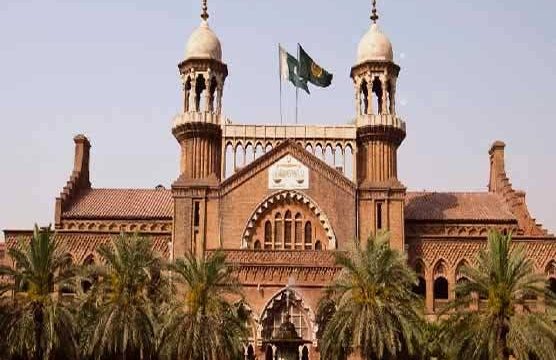

LAHORE: Eight writ petitions challenging the vires of Section 7 of the Punjab Sales Tax and Services Act, 2012 were filed before the Lahore High Court (LHC) on Wednesday.

The petitions were filed by Supreme Court (SC) Advocate Syed Sajjad Haider Rizvi, a partner at Rizvi & Company and are numbered 59780/20, 59789/20, 59800/20, 59793/20, 59784/20, 59787/20, 59797/20 and 59801/20.

Speaking to Profit, Rizvi said that the issue raised relates to the chargeability of sales tax on services rendered by manpower companies.

“The challenge is made to the chargeability of sales tax on reimbursable expenditures claimed by manpower companies,” the leading tax consultant added.

He shared that LHC Judge Shahid Waheed, after being convinced by the contentions, admitted the writ petitions for regular hearing and has issued notices to the Punjab Revenue Authority and government of Punjab.

Speaking to Profit, a leading tax consultant Dr Ikramul Haq said that the Sindh High Court (SHC) has already decided that it is the net value that is chargeable, not the gross value, for such services.

As per SHC’s short order, Sindh sales tax is chargeable on the service component of a manpower service provider and not on the amount paid as reimbursement of salaries and wages.