It was the news that sent shockwaves for the few minutes we all thought it was true. On Thursday, September 17, 2020, Topline Securities, an investment bank, sent out a note to clients stating that several financial institutions had received a request for proposals from the Pakistan Telecommunications Company Ltd (PTCL) to serve as advisors on possible mergers and acquisitions transactions involving the company’s mobile subsidiary, Pakistan Telecommunications Mobile Ltd (PTML), better known by its consumer-facing brand name Ufone.

That is the kind of news that is not surprising, but still shocking. Anyone who has been observing the Pakistani telecommunications industry knew this made all the sense in the world. But is it really happening? Could PTCL be making what seems like an eminently sensible decision of selling off the struggling Ufone?

It turns out that the answer is quite complicated. PTCL may be partially privatised with a 26% shareholding and management control in the hands of the Abu Dhabi-based Etisalat, but it is still mostly a state-owned company, with the government of Pakistan retaining a 62% stake. That meant – as the federal law ministry was quick to point out that very same day, upon being reached for comment by Profit – that any such transaction would have to go through the Privatization Commission, which in turn requires the federal cabinet to approve of the decision.

The only transaction, the law ministry pointed out, that could be contemplated without those approvals would be a merger of Ufone into the main PTCL operations, a mostly pointless exercise, since Ufone is already a wholly owned subsidiary of PTCL anyway. There might be some cost savings realised by merging the administrative functions of the two companies, but certainly not worth the kind of exercise that would involve hiring investment bankers to conduct the transaction.

The law ministry, of course, is right insofar as the law itself is concerned. But with respect to the strategic decision, a merger into PTCL would be absolutely the wrong decision. The better decision would be an acquisition of Ufone out of PTCL, and into the waiting arms of China Mobile Pakistan Ltd, better known by its consumer brand name, Zong. (We will explain later why Zong is the only logical buyer.)

At Profit, we have previous covered the decision of PTCL not to invest in 4G infrastructure, and pointed out in that story that we had been told by sources familiar with the matter that the PTCL management had previously considered selling Ufone in 2016. Etisalat had publicly denied those rumours in September 2016.

Yet it seems that the idea may not have been entirely discarded back then, and PTCL – which has been struggling to increase its revenues over the past seven years – may still be looking at mergers and acquisitions as a means of unlocking the value in its assets. As we examine in this article, that is likely to be a profitable decision, provided PTCL makes the right choice: sell Ufone and go all in on becoming the nation’s telecommunications infrastructure backbone, rather than trying to extract what little synergies will be available through a complete merger with Ufone.

A brief history of PTCL and the Ufone debacle

First a quick recap of the history of how PTCL arrived at this situation. We have covered this in detail in a story in August 2019, and hence will be brief here.

PTCL was set up after Partition as the monopoly provider of telecom services in Pakistan, a role that remained unchallenged between 1947 and 1989, when the first mobile operators started services in Pakistan. Mobile telecommunications started becoming important in Pakistan around the late 1990s and early 2000s. The first mass market player was Mobilink, which established operations in 1998, followed in 2000 by PTCL itself, which set up Ufone.

The market grew more competitive in the following decade as Telenor arrived in 2005, Warid set up operations in 2006, and Zong set up shop in Pakistan in 2008. Yet Ufone was largely able to maintain a solid market share and remained the second or third largest player in the market for most of this period.

What completely changed the game was the introduction of 3G and 4G spectrum, which was first auctioned off in Pakistan in 2014. Zong was the only one to buy a 4G license in that auction, spending $517 million to do so, and rapidly began to gain market share as a result of its 4G services, jolting the complacent market leaders – Mobilink and Telenor – into buying 4G spectrum the next time the government auctioned licenses in 2016. Following that move, Mobilink acquired Warid in 2017 and renamed itself Jazz (previously its prepaid consumer product name).

