If you are reading this, chances are that you have already read a ton of information about the coronavirus and probably do not want to read more of the same. This is not that. And though it seems, that the federal government, for now, has made up its mind to do away with the lockdown, we will still try to address and answer one very specific question: how and why should Pakistan engage in a nationwide shutdown as a response to the Covid-19 pandemic. We leave no mystery on the answer we have come up with: yes, we can and should do so.

First, let us establish the verifiable, undisputed facts: the novel coronavirus spreads very fast through interpersonal proximity, is far deadlier than the ordinary flu, and would kill millions if left unchecked. There is no cure, and no vaccine, and so until one is developed, the best solution known to experts who study pandemics is social distancing, effectively involving staying at home until the pandemic dies down.

Over time, as the number of new cases subsides, social distancing restrictions may be relaxed by allowing people to go about their daily lives while wearing face masks (and ideally also gloves) in public and when around other people, in addition to diligently washing hands after contact with unknown surfaces.

These are established facts, and we do not dispute these whatsoever. Our contention begins with what happens next: social distancing, which means shutting down businesses and preventing people – most of whom in Pakistan are too poor to have substantial enough savings to tide them over an extended period without income – from reaching their places of employment and business.

Such a shutdown is necessary for one very big reason: it will save millions of lives, and no amount of money is worth the number of lives Pakistan would lose if we were to not undertake preventive measures.

This is not to minimise the economic pain that people would feel, of course. That is very real, and should absolutely be addressed. But the way to address that is through massive government intervention: the government should compensate people for lost income – at least partially – in order to minimise their losses and make it economically feasible for them to stay indoors – and without income – for long enough.

Why the impact will be worse in Pakistan

“You have to understand one thing about Pakistan’s economy,” said one internet entrepreneur based in Karachi and San Francisco, who wished to remain anonymous. “We can talk all we want about Pakistan’s rising startup scene, e-commerce, and teledensity numbers. But the fact remains that the internet in Pakistan – for most Pakistanis – is only three years old, really probably just two years old for most people, if you think about serious speeds and connectivity.”

“All of that came with the advent of 3G and really with 4G mobile internet. Most people do not have internet at home,” he continued. “You and I may have had the internet in our homes since the mid-1990s. But the average Pakistani did not get it until 2016-17 or even later.”

Why does this matter? Because it means that, structurally, Pakistan’s economy is simply not set up for remote work. Sure, if you work in, say, the treasury department of United Bank Ltd (UBL), you can do almost the entirety of your job from home, at least theoretically. We have not confirmed with UBL as to how much of their operations are viable over the internet versus requiring personnel to come into the office, but we suspect that the banks in general will have an easier time setting up remote work arrangements than, say, a textile factory.

As a result, the vast majority of Pakistan’s labour force – which numbers just over 75 million people, according to estimates from the World Bank – is unable to earn a living without physically going to their place of work, in the case of the employed, and their place of business, in the case of business owners and the self-employed. Most of those people are unlikely to be paid if there is a shut down.

How many people cannot get paid in a shut down?

That is a hard question to answer, and there are not nearly enough economists in the country who would have the data or the research resources to adequately answer that question. (Except perhaps the folks at the State Bank of Pakistan, but there is no significant public estimate from the central bank yet.)

The best we can do is examine the structure and composition of the labour force and estimate who might be more vulnerable to a shut down. This is a very crude estimation, but may nonetheless serve as a starting point for estimating the loss of income expected, and the magnitude of the economic damage that the government needs to repair in order to persuade people to stay at home.

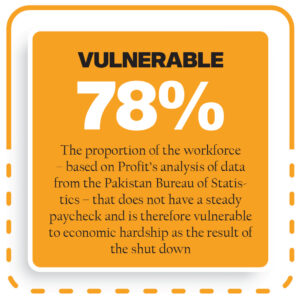

An estimated 55.6% of Pakistan’s labour force is categorised as ‘vulnerable’ by the Pakistan Bureau of Statistics (PBS), meaning they hold no security of any kind in terms of their employment. People like this are often employed on a daily wage basis, or are what are called ‘contributing family workers’, meaning they are people “who work without pay in cash or in kind on an enterprise operated by a member of his/her household or other related persons,” according to the 2018 Pakistan Employment Trends Report published by the PBS.

It seems reasonable to assume that just about all of these people are likely to fall under a severe economic strain under the pandemic-induced shut down currently being observed in most of the country. And no amount of incentives to help employers and industries will protect these people, because they do not operate in businesses directly – and sometimes even indirectly – connected to the kind of formal economy companies most likely to benefit from a bailout.

