The Pakistan Stock Exchange (PSX) will conduct the first-ever auction of listed government sukuk bonds on December 8, 2023, according to a notice issued by the exchange on Tuesday.

The auction is part of the government’s plan to raise Rs90 billion from the sale of one-year Islamic bonds between December 2023 and February 2024. The bonds are based on the Shariah-compliant principle of Ijarah, which involves the leasing of assets.

The auction will be held through the Capital Market Infrastructure Institutions (CMIIs), which include the PSX, the National Clearing and Settlement Company of Pakistan (NCCPL), and the Central Depository Company of Pakistan (CDC).

The Ministry of Finance had recently approved some amendments to the rules governing the issuance, registration, trading, and transfer of government debt securities through the CMIIs, allowing the PSX to conduct the primary market issuance.

The government sukuk bonds are expected to attract investors who are looking for Shariah-compliant investment options and diversify the government’s sources of financing. The bonds will also help develop the Islamic capital market in Pakistan.

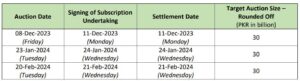

The first auction of the government sukuk bonds will take place on December 8, with a target of Rs30 billion and settlement on December 11, 2023.

The second auction will be held on January 23, with the same target of Rs30 billion, and settlement on January 24, 2023.

The third and final auction will be held in February 2024, with a target of Rs30 billion and settlement on the same day as the auction date.

The auction dates and targets are subject to change depending on the market conditions and the government’s borrowing needs.

The unique feature of the GDS auction at the PSX is its inclusivity, enabling ordinary individuals to directly invest in T-bills and PIBs with even small amounts of financing. This would allow them to later trade these securities.

A significant increase in trading volumes at the stock exchange is anticipated, as both institutions and the general public express a strong interest in investing in sovereign debt securities.

Approximately 200 stockbrokers and 30-40 banks are expected to actively participate in the sale and trade of these debt securities. High-net-worth investors also have the option to invest in these debt securities through specific banks.