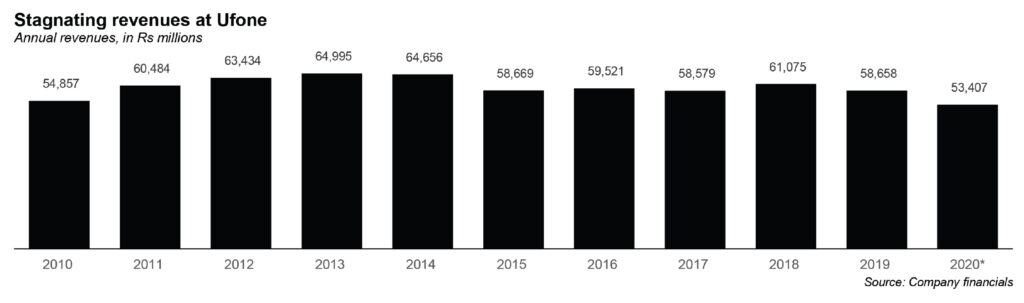

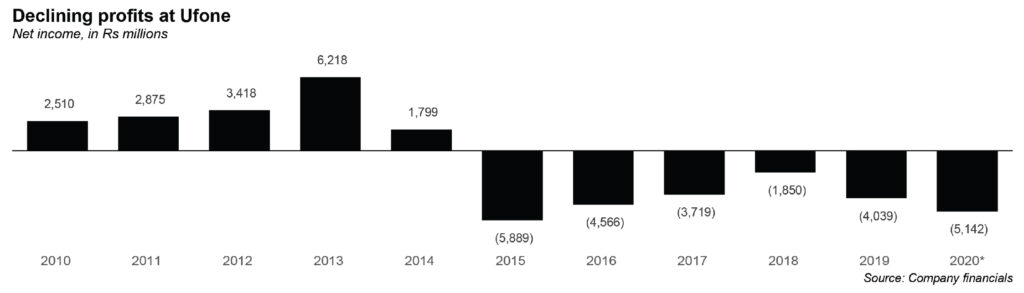

As of early 2017, Ufone was the only company in the Pakistani telecommunications market that did not offer 4G data services. And it has showed up in the fact that it is now the smallest of the four mobile telecommunications operators in the country. Since Zong began its assault on the market share of its competitors in 2014, Ufone has suffered particularly badly. The year 2014 was the last time Ufone made a profit. It has consistently lost money since then.

In August 2019, however, Ufone launched its 4G services quietly, with the government apparently allowing it to set up such operations without having to buy 4G spectrum separately, similar to how Warid started its 4G services.

Unfortunately for Ufone, that does not seem to have helped matters. In the 12 months ending June 30, 2020, Ufone lost 1.3% of its subscribers, and saw its revenue decline by 9% compared to the same period in the previous year. That means that Ufone lost some of its best-paying customers to other mobile operators in the year that it finally launched its 4G services. In other words, as far as Ufone users are concerned, the switch to 4G is too little, too late.

Ufone remains the only mobile company that still has more 3G subscribers than 4G subscribers. The industry as a whole has made a rapid shift in the direction of 4G, and Zong has even begun making preparations for 5G services in Pakistan.

Of the 83 million people in Pakistan with mobile internet connections, 51.4 million – or nearly 62% of them – have 4G connections. That number just two years ago was just barely over 25% of a much smaller population of mobile broadband internet users. There is no question: a nationwide infrastructure of 4G data services is now table stakes in the game of offering mobile communications services to Pakistanis.

PTCL’s core business

Despite Ufone’s struggles, of course, PTCL has quite a few other businesses. Its core business remains its landline-based business, which it has successfully transitioned towards becoming the backbone of its broadband internet and cable television business. PTCL also remains an important carrier of Pakistan’s telecommunications to the outside world, with an international business. And its mobile banking unit has also grown quite rapidly over the past four years.

