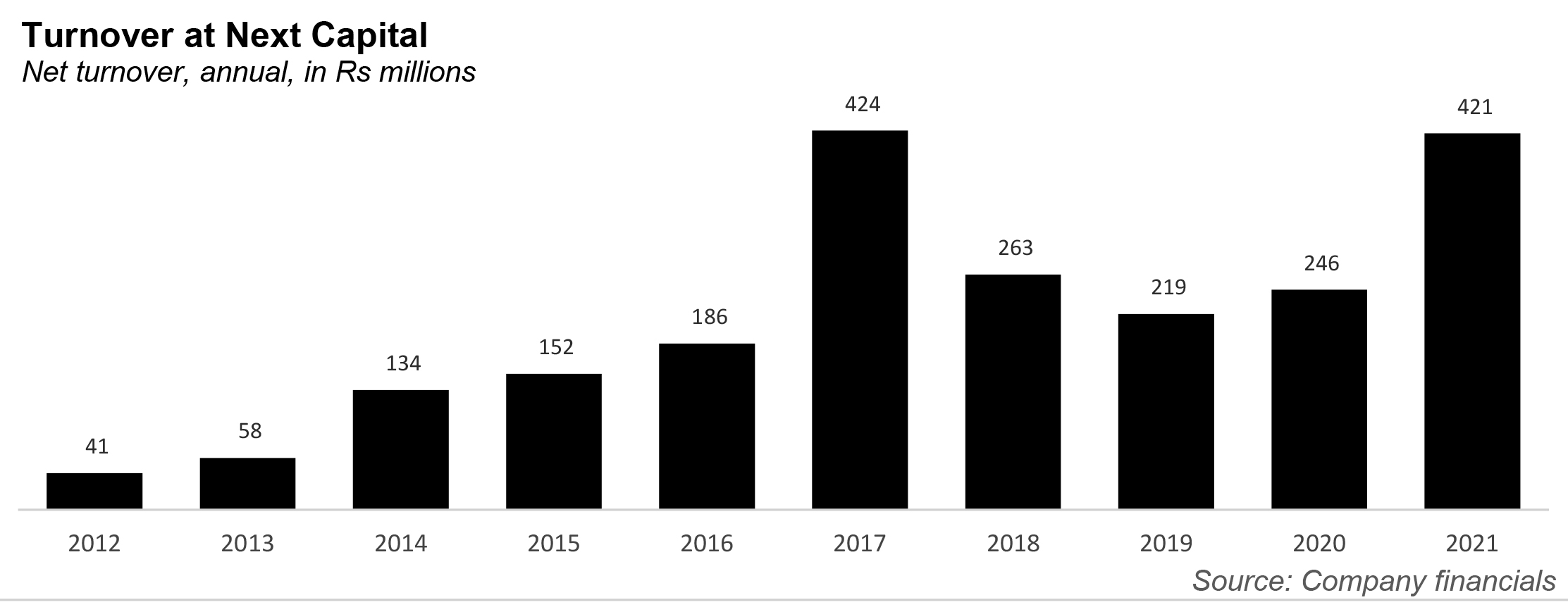

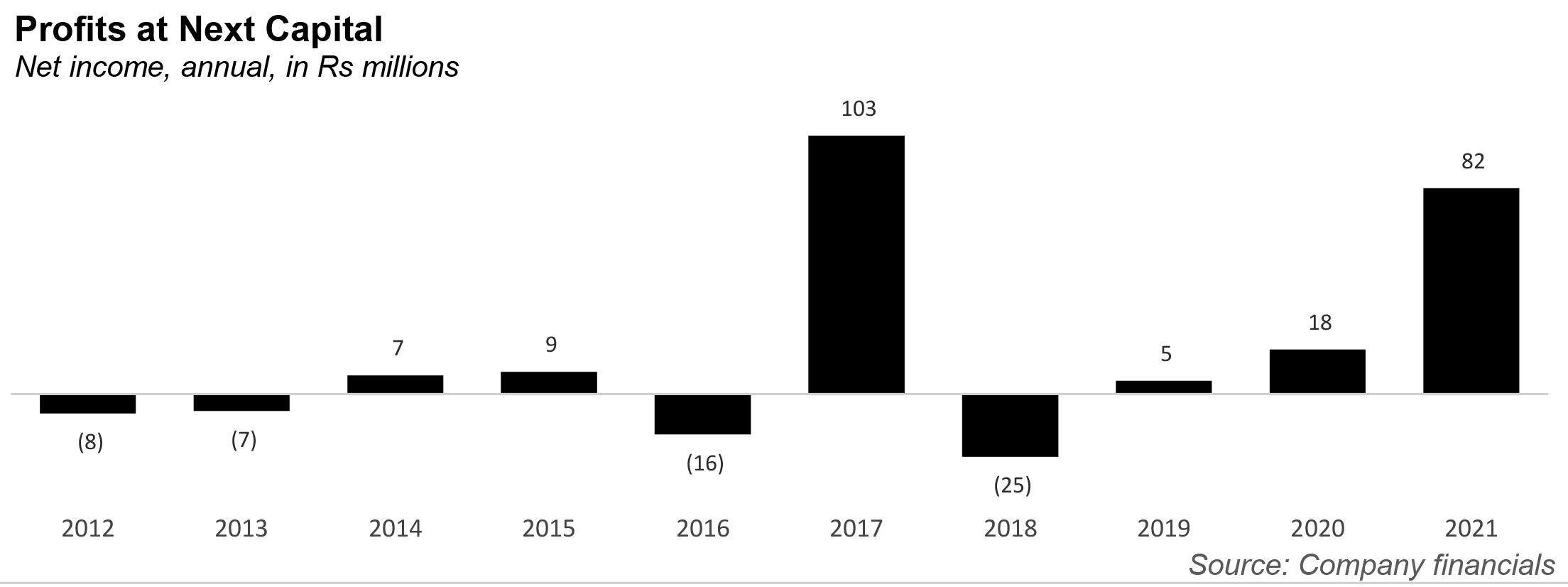

By all accounts, it looks like an astonishingly good year for Next Capital. In its recently released financials to the Pakistan Stock Exchange, the company’s turnover jumped to Rs421 million from just Rs 246 million, while its net income shot up to Rs 81.9 million, compared to just Rs17.7 million the year prior. That’s a jump of nearly 4.5 times.

But the increase does not look as impressive when one zooms out. In fact, this is the second best pair of results that the company has ever earned. In 2017, the company had a net profit of Rs108 million, the highest it has ever been. That year also boasted the highest revenue, at Rs424 million. So the question is now why the company did well this year – it is what happened between 2018 and 2020 that forced it to catch up?

But first, some context on Next Capital. The investment bank and equities brokerage house is the brainchild of Najam Ali. Perhaps most famously before Next Capital, Ali was the chief executive officer at JS Investments Limited. During his tenure at JS Investments, the company achieved the highest rating of AM2 Plus in the industry, and remained the largest asset management company in the private sector, with Rs300 million assets under management. He has also been the founding chief executive officer of the Central Depository Company (CDC), Pakistan’s first and only securities depository. While at CDC, he also led the development and implementation of the National Clearing and Settlement System, which is the centralized clearing system in Pakistan for all the stock exchanges.

The point of listing these resume activities is to say that when Najam Ali decided to start Next Capital in 2009, people paid attention. It helped that he was able to also snag other members for Next Capital form the industry: such as Zulqarnain Khan,director, who had previously worked at JS Global Capital Limited, and at AKD Securities, Ali Akhter Ali, the man aging director for Capital Markets, who had previously worked at TPL Life Insurance and JS Investments.

Next Capital was quick to list: while started in 209, it was listed on the exchange in 2012. That year, its turnover stood at Rs41 million, cand crossed the Rs100 million mark in 2014, and the Rs150 million mark just a year later.

