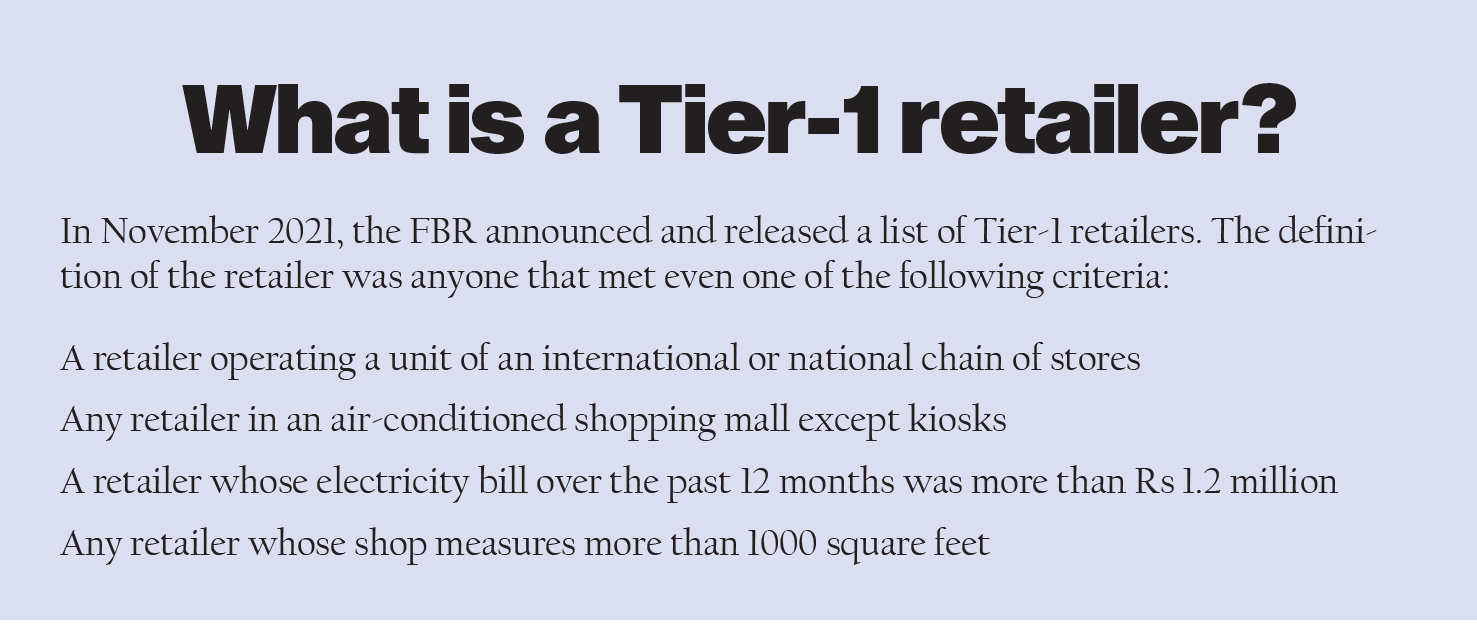

In November 2021, the Federal Board of Revenue issued a list of 608 big retailers which it had categorised as ‘Tier-1.’ These 608 retailers would have to integrate with the board’s Point of Sale (POS) system. Failing to do so would result in these retailers being denied 60 percent input tax credit.

At first glance the penalty may seem harsh. A closer look at the numbers reveals that the measures were taken by the FBR to curb the culture of rampant tax evasion within the retail industry. According to a recent report by Planet Retail, the retail market in Pakistan has crossed $152 billion, which makes the sector the third largest contributor to the country’s GDP and its second large employer.

According to the FBR, the retail market accounts for a whopping 18% of the GDP. Meanwhile it’s contribution to the national exchequer is a meagre 1%. There has long been an understanding that the only way to bring these retailers within the tax net was to digitise transactions and keep an eye on buying and selling at these retailers. The latest idea was that under the FBR’s new POS system, details of each transaction would go directly to the board and they would be able to calculate and charge tax accordingly.

