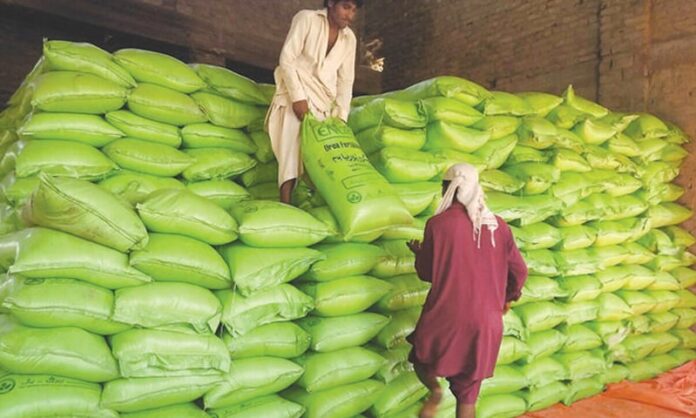

ISLAMABAD – Pakistan’s overall nutrient offtake in June 2025 saw an 11% year-on-year increase, reaching 407 thousand tonnes, according to the latest fertiliser report from the National Fertiliser Development Centre (NFDC). Among major nutrients, nitrogen and potash offtake recorded notable increases of 15.7% and 41.2%, respectively. However, phosphate offtake declined by 6.7% compared to June 2024.

The report highlights that urea off-take during June 2025 increased by 20.6%, reaching 582 thousand tonnes, driven by peak Kharif 2025 planting activity, better farmer incomes from higher crop prices, and increased loan disbursements through the Kissan Card scheme. On the other hand, DAP offtake decreased by 6.6%, totaling 115 thousand tonnes, reflecting the impact of higher DAP prices that limited farmers’ purchasing ability.

In terms of domestic fertilizer production, total production in June 2025 was 790 thousand tonnes. Urea production amounted to 555 thousand tonnes, while DAP production was 75 thousand tonnes. The total imported supply was recorded at 128.7 thousand tonnes, mainly consisting of DAP and MOP.

The total urea availability for June 2025 was 1,870 thousand tonnes, including both domestic production and leftover stock from May. After accounting for the offtake, the closing balance for urea stood at 1,278 thousand tonnes. For DAP, availability rose to 439 thousand tonnes, with a closing balance of 324 thousand tonnes after offtake.

On the pricing front, domestic prices saw slight changes. The price of urea (sona) decreased by 0.5%, while DAP prices decreased by 1.3%. The average price of urea (sona) and DAP was Rs4,452 and Rs12,768 per 50 kg bag, respectively. Internationally, urea prices in China and the Middle East saw an upward trend, with prices ranging between $350–420 per tonne in China and $375–458 per tonne in the Middle East. DAP prices also increased in Morocco and China, reflecting higher international market costs.

These developments indicate a strong fertiliser market performance in June 2025, driven by higher demand during the planting season, despite price challenges in some segments.