Of the remaining 44.4% of the workforce, 42.9% are salaried employees (the remaining 1.5% are business owners or self-employed). These salaried employees might have somewhat more protection than the ‘vulnerable employment’ part of the labour force, but even here, there are many people whose economic situation was precarious even before the pandemic.

Only slightly more than half of the salaried / wage-earning part of the labour force – or about 22% of the labour force – are salaried employees with a fixed wage rate that is supposed to get paid every month. The rest are divided among people who are ‘casual paid’ – meaning they get paid intermittently or irregularly (yes, that is so common in Pakistan that the PBS actually measures it; they are about 14% of the workforce) – and then workers who might get paid by piece produced or specific task performed.

Those numbers make for grim reading. Only 22% of the work force has a contract or any kind of arrangement where they can expect their employer to pay them every month. The rest of the 78% need to go out every day and hope for the best.

Even among that 22%, we suspect many are vulnerable to employers who may engage in pay cuts, furloughs, or outright lay offs in the face of the economic shut down.

In other words, over 78% of households in Pakistan – and possibly as high as 90% – need the government’s assistance in one form or another if they are to make ends meet in the midst of a shut down, or else they will be forced to keep on looking for work when the public health interest requires them to stay at home in order to prevent the spread of the virus.

The scale of the problem would be almost overwhelming, until one realises the alternatives: tens, or even hundreds of thousands of deaths, possibly even running into the millions. No society, no matter how poor, can value human life so little as to let people die in numbers that large in order to try to prevent the economic damage that is all but inevitable anyway (and – as we argue further down – the shutdown would prevent more permanent forms of economic damage).

The government’s plan

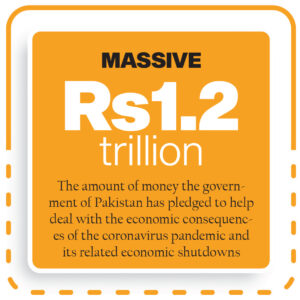

In this matter, as in just about everything, there appears to be a wide gulf between what the government of Pakistan plans to do, and what it likely should be doing in order to help people. The government’s announced plan thus far is large in scope – though probably not large enough – but has, in our view, completely the wrong focus.

A review of what the government plans to do: the spending package announced by the government is larger than any previous stimulus the government of Pakistan has ever undertaken – or had to undertake. That is good, because it means that the government – and its key decision makers including Prime Minister Imran Khan – understand the scale of the problem.

The problem comes with respect to how they plan to spend the money. First, let us look and what we think are appropriate uses of the money.

The second biggest chunk of the money is Rs200 billion set aside for “labour” and meant to help prevent mass layoffs. We applaud the effort, though absolute lack of specificity on the biggest line item is disconcerting in the extreme, to say the least.

Another Rs150 billion has been allocated towards direct payments to the most vulnerable families – up to 12.5 million families receiving Rs3,000 per month for four months – which we think is much more in line with what the government needs to be doing (spoiler alert: we think this should be the core of the government’s response.)

About Rs50 billion has been allocated to purchase protective gear for medical workers, which is an absolutely vital investment in the safety of this critically important segment of our work force, particularly at a time like this.

But then there are some elements that are not even really a bailout. For instance, the government is counting Rs280 billion in wheat procurement as the biggest chunk of the bailout, even though that is something the government does every year. And it is not even a bailout. It is not as though the government buys the wheat and then gives it away for free. The government buys the wheat and then sells it to flour millers and distributors for a profit.

And the government is also counting Rs100 billion in tax refunds as some sort of bailout, even though it is money that the government owes taxpayers! That is not remotely in the same definition as a bailout.

The Imran Khan Administration is also counting Rs75 billion as part of the bailout by pretending like they are responsible for reducing the prices of petrol and other fuels, even though those prices are going down because of the collapse of global oil prices, which have tumbled over 60% since the start of the pandemic. If anything, the government is likely increasing its tax revenues by not fully passing on the full decrease in price to consumers.

When all is said and done, there is at least Rs455 billion in the supposed ‘bailout’ package that is not at all a bailout and should not be classified as such. So the real bailout amount is Rs750 billion, which is still sizeable, but when you consider how much of it will go to rich, well-connected businesses, does not mean much for ordinary Pakistanis.

Even in the most charitable view, the rest of the bailout becomes debatable, ranging from the well-meaning but possibly not as effective to the outright “goodie bag for Big Business by another name”. [Note to our occasional Marxist readers: we are pro-free markets, not pro-business. The two are not the same, no matter how much your memes and The Guardian tell you that is what “neoliberal” means.]

