International trade has come to a standstill owing to the outbreak of coronavirus and the subsequent lockdown measures taken worldwide to tackle the spread.

As per the Pakistan Institute of Development Economics (PIDE), trade disruptions due to the COVID-19 pandemic are likely to cost the country a 4.64pc loss in GDP if both exports and imports fall by 20pc.

However, an AKD Research report titled, “External Account & COVID-19: variables to remain manageable”, stated the impact of the virus on Pakistan’s international trade in the worst-case scenario “is not disastrous”.

“While the impact varies from net negative to net positive, depending on which scenario plays out, we highlight the near term impact, even in a very pessimistic scenario, to be relatively moderate and manageable, given the country’s limited reliance (fortunately or not so) on exports (10.4pc of GDP) and tourism (0.1pc of GDP).”

IMPORTS

Imports for March 2020 clocked in at Rs525 billion, depicting an 18.7pc decline over last year. Of the total, 51pc of the imports came from China, UAE, Singapore, USA, and Saudi Arabia, with China alone accounting for 21pc, as mentioned by “Impact of Coronavirus on Pakistan’s Economy”, a report released by Dun & Bradstreet Pakistan.

As per the report, the decline in import value can be attributed to multiple factors, including disruptions in supply chains, lower demand in Pakistan, and a fall in prices of goods and commodities. A decline in imports will have a positive impact on Pakistan’s current account deficit; however, delays in imports of essential items could disrupt the supply chains of multiple industries.”

Approximately 32pc of Pakistan’s imports are direct products. However, the remaining 62pc are intermediary products or raw material that are further used in the industry.

As per Profit’s analysis, import and gross domestic product are positively integrated and the exchange rate is not a significant determinant of imports due to the relatively inelastic nature of the products in the production process of goods and services. This is due to the lack of local alternatives to such commodities and the lack of technological advancement.

EXPORTS

According to data released by the Pakistan Bureau of Statistics, total exports for the month of March 2020 were down by 12.9pc over January and stood at Rs287.7 billion. A major proportion, approximately 40pc, of this trade is to the USA, UK, China, Germany, and the Netherlands. All these countries have been hit with the pandemic.

Due to a cancellation of export orders, Pakistan may lose on $4 billion exports by June 2020 based on calculations made by the Ministry of Commerce.

REMITTANCES

As per data released by the State Bank of Pakistan, inward remittances clocked in at $1,824 million for February 2020, showing a 4.4pc decline over January. The decline, however, has been attributed to the spread of COVID-19 around the world. While the extent was not drastic in February, the number of cases, deaths, and countries on lockdown have increased since then. Based on that, remittances are expected to further decline.

Ammar Habib, Head of APAC investments i5 Capital, opinioned “Would be interesting to see if the Middle East and Gulf states are reducing construction activity – which would have an impact on overseas Pakistani workers. This could hurt the inflow of remittances and dollar reserves.”

A major proportion of Pakistan’s remittances can be traced to GCC countries. Saudi Arabia, UAE, and the USA account for the largest share of remittances contributing $422 million, $387.1 million, and $333.5 million respectively.

Remittances made up 7.7pc of the Pakistani GDP in 2019, in comparison to the World Bank’s calculated average of 5pc share of GDP experienced in more than 66 emerging and developing nations. This highlights the importance remittances have in the Pakistani economy.

However, as per AKD’s Umer Farooq, the situation can be offset by other factors. He says, “Savings in oil import bill (24pc of total import bill in 8MFY20) from a crash in oil prices and low domestic demand partially offset the dollar earnings loss in the form of lower exports and remittances.”

WORST CASE SCENCARIO

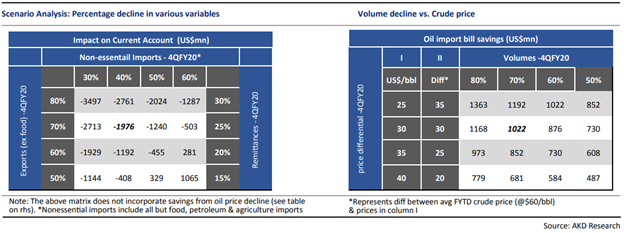

Farooq explains, using a matrix, “Even in a pessimistic scenario where we assume an aggressive 80pc decline in 4QFY20 exports (ex-food), 30pc decline in 4QFY20 remittances – through resilient in short term, in our view – and a relatively moderate decline of 30pc in imports (non-essential), the net incremental impact comes around US$3.49bn (1.25pc of GDP).”

He further adds that there will be some relief due to the oil price and consumption decline. “Adjusting for import bill savings from oil price and consumption decline (see table above on RHS), the net incremental burden on the current account would be $2.30bn (0.8pc of GDP).”

IS THERE A SILVER LINING?

Farooq comments, “Given the manageable impact on external account even in a worst-case scenario and the government efforts to galvanize additional funding support from multilaterals (WB has approved $200m recently, while the government is in talks with the WB and the IMF for additional support of $0.8bn and $1.4bn, respectively), we do not see much downside risks for Rupee in the near term.”

He, however, comments on the risks, “… should the crisis prolong, the currency could see further pressure, given the weak FX reserves position (SBP reserves/import cover: US$11.2bn/3months).”

Sami Tariq, Head of Research and Business Development at Arif Habib Limited, points out “Though on a recurring basis, Pakistan is a net beneficiary in our view, however, as the size of reserves is small, therefore handling the currency parity in this avalanche is tricky. As soon as situation normalizes, flights from Dubai resume and Pakistan receives aid money from multilateral institutions, PKR USD parity is going to stabilize”

However, despite the impact of the virus on Pakistan’s external trade front being weak in comparison to other countries, one cannot ignore how this is due to the lack of integration in international markets.

While speaking on the low trade to GDP ratio, Professor Aadil Nakhoda, Assistant Professor and Research Fellow at CBER, IBA opined, “Our poor trade performance is a symptom of economic mismanagement. The lack of trade integration has historically hurt our economy and the cost is significantly large.” Through this quote, he points out that although the cost of COVID-19 on Pakistani trade may be positive as suggested by certain quarters, this, in turn, points out a shortcoming within Pakistan’s international trade policy.