But perhaps the most promising business for PTCL is the ‘carrier of carriers’ business, where the company offers fiber connectivity to other telecommunications businesses.

“PTCL is the carrier of carriers,” said Daniel Ritz, who was CEO of PTCL from March 2016 through March 2019, in a February 2019 interview with Profit. “In a way, the rapid data volume growth of the mobile operators is a blessing for PTCL, because these operators need a lot of capacity for data traffic. The most efficient way to carry this traffic is fiber, and PTCL has the largest fiber network in the entire country. So, while these mobile operators are competitors for Ufone, they are at the same time a great opportunity for PTCL.”

Can you spot the central tension in that comment by Ritz? The ‘carrier of carriers’ business is a great opportunity for PTCL, but it relies on offering high quality services to companies that are competitors of its Ufone business.

This is not just a nice little side business that PTCL has. It is rapidly becoming PTCL’s core business, and has the potential to account for the dominant share of the company’s business in the next few years.

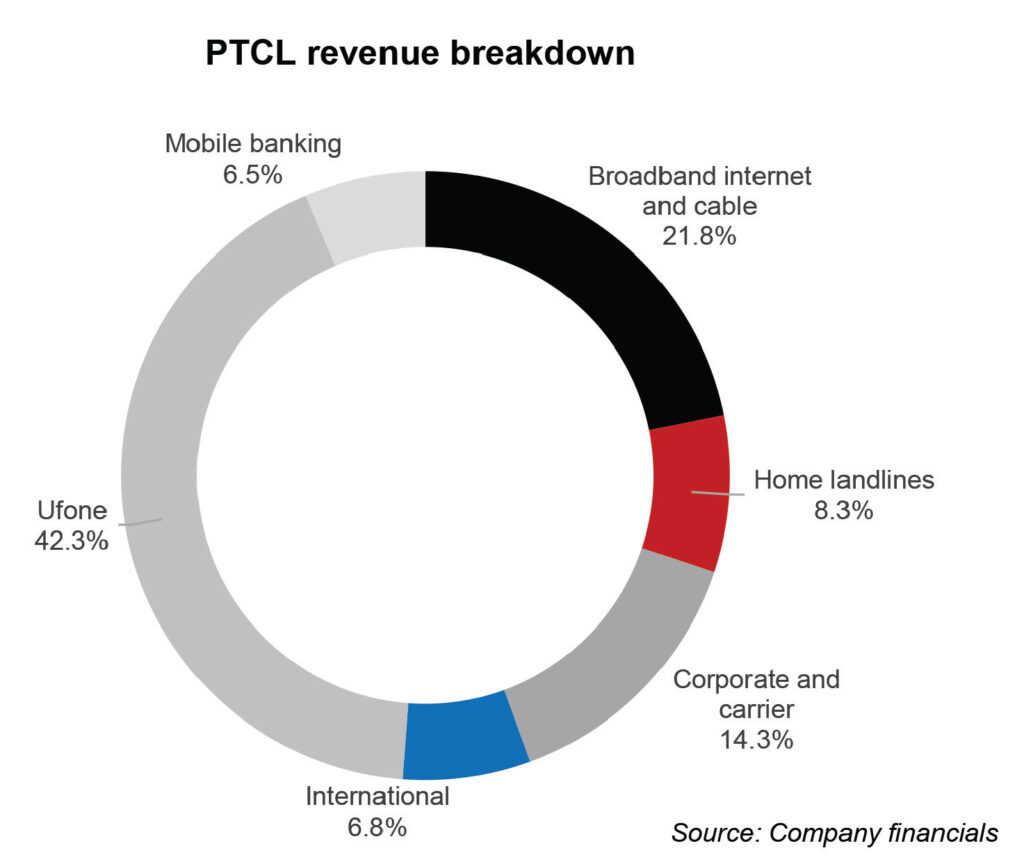

Let us break down the data. PTCL effectively has six business lines. They are, in order of size: Ufone, the broadband internet and cable television business, the corporate and ‘carrier’ business, home landlines, international services, and mobile banking. Of these six, three – Ufone, home landlines, and international services – have seen revenues consistently declining since 2017, when PTCL started breaking out the data for its revenues by business line.

