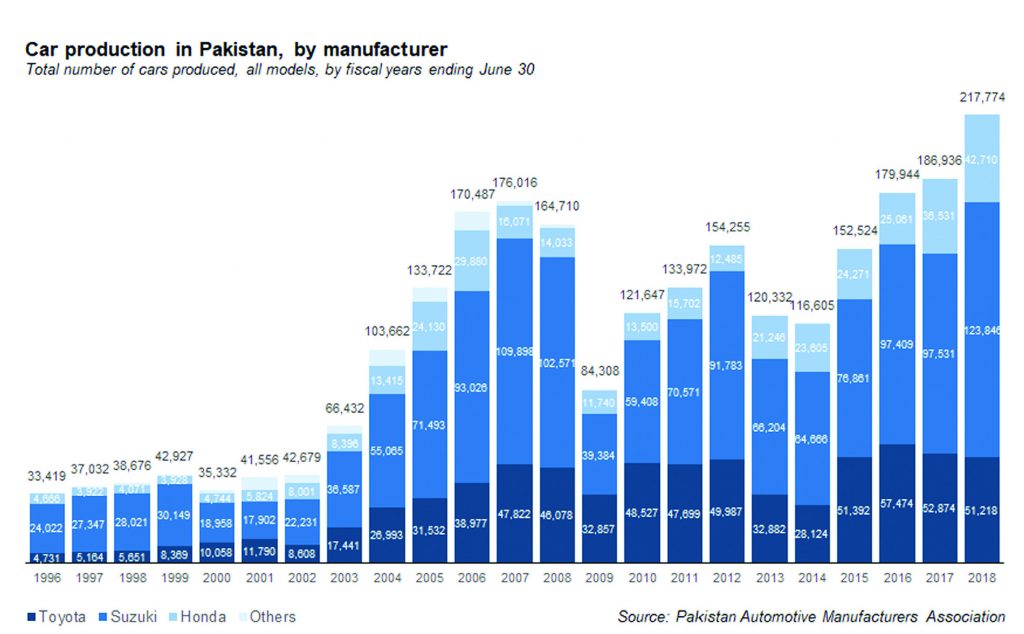

Pakistan’s auto industry does look like a cartel of Japanese auto manufacturers – Suzuki, Toyota and Honda – with Suzuki catering to the smaller hatchback car market; Toyota manufacturing mid-size sedans; and Honda producing larger sedans. The three companies essentially do not compete against each other and largely stay within their lanes in one of the clearest examples of oligopolistic collusion possible.

Ali Asghar Jamali, the CEO of Indus Motor Company (PSX: INDU), the Pakistani subsidiary of Toyota, however, would like to dispute that notion.

Jamali says when Toyota along with other original equipment manufacturers (OEMs) entered the Pakistan auto fray a few decades ago when the government’s policies for the industry were focused on import substitution. Islamabad wanted the auto companies to be more localized, which he said made the auto companies to endeavor to localize more of their production.

“It made us strive towards more localization and we did that, and we are now more localized and therefore more cost effective than before,” he said.

He also bragged about the fact that Toyota cars especially its flagship Corolla has what he termed a relatively high level of indigenous components. “With every model change in Corolla, Toyota Pakistan has successfully localized more and more, despite significant advancements in parts sophistication and resultantly achieve reduced dollarized cost of Corolla,” he said.

“The first Corolla car costed more in US dollar terms with a lower level of localization as compared to contemporary Corolla, which is 64% localized. There are numerous advancements comparatively such as dual air bags, power steering, ABS brakes, immobilizer etc.,” he said.

Toyota has recently increased its production capacity in Pakistan by 20% and has invested around $126 million to allow it to both increase production of existing models as well as introduce new ones into the Pakistani market. The company’s capacity has increased from 54,800 to 66,000 vehicles, and with overtime Toyota can produce 80,000 vehicles in Pakistan.

The increase in production capacity comes at a time when Toyota is the largest car company in Pakistan by revenue and operates in a market where it is heavily protected by government tariffs on imported cars, both new and used. And yet, that level of government protection is not enough for Toyota and the other Japanese car makers, who still want more protection. And the incumbent players are particularly peeved about the fact that the government of Pakistan has offered additional incentives to newer entrants into the Pakistani market, incentives that are not available to the incumbent players.

