The financial sector in Pakistan is largely defined by the banks, with little consideration given to the space that non-banking financial services and companies occupy. Companies in the business of loans and advances, as well as acquisition of shares, stocks, bonds, debentures, and other government and local authority issued marketable securities remain largely ignored, with a regulatory structure that still has significant holes in it.

Asset management companies, investment and securities advisors, insurance firms, investment banks, securities brokerage firms, venture capitalists, currency exchanges, some microloan organizations, and even pawn shops are non-banking financial institutions. While a lot of the services that these institutions provide are not necessarily suited to the banks, they still serve – in one form or another – as competition to the banks, and as such as the stepchild of the financial services industry that is dominated by the banking lobby.

The difficult charge of managing the country’s corporate sector and turning it into a modern and efficient capital market lies with the Securities and Exchange Commission of Pakistan (SECP). And while the regulatory body has been has defined a significant number of rules and regulations that govern the sector – coupled with laws passed by Parliament – there remain a number of glaring holes in the regulatory infrastructure of the country, specifically as it relates to enforcement mechanisms.

The ‘Non-banking Finance Companies and Collective Investment Vehicles Bill, 2020’ has been drafted with the stated purpose of protecting investors and tightening the supervision and monitoring of non-banking finance companies which, critics argue, has remained lax in the past.

The stated rationale behind the draft bill has to strengthen the neglected non banking financial sector in Pakistan, and more importantly to protect investors.

What is the bill and what does it do

The first and foremost goal of the draft bill is to formulate the rules and regulations that will govern finance and investment companies that fall outside the gambit of the traditional banking sector. The bill also has a comprehensive set of rules outlined to protect unsuspecting investors from fraud.

In Pakistan, people shy away from investing in non-traditional financial institutions precisely because they are scared of being scammed or defrauded. It says a lot about the country that even run-of-the-mill mutual fund managers and asset management companies are considered ‘non-traditional’ – a label given to private equity and venture capital in more developed markets – but given how woefully unregulated these are in Pakistan, it is no surprise.

Ask a regular citizen where they are most likely to invest their money, and the answers will all be variations of the same few things: real estate, gold, prize bonds, foreign currency and just maybe the stock market if someone is feeling particularly adventurous. Most people in the country, even those with a lot of money, are not even aware of all the investment possibilities available to them.

But the core reason for this is the mistrust of people in trying out new and risky-sounding investment ventures. It is a once-bitten, twice shy situation, and people need assurances or a sense of security before they even dip their toes in these uncharted waters. This is where the SECP and their new bill comes in, which if approved, will go some way to at least begin trying to solve these problems. This means the bill is important not just for the corporate conglomerates, but also the smaller businesses.

The first requirement proposed by the bill is that all of the businesses and activities that it has listed under its jurisdiction need to have a proper license. While the licensing requirements had existed before, this new bill formalises the penalties for operating a particular non-banking financial service without a licence, thus giving the existing set of regulations more teeth.

Furthermore, even these activities must be carried out by a non-bank financial sector that has been specified in the given license, which does wonders towards formalising the non-banking financial sector. The tolls for violation of this clause are heavy, carrying a punishment of up to seven years of jail time, or fines up to Rs100 million.

To protect investors, the bill also implements a fine of up to Rs100 million when contravention results in substantial loss to the other person, or results in pecuniary gain to the person who committed the offence. In such a scenario, a different kind of fine may also be charged, which would be twice the amount of loss caused or gain made.

To get such a license, a company needs not only to be registered as per the Companies Act 2017, but also each of its promoters, proposed directors, major shareholders, chief executive officer and chairman of the board of directors must fulfill the terms and conditions mentioned in the fit and proper criteria as may be specified and complies with the requirements of this Act.

Additionally, those companies that are already involved in the provision of financial services as an ancillary activity for at least a year will still have to get a license.

Non-banking financial corporations will not be able to appoint a director or chief executive without prior approval by the SECP either. The ‘fit and proper’ criterion for promoters, majority shareholders, directors, and chief executives will also be determined by the commission. The factors to be considered by the SECP were outlined in the bill as the financial status or solvency, educational or other qualifications, experience as well as the ability of the person in concern to carry on their activities honestly, competently, and fairly.

