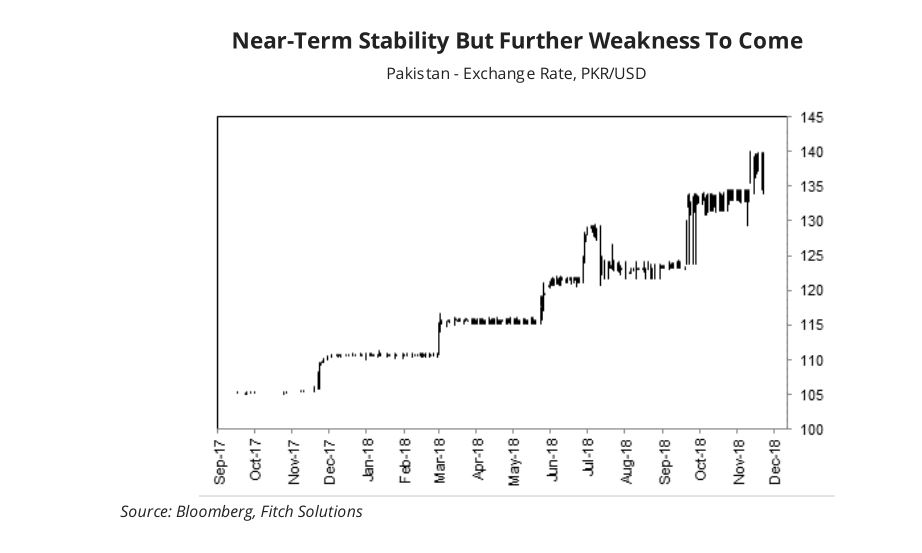

LAHORE: Fitch Solutions in a report released on Thursday said it expected the rupee to touch Rs148 against the US dollar by end of the financial year 2018-19.

Notwithstanding, the report forecast the rupee to weaken further against the US dollar over the coming quarters, as the IMF would typically require the central bank to build up its foreign reserves’ buffers.

“Pakistan’s Finance Minister Asad Umar has alluded that the government can afford a two-month delay in the negotiations as the $6 billion loan secured from Saudi Arabia in October suggests there is no imminent balance of payments crisis in the near-term, said the report.

According to Fitch Solutions, despite the failure of Pakistan and the International Monetary Fund (IMF) to reach a final agreement on the terms of a bailout, it was only a temporary stumbling block, as it anticipated that the agreement would be reached by the first quarter of 2019.

In an emailed response to Profit, Raphael Mok, Senior Country Risk Analyst, Fitch Solutions said, “Our core view remains that Pakistan will eventually secure a deal with the IMF.”

When asked what would happen if Pakistan failed to clinch a bailout with the IMF, Mr Mok explained, “However, in the worst-case scenario that Pakistan does not reach a deal with the IMF over the coming months, this could see selling pressure on the rupee intensify in the form of portfolio outflows.

The SBP would have to hike interest rates significantly to boost the attractiveness of Pakistani assets. Imports would likely have to contract sharply as the country runs low on dollars, and this will likely trigger a recession.”

In response to whom Pakistan would turn to for external financing, Mr Mok said, “Pakistan could turn to China for more external financing, but such a move would increase the country’s external indebtedness and would not be politically popular.”

Thanks to the collapse in oil price witnessed in October and November, Fitch Solutions said it provided the Pakistani economy with a huge helping hand since it is a net importer of oil.

It added that a combination of low oil prices and an eventual IMF bailout would assist the economy in regaining some of its footings.

In the near-term, the rupee is expected to stabilize against the US dollar at around the current level of Rs140 per US dollar, said Fitch Solutions.

According to Fitch Solutions, the IMF has adopted a stricter stance on Pakistan against the previous rounds of the bailout.

