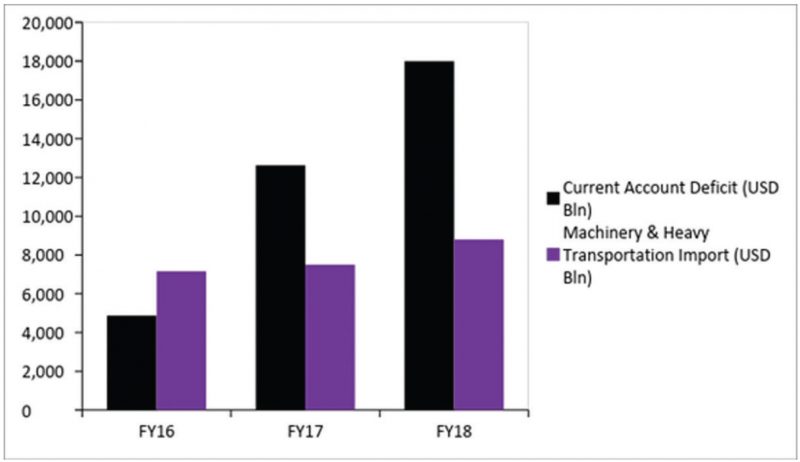

Pakistan is currently under an unremitting balance of payments crisis with foreign exchange reserves falling below US $10 billion, barely enough to cover two months of imports for one of the world’s 40 largest economies. The cause: a ballooning current account deficit that has quadrupled in size across two years because Pakistan has been importing much more than it exports.

The misconception:

Conventional wisdom is that the problem is driven by the China Pakistan Economic Corridor (part of China’s Belt & Road Initiative), a paradigm shift in bilateral economic relations marked by multibillion dollar investment in infrastructure and energy. Import of Chinese machinery, manpower and resources as well as repayment of Chinese loans to fund the corridor has therefore pulled down reserves from a high of US $18 billion two years ago, prompting Pakistan to once again knock on the doors of IMF for a bailout, its twelfth such approach since the 1980s.

The tale mirrors similar news from Africa, South Asia and other countries benefitting from China’s foreign policy driven largesse, ostensibly marking another story of overstretch by the middle kingdom.

A problem of consumption

Main-street and numbers, however, present a different story. Fruit sellers in the bustling port city of Karachi offer a cart load of apples from New Zealand and China. Furniture shops boast wares from Turkey and Europe. Edible oil imports from Malaysia and Indonesia have grown constantly, touching US $2 billion this fiscal year. Markets are abuzz with imported cell phones and cars including SUVs from Japan and South Korea line the meandering streets of major urban centers.

Even the textile sector, that hallowed fort of the country’s export machine, is facing competition from imported western brands. The country of over 200 million with a voracious appetite and over 5% growth is consuming increasing quantities of imported goods, even in areas where it’s agrarian economy should provide local producers a competitive edge.

Then there is oil. Petroleum and LNG imports have soared 60% over two years as oil price increase and rising thermal power generation capacity enabled by Chinese investment helped bridge Pakistan’s 6 Gigawatts of energy deficit that used to cause rolling blackouts across the country. Most of the new energy has gone towards domestic consumption with industrial expansion lagging behind its potential.

While China is part of the story, it is not the pièce de résistance. Import of Machinery and heavy transportation equipment accounts for less than 15% of the widened current account deficit. Imports from China have remained stagnant as a percentage of total imports for the past three years. While repayment of debt has been increasing, it is a dip in the ocean compared to the more significant issue of trade imbalance.

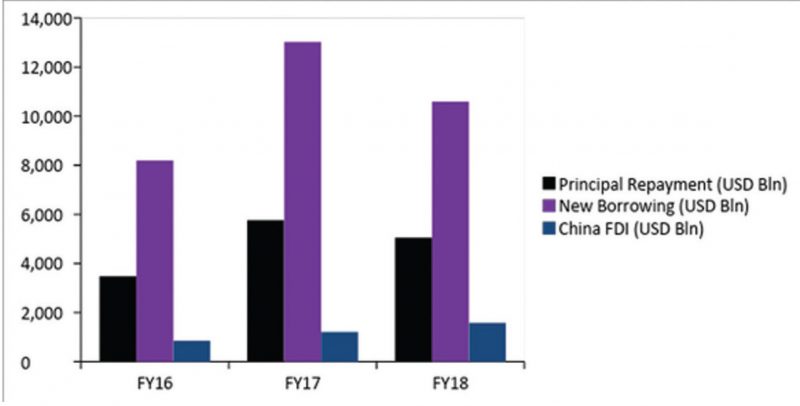

On the flip side, Chinese inflows have significantly supported balance of payments. Chinese investment now accounts for over half of total inward investment and state-owned policy banks have provided much needed external account buffer to finance what is mainly a consumption driven problem.

Reforms under IMF Umbrella

As the commodity cycle turns, Pakistan finds itself in a familiar position where an overvalued exchange rate exacerbates a problem of structural reform and lack of competitiveness. The solution is to address both. China has been part of the solution by helping bridge the energy deficit and channeling much needed investment into infrastructure that can help bring goods to port.

Some of the steps needed to address imbalances have already been taken, with four currency adjustments since December 2017 devaluing the Pakistani rupee by over 20% against the US dollar. Interest rates have increased by 1.75% over the last six months looking to address an overheating economy.

However, avoiding imminent default on international payments requires doing more. While China has recently provided additional buffer with a US $2 billion loan, that is not sufficient. What is required is the discipline of an IMF programme complemented by support from allies like China and Saudi Arabia. The newly elected Pakistan Tehreek e Insaaf government coming on the back of popular support has the mandate to engage the Fund and initiate reforms.

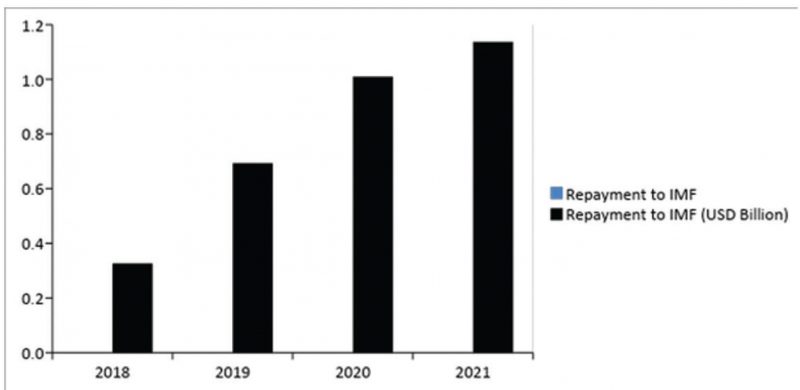

It is not just a Chinese problem either. Repayments to IMF double in 2019 and increase by another 50% in 2020. The fund’s stated purpose is that it “promotes international monetary cooperation and exchange rate stability, facilitates the balanced growth of international trade, and provides resources to help members in balance of payments difficulties.”

That in a nutshell is the Pakistan problem. An approach to the fund driven by genuine macro-economic structural problems should not be sacrificed at the altar of global foreign policy.