Finally the reputation, character, reliability and financial integrity of the individual will also be on the table for SECP to evaluate if this bill comes into play.

The bill thus gives the SECP a lot of power over non-banking financial institutions. The bill allows the SECP to not only control the operations of the NBFCs, but also stop any investment vehicle in its tracks. If SECP deems fit, it can also cancel the license of any corporation’s officials any time, and even has the final vetting rights on CEOs, directors and majority shareholders.

Why this bill matters

In plain words, the bill is important because these financial institutions are important. For a largely unbanked population, it is startling that non-banking financial services are not given more importance. The notable lack of financial exclusion, at the moment, is one of the major factors plaguing the economy. No example is better than this exclusion has caused great delays in the distribution of relief aid in recent times.

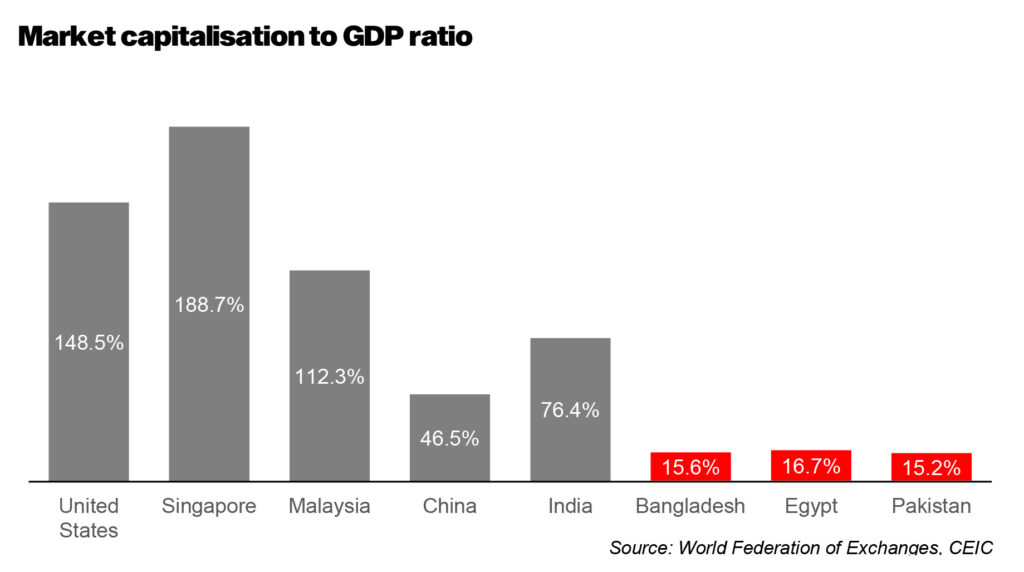

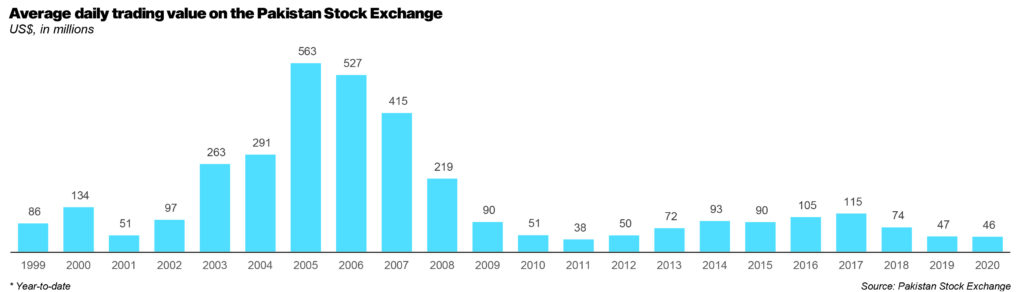

But first, a review of the current situation. Just how bad are market participation levels in Pakistan? Pretty bad, from even a cursory look at the data.