Jamali admits that the government had to offer incentives to new entrants to lure them into the country but added that the government should also increase the opportunity cost for them to import so that they opt for cheaper parts produced by local vendors.

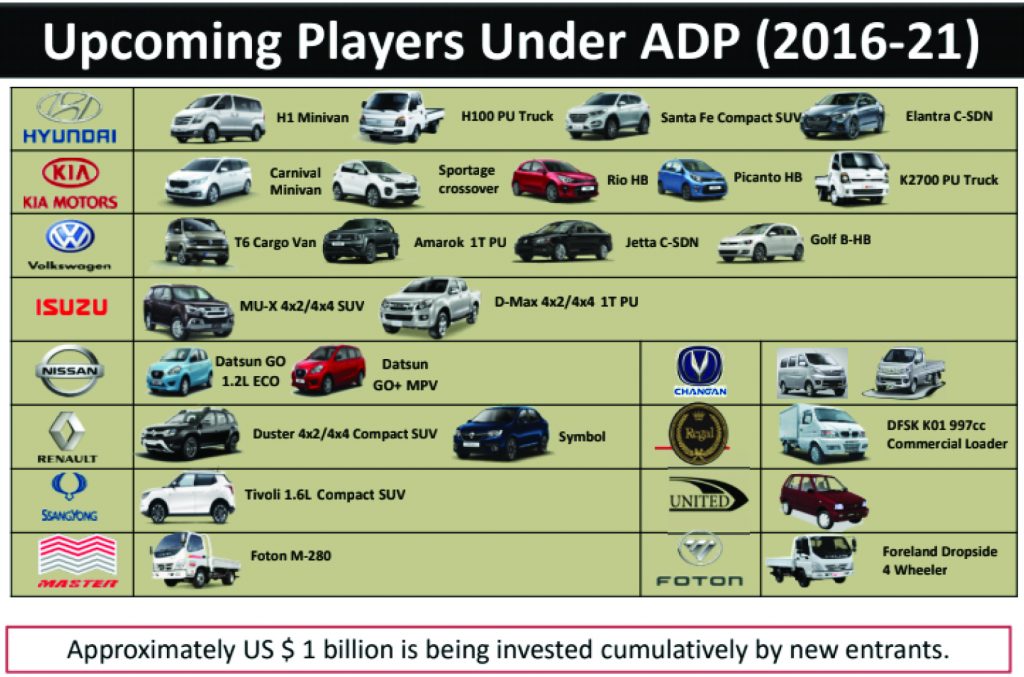

Under the new policy, the new entrants – Volkswagon, Nissan, Renault, Hyundai, Kia, and others – can import completely knocked down (CKD) units at a 10% customs duty while local part makers import components at 10% and sub-assemblies at 20% customs duties – which makes, in Jamali’s view, local vendors uncompetitive.

“Local auto part makers will further have to compete with high economies of scale of global OEMs as well. Therefore, the government must remove this tariff anomaly by reducing the customs duty on components to 5% and sub-assemblies duty to15% to 10% – which would reduce cost of locally produced parts and will enable part makers to produce parts for new entrants as well.”

According to Jamali, around 30% of the auto parts purchase by the recent and upcoming local assemblers will be on the borderline – means that they may opt for local parts’ purchase if it is a bit cheaper than their imported substitutes.

For instance, if a part is selling at Rs125 while it would cost Rs130 if they import, then they would opt for the latter. But if duties are reduced and Pakistani auto part makers can sell their parts for Rs110, then sales for local vendors will certainly increase.

“Toyota has always encouraged the local engineering base and has arranged 35 technical assistance and technology transfer agreements between local vendors and foreign counterparts for various technologies and parts and has localized more than 170 parts since 2004 and procuring local parts worth over Rs200 million every working day, which shows our commitment to the localization,” he said.

Pakistan’s car-ownership rate is relatively low at only 18 per one thousand people. The low car-ownership rate in a country of 200 million-plus people, along with a growing economy and the government’s incentives for the entry of new companies under greenfield and brownfield status, has combined to make the auto industry quite lucrative for the newcomers.

“The goals of the auto industry for the year 2021 include annual car production of more than 415,000 units, with contribution to GDP increasing up to 3% and generate employment of four million people in auto and allied industries,” said Munir Karim Bana, the CEO of Loads Ltd, an auto parts manufacturing company.

