It has been an interesting week for Samin Textiles. The textile mills, which sits on the defaulter list of the Pakistan Stock Exchange, found itself within the space just 10 days, receiving a public announcement of intention, and then also a public announcement of offer. The textile mills owners and management will also change through this acquisition.

And who is interested in this textile mill that has not operated since 2018? Haroon Ahmed Khan, the CEO of Waves Singer, the immensely popular and iconic refrigerator brand.

Let us first take a look at the textile mill itself. Samin Textiles Limited was incorporated in Pakistan in November 1989, and was listed on the PSX in 1994. The registered office of the company is situated at Main Gulberg, Lahore, while the plant used to be located at Manga Raiwind Road, Kasur. The principal business of the company used to be manufacturing and sale of cloth.

We use the phrase “used to be”, because Samin Textiles no longer does the ‘textile’ bit of its name anymore. On its website, Samin’s tagline says “success is always accompanied by challenges”. But the challenges faced by this textile mill were too much for it to handle.

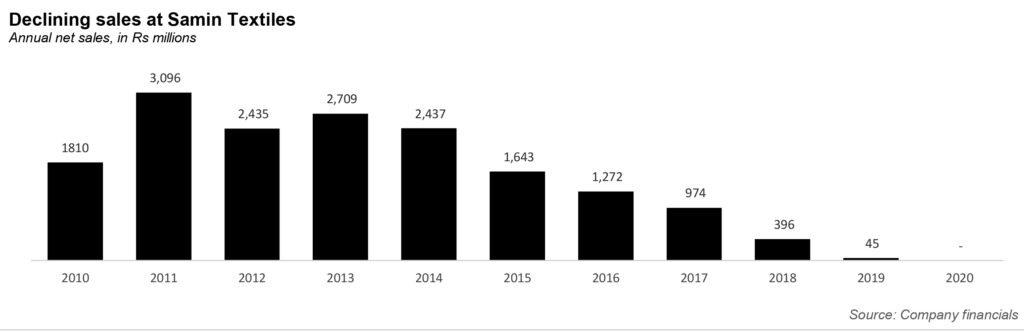

Between 2010 and 2013, the company had decent sales. It jumped from Rs1,810 million in 2010, to Rs3,096 millio, the next year, before hovering around the Rs2,500 mark the next two years. But then starting in 2014, sales began to decline, rather rapidly. By 2016, sales had halved to Rs1,272 million; by 2018, sales had crashed to Rs396 million, and then just Rs45 million in 2019.

Between 2010 and 2020, the company made a profit in only three years; the rest all faced losses. Perhaps the worst years were 2017, when the company made a loss of Rs283 million, and 2018, when the company made a shocking loss of Rs 898 million.

What happened? The warning signs were there in 2015, when the directors’ report noted that “the entire textile sector specially the weaving is depressed for quite sometime…In Pakistan, greige fabric market is facing tough competition from China and India who are more competitive in energy and labor cost.”. Then in 2018, the plant ceased production. Samin listed the following reasons: sluggish textile demand in the international market; the existing plant and machinery has become too old, obsolete and inefficient; a lack of investment from sponsors; and the non-availability of viable orders. In 2019, the plant was disposed of entirely.

An alternate business plan was drawn up in 2018, to switch to the trading, import, and export of textile products. But this also miserably failed: according to the company, poor market conditions, and high energy cost, mean running the mill is not economically viable.

The principal sponsors seem keen on getting rid of this asset. Sarmad Amin, Mehvash Amin, and Shehla Saigol own 58.3%, 4.8% and 4.1% of Samin Textile Mills, or around 67.1% collectively.

Enter Haroon Ahmed Khan. He is a relatively new owner of the storied brand. Singer, the company that started off manufacturing sewing machines in Boston in 1850, has had a presence in the subcontinent since 1877. And then there is Waves, the relatively new brand, but nonetheless one that has managed to make its way into the minds of many households. The white goods company was established in 1971 by a Lahori family, and began to produce refrigerators in 1976. It began to make air conditioners in 2002, microwaves in 2003, and washing machines in 2004. It was then bought out by Singer Pakistan Ltd (the sewing machine company), in 2017. The combined company owns brands and manufactures products that have a major presence in most middle class households in the country, an enviable platform upon which to build its growth story.

The company’s current business is doing rather well. As of August 2020, it has a significant presence in the country, with 2,398 dealers, warehouses, and service centers across Pakistan. Sure, it has a measly 5% share of refrigerators in Pakistan, compared to Dawlances’s 27% share, or Pak Electron’s (PEL) 25% share. But it has still made positive net income for the last four years straight, earning Rs382 million in 2018, and Rs378 million in 2019.

Haroon Ahmed Khan first emerged as the chairman of the company in 2015, with 5.51% of all shares, and his wife Nighat Haroon Khan holding 4.40% of all shares. In 2016, Haroon Ahmed Khan became the CEO, and by 2020, Haroon and Waves Singer are now synonymous with each other. Haroon owns 38.3% of the company in 2020, Nighat owned 15.6%, while dependent children own 1.67%. Collectively the family owns 61.64%. Haroon was reappointed CEO in August 2020, for a term of three years.

Haoron Ahmed Khan entered into a share purchase agreement with the sponsors for 67.1% of the company, including management control. He has also issued a public announcement of offer for 16.4% of the company. Both are a share price of Rs1.39. This amounts to Rs6.12 million for the shares through pubic offer, and an aggregate sale price of Rs25 million for the share purchase agreement.