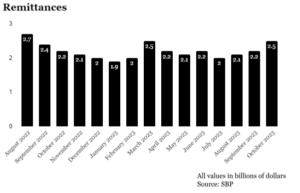

Remittances sent by overseas Pakistanis reached a seven-month high of $2.46 billion in October, improving by nearly 12% from last month’s figure of $2.21 billion, data shared by the State Bank of Pakistan (SBP) showed on Friday.

Remittances also increased on a year-on-year basis, rising by 9.58% compared to October 2022 when the figure stood at $2.25 billion.

For the last six months, remittances have ranged between $2-2.2 billion. However, in October, remittances improved across the board, especially from the United Arab Emirates and Saudi Arabia, which cumulatively contributed 60% to the month-on-month increase, according to a report by JS Global.

The brokerage house attributed this improvement to the crackdown on illegal foreign exchange trading launched by the government in early September. The crackdown, which was followed by SBP-mandated structural reforms in the exchange companies sector, led to a reduction in the difference between the interbank and open market exchange rates.

The report noted that the gap between the rates in both markets, which cannot exceed 1.25% for five business days under the agreement signed with the International Monetary Fund (IMF), had reached 8.5% at the start of September. However, it started declining from September 5 following the crackdown and averaged 0.5% throughout October.

While terming the improvement in remittances “good news”, Sajid Amin Javed, a senior economist associated with the Sustainable Development Policy Institute, said a stable rupee, convergence of open market and interbank rates and the ongoing crackdown against hoarders and hawala dealers were major drivers behind the rise.

Whenever the difference in rates between the interbank and open market widens, some overseas Pakistanis start sending money either through illegal channels such as hawala dealers or to exchange companies doing backroom deals.

Yousuf Saeed, head of research at Darson Securities, noted that a double-digit increase in remittances was seen after a “very long time”. He also attributed it to more overseas Pakistanis using legal channels following the crackdown, and the lower difference in rates between the currency markets.

Breakdown in remittances

The highest remittances were received from Saudi Arabia as Pakistanis residing there sent home $616.78 million, followed by the UAE with $473.91 million, the United Kingdom with $330.22 million, European Union countries with $297.54 million, and the United States with $283.26 million.

However, when considering a cumulative view over a four-month period of the fiscal year 2023-24, total remittances amounted to $8.79 billion, showing a decrease from the $10.14 billion received during the same period in the previous fiscal year, marking a 13.31% reduction. However, this was much better than the previous trend of 20%, according to the JS Global report.

The brokerage house further said that the rise in remittances was encouraging in light of expectations of import levels normalising in the near future. Pakistan’s current account – the difference between what it earns from exports and remittances and loses due to imports and debt repayments – had turned negative in July 2023 after four months of posting a surplus as exports declined and imports rose. However, some uptick in exports and remittances controlled the current account deficit during August and Septemeber, which is expected to continue for the October reading as well, it added.

Meanwhile, Javed said a successful IMF review, announcement of elections and a stable currency would boost market confidence and economic activity. “All this together can help sustain the trend of increasing remittances over the next few months, good news for a struggling economy,” the economist added.