It will be a long winter for the budding tech industry of Pakistan. Although bursting with potential, the global funding crunch has nipped most efforts of local startups and VCs to raise capital in the bud. While it looks like the American market stands at the cusp of a revival in funding, with the rest of the world eagerly anticipating any positive development, the landscape for startups and entrepreneurs seeking investment across the globe remains a challenging one.

Some are speculating that AI is quickly becoming the catalyst for a funding comeback, however, still unsure whether it can save the entire ecosystem or not.

But what is happening in the rest of the startup economy and what does that mean for Pakistan?

What is happening in the land of opportunities?

The American economy serves as the cornerstone of the global financial system, influencing markets and policies worldwide. Developments within the US, whether in trade, technology, or monetary policy, reverberate across borders, consequently shaping the trajectory of economies globally. Therefore, any shifts in the American economy hold profound implications for businesses and investors worldwide.

That is the reason why, currently, all eyes are on the American tech landscape and the expected recovery of tech funding in the US.

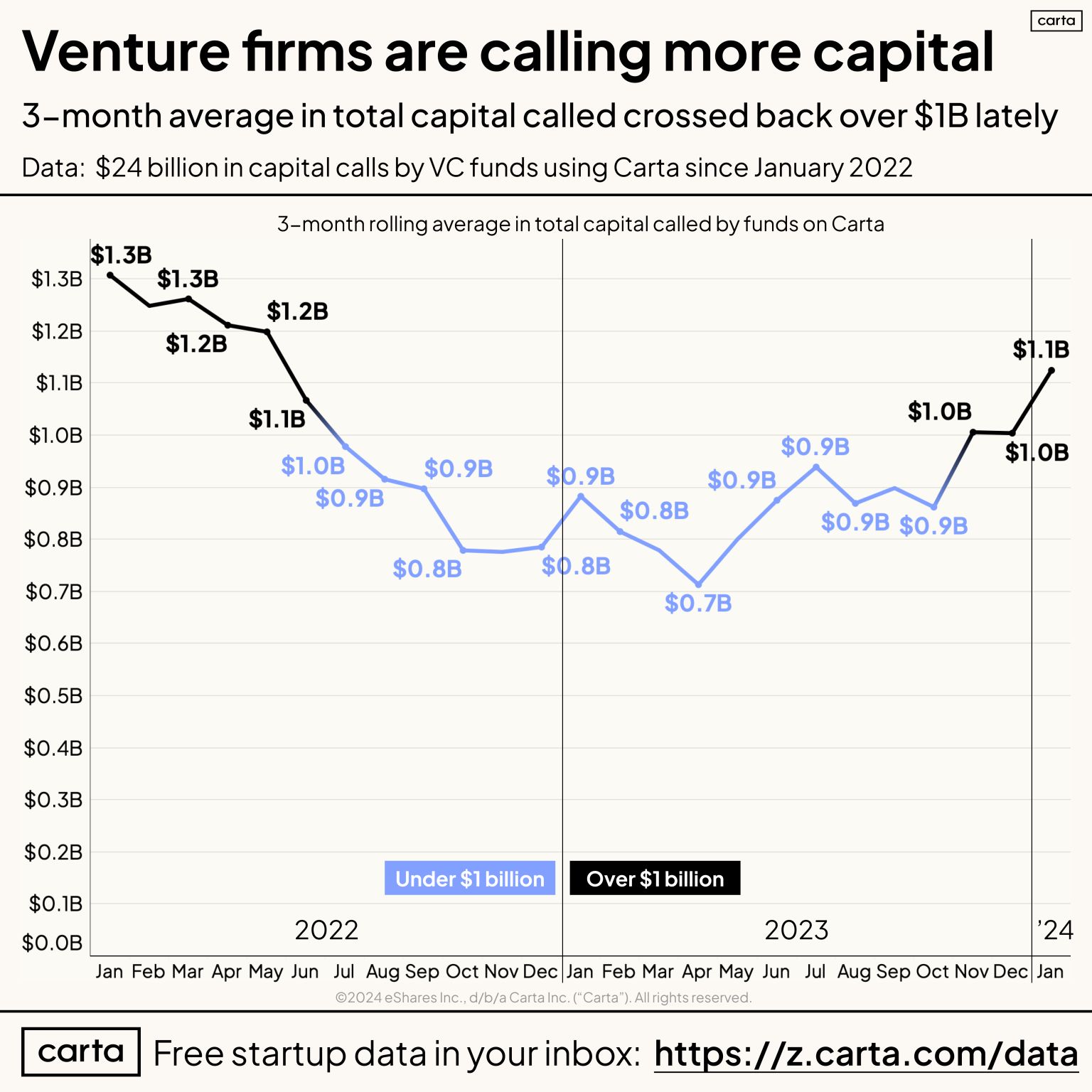

Earlier this month, Peter Walker, the head of Insights at Carta, wrote on LinkedIn, “Funding to VC startups might be rising soon.” Carta is a US-based technology company that helps companies, investors and employees manage their ownership.

