Oil-based power production is on its way out. In Pakistan, and what is replacing it is a hodgepodge of coal and liquefied natural gas (LNG) based power plants that have taken over in the past few years in an attempt to get out of the rut of oil based production problems such as fluctuating prices.

Earlier this month, Profit’s cover piece explored the dimming stars of the Hub Power Company (Hubco), Pakistan’s largest independent power producer (IPP), and a company that has traditionally used oil to fuel its power production.

With its largest base plant, which accounts for 80% of its production capacity, effectively shut down, Hubco has a lot of introspection to do. But it seems that the company had seen this coming down the road some years ago, and had been planning their next step for whenever the inevitable happened.

Hub Power Holdings Ltd (HPHL) was established in 2015 as a wholly owned subsidiary of Hubco to invest in its future growth initiatives like recently commissioned China Power Hub Generation Company Ltd. With the changing times, the HPHL is looking towards other avenues to make up for what are going to be hard times ahead in the power production sector.

And while the natural impulse or assumption would be that Hubco is or should move towards operating on a different fuel source such as coal or LNG, there might be an even bigger change on the cards. Since its inception, the HPHL has been actively pursuing an aggressive growth plan for the water and power portfolio of Hubco.

With so much on the line and some change or the other definitely in the offing, Profit spoke to Mr Ruhail Muhammad, the CEO of HPHL, to find out what in the world is Hubco planning next.

Terrifying numbers

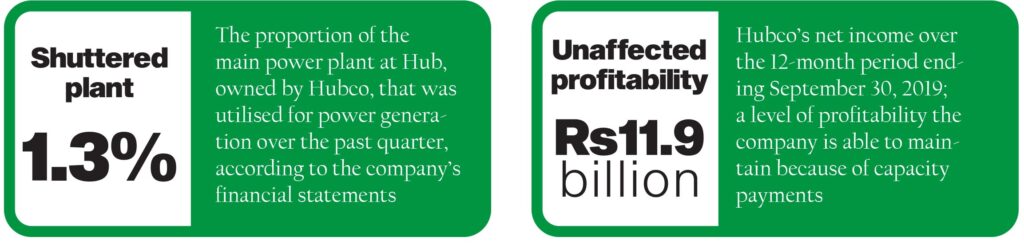

They are still not easy to digest. As Profit pointed out last month, it is a hard sell saying a company that made Rs11.9 billion in profits last year is struggling. But the future is full of existential questions for Hubco, with their base plant effectively shut down operating at 1.3% of its capacity.

Hubco’s bane has been oil. Traditionally, the company has focused on efficiency to stay on top, taking great pride in their top of the line technology from the likes of General Electric rather than the cheaper Chinese options that a lot of companies end up using. But has oil-based power production become unsustainable even for efficient companies like Hubco?

Ruhail Muhammad recognises the trouble that Hubco is in, and the company seems to have been aware of the impending doom and gloom. Government policy had clearly been changing soon after the Nawaz administration came into office in 2013, and the most significant change to that had been in attitudes towards the fuel mix.

The type of fuel being used was the biggest factor in the high energy prices, and with most of the base requirement being fulfilled by power producers that used oil, matters became even worse because of just how volatile oil prices were. Because of this, the latest additions of power plants that came after 2013 were mostly consuming coal, LNG as well as hydroelectricity rather the more expensive fuels like refined furnace oil (RFO).

Most of these plants are now contributing to the national grid, and at the cost of record breaking smog levels and the country’s largest province unable to breathe, the capacity has become sufficient. But needless to say, with the current trend, RFO-based plants will be used less and less, and their only role will be for peaking in summer, rather than being used as the base load as they once were.

With this clear change in trend, Hubco had set up the HPHL, in part to tackle the problems of the future and chart the path the company would eventually take to invest in its future growth initiatives.

