KARACHI: Having infected more than 130,000 individuals, and with a death toll surpassing 5,000 people, coronavirus (COVID-19) – now labelled a global pandemic – has brought life around the world to a halt, resulting in global economies feeling the heat due to disruptions in supply and dampened demand sentiments.

In the wake of the deadly virus, global GDP estimates have been slashed by 5bps to 2.4pc as opposed to previous estimates of 2.9pc.

Although the spread has been curtailed in Pakistan, and the World Health Organisation (WHO) has expressed satisfaction with national policies against the disease, Pakistan is not an island, and thereby the impact of the virus is likely to penetrate into the economy.

TRADE IMPACT

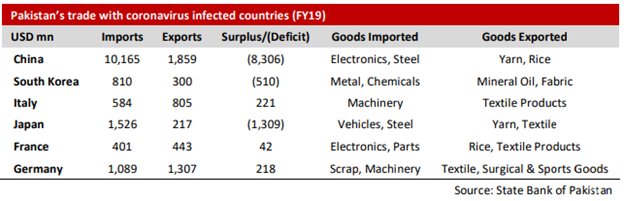

As per a report by BMA Research, the impact is likely to hit Pakistan due to its trading with infected countries. The report reads, “A large portion of Pakistan’s economy is driven by imported materials including most key sectors such as textiles, automobile, energy, steels, pharmaceuticals and consumers.”

Considering how a number of these countries are in quarantine, analysts expect that Pakistan’s trade with these countries will be impacted thereby disrupting supply chains.

However, with global export leaders impacted by the spread of the virus, this could lead to Pakistan emerging as an exporting nation.

Dr Aadil Nakoda, Assistant Professor of Economics at the Institute of Business Administration opined, “Pakistan must continue with its policies to boost its export volume. Although the growth in global trade is likely to slow down this year, Pakistan must consider developing its export sector to take advantage of opportunities as a result of the challenges reported by the large manufacturing powerhouses.”

OIL PRICE SHOCK

As a result of the damped demand sentiments, oil prices took a historic downturn last week. This was further aggravated by the disintegration of the OPEC+ resulting in the world’s two biggest oil exporters, Saudi Arabia and Russia, engaging in a price war.

This, however, is a development for Pakistan’s economy. As per BMA, “During FY19, Pakistan imported $16 billion worth of oil, 31pc of the country’s total import bill. We estimate that for every $10 per bbl decline in Arab Light’s spot price, Pakistan’s import bill can fall by $1.6 billion.”

As a result, inflation is likely to go down considering the low energy tariff and transportation costs.

Considering how developed countries are stockpiling on low priced oil, Pakistan is expected to follow. Trump said the US will “purchase at a very good price large quantities of crude oil” for storage in the Strategic Petroleum Reserve (SPR) emergency stockpile, a move that could help US producers.

MONETARY EASING

In order to prop up demand, central banks around the world have slashed policy rates. Considering how the market pushed forward the expectation for a policy rate cut in Pakistan later to beyond May, analysts now call for a sooner rate cut.

BMA notes, “In the backdrop of lower inflation trajectory and anticipated economic slowdown, we expect Pakistan’s central bank to follow suit. We contend for a 100bps cut in policy rate in the upcoming Monetary Policy Committee (MPC) meeting scheduled for March 17.”

CURRENCY

The currency is likely to be under pressure considering the outflow of dollars due to the liquidity concerns of foreign investors. Given how gold, a safe haven, has not managed to save itself from this liquidity selling spree, the rupee is likely to lose unless an intervention takes place.

According to sources, the State Bank of Pakistan (SBP) intervened at 4 pm on Friday to ensure the stabilisation of the rupee to bring the dollar down to Rs157.25 by pumping liquidity.

As reported by SBP on Friday, total gross divestment during March 2020 has reached $772.3 million, as ‘hot money’ left the country amid ongoing concerns about the impact of the COVID-19 outbreak.

It is expected that by the end of this week, T-bills’ outflows from the Special Convertible Rupee Account (SCRA) will cross $800 million.

Foreign investors divested $166 million net worth of treasury bills (T-bills) on March 12, as per the SCRA, which tracks inflows and outflows from foreign countries.

The net investment in T-bills from July 2019 to date now amounts to $2.327 billion.

WHAT THE FUTURE HOLDS

As China recovers from the adverse impacts of the virus, it is expected that things will return to normalcy in due time. However, the surge continues in western countries and is likely to go on till June.

BMA expects the stock market to recover at a similar pact to the international oil prices. “We are of the view that the Pakistan stock market has the potential to bounce back from current levels. The pace of prevention in the virus-hit countries along with movement in international oil prices will determine the speed of recovery in local equities.”

While no one can deny the impact the oil price drop brings to the local economy, the relative short-term aspect of it makes the positive impact questionable. This places pressure on the government to devise the right policies to bolster demand and investment while avoiding adverse supply shocks.

Pakistanis are paak so the virus will turn away and will not infect the blessed people of this pure land. Our mosques will not be breeding grounds of this virus.

InshaAllah. 🙂

For the retarded fucks like you, it will be good enough. Hope you get one soon!