According to Walker’s LinkedIn post, in January 2024, VC funds on Carta requested more money to invest than they have since mid-2022, signalling a boost in VC funding. This increase in capital calls, along with a successful Reddit IPO, proves to be a positive sign for the larger American tech scene.

Needless to say that this news brought some semblance of hope to tech professionals globally.

But are these funding calls enough to revitalise, not only American, but also global tech funding?

Well, according to the Financial Times (FT), VCs are encountering difficulties in raising funds, indicating the conclusion of an era characterised by “megafunds”. The numbers have been quite bleak recently, projecting a deceleration in start-up dealmaking in the forthcoming years.

Has global venture capital funding finally reached its lowest point?

Based on the latest data from PitchBook, global VC funding totaled $95.7 billion in Q1’24. While it remained steady year over year, there was a 14% recovery compared to the previous quarter.

Nevertheless, the number of deals continues to decline consistently, marking the 7th consecutive quarter of decrease. In Q1’24, it plummeted by 37% year over year, reaching less than half of its peak levels. Even when factoring in the estimated 2,702 undisclosed deals, this figure represents the lowest since Q4’20.

On a global scale, venture firms secured $30.4 billion from university endowments, foundations, and other institutional investors in the initial three months of this year. According to reports by PitchBook, this marks a noticeable slowdown compared to 2023, which itself represented the poorest year for fundraising since 2016.

FT also reports that Limited partners have moderated their expenditure over the past couple of years, adopting a more cautious stance as interest rates have risen, start-up exits, including public listings and sales, have decelerated, and returns from venture fund managers have plummeted.

Kaidi Gao, a venture capital analyst at PitchBook, told FT that a revival in initial public offerings or sales would enable limited partners to regain their invested capital and reinvest it. That is, if there are no significant enhancements in the exit market, Gao anticipates enduring challenges in fundraising, which will consequently exert downward pressure on dealmaking.

However, there’s a caveat. Or two.

According to Farooq Tirmizi, founder of fintech startup Elphinstone, “Carta is an American organisation, while the Financial Times reports from a European perspective. So, the US might be on the verge of welcoming a new wave of funding but it will take time before the effects of it reach Europe and even longer till we see improvements in developing economies like Pakistan’s.So, these two sources are not contradicting each other, rather talking about two different markets at different stages of recovery.”

Tirmizi highlighted how historical trends show that the American market is the first to get hit with funding droughts, however, it is also the first and fattest market to recover. He associates this trend with certain salient features of the US market, ”It is much easier to make money in the US and consequently, risk adjusted returns are higher in the US.” This is why American startups are more likely to receive funding during a time like this.

Eventually, funding trends trickle down from America to the rest of the world, with Europe and the developed Asia experiencing recovery before markets like Indonesia, Bangladesh and Pakistan.

Tirmizi speculates it to be a “very long winter” for Pakistan. “I would say it will take a good five to 10 years before Pakistan benefits from the current anticipated boom in the US,” he concluded.

The second caveat is that only a specific sector is observing an influx of capital.

William Chu, co-founder of SparkLabs Fintech, told Profit, “What Carta is referring to is a very recent occurrence. Yes, there is hope because the American market has been seemingly healthier than before in the past few months. However, investors have just been aggressively funding AI companies, which cannot be used to describe the state of the overall startup ecosystem. Startup funding is still very much at a standstill.”

FT backs this claim, reporting that according to Venky Ganesan, partner at Silicon Valley firm Menlo Ventures, “VCs are now gambling that a boom in artificial intelligence will provide a generational opportunity and help ‘overcome the sins of 2020 to 2022’. Every venture firm is chasing the AI unicorn. Some are going to get it and will thrive, those who don’t will be sent to the dustbin of history.”

Chu divulged that there has been a dynamic shift in the global investment community. VC and private equity investments were characterised by very low interest rates, which has now changed due to tough macroeconomic conditions worldwide. “There is a slim chance of interest rates coming down soon, however, investors have stopped pursuing the same kinds of risks they did when interest rates had been low.”

So, the very essence of VC investment, which was precisely the risky nature of these investments, has seen a shift.

Can local capital be the saving grace of Pakistan’s tech industry?

It would be an understatement to say that Pakistan’s tech sector has seen better days. In an article for Techshaw Notes, Zahid Lilani writes that there has been absolutely no deal activity in Pakistan in the first quarter of 2024. Or at least no official announcements of deals have been made, other than that of Abhi, which raised an undisclosed amount earlier last month.

