KARACHI: The banking sector of Pakistan had an impressive start to the year 2023, as revealed by a performance review conducted by JS Global. This comprehensive assessment focused on a sample size of 12 banks, which collectively represent a whopping 85% share of the entire banking sector market. The findings unveil a narrative of soaring income and profitability for the banking sector of Pakistan.

Increase in income

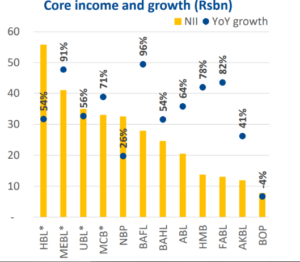

The research findings reveal that the first quarter of 2023 was an exceptional quarter for the banking sector, with a record-breaking increase in income. This remarkable increase can be attributed to the unprecedented surge in interest rates, which ensured a steady flow of interest-based income for the banks.

Over the past two years, interest rates have consistently been on the rise. As of January 2023, the interest rate stood at a notable 17%. However, it didn’t stop there, as it climbed by a significant 300 basis points to reach 20% by March 2023. Presently, the interest rate stands at an impressive 21%.

With the escalation of interest rates, interest-based income, also referred to as markup income, experienced substantial growth for the banks. Most banks witnessed double-digit year-on-year growth rates in their interest-based income. Bank Alfalah (BAFL) recorded the highest growth rate, soaring by an impressive 96%, closely followed by Meezan Bank (MEBL) at an outstanding 91%.

Increase in Deposits

The balance sheets of banks demonstrated robust growth in deposits, with double-digit year-on-year increases observed for most banks. Notably, Bank Alfalah (BAFL) once again stood out with the highest year-on-year growth rate, reaching an impressive 32%. This indicates that BAFL’s deposits in Q1 2023 expanded by 32% compared to the same period in 2022.

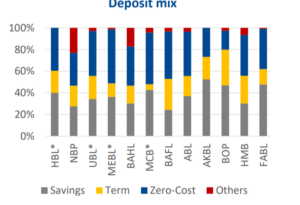

For many banks, a significant portion of their deposits comprised zero-cost deposits. These banks are typically larger institutions with extensive branch networks and well-established brand names, attracting a larger customer base. Consequently, they possess a greater number of current accounts in comparison to smaller banks. These current accounts represent zero-cost deposits, as they do not require interest payments to customers.

In the ongoing high-interest rate environment, zero-cost deposits hold significant value for banks. These deposits serve as the holy grail for banks as they can utilize them for lending purposes or invest them in government securities. Both of these options generate interest income for the banks, contributing to increase in profitability and overall financial performance which explains the astounding increase in income.

As the above graph shows, MEBL maintains highest rank in zero-cost deposit mix, clocking in at approximately 50% this quarter.

ADR vs IDR

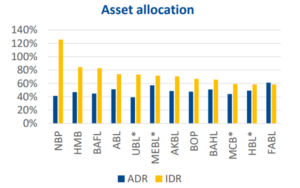

As mentioned earlier, banks have the opportunity to utilize their deposits in two distinct ways: by extending loans to individuals and businesses or by investing in government securities and bonds.

The Advances to Deposit Ratio (ADR) serves as a gauge for measuring the extent of lending to the private sector, encompassing both businesses and individuals, in relation to the total deposits held by the bank. Conversely, the Investment to Deposit Ratio (IDR) reflects the proportion of a bank’s overall investments in comparison to its total deposits.

Interestingly, Pakistani banks have exhibited a tendency to prioritize income generation through investments in government securities rather than focusing on lending to the private sector, comprising businesses and consumers. This preference stems from the perception that private sector lending entails a certain degree of risk, despite the potential for higher returns. In contrast, investing in government securities is regarded as risk-free, ensuring the preservation of the invested capital and the recoverability of interest income.

As a result of this inclination, the average ADR in Pakistani banks stands at 51%, while average IDR is notably higher at 71%.

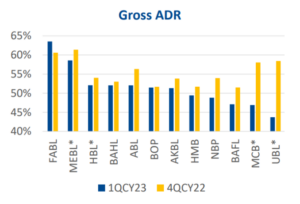

Reversal of ADR based tax and its effect

Furthermore, the ADR experienced a decline below the 50% threshold in Q1 2023 as compared to Q4 2022 following the reversal of an additional tax measure.

In July 2022, the government imposed a heightened tax on banks’ income derived from investments in government securities. This tax was supposed to be applicable in 2022. This tax amendment introduced steep tax rates of 55%, 49%, and 39% for banks’ investment income based on their gross ADR falling within the ranges of up to 40%, 40-50%, or over 50%, respectively. Consequently, banks were compelled to raise their ADRs above the 50% mark to mitigate the impact of the tax burden.

However, in late February of the current year, the government rescinded the tax amendment. With this reversal, banks are now only liable to pay the regular tax rate of 39% along with an additional 4% super tax. Without the ADR-based tax in effect, banks now have the freedom to invest in government securities, while the government can readily access substantial funds through borrowing from banks. This strategic move is expected to further hinder lending to the private sector. Consequently, gross ADR of prominent banks such as HMB, NBP, BAFL, MCB, and UBL has dipped below the 50% threshold.

best sector in psx banking sector .invest in banking sector shares and enjoy best dividend. life time investment sleep well,

Play to thousands and still find it very good.

I extend my deepest appreciation to the author for their commitment to excellence, as evident in the extensive research, thoughtful analysis, and polished writing style that characterize this remarkable article.

ADR based taxation must be abolished.

I find your content to be extremely valuable, and I enjoy reading blogs that provide me with knowledge. Now I’ll provide you some information and recommend that you wear this Mason Freemasons Varsity Crest Jacket this winter.

Racing heritage meets culinary charm – the Wonder Bread racing jacket is a collector’s dream.

THANK YOU FOR YOUR VERY IMFORMATIVE POST THAT YOU’VE SHARED TO ME.

THIS IS WOW AND AWESOME BLOG.

EXCELLENT POST, THIS IS SO REALLY NICE.

HAVE A GREAT DAY TO ALL! THANK YOU FOR THIS WONDERFUL BLOG THAT YOU’VE SHARED TO US.

This is really an amazing article.Thanks a lot for sharing a piece of wonderful information. keep it up posting.

Excellent and decent post. It is brilliant blog. I like the way you express information to us. Thanks for such post and please keep it up.