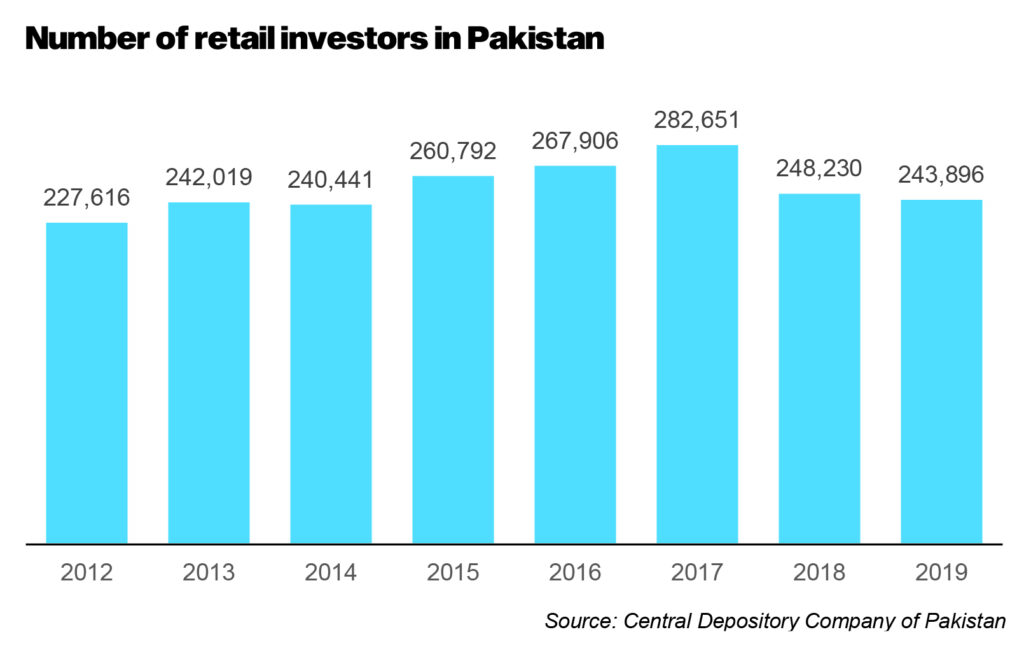

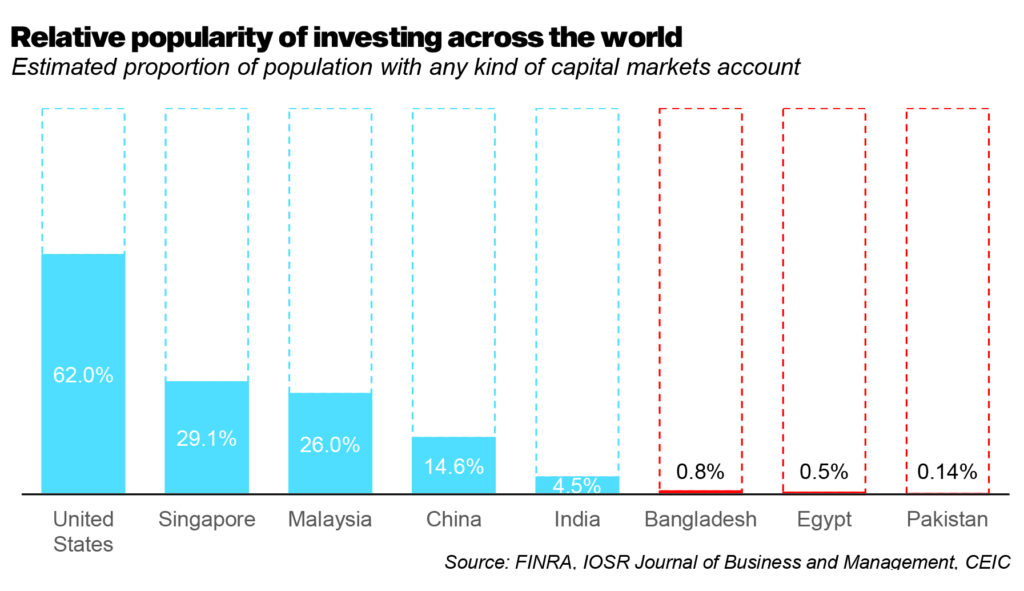

There are just under 244,000 people in Pakistan who have a capital markets account of any kind, according to data from the Central Depository Company (CDC), which amounts to just about 0.11% of the total population. This compares to 0.81% even in comparable economies like Bangladesh. The number for India is 4.5%, and it is a significantly higher 62% in more sophisticated markets like the United States, according to data compiled by Elphinstone, a securities advisory company.

