk of the customers of EMIs and are growing at a brisk pace due to the exceptional services offered by them.

EMIs like Sadapay are compatible with payment systems like Apple Pay and Google Pay, which allow freelancers in Pakistan to receive international payments in their local bank accounts. They charge 5% on these international transactions and offer better exchange rates than other platforms. Hence, the number of freelancers using Sadapay has increased from nil in 1Q23 to 243,639 by the end of 4Q24. Nevertheless, freelancers can’t store their funds in dollars. Moreover, EMIs need to partner with one of the 31 SBP-approved commercial banks to deal with foreign exchange, which is a bit of a nuisance for them.

Experts suggest that EMIs can diversify their revenue by leveraging their customer base through partnerships with financial institutions. By enabling cross-selling and profit-sharing, EMIs could potentially access additional revenue streams. The ultimate goal would be acquiring an NBFI license, which would allow expansion into product distribution like mutual funds and insurance.

However, the evolving financial landscape—with enhanced digital services from commercial and microfinance banks, and emerging digital banks—makes digital payment services alone insufficient. EMIs must explore adjacent segments like lending and financial product distribution to remain relevant in the market. [/restrict level]