Of the three business lines that have had positive revenue growth, broadband internet and cable television has been a mostly steady business, growing at just 3.7% per year between 2017 and June 30, 2020, the latest period for which financial statements are available. That leaves two rapidly growing business segments: mobile banking and the corporate and carrier business. The mobile banking business is growing slightly faster than the carrier business (53.4% per year versus 48.4% per year), but crucially, the carrier business has been able to nearly match the growth of the mobile banking business from a much higher base.

If a bigger business can grow nearly as fast as a significantly smaller business, that makes it easily the most attractive business in PTCL’s portfolio.

Of PTCL’s Rs126 billion in revenues for the 12 months ending June 30, 2020, Ufone now accounts for just 42.3% of its business, compared to a high of 52.9% in 2011. It was as high as 50.1% of PTCL revenue as recently as 2017. That is a dramatic fall from grace, and one that PTCL simply cannot afford to ignore.

Meanwhile, the carrier business has gone from 5.7% of revenues in 2017 to 14.3% of revenues in 2020, and is likely to continue growing. Back when Profit spoke to Ritz, he was already talking about ways to grow the business much more substantially.

“The IRU [indefeasible right of use] contract with Zong was the first of its kind, and since then we have done more of the same. We have also signed a deal with Telenor in 2018. And there is more to come,” said Ritz in 2019.

In short, PTCL’s most promising business is currently being hampered by an albatross around its neck that is Ufone. What is the solution? Should PTCL just cut its losses on Ufone, and sell it? The answer from research analysts who track the company’s stock is a resounding yes, but some experts say that just because PTCL would sell the Ufone business does not mean it needs to let go of Ufone’s own infrastructure in addition to retaining the core PTCL fiber infrastructure.

What a Ufone transaction could look like

First let us take a look at just the purely financial aspect of what selling the Ufone business might look like, particularly as it relates to the impact it will have on PTCL. Analysts who have examined the question come to one resounding conclusion: selling the business would result in significant gains for existing shareholders of the company, the biggest of which is the government of Pakistan.

Shankar Talreja, an equity research analyst at Topline Securities, the investment bank, has done some calculations that suggest that Ufone could be worth approximately Rs76 billion. That gain amounts to Rs15 per share of PTCL, which is staggering, considering the fact that PTCL closed at Rs11.72 per share in trading on the Pakistan Stock Exchange on Thursday, September 24, 2020.

How does Talreja arrive at that valuation? Recent transactions in the mobile telecommunications space have seen companies sold for an average enterprise value of 2.77 times revenue. Enterprise value equals the value of the company’s stock plus the amount of net debt it has on its balance sheet.

Talreja assumes that Ufone might sell for lower than that, at around 2.5 times revenue, which implies an enterprise value of Rs153 billion, given the company’s Rs61 billion in 2019 revenue, minus the Rs76 billion in net debt equals just over Rs76 billion in equity value.

Beyond just the value of the sale, PTCL would stop bleeding money, which is currently happening due to the consistent losses at Ufone. “PTCL has been injecting cash in Ufone due to its increasing working capital requirements and deteriorating balance sheet. Loans and advances given to Ufone by PTCL have touched Rs7.5 billion,” wrote Talreja in a note issued to clients on September 17.

More than just the economics of Ufone, though, PTCL would be a better, stronger, and – in the medium to long run – even a bigger company if it sells its mobile subsidiary.

What the transaction would mean for PTCL

“The possibility of a Ufone sale and PTCL focusing on a carrier of carrier strategy is fantastic,” said Isfandiyar Shaheen, CEO of NetEquity Networks, a San Francisco-based startup focused on making the internet more affordable around the world.