In our view, any form of bailout will not matter at this stage if it does not recognise the structure and composition of the Pakistani labour force that we laid out above. We are not an economy with people who are tied to the formal economy in terms of our employment arrangements. The overwhelming majority of us – at least 78%, according to PBS data – do not even have formal employment arrangements with a regular income.

Under such circumstances, the only thing that makes sense is direct cash transfers – bigger and to a much wider segment of the population.

And for that, we have a proposed plan of action that might be executable because it involves the use of an infrastructure that already exists.

What might work better

As we stated, we believe direct cash transfers – both a larger amount per month, and to more people – is the single biggest component of the solution that the government of Pakistan should be pursuing. For that, we have a suggestion for both how to find the people who will get the money, as well as a fast mechanism of delivering the cash.

First, on who should get the money. As we stated, the government’s plan of targeting the poorest 12.5 million households with direct cash infusions is too modest, if in the right direction. We think closer to 80% and probably even more of Pakistani households will need some form of cash infusion. And we think the amounts they will need will be significantly higher.

Based on the most recent census data – along with some simple projections by Profit – we estimate that there are approximately 34 million households in Pakistan. How would one decide who among them gets help and who does not? In an ideal world, the government would be able to target the bottom 80% by income and send them straight cash transfers, but in an economy as undocumented as Pakistan’s that is not likely to be possible.

So what to do instead? We suggest determining the much shorter list of who not to provide with financial assistance and then find a way to deliver the cash to everyone else. How do we do that? Through a little-known, but very detailed data set jointly maintained by the Federal Board of Revenue (FBR) and the National Database and Registration Authority (NADRA).

In 2012, NADRA and the FBR began a project to help identify tax thieves in Pakistan and came up with a list of over 3 million individuals who do not pay any taxes at all, but who have lifestyles (frequent foreign travel, property registrations, weapons licenses, etc.) that indicate considerable wealth. Since then, the data set has come to include data from bank accounts as well, and the list is likely to swell even further, likely close to 4 million individuals, nearly all of whom constitute separate households (separating households was one of the variables the data set sought to control for).

In our view, the government should exclude those 4 million people, plus the 2 million households where at least one person is employed by the government itself, and send Rs10,000 per month for four months to every other household in Pakistan. That is 28 million households, receiving Rs40,000 spread over four months. That comes out to Rs1.12 trillion, slightly less than the package announced by the government (their full claim, though, of course, as we pointed out, in reality, it is much less).

How would the government deliver this to everyone else? That’s where another of the government’s documentation drive comes in: the drive to get everyone to biometrically verify their ownership of the mobile telephone line that they use.

There are 165 million cellular subscribers, or about 78% of the population. We suspect the bulk of the rest are either children or the elderly who do not use cellphones because of their age but are connected to an earning member of their household, or are poorer individuals who would likely be documented by the government as part of the Benazir Income Support Program (BISP) and the National Socio-Economic Registry (NSER).

Here is how we think the government should do this: for the 12.5 million households that the government either already has on the BISP rolls or can find through the NSER, it should go ahead and deliver the cash through its existing mechanisms. For the remaining 15.5 million households, the government can rely on the NADRA data set.

First, it should run a screen to eliminate the tax thieves and those on its own payroll, followed by people whose national identity card (NIC) numbers or household numbers match those of recipients through the BISP or NSER. Everyone else should be grouped into households (easy enough, since the NADRA database already does that), and one person in each household should be sent one payment of Rs10,000 per month (untaxed) through their mobile balance, based on their biometric registration.

This is the part where it gets tricky: this would not be the government giving people Rs10,000 worth of mobile credit per month for four months. This would be the government giving people Rs10,000 worth of credit that would be redeemable for cash at their local store where they buy mobile credit anyway.

In order to make this work on as massive a scale as it needs to, the government needs to make sure to pre-deliver the cash into the bank accounts of the mobile companies, who then need to be delivered physical cash in large volumes by the State Bank of Pakistan against those government deposits. The mobile companies then need to go out and pre-deliver cash equal to at least four times the normal annual mobile credit sales volume at each store or stall that sells their credit.

Why four times? Because the bailout is worth about four times the amount of revenue the companies make in a year.

Once that is done, people should be notified via text message to collect their cash at their nearest location, ideally a food / grocery store or a pharmacy, since those are the only kind of retail outlets that should be allowed to remain open during the shutdown.