“In the past two years, we have witnessed the addition of more than 10,000 megawatts (MW) generation capacity in the national grid. These include thermal as well renewable power plants. The thermal plants include coal and RLNG [reliquefied natural gas] based plants which not only use cheaper fuels but are also based on the latest technology and therefore offer significantly higher efficiency,” says Ruhail Muhammad, CEO of HPHL.

Hubco’s RFO plants based at Hub and Narowal continue to be amongst the most efficient plants in the country, beating out other power producers. “This is why our Narowal Plant was dispatched sporadically in the August-September (during a time when demand was at its peak). However, since demand has not increased in line with the capacity additions, none of the RFO plants are getting regular dispatch,” he says.

But this is not the end of the story, because an additional problem is transmission and distribution (T&D) that the government needs to give some thought to.

The country’s T&D infrastructure is in dire need of upgrade if the government wants to ensure that the potential demand is met through maximum utilisation of available generation capacity. This would also lead to improvement in grid stability which should motivate industries to switch from captive power to the national grid, thus increasing power demand while making cheap local gas resources available to more efficient uses.

The alternatives

Getting gas, would of course, be a natural boon for Hubco. However, for now they seem to be looking towards coal while trying to keep their clean, efficient image. According to Ruhail Muhammad, Hubco is leading the country’s generation capacity expansion by undertaking growth projects worth more than $4 billion.

“It is pertinent that we are the only IPP in Pakistan with four growth projects listed in CPEC [China-Pakistan Economic Corridor]. Two of these growth projects, the 2×660 MW imported coal power project at Hub and First Phase of the Thar coal mining project, have already started commercial operations” he says. “Coal is supposed to be the cheapest fuel among all other sources for the base load and hence the newer projects that we are doing are all based on coal.”

But even with this, he insists that the company is going to keep its operations smooth and clean, working on the efficiency ethos that has got it so far up until now. “Efficiency and engineering excellence are at the forefronts of Hubco’s operations. That is why Hubco has long been partnering with the most technologically advanced companies like GE, MAN, Ansaldo, ABB, etc. to institute technological initiatives at its base plant” he explains.

“These include implementation of Predictive Enhancement and Performance Improvement (PEPI) Solutions of GE at Hub plant which has led to 3.5%-4% improvement in efficiency of its generating units. A similar initiative of GE for predictive maintenance, Advance Performance Management (APM), was implemented at the Narowal plant. On the other hand, Hubco has selected the state-of-the-art equipment for its growth projects as well. Our coal-based growth projects utilise the latest supercritical / subcritical technology and highly efficient European boilers.”

Seeing the cards, the government had already offered to convert two units of 300 MW each into coal power units for Hubco. There was talk of using supercritical and GE technology to make the plant as viable and efficient as possible.

“With the current trend in the demand and supply, the RFO based plants like Hubco are not likely to be dispatched until 2027. However, the government will be paying us the capacity charges so we offered that the Hub Plant shall be used for a national cause. Hence we initiated proposal first to K-Electric and then to the federal government to convert two units out of four i.e. 600MW to coa,l” Ruhail Muhammad explains.

“We will only have to convert the boiler to the coal base and the rest of the plant including the turbines will remain the same. Using coal as the fuel will keep the cost of electricity generation significantly lower as compared to any other fuel and hence Hubco and KE have signed an MoU to further the feasibility of the project.”

As per Hubco, this would be a win-win situation for everyone. Indeed, the state-owned monopoly buyer of electricity from power plants, the National Transmission and Dispatch Company (NTDC), would be relieved on making capacity payments for two units for at least 5 years. which would end up saving around Rs50 billion. Meanwhile, KE will get a cheaper source of electricity, and the government will spend less on importing new plants rather than retrofitting an old plant.

“We are right now in the process of preparing feasibility and in parallel getting approvals from NTDC for the conversion process. For the remaining two units we have started to assess the possibility of converting one unit into a sea water RO plant to address the water scarcity. However we are yet to work on the economics and formal approvals of this proposal.”

Capacity payments

This of course raises the question of what exactly these capacity payments that would be relieved from the NTDC are, and whether Hubco and other power producers depending on them is a sustainable or healthy business model in the first place.