He added that investments were now coming from China, Saudi Arabia, the United States, the United Arab Emirates, and a bailout package from IMF. Under these circumstances, the Pakistani auto market was likely to get a boost in car sales and it may cross 500,000 units mark before expected.

“But for that the government must continue to ensure consistent and long-term policies. However, the recent decision of imposing a 10% federal excise duty (FED) creates uncertainty in the minds of investors as it disturbs their feasibility and affect planned volumes,” he added.

Bana, the former chairman of Pakistan Association of Automotive Parts and Accessories Manufacturers (PAAPAM), added that incentives for local auto parts makers along with consistency in policies can help the auto manufacturers and vendor to significantly enhance their contribution to the national economy and employment creation.

Aamir Allawala, the CEO of Tecno Auto Glass Ltd, which will be the first company in Pakistan to make windscreens, said that there is another problem auto part manufacturers were facing – malpractice in parts imports. He said that it has been creating issues for the industry as the government is losing an estimated Rs19 billion in customs duties and taxes annually on account of low valuation by Pakistan Customs for auto parts imports.

“The discrepancy in Custom Valuation Ruling 661 has become an opportunity for duty and tax evasion to unscrupulous importers that puts local auto industry at a disadvantaged position,” he added. He pointed that commercial importers evade sizable taxes due to Customs Ruling 661 (formerly 329) by under valuation of parts, especially high technology parts, whose assessed value is far less than OEM imports as well as local manufacturing cost.

He added that import of old and used auto parts is not allowed under Import Policy as defined by SRO 345(I)/2016, Paragraph 5(A)(VIII) Appendix-C Serial No. 11.

“However, the concession is being given through a Custom notification to allow clearance of old and used auto parts through the payment of a 20% penalty,” Allawala said. Allawala is also a former PAAPAM Chairman. “We have urged the government to look into these discrepancies which are not only hurting the local auto industry but also the government due to lower collections of customs duties and taxes,” he added.

Last year Profit interviewed senior vice-president of Nissan Motor Corporation, Peyman Kargar, who came to Pakistan to sign MoU with local partners Ghandhara Nissan. He said that Nissan would initially be starting with 20% indigenous parts and would gradually move towards greater indigenisation of its cars provided that production increases.

The Nissan SVP added that the process of localisation depends on the number of cars produced. The cost-benefit ratio is higher when importing parts compared to producing them in host countries with low demand levels. He added the volatile exchange rate in Pakistan makes localisation process more feasible and it would be necessary in order to become cost competitive.

But an industry official has claimed that there’s a conflict of interest for new entrants’ foreign partners, who may want to increase their home country’s exports rather than letting or facilitating their peripheral partners localize more.

An official of one of the new entrants, which will soon be making passengers cars, said that if vendors receive duty rebates when they sell their products to new entrants, then the new entrants will likely try to localize more and as soon as possible. But the government has to make sure that the vendors receive duty rebates only when they sell it to new entrants in order to sustain advantage given to new entrants, which has at first place has enticed them to start their operations in Pakistan.

“For example, the government may collect 5% less tax from vendors when they sell auto parts to newcomers. It will translate into less expensive auto parts for new entrants therefore it would lure them towards localization as incentive would be bigger. The cost of production would be a bit lower, making them competitive,” the source said.

The source rebuffed the notion that the new entrants may have conflicts of interests of seeking more localization as it would decrease sales of their parent company back home. “Even Chinese companies have now been trying to start production elsewhere like Pakistan where labor is cheaper in order to remain cost competitive internationally. Chinese labor is expensive when compared to Pakistan. And auto companies in Pakistan have to localize sooner or later to remain competitive,” it added.

“The only thing lower duties for vendors would do is to help new entrants localize quicker than under present duty structure as they will ask vendors to pass on the impact on the reduced duty, therefore making local procurement a bit less expensive therefore attractive.”

However, a well-informed industry source said that becoming a vendor for a new company is not an easy task. Most of the present vendors supplying technical parts to present Japanese companies have technical collaboration with those OEMs. “From a layman perspective, it may sound very good that duties are reduced for local vendors so that they are able to supply cheaper parts and it will attract new entrants to localize more. But it’s not that simple as it looks,” the source said.