The comparison with Bangladesh is made especially surprising by the fact that the Karachi Stock Exchange, the largest predecessor of the Pakistan Stock Exchange, was founded in 1949, a full five years before the Dhaka Stock Exchange, which was founded in 1954. Incidentally, one of the first listed companies on the exchange, the Karachi Electric Supply Company, is still listed on the PSX as K-Electric.

So why exactly is the situation so bad in Pakistan? Why are Pakistanis so uniquely unwilling to invest in the capital markets?

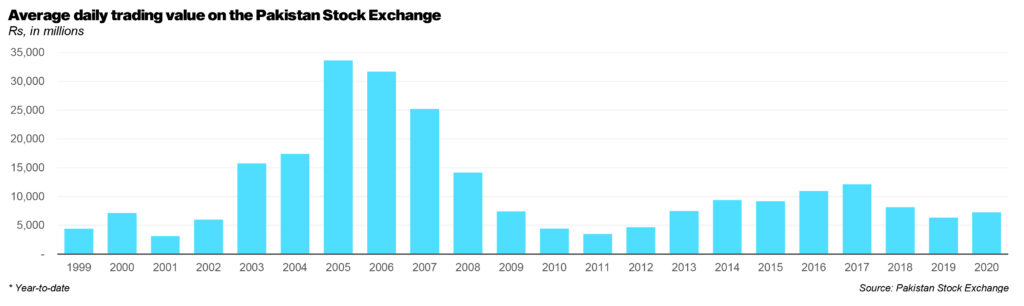

The reason has absolutely nothing to do with Pakistani stocks as an asset class. Stock market investing in Pakistan – over a long-term horizon – is actually a great investment.

On January 1, 1999, if you had Rs10,000 in your pocket, and you invested that money in a variety of different investment options, here is where it would stand today. To purchase the same amount of goods and services as your could with Rs10,000 in 1999, you would need Rs43,176 today, meaning any investment that you made back then that did not result in you having at least that much money today lost you money.

So here is how the investment options stack up: if you simply bought US dollars with that money, you would have Rs31,827 today. If you bought gold, you would have Rs157,254; if you had bought bonds, you would have Rs75,109. But if you had bought stocks, you would have had Rs355,956. There is, quite simply, no beating the stock market as a venue for investment for ordinary investors.

(Of course, this assumes you had the discipline to stay invested and not try to cash out your money in a panic during the stock market crash of 2008 and the many mini-crashes in the middle. Investing of any kind requires self-discipline.)

So, if it is such a great asset class, why do more people not invest? For that, there are multiple reasons, but at least one of them has been the lack of trust in the regulatory oversight of such institutions, a problem the SECP is actively seeking to remedy.

Improving consumer access to credit

But it is not just the investment side of matters. The SECP and the government more broadly are also intent on seeking to improve access to credit for consumers.

One significant such regulatory action took place in 2015 when the “Credit Information Bureau Act” was passed by Parliament to allow the establishment of private credit bureaus. This was touted as an effort to promote financial inclusion, as part of the government’s National Financial Inclusion Strategy (NFIS) and was directed towards enhancing formal financial access to 50% of the adult population by the end of 2020.

According to estimates by the World Bank, Pakistan only had 21% financial inclusion up until 2017. Before the act, several credit bureaus operated in the country unlicensed, but after the passage of the Act the government’s control increased. The current bill is a continuation of that process.

One of the major problems contributing to slow growth of financial inclusion rate as well as the overall performance of such institutions are the challenges in collecting payment history of the customers of financial institutions. Other sources such as telecommunication firms, and utilities are also important for building a reliable repository of credit information data of both individuals and corporate entities

This might be traceable to the fact that these credit bureaus were initially only given the primary authority to collect data from the financial institutions. However, with this act the financial institutions were mandated to share data with all private credit bureaus.