Shaheen knows the market quite well. In addition to currently leading a startup that is focused on improving connectivity, he has previously served on the board of directors of Towershare, a Dubai-based company that has been active in the mobile communications infrastructure sharing business in both Pakistan and other countries in the region.

He believes that PTCL’s assets are currently undervalued by the market for two reasons: PTCL has not yet fully focused its efforts on being mainly an infrastructure company, and even if it did, its ownership of Ufone will be seen as the potential clients of that infrastructure company as too big a conflict of interest.

“PTCL has amazing infrastructure and if it focuses on becoming an infrastructure company – that is, makes its towers and fiber and other such infrastructure accessible for other operators – it will not only build an amazing business but also accelerate fiberisation towards rural areas,” said Shaheen, via e-mail. “I think selling Ufone is critical and I really hope the regulator allows this. Jazz, Zong, and Telenor will have a much easier time sharing infrastructure with a non-competitor.”

Let us tackle the first part of those two reasons first: why becoming an infrastructure company would make sense for PTCL. “Infrastructure companies are a better business. They offer more cash flow predictability, and trade at higher [valuation] multiples,” said Shaheen.

What does it mean when we say infrastructure companies have more predictable cash flows? Their revenues are dependent on large corporate contracts that tend to have less variability because their clients – in this case the other mobile operators – are paying for capacity rather than paying per data use or per minute of calls. In this way, they are more similar to a rental business, except in this case, an infrastructure company can keep on adding more capacity as the market grows and the demand for services continues to grow.

In other words, it retains exposure to the growth in mobile services – especially mobile internet services – but at lower risk: if, for example, there is an economic downturn and people want to spend less money on cellular services, the mobile service operators would still have to pay their infrastructure provider for the capacity they will have to maintain. The downside of an infrastructure provider is better protected.

As for what the transaction structure should look like: if PTCL is to become that infrastructure sharing company, it should only sell Ufone’s spectrum and users, and retain the cellular towers. Indeed, Shaheen even suggests that whichever company buys Ufone should partially defray the cost of acquisition by selling its own towers to PTCL.

“Just do a tower for spectrum / users swap,” said Shaheen. “If, say, Telenor does this, then PTCL ends up with some 14,000 towers and over 60,000 kilometres of fiber. That’s an awesome infrastructure company. Telenor gets more spectrum and customers. Same for Zong or Jazz.”

As for who could end up buying Ufone, sources familiar with the matter tell Profit that neither Jazz nor Telenor Pakistan have the appetite for buying Ufone, though they would likely at least go through the motions of examining the possibility of an acquisition. Jazz just went through a painful exercise of merging with Warid, and has only just now started to realise the benefits of the cost synergies. It will be unlikely that it will feel the need to acquire Ufone.

Meanwhile, Telenor does not seem to be interested in acquisitions as a growth strategy in Pakistan, having previously more or less passed on the idea of buying Warid. Eliminating those two leaves just Zong, which is both eager to grow, and has the balance sheet to pull of a transaction.

What the transaction would mean for Pakistani consumers

“The impact of PTCL selling Ufone on Pakistani consumers will be overwhelmingly positive,” said Shaheen. “I cannot stress this enough. We don’t need another telco. We need more fiber. PTCL getting out of Ufone will accelerate fiberisation. This will be amazing for data prices. Especially if PTCL treats its infrastructure as open access infrastructure, which I believe they will.”

Here is how that would likely play out: PTCL would sell Ufone’s spectrum and users to a competitor, but retain Ufone’s towers and indeed buy that competitor’s towers. At that point, PTCL owns the fiber network, and a large network of towers, meaning that its cost of providing cellular services would be dramatically lower than any competitor could possibly hope to achieve.

PTCL would then rent access to those tower and the fiber network to the remaining three cellular operators, who in turn no longer need to make the costly upfront investments in maintaining their tower infrastructure. They can just rent it from PTCL, which is likely to be viewed as a positive by these companies.

