Finance Minister Muhammad Aurangzeb highlighted the need to include the wholesale and retail sectors in the tax net, assuring support for small traders throughout the process.

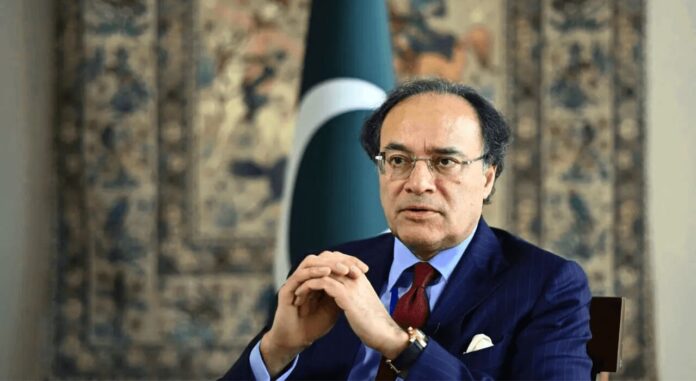

He made these remarks during a meeting with trade representatives at the Finance Ministry, where discussions focused on tax reforms and integrating businesses into the formal tax system.

The meeting was attended by Federal Minister Rana Sanaullah, State Minister Ali Pervez, and Federal Board of Revenue (FBR) Chairman Rashid Langrial. Naeem Mir, Chairman of the Supreme Council All Pakistan Traders Association, participated via video link from Lahore.

Aurangzeb emphasized that effective governance requires the contribution of all sectors to the tax base, stating, “To run the country effectively, everyone must contribute their fair share in taxes.” He reassured small traders that they would receive full support in transitioning into the formal tax system.

Naeem Mir appreciated the FBR’s modern approach to tax collection, which incorporates data analytics and artificial intelligence to reduce tax evasion. He noted that this strategy aligns with Prime Minister Shehbaz Sharif’s vision of digitizing the FBR’s operations, marking a shift from traditional methods.

Business representatives at the meeting expressed their commitment to cooperating with the government and supporting efforts to expand the tax network.