However, the retailers in question have not taken these directive meekly, and have responded with a slew of tactics meant to either stall, sabotage, or spoil the FBR’s efforts to bring the untamed retail market within the tax net. At the same time, retailers have also brought up concerns regarding the FBR’s new system, saying that the details they require exposes a lot of sensitive business information and the FBR has not had the best relationship with data breaches.

Even though the FBR has been able to net a significant amount of retailer’s into the new POS system, most retailers have either cited technical difficulties or have simply continued to operate mostly on cash to try and go under the radar on transactions. The question is, will the FBR manage to wrangle the market or will it eventually submit to their resistance?

The POS system

Most of the retailers that fall within the Tier-1 had the option to pay through POS machines well before the FBR introduced the new system. The concept of a Tier-1 retailer was introduced through the finance act 2017. Tier-1 retailers would include large chain stores, any stores in malls, most restaurants etc. A good way of looking at it is through grocery stores. Tehzeeb in Islamabad, Imtiaz in Karachi, and Jalal Sons in Lahore all fall under the category of Tier-1 retailers.

The implementation of this tiered system only really kicked off at the tailend of 2021. It was around this time that the finance ministry set a target of wanting to collect Rs 50 billion in additional taxes from these retailers by launching a drive to get them to install Point of Sale machines that will monitor their sales and report every transaction in real time to the FBR.

How would this tax collection work? The FBR would launch a massive drive to integrate all of the Tier-1 retailers and have a total of 500,000 POS machines integrated within three years. The new system conceived by the tax department would help monitor every integrated sales tax transaction. The content in this publication is expensive to produce. But unlike other journalistic outfits, business publications have to cover the very organizations that directly give them advertisements. Hence, this large source of revenue, which is the lifeblood of other media houses, is severely compromised on account of Profit’s no-compromise policy when it comes to our reporting. No wonder, Profit has lost multiple ad deals, worth tens of millions of rupees, due to stories that held big businesses to account. Hence, for our work to continue unfettered, it must be supported by discerning readers who know the value of quality business journalism, not just for the economy but for the society as a whole.To read the full article, subscribe and support independent business journalism in Pakistan

You mentioned the following in your article “measures were taken by the FBR to curb the culture of rampant tax avoidance within the retail industry.”

I would urge you to look at the definition of avoidance and evasion. Avoidance is legal and evasion is illegal. The retailers of Pakistan are engaged in tax evasion. Not only are they not paying taxes honestly on their profits, they are collecting GST on behalf of the government and keeping it. This is illegal in every part of the world but some people think it’s perfectly acceptable. These retailers should be threatened with closure if they don’t comply. They should in an ideal world pay the stolen taxes from previous years.

I second you, you spoke my heart out

Why should anyone pay any tax. The hard earned private tax money collected by FBR is used to line the pockets of elites, politicians, establishment, corruption, graft and waste to an extreme level.

Leave the funds in the pockets of private citizens who have earned them.

Tax evasion mindset. Trying to give every lame argument and blame every govt for not providing the facilities

People like you are the reason for downfall of Pakistan

& people like you promote corrupt politicians, do not pay tax and stay safe.

Do away with Rs 5,000 and 1,000 denomination notes. Let people carry tons of paper currency to pay in cash. It will be multiple measures in domain of education, facilitation and enforcement that tax net can be extended

Really that’s my question. This seems to me a very simple and elegant solution for corruption and tax evasion. But no government is applying it. Why?

I want to draw your attention on an issue. That Teir-1 retailers’ catagory defined by FBR is a big question mark. They considered large retail stores, fine. But why ordinary retail shop qual to or above 1000 sq. Ft size is equivalent to a large retail chain store like Imtiaz and tehzeeb?

An ordinary retailer cannot arrange sales tax invoices from the suppliers in the open market. Infact, there are large wholesalers and retailers having smaller shops in the rushy markets making millions of profit every day supplying to retailers. And retail showroom are just selling on a limited basis. 1000 SQ ft size option is not a thing to be fit in this catagory. Some of the retailers are not even able to manage their expenses. But FBR thinks they are Teir-1.

Retailers expressing their difficulties in adopting new system have all the wisdom n know all tricks of doing business.

