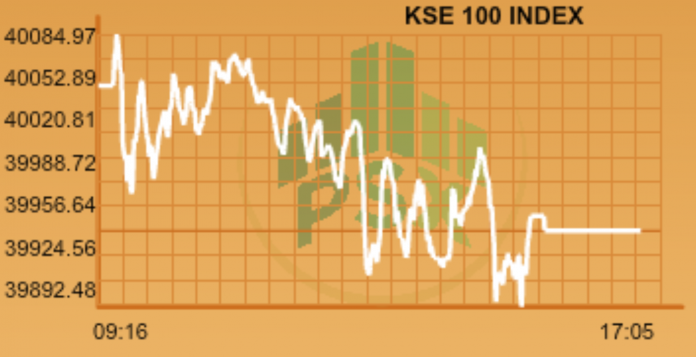

LAHORE: Pakistan’s benchmark KSE 100 index shed 104 points or -0.3 per cent on Tuesday as investors were unnerved that the Lahore High Court (LHC) ordered the Punjab government to make 2014 Model Town incident, a clash between Punjab provincial police force and political party Pakistan Awami Tehreek’s activists in June 2014, judicial inquiry report public within 30 days.

Nevertheless, activity picked up, volumes gained up 52 per cent day on day while traded value rose 34 per cent. Penny hunter’s high-risk high return strategy paid off as JPGL (+78 per cent/+Rs1.0), a shuttered oil based IPP, said in a bourse filing that it would appeal an earlier winding up petition.

Japan Power Generation (JPGL) informed the bourse that in response to an order dated October 31, 2017, passed by the SECP authorising the Company Registration Office Lahore to present a petition for winding up of the company, JPGL has filed an appeal against the said order before an Appellate Bench of the SECP no November 29, 2017.

Meanwhile, KEL (+3.3 per cent) made some late gains on speculation over the outcome of MYT hearing. SNGP (-4.9 per cent) caved into pressure as the gas utility uploaded a document on its website alleging its profits would be slashed in half if OGRA’s proposals go through.

Top index point detractors were UBL (-2 per cent), OGDC (-1.5 per cent), HBL (-1.3 per cent), SNGP (-4.9 per cent) and MCB (-1.3 per cent) holding 152 points while NESTLE (+5 per cent), DAWH (+2.3 per cent), SEARL (+3 per cent), ENGRO (+1 per cent) & KEL (+3.3 per cent) added 85 points. On the sector front; Banks shed 92 points, OMCs 54 points, E&Ps 24 points, Power 23 points and Cement 20 points; while Food added 23 points, Auto Assemblers 22 points, Pharma 18 points and Fertilisers 16 points.

Pakistan’s Consumer Prices Index rose 3.97 per cent YoY in November 2017, as compared to 3.8 per cent YoY in October 2017 and 3.8 per cent YoY in November 2016. On a cumulative basis, 5MFY18 inflation averaged 3.6 per cent as compared to 3.9 per cent last year.

Orix Leasing Pakistan (OLPL) notified the PSX that it holds 30.4 million shares of Oman Orix Leasing Company (OOLC), which is merging with and into National Finance Company, Oman (NFC). Against this merger, OLPL should opt for NFC’s cash offer and estimates that it will book a gain of Rs 400 million after tax on this transaction, subject to shareholder approval.