Attock Petroleum Limited (APL), one of Pakistan’s leading oil marketing companies, has announced its financial results for the six-month period ended December 31, 2024. The company reported a profit after tax of Rs. 5.12 billion, marking a 34% decline compared to Rs. 7.80 billion in the same period last year. Earnings per share (EPS) stood at Rs. 41.18, down from Rs. 62.69 in December 2023.

The decline in profitability was primarily attributed to a 15% drop in net sales revenue, which fell to Rs. 231.82 billion from Rs. 271.91 billion in the corresponding period last year. APL cited lower average selling prices, inflationary pressures, and the persistent issue of illicit trade as key factors impacting revenue. Despite these challenges, the company managed to offset some losses through strategic financial management, including a significant reduction in exchange losses and increased finance income.

APL maintained an uninterrupted supply of petroleum products to its customers, securing key contracts with the Pakistan Army and Pakistan Air Force for the supply of High-Speed Diesel (HSD), Premium Motor Gasoline (PMG), and Jet Petroleum. The company also achieved a milestone by delivering HSD to the Pakistan Air Force at Deosai, Gilgit Baltistan, the world’s second-highest plateau.

The overall oil and gas industry saw a 5.6% increase in sales volume, reaching 8.99 million metric tons. APL’s sales volume of HSD grew by 2.4%, while PMG sales declined by 0.7%, contrasting with a 4.8% industry-wide increase in PMG sales.

Expansion and Diversification

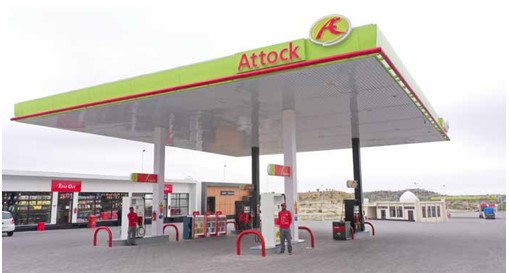

APL continues to expand its retail network, adding 18 new outlets, bringing the total to 816 multi-fuel retail sites, including 44 Company-Owned Company-Operated (COCO) outlets. The company is focusing on high-traffic motorway locations and urban centers, with new sites under development in Peshawar, Lahore, Karachi, and Quetta.

In a strategic move to diversify revenue streams, APL is venturing into the sale of Liquefied Petroleum Gas (LPG). A new LPG storage facility at the Rawalpindi bulk oil terminal, with a capacity of 203 metric tons, is nearing completion and is expected to be operational by the end of FY 2024-25.

Infrastructure and Sustainability

APL is investing heavily in infrastructure to meet rising market demands. Expansion plans include the addition of a 10,000 metric ton PMG tank at the Rawalpindi terminal and an 18,700 metric ton PMG tank at the Port Qasim terminal. The company is also working on developing EV charging infrastructure in collaboration with the National Energy Efficiency and Conservation Authority (NEECA), aligning with global sustainability goals.

Financial Position

As of December 31, 2024, APL’s total assets stood at Rs. 114.04 billion, up from Rs. 105.28 billion in June 2024. The company’s current liabilities increased to Rs. 44.31 billion, while non-current liabilities remained stable at Rs. 10.83 billion.

The Board of Directors declared an interim cash dividend of Rs. 12.50 per share for the year ending June 30, 2025, amounting to Rs. 1.56 billion.

According to reports, the company’s efforts to combat illicit trade and improve operational efficiency are expected to strengthen its market position in the coming years.