It was in 2017 that the company did astoundingly well. According to that year’s annual report, where total revenue increased by 116%, the brokerage revenue has grown by 77%. The company has basically increased its presence significantly in foriegn equity brokerage.

There was only one ominous line from the report: “Although a subdued outlook for the equity market could not be ruled out in the immediate term given macroeconomic headwinds, long term prospects for local equities remain robust.”

And it was that short term crash that ruined them. The very next year, revenue fell 38% to Rs263 million, and the company made a loss of Rs 25 million – its second loss in two years. The economy and the capital markets had essentially crashed the following year. As a rule, an election year is always a miserable year of uncertainty, which is reflected in Pakistan’s general economic health. The decline in trading volumes meant a decline in the brokerage income by 28.5%. Institutional and retail equity brokerage declined by 30.5% and 25.3%. It also didn’t help that the same year the government changed some of its taxation laws around brokerages. The tax rate on equity brokerages was doubled in 2018’s budget, which meant that even though the company made a pre tax profit of Rs4.7 million, it ended up making a loss of Rs25.3 million.

Still, it didn’t do too bad in the years after. WHile revenue fell to Rs219 million just the year after, the company made a profit of Rs5 million, and then a profit of Rs18 million the next year. This year was a bumper year, as it were. The company’s operating revenue increased by 885, while the brokerage income increased by 78%, mostly because of increased trading activity. The advisory and consultancy revenue also increased by 35% from last year.

What is interesting is how the composition of how Next Capital makes its money has changed. For instance, in 2017, almost 30% of the company’s operating revenue originated from consultancy fees, while the brokerage segment contributed 70% Of that, more than 62% of brokerage income originated from institutional clients, such as banks, mutual funds and insurance companies, while the rest came from retail investors.

Fast forward to 2021, and brokerage income stood at Rs355 million or around 85% of total operating revenue, while investment banking only makes up 15%. Meanwhile only 28% of the brokerage income comes from institutional clients, while retail clients make up the rest.