Capacity payment is a critical feature of an IPPs business model. The business model of an IPP is that a custom-made plant is setup for the only buyer in Pakistan which is NTDC. Hence there is no other option for all IPPs but to rely on capacity payments. This was embedded in the policy made by the government during the 1990’s and after which was followed for all the IPPs .

But this is something that the company eventually wants to wean itself off, especially since the government has since the very beginning has not been a particularly reliable partner. Hubco’s management and board have also told Profit, that they have been proactively seeking and venturing into new opportunities and made timely decisions to invest into projects in hydroelectricity and other lower cost of fuels and diversify into B2B models, water projects and other industrial sectors.

But despite volatility in government policy, Hubco is still hoping that the current government will end up somehow improving the sector. Their hope is that the power sector reforms initiated by the new government will start producing results during the ongoing fiscal year over the flow part of the equation i.e. the gap between the receipts and payments.

“Measures such as curbing power theft, improving recoveries, increasing end-consumer tariff and improving the share of renewables and indigenous fuel in the generation mix, are expected to address the root causes of circular debt and will ultimately benefit Pakistan’s energy sector on a sustainable basis,” says Ruhail Muhammad, going on to explain that “the power sector circular debt stands at historically highest level of approximately Rs900 billion at the start of December 2019.”

“This situation is severely constraining the sector’s liquidity for which the government had planned to inject a sizeable amount of Rs600 billion through issuance of Energy Sukuk in 3 tranches to ease the liquidity of the sector. After the first tranche of Rs200 billion in March 2019, the remaining two tranches have been considerably delayed mainly owing to IMF program. However, we are hopeful that after the recently concluded IMF review, the work on Energy Sukuk will speed up and the next tranche of Energy Sukuk would be issued soon.”

The company’s image

Coal is bad. That much humans have been able to figure out. As cheap and reliable fuel source as it may be, it is limited and causes irreparable damage to the environment. But then again, it is cheap and reliable, which seems to outweigh all the nastiness.

At a recent lunch hosted by Hubco senior management, there was a lot of talk about critical and supercritical technology that would provide ‘clean’ coal energy. However, despite all of this, the bottom line was that coal is still the most used fuel source in the world, and if that is where Pakistan’s government policy was taking power production, then there was no other choice.

Ruhail Muhammad had the same take on this issue. He did not really say whether or not the company’s image would be hurt, but he did try and give reassurance that they would maintain what they see as their standards of efficiency and cleanliness.

“All our coal projects are approved by the respective provincial Environment Protection Agencies (EPA). Further, the projected emissions of all plants comply with the National Environment Quality Standards (NEQs) and IFC Standards and the emission levels are well below the limits prescribed by such standards,” he says. “Unlike the common perception that coal plants emit black smoke, smog or particles, one has to know that the Supercritical Technology does not emit any particles or negative emissions. You can visit the new coal-based plants at Port Qasim or Hub and see there is no such issues.”

“It is also important to mention that Pakistan’s carbon footprint is one of the lowest in the world and the overall emissions level on absolute and per capita basis are still far less than many countries including US, UK, China and India.”

He also pointed towards a recent study published by John Hopkins University, which oddly enough seemed to claim that countries like Pakistan might just benefit from a larger carbon footprint. The research paper argues that development will require a substantial increase in greenhouse gas emissions and water used for the country’s population to achieve a nutritious diet. In order to get countries such as Pakistan to a place where they are not experiencing chronic undernutrition, they will need to eat more, and accordingly, will need to increase their carbon footprint.

“Hubco has also made significant investment in the latest available technological intervention to control the environmental impact of emissions at all its plants including coal projects,” adds Ruhail Muhammad.

The claims are tall ones, and at moments dubious ones. Coal, no matter what you do, is still going to mess up the environment. But that seems to be a cost that the world is willing to pay, and Pakistan and its power producers are not going to be the ones to make any revolutionary changes.