The National Financial Inclusion Strategy (NFIS) acknowledges the role of these non-banking financial institutions in removing the constraints to formal lending to the micro, small and medium enterprise. These institutions are a major factor in providing business loans and other forms of credit to small and medium enterprises (SMEs). Business Recorder reported in November 2019 that, “Since fiscal year 2008, the number of SME borrowers have contracted from a peak of 230,000 to 184,000; as a proportion of private sector financing the SME portfolio now stands at 7.5% against 15% in fiscal 2008.”

These non-banking financial institutions also allow for a wider range of products available for personal and SME loans, otherwise not possible through formal banking channels, thereby increasing the access of the financially excluded population to various lending options.

To link it back to our main question, as to why this is important, the new rules and regulations laid down by the bill will not only be impacting the sectors mentioned above directly, but they will also have a trickle down impact on the small and medium industry as well as sole proprietors who wish to get involved with non-banking financial institutions.

The pain points

Currently, it is being reported that the cabinet is going to approve a notification under Section 11 of the Credit Bureaus Act 2015, making it obligatory for utility companies, including gas and electricity providers, to share data of consumers with credit bureaus. This is significant for the development of any anti-fraud products that use data from applications and other data sources in addition to the credit account data.

The clause about data provision by the utility companies is a key reform under the ease of doing business (EODB) goals of the government – tracked by the World Bank as a means of ranking which countries are most attractive to do business in from a regulatory perspective. If adopted, this regulation will help improve the country’s ranking on the World Bank’s EODB index.

At the same time, a regulatory requirement for telecom companies to share data is being considered. The federal government will be issuing a new rule making it obligatory utility companies, including telecom firms, to share data with the licensed credit bureaus.

The federal cabinet has already approved a new regulation mandating that all companies providing wireless telecommunication services to consumers will be members of credit bureaus and furnish information in accordance with the Act and regulations made there under.

A number of challenges exist for non-banking financial institutions in how they are going to implement all of these policies and the collection of data from each sector. To begin with, these institutions are obligated to share their data with at least one private credit bureau as opposed to sharing data with every credit bureau.

Mansoor Ahmed wrote a detailed piece on this topic, outlining that this has “resulted in partial reporting to each credit bureau and the lenders’ needs to carry out credit checks from each credit bureau to get a complete picture of a person’s credit profile or payment history. The Act also allows credit bureaus to share data among themselves, but the exact mechanism of this process still needs to be developed.”

Furthermore, since the NBFCs, including microfinance institutions and retailers involved in hire purchase transactions, are regulated by the SECP, there is a need to raise awareness and involve the Commission in the NFIS.

The SECP will also need to play its part yet again in order to ensure that these companies comply with the credit bureau regulations and provide accurate data to the credit bureaus in a timely manner.

Another unavoidable hiccup in data collection from utility companies will be posed by the disparity in the ownership of utility connections. Mansoor wrote, “Policy changes need to be introduced requiring the utility licensee to certify whether the connection is in his/her use or someone else’s so that payment behaviour of the actual user can be gathered.”

Likewise, the fact that most telecom subscribers continue to remain unbanked means that the profiles of many customers, even those with mobile wallets would be incomplete. This is in addition to the fact that telecommunication companies are not as willing, or even able, to share their customer data as the utility companies or formal financial institutions might be. The regulations governing the telecom sector themselves go against this new regulation of data sharing with private NBFIs. Telecommunication regulations do not permit telecom companies to share data of their customers with a third party.

In a nutshell

Now the bill that has been introduced by the SECP to increase control over non-banking financial institutions is a reasonable effort in ensuring that all these other steps about credit bureaus as well as other stakeholders through the data connection stay within the legal limits. However, in the absence of any clause in any of the bills being brought forward regarding better and smoother cooperation between different stakeholders can through the entire effort into mayhem.

With the current economic turmoil already taking its toll, especially on small and medium businesses, it is necessary that the government takes into account all the extra powers that SECP will be enjoying. One ‘wrong’ action, such as data sharing, through any of the non-bank financial institutions will lead SECP to completely shut down the organization in concern, stopping the entire lending process in its tracks along with any data sharing accountability.

Very well written article on a neglected financial sector. Let’s hope SECP’s initiative bear fruit. But only time will tell. I think educating the lay man about investment choices is a big challenge in Pakistan.

Well oriented!

Thanks for sharing