We are the problem!

We salaried individuals are taxed at source. We are not nawabs. More than one months salary in year is taken by govt on the name of tax. Which other industry give one months profit/income as tax to government?

May Allah Save Us.

Even though the FBR has been able to net a significant amount of retailer’s into the new POS system, most retailers have either cited technical difficulties or have simply continued to operate mostly on cash to try and go under the radar on transactions. The question is, will the FBR manage to wrangle the market or will it eventually submit to their resistance?

UNv

Very Good .very informative Post Thank you very Much for Sharing these kind of information.

Feeta.pk, Pakistan’s smartest property portal, lets you buy, rent and sell houses, plots, shops, and flats in Islamabad, Rawalpindi, Lahore and other cities.

𝑰 𝒂𝒅𝒗𝒊𝒔𝒆 𝒆𝒗𝒆𝒓𝒚𝒐𝒏𝒆 𝒐𝒖𝒕 𝒕𝒉𝒆𝒓𝒆 𝒕𝒐 𝒑𝒍𝒆𝒂𝒔𝒆 𝒅𝒐 𝒚𝒐𝒖𝒓 𝒐𝒘𝒏 𝒓𝒆𝒔𝒆𝒂𝒓𝒄𝒉 𝒃𝒆𝒇𝒐𝒓𝒆 𝒊𝒏𝒗𝒆𝒔𝒕𝒊𝒏𝒈 𝒊𝒏 𝒂𝒏𝒚 𝒐𝒇 𝒕𝒉𝒆𝒔𝒆 𝒐𝒏𝒍𝒊𝒏𝒆 𝒄𝒓𝒚𝒑𝒕𝒐 𝒄𝒖𝒓𝒓𝒆𝒏𝒄𝒚 𝒕𝒓𝒂𝒅𝒊𝒏𝒈 𝒑𝒍𝒂𝒕𝒇𝒐𝒓𝒎𝒔. 𝑴𝒚 𝒃𝒐𝒚𝒇𝒓𝒊𝒆𝒏𝒅 𝒊𝒏𝒕𝒓𝒐𝒅𝒖𝒄𝒆𝒅 𝒎𝒆 𝒕𝒐 𝒐𝒏𝒆 𝒔𝒖𝒄𝒉 𝒑𝒍𝒂𝒕𝒇𝒐𝒓𝒎 𝒄𝒂𝒍𝒍𝒆𝒅 𝒃𝒊𝒕𝒃𝒚𝒃𝒊𝒕 𝒕𝒓𝒂𝒅𝒊𝒏𝒈 𝒘𝒉𝒆𝒓𝒆 𝒉𝒆 𝒉𝒂𝒅 𝒊𝒏𝒗𝒆𝒔𝒕𝒆𝒅 $200,000 𝒘𝒉𝒊𝒄𝒉 𝒘𝒐𝒖𝒍𝒅 𝒈𝒆𝒏𝒆𝒓𝒂𝒕𝒆 $400,000 𝒘𝒊𝒕𝒉𝒊𝒏 2 𝒘𝒆𝒆𝒌𝒔. 𝑨𝒇𝒕𝒆𝒓 𝒎𝒖𝒄𝒉 𝒄𝒐𝒏𝒗𝒊𝒏𝒄𝒊𝒏𝒈 𝒇𝒓𝒐𝒎 𝒉𝒊𝒎, 𝒊 𝒔𝒂𝒘 𝒊𝒕 𝒂𝒔 𝒂 𝒍𝒖𝒄𝒓𝒂𝒕𝒊𝒗𝒆 𝒐𝒑𝒑𝒐𝒓𝒕𝒖𝒏𝒊𝒕𝒚 𝒂𝒏𝒅 𝒔𝒐 𝒊 𝒋𝒖𝒎𝒑𝒆𝒅 𝒐𝒏 𝒊𝒕 𝒂𝒏𝒅 𝒊𝒏𝒗𝒆𝒔𝒕𝒆𝒅 𝒎𝒚 $150,000 𝒕𝒐 𝒆𝒂𝒓𝒏 $300,000 𝒘𝒊𝒕𝒉𝒊𝒏 𝒕𝒉𝒆 𝒔𝒂𝒎𝒆 𝒑𝒆𝒓𝒊𝒐𝒅 𝒂𝒔 𝒎𝒚 𝒓𝒐𝒊. 𝑰 𝒔𝒕𝒂𝒓𝒕𝒆𝒅 𝒏𝒐𝒕𝒊𝒄𝒊𝒏𝒈 𝒓𝒆𝒅 𝒇𝒍𝒂𝒈𝒔 𝒘𝒉𝒆𝒏 𝒕𝒉𝒆𝒚 𝒂𝒔𝒌𝒆𝒅 𝒎𝒚 𝒇𝒓𝒊𝒆𝒏𝒅 𝒕𝒐 𝒑𝒂𝒚 𝒇𝒐𝒓 𝒔𝒖𝒄𝒉 𝒄𝒉𝒂𝒓𝒈𝒆𝒔 𝒕𝒐 𝒇𝒂𝒄𝒊𝒍𝒊𝒕𝒂𝒕𝒆 𝒕𝒉𝒆 𝒘𝒊𝒕𝒉𝒅𝒓𝒂𝒘𝒂𝒍 𝒑𝒓𝒐𝒄𝒆𝒔𝒔 𝒘𝒉𝒊𝒄𝒉 𝒘𝒂𝒔 𝒏𝒆𝒗𝒆𝒓 𝒔𝒖𝒄𝒄𝒆𝒔𝒔𝒇𝒖𝒍. 𝑻𝒉𝒆 𝒔𝒂𝒎𝒆 𝒉𝒂𝒑𝒑𝒆𝒏𝒆𝒅 𝒕𝒐 𝒎𝒆 𝒘𝒉𝒆𝒏 𝒎𝒚 2 𝒘𝒆𝒆𝒌𝒔 𝒘𝒆𝒓𝒆 𝒅𝒖𝒆, 𝒃𝒚 𝒕𝒉𝒆 𝒕𝒊𝒎𝒆 𝒘𝒆 𝒓𝒆𝒂𝒍𝒊𝒛𝒆𝒅 𝒊𝒕 𝒘𝒂𝒔 𝒂 𝒔𝒄𝒂𝒎, 𝒕𝒉𝒆𝒚 𝒉𝒂𝒅 𝒂𝒍𝒓𝒆𝒂𝒅𝒚 𝒓𝒐𝒃𝒃𝒆𝒅 𝒖𝒔 𝒐𝒇 𝒂 𝒕𝒐𝒕𝒂𝒍 𝒐𝒇 $650,000. 𝑾𝒆 𝒐𝒑𝒕𝒆𝒅 𝒕𝒐 𝒉𝒊𝒓𝒆 𝒂 𝒉𝒂𝒄𝒌𝒆𝒓 𝒂𝒏𝒅 𝒇𝒐𝒖𝒏𝒅 𝒎𝒊𝒄𝒉𝒂𝒆𝒍 𝒎𝒖𝒓𝒑𝒉𝒚 𝒘𝒉𝒐 𝒕𝒐𝒐𝒌 𝒐𝒖𝒓 𝒄𝒂𝒔𝒆, 𝒂𝒏𝒅 𝒊𝒏 72𝒉𝒐𝒖𝒓𝒔, 𝒉𝒆 𝒉𝒂𝒅 𝒕𝒓𝒂𝒄𝒌𝒆𝒅 𝒕𝒉𝒆 𝒔𝒄𝒂𝒎𝒎𝒆𝒓𝒔 𝒂𝒏𝒅 𝒓𝒆𝒇𝒖𝒏𝒅𝒆𝒅 𝒐𝒖𝒓 𝒎𝒐𝒏𝒆𝒚. 𝑪𝒐𝒏𝒕𝒂𝒄𝒕 𝒕𝒉𝒆𝒎 𝒐𝒏 𝒎𝒊𝒄𝒉𝒆𝒂𝒍𝒎𝒖𝒓𝒑𝒉𝒚@𝒓𝒆𝒑𝒂𝒊𝒓𝒎𝒂𝒏.𝒄𝒐𝒎.