“New players will certainly be hesitant to share CAD [computer-aided design] drawings of technical parts with vendors, who are already in collaboration with their already established competitors. So, they may opt for local auto parts like tyres, audio system, glasses and batteries etc. but they won’t be buying technical parts unique to their respective brands,” the source explained.

A CAD drawing is a detailed 2D or 3D illustration displaying the components of an engineering or architectural project. Computer-aided design utilizes software to create drawings to be used throughout the entire process of a design project, from conceptual design to construction or assembly.

The source added that if incentive is given to local vendors in terms of reduction in duties then it would only translate into increase in profitability of local vendors and OEMs knowing this would certainly ask for discounts so it will further eventually make present auto car makers a bit more cost effective. The source said that the government has been mulling that it should attract new vendors as well to start their operations in Pakistan giving them incentives just as they did for OEMs under its ADP 2016-21 policy.

“That will be the only proper way for the government to help, facilitate and make lucrative for new players to localize more by paving the way for new vendors,” the source added.

The source added that under present circumstances, new auto players will only be able to localize in terms of non-technical parts and peripherals like tyres, audio system, glasses and batteries etc whether local vendors receive duty incentives or not.

Revisiting the Automotive Development Policy (ADP) 2016-21

According to Board of Investment (BOI), a new manufacturer under ADP 2016-21) establishing maiden assembly facility will invariably need separate treatment and greater incentives in the early years to enable it to introduce its brand, develop a market niche and share, create a distribution and after-sales service networks, and develop a part-manufacturer base.

For this purpose, BOI created two different categories to attract new investment with different incentives.

The first category, has been named Greenfield Investment, which is defined as the installation of new and independent automotive assembly and manufacturing facilities by an investor for the production of vehicles not already being assembled or manufactured in Pakistan.

The second category enacted is Brownfield Investment, which has been defined as the revival of an existing assembly and or manufacturing facilities that were non-operational or closed on or before July 01, 2013 and the vehicle has not been in production in Pakistan since that date.

The revival is undertaken either independently by original owners or new investors or under joint venture agreement with foreign principal. Foreign principal can also independently through purchase of plant utilize it.

These new ventures under the Greenfield Investment have been given duty-free import of plant and machinery for setting up the assembly or manufacturing facility or both on a one-time basis. They are also allowed import of 100 vehicle of the same variant in completely built unit (CBU) form at 50% of the prevailing duty for test marketing after ground breaking of the project.

Meanwhile, concessional rate of customs duty at 10% on non-localized parts and 25% on localized parts for a period of five years for the manufacturing of cars and light commercial vehicles.

Import of all parts (both localised and non-localised) at prevailing customs duty applicable to non-localised parts for manufacturing of trucks, buses and prime-movers for a period of three years.

For the Brownfield Investment, investors are entitled to import of non-localised parts at 10% rate of customs duty and localised parts at 25% duty for a period of three years for the manufacturing of cars and LCVs. Import of all parts, both localized and non-localized, at prevailing customs duty applicable to non-localised parts for manufacturing of trucks, buses and prime-movers for a period of three years.

The above stated scenario highlight prospects of setting up car manufacturing / assembling say by ten new companies /brands catering to say 5-10% of 200 million population, where as it hardly highlight the importance of setting up manufacturing /assembling buses, LCVs catering to 100% of 200 million population, meaning by general public is again being ignored by the PTI New Pakistan.

Well we should appreciate things being done by PTI rathar than consistently and persistently battering on about whats not being done.

joss article.

PAMA, PAPAM, JAMA, symbols the first thing to verify standards of the three. Our foreign Minister statement on Japan or JAMA will switch all Japanese auto manuacturing/assembly to Pakistan from 2019 onwards. Are we ready to comply with JAMA standards of autos, which is OICA the Paris based world authority.

The World Road Safety Standards decade ends 2020 by UN/WHO requires Pakistan to comply with Road Safety Standards are we ready to accept it. PAMA standards comply with world Road Safety Standards for exports to the Middle East, where Toyota will export cars assembled in Pakistan. The number of death/injuries in Pakistan in road accidents are self explanatory. The honorable members of PAPAM Mr. Amir Allahwala, Mr. Bana efforts are remarkable for Pakistan auto Industry. We seek compliance to OICA and UN standards compliance.

Comments are closed.