KARACHI: It seemed as if optimism at the Pakistan Stock Exchange (PSX) was just a false alarm. Indices which opened positive on Wednesday sunk by midday to end the day in red.

Foreign investors closed the first trading session of the year with the same trend, being net-sellers with a total outflow of $12.56 million. Major selling was observed in the banking and oil and gas exploration sectors ($3.47 million and $3.15 million).

As per the data released by Economic Affairs Division (EAD), a total of $1.86 billion has been borrowed by Pakistan from multilateral and bilateral donors in the first five months (July-Nov) of the current financial year 2018-19, against $2.877 billion during the same period of last year.

Furthermore, as per recent data released by the Ministry of Planning, Development and Reform, the government has disbursed Rs187 million under the Public Sector Development Programme (PSDP) 2018-19, which also consists of Rs57.4 billion foreign aid for various development projects.

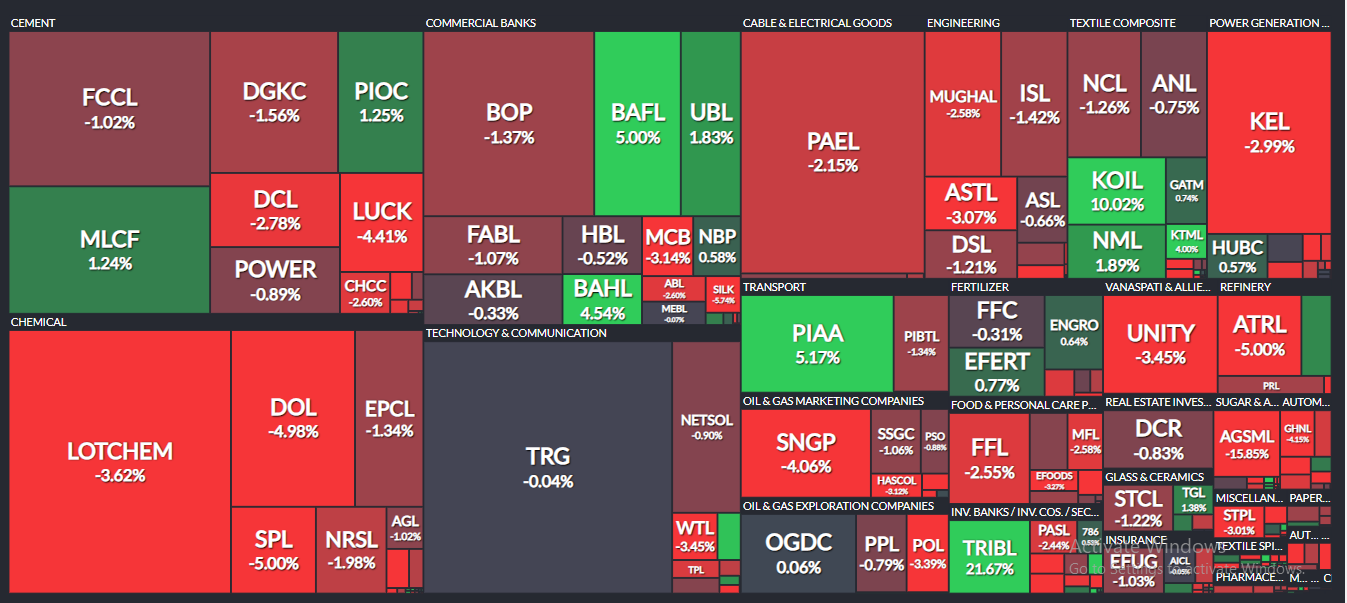

The KSE 100 index benchmark touched its intraday high of 38,499.04 after gaining 453.27 points by noontime. It then changed its course to reach its day’s low of 37,710.38 (down by 285.39 points). Failing to recover losses, it ended lower by 200.52 points at 37,795.25. The KMI 30 index depreciated by 505.76 points and ended at 62,862.40, while the KSE All Share index closed lower by 230.98 points at 28,399.34 points.

The overall trading volumes increased from 96.66 million in the previous session to 133.65 million. TRG Pakistan Limited (TRG -0.04pc), Lotte Chemical Pakistan Limited (LOTCHEM -3.84pc) and Pak Elektron Limited (PAEL -1.96pc) remained the most traded stocks of day. The scripts had traded 11.66 million shares, 10.86 million shares and 8.29 million shares respectively.

Top losers of the day included the woolen sector (-4.88pc), food and personal care products sector (-3.79pc), vanaspati and allied industries sector (-2.54pc), whereas tobacco sector (+3.65pc), miscellaneous sector (+1.54pc) and synthetic and rayon sector (+1.54pc) ended as gainers.