“The first round of talks between the IMF and the Pakistani government, which ended on November 20, was inconclusive after both sides failed to bridge the gulf on a wide range of issues such as the increase in electricity prices, hike in interest rate, rupee devaluation, tax collection targets, and the circular debt problem at the state’s utilities,” it added.

Also, the report stated the country was unlikely to receive an $8 billion bailout package from the IMF by the next board meeting scheduled for January 15th next year, as the lender wants the government to adopt stricter measures to address the country’s economic imbalances before sending the country’s case to its Executive Board.

Moreover, the research agency believes the IMF is putting the new government through its paces to assess as to why previous reforms failed to bear fruition.

Fitch Solutions stated the IMF has raised queries as to why the previous strategy for ending circular debt wasn’t fully implemented after completion of the previous bailout programme in November 2016, noting that the ‘reversal of policies and lacklustre attitude on reform path has played havoc with the country’s economy’.

“The IMF team also stated that ‘the reversal of policies on many fronts is the main cause of existing quagmire which Pakistan’s economy is witnessing currently’, and now ‘Pakistan will have to undertake a comprehensive package’”, said Fitch Solutions.

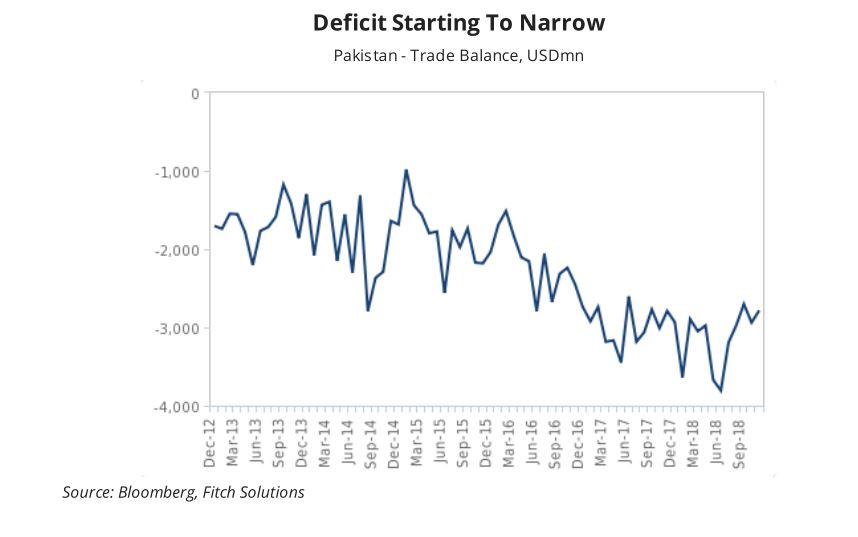

Talking about the trade deficit, Fitch Solutions highlighted it remains deeply in the red, it has narrowed from all-time highs seen in June.

It added, the latest data for November indicated that the trade deficit was recorded at $2.8 billion, bringing the cumulative figure to $34.6 billion (more than 10% of GDP) in the first eleven months of 2018.

Pakistan’s oil imports constituted just over half of this deficit figure in October and comprised of 31% of total imports for the month, said the report.

It anticipates the trade deficit to narrow over the coming months irrespective of oil price dynamics taking the country’s dollar shortage and recent rupee weakness into context.

The report highlighted the recent decline in oil prices should ensure that non-oil imports don’t crash, which could be a trigger for a recession.

According to Fitch Solutions, the economic stability experienced between 2014-16 was largely due to a combination of fall in global oil prices with the availability of IMF funds due to the bailout agreement reached in late 2013, which fueled the growth of imports.

Furthermore, it said the present external climate is more uncertain compared to the aforementioned period, since the continuing US trade clash with China and the EU.

It said the recent decline in global oil prices and an eventual IMF bailout indicates some relief for the external account is on its way.

“Higher inflation (which came in at 6.5% year-on-year (YoY) in November) relative to the US would also necessitate a weaker currency for Pakistan’s exports to remain competitive, concluded Fitch Solutions.