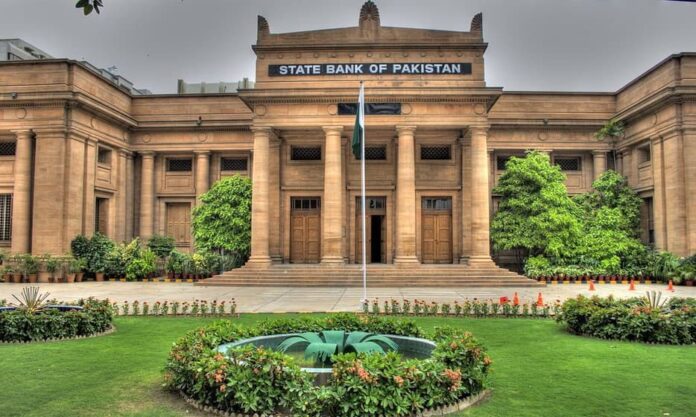

LAHORE: Effective July 1 this year, the State Bank of Pakistan (SBP) has decided to continue fee waivers on inter-bank fund transfers on transactions up to Rs25,000 limit, in a bid to keep digital transactions inexpensive for the low-income demographic of the country which will help promote financial inclusion.

But while the SBP’s push is noble, the captains of financial inclusion, branchless banking players JazzCash and EasyPaisa that have helped bank the low-income segments of the population, are unhappy as IBFTs form a major source of revenue for these players. Consequently, this might affect the goal of financial inclusion if these companies see a decrease in financial viability.

In a recent circular, the central bank has instructed that commercial banks, microfinance banks (MFBs), and electronic money institutions (EMIs) shall continue to provide free of cost IBFT services to their individual customers up to, at least, a minimum aggregate sending limit of Rs25,000 per month per account or wallet. Individual customers of banks, MFBs, and EMIs shall continue to send out as many free IBFT transactions as long as they remain within their monthly limit of Rs25,000. The content in this publication is expensive to produce. But unlike other journalistic outfits, business publications have to cover the very organizations that directly give them advertisements. Hence, this large source of revenue, which is the lifeblood of other media houses, is severely compromised on account of Profit’s no-compromise policy when it comes to our reporting. No wonder, Profit has lost multiple ad deals, worth tens of millions of rupees, due to stories that held big businesses to account. Hence, for our work to continue unfettered, it must be supported by discerning readers who know the value of quality business journalism, not just for the economy but for the society as a whole.To read the full article, subscribe and support independent business journalism in Pakistan

My money got stolen from my easypaisa account and they didnt do anything about it. Honesty i’m glad that they are now going to suffer because of this .