The startup funding has seen a drastic drop in Pakistan. From its peak of over $380 million in 2021, startup funding dropped to $332.4 million in 2022 and stood at a meagre $75.6 million in 2023. As the second quarter of 2024 has kicked off, no new funding deals have been announced so far and investors and founders predict a bleak funding outlook for the entire year.

This has led to dark clouds of layoffs and shutdowns and one slightly desperate exit looming over the sector. This would likely linger on for a while as the raising capital from abroad still looks difficult. Local VCs on the other hand do not have enough financial heft to invest millions of dollars in startups all by themselves in absence of rich foreign VCs.

According to a local VC investor Profit spoke to, local funds possibly did not fully deploy the money they had from the funds they had closed before the downturn kicked in because the pipeline was not solid. But they did support their existing portfolio companies with follow-on investments in the downturn. “From a VC perspective, the deal pipeline is still not solid for new investments at the moment.”

On top of that, the current environment requires a certain type of startups to be funded. These are the ones that have strong fundamentals. This further shrinks the number of startups that can be funded.

As the downturn continues, some of the local VC firms are also reportedly struggling to close new funds. Some of these local VCs have taken massive hits with important portfolio companies shutting down because of the downturn and otherwise. This would have certainly dampened local VC confidence.

But it’s not all gloomy for the Pakistani market either. None of the local VCs have decided to wrap up and leave. As one investor puts it, local VCs being cautious is just them following the global investment cycle.

The exits are going to come a few years down and until then, local VCs just have to hold fort.

On the bright side, the caretaker government has launched a Rs2 billion Pakistan Startup Fund that would underwrite risk for foreign VCs, encouraging them to bring investment into startups in the country. That is besides Rs 500 million allocated by the same caretaker government to fund startups for international incubation. On the other hand, PSO has allocated 1% of its pretax profits for investments in startups and currently has Rs1.7 billion in the VC fund.

The way forward

One thing is for sure; we might not be getting any foreign funding, or at least not a sizable amount, in the near future. And it won’t be a surprise if people started packing up their things and moving away, to markets where there is more hope and better opportunities.

We asked Ahsan Jamil, managing general partner and founder of sAi Venture Capital, to put in perspective the state of the industry and a possible way forward. He said, “The essence of venture investments is growth and that attraction won’t go away. However, right sizing of capital deployment in this space over a long-ish horizon is happening. It had a hyped upward swing and now perhaps a little over correction because of macro factors, and micro or VC specific learnings we’ve experienced.”

He added that the trickle effect of global adjustment will happen as VC funding stabilises because of the digital journey ahead.

“But what would be really exciting is making startups in Pakistan a choice destination for risk capital. For sAi, we’ve always believed in analysing and developing fundamentals with venture upside, hence our focus on Frontier Technology for almost 2 years. When this focus is coupled with localised business models, and local capital deployment, it is likely to attract global capital. We don’t need to be oversubscribed with global capital but rather focus inwards with global standard technology,” Jamil concluded.

Jami’s argument holds weight, especially because seeking lesser investment locally is obviously better than sitting around and waiting for foreign investors to come save us. Or worse; giving up on the sector and going back to our plain old corporate nine to fives.

Even though there is money in the country, a lot of it actually goes to unproductive and oldschool sectors like real estate. This money can be put to much better use and result in much lucrative returns, if invested in building a local tech infrastructure.

But there’s a catch.

Chu, whose first accelerator in Saudi Arabia has seen a great response since its installation late last year, says, “Even though local government funding in Saudi has been robust, along with their help in creating incentives for hiring and dealing with taxes, it is extremely important to welcome offshore investors to enter the region.”

Chu quotes role modelling for building standards as the reason for this. International investors bring more than just their dollars to the table. They bring decades of experience, a stellar network necessary to excel in the global tech landscape and, well, of course the capital, as well.

So, Pakistan’s VCs and founders, while continuing to try seeking foreign investment, should still seek and utilise local capital. The returns would also prove to be better when startups build their products and services using local currency and potentially make returns in foreign currencies if they can crack the export code.

Coming onto AI.

We already discussed how global funding trends point towards AI as the next best idea or space with the potential to attract capital. When asked whether AI could become a gateway to revive funding in the country, Jamil said, “I won’t use the term ‘funding revival’. That makes it sound like building AI isn’t the goal, but rather finding the next thing to attract capital is. That approach is a poison pill to real big vision.”

He continued, “I’d state it differently. AI is the most attractive growth opportunity presently because it will fingernail change value creation, and it has been for over 4 years now.

Unfortunately those starting to look at it now are at a disadvantage. And yes, this technology “reset” is a great opportunity for Pakistan to participate in innovation and creating value, and my hope and advice is that we should think global, AI or otherwise, when we talk about technology.”