“These telcos face declining ARPU [average revenue per user] and rising data demand. Having PTCL take care of a chunk of capital expenditure will be amazing for them,” said Shaheen.

Here is how that saves costs and lower prices for consumers: PTCL’s infrastructure can be shared by all three companies, and relatively low marginal costs, meaning it costs PTCL about the same to serve one company as it does to serve all three. That means that if it serves all three companies, the cost it can charge each of the three will be one third that of what it need to charge if it was doing this for just one company.

That lower cost should result in significantly lower prices over time, and may even significantly expand access to the internet and cellular services for more and more Pakistanis.

There is also one other factor to consider. Right now, a large part of Pakistan’s telecommunications infrastructure is owned by foreign companies: Jazz, Telenor, and Zong all being local subsidiaries of multinational corporations. If PTCL were to become the carrier of carriers for all of these companies, that is likely to be an outcome viewed more favourably by the country’s national security establishment, particularly the military. To have control over all telecom infrastructure in the hands of a company still largely government-owned would be an attractive proposition.

Why Zong is the only potential and logical buyer? Could you explain it soon?

Every thing sale to Chinese. Govt should make easy for new players to enter in the market so market will having more competition

who owns the remaining 12% stack in PTCL, 62% by Govt and 26% by Etisalat?

Public – Small share holders

12% share in stoke exchange of Pakistan.

PTCL has not subscribed to Mobile Phone Spectrum of 4G/LTE in the Spectrum Auction by the regulatory authority. Hence the network of Ufone is not compliant to Digital Networks, Upgradation to 5G when offered. PTCL LandLine network is not Digitised. Hence it has to struggle with the conventional old aluminum insulated wire not compliant for Broadband. The private Sector companies offer OFC PON Digital network in most parts of Pakistan. Secondly the PTCL properties telephone exchanges are attached are not upgraded over years on the Digital Network. Most of the internet customers subscribe to hundreds of licensed ISP’s catering to education, masses, businesses are reasonably priced, standardised, Digital Networks of PON OFC network also very compeetively priced. The telephone exchanges & related properties are still occupied by PTCL and not returned to the Government. Lastly in view of the technology infrastructure of PTCL in que is wholly analog, as PTCL did not participate the launch of 5G. The era of 5G is very important which is done by Zong. Trust PTCL should show its seriousness by investment in the networks for 5G, and related trails to the Government. Digital Networks will help safety of humans as road accidents, surveillance safety, emergencies, etc., all responsibiliy of PTCL.

Can you please write an article on why Zong CMPAK is only potential buyer and how it will impact CMPAK Buisness and customer experience.

Great article on current dynamics of telecom sector of paksitan in general and on PTCL in particular. What i believe is that PTCL was unable to diminish its long existing ~negative Aura ~ of complains and Disconnectivity. Although customer service has improved alot over the years. However, persistent issue in the infrastructure pose it a grave risk to its reputation.

I previously read an articel at Businesstribune.com.pk and they have mentioned that Foreign Debt of Ufone has caused significant Revaluation loss for PTCL. Ufone stands overly leveraged at the moment.

this article is highly tilted towards cmpak. now ptcl n ufone has merge management. I hope our national cellular company will return to shining days. Inshallah

why PTCL sell to Ufone and is that good idea or bad and why it’s a good idea or why it’s a bad idea

Happy Readings

Sorry To Here That! Mr Nouman😂😂

i want reason sir not happy reading sir

The Valuation methodology over here for UFone is based on EV to Sales multiple of 2.7 which seems too high. In USA good companies have around 3x sales = EV. In Pakistan the multiple would not be more than 1.5 . Secondly, Ufone should be valued via FCFF( Free cash flow to firm) to find out the EV based on Intrinsic value which would be far lower. This is due to the fact that free cash flows in ufone are very low due to high NWC and High capex and a larger cost of capital.