Some sensitivity analysis

With an approach this broad, is there a risk that some people who do not need the help will get it? Yes. Is there a risk that some people who need the help will not get it? Also, yes. But with this broad an effort, the government has the best chance of helping as many people as possible, while missing as few people as possible who might need the help.

How bad is the error rate likely to be? We are fairly sure that at least 78% of households, based on the government’s own data about the work force, need the help. And the proposal we outline calls for delivering aid to 28 million households, or about 82% of all households in the country. Even if we assume that all of those additional households do not need the help, that still implies a nearly 95% effectiveness rate in terms of the money reaching people who need the help.

How many other government programs can you think of that are 95% effective in terms of the money spent?

These are, of course, back of the envelope calculations, and the government should attempt to refine this as much as possible using the data it has. But given how quickly the virus is moving, it may not have the time to wait around to develop a more robust infrastructure to deliver the amount of aid in the speed and scale that is needed, given the moment we face.

The method we outline is quick and a little rough, but perhaps more likely to get the job done than most other proposals currently floating around in Islamabad.

The financing problem

As we noted above, the government is really only planning a Rs750 billion in terms of what it needs to actually finance. At least Rs230 billion is likely to come from the $1.5 billion in additional funding from the International Monetary Fund that the government has requested and is likely to receive, given the more charitable mood in Washington these days.

The remaining Rs520 billion is likely to come through a combination of new borrowing from the banks, suspension of the development budget spending and diversion of cash towards the bailout, and perhaps (hopefully) a small amount of central bank borrowing, also known as simply printing the money.

Our proposal calls for actually spending new money close to Rs1.1 trillion, or about Rs370 billion more than what the government is already planning to spend. We believe that such an amount is likely to be possible to raise through a combination of additional bank borrowing and perhaps a small bond issue in the global financial markets.

Having said that, however, we do acknowledge that Prime Minister Imran Khan has a valid concern: what if he closes down the country for four months and we still have the virus at the end of it? What then? Because even our plan, while minimising the pain, realistically cannot last much more than those four months.

The government would begin to run out of places to borrow the money, particularly in the face of collapsing tax revenues which means that it would need to start printing money, which would dramatically accelerate the already very high levels of inflation in the economy, and further hurt the poor at their most vulnerable time. [Editor’s note: I argue in my editorial that even this would not result in hyperinflation]

As we have noted, however, it should be possible to re-open the economy with people wearing masks in four months, provided we actually take the actions to prevent the spread of the disease in those four months.

The Prime Minister is right to point out that shutting down the economy for four months is a big risk with massive costs that cannot realistically be increased. We believe, however, that that is all the more reason to make sure that we make the most of these four months, rather than risking massive numbers of deaths and long-term collapse of our healthcare system.

It is likely to be the only way we have forward.

Comments are closed.

under current scenario, u can not predict, how would things unfold. Things on paper seem good but implementation is our country, u r aware. Lot of consultation among top leadership of whole country is being done and they bear the responsibility of any adverse reaction also. Theories are easy to put up and call others with wrong focus, when this has not occured b4.

Where to next? hello there. I am Mia Parker Manager of Airlines Reservation. Only a few people know what traveling gives us. Find all magnificent destinations in my blog and uniquely explore all beautiful places through SAS Airlines. Make new destinations your happy place through SAS Airlines Reservations. wake up the true traveler in you and discover the world. Book soon for your upcoming journeys.

Interestingly a lot of thought process has gone into this, I have been working on this since 2008 and carried out the first POC for the IDP’s of SWAT, using UBLs Gold Debit card. The solution is much much Simpler, Effective Idiotcally Simply to implement and use, Safe, Secure and traceable. It has far greater benefits then Financial Inclusion only. If the government is Serious about a Solution which is effective and beneficial to all, the government, the financial Industry, The Agent networks And the common man. This model has far reaching effects mucb beyond Financial Inclusion

You seriously believe that 90% of Pakistan needs 10K/month to survive. That’s the basis of your costs. Perhaps the bottom 40% could but basic needs of the top 10-20% is likely to be around 50K/month.

[…] 1.2 trillion package attempted to provide relief to citizens and support to businesses and economy. Profit estimated at the time that the package was closer to PKR 750 billion, discounting certain […]

[…] 1.2 trillion package attempted to provide relief to citizens and support to businesses and economy. Profit estimated at the time that the package was closer to PKR 750 billion, discounting certain […]

[…] Economic Survey of Pakistan 2019-20; MP AnalysisProfit estimated at the time that the package was closer to PKR 750 billion, discounting certain […]