We all know someone who has a bancassurance story, whether a recent retiree, an elderly person, or someone with minimal financial literacy. The moment a large sum enters your account, a representative of your bank’s branch would schmooze you into buying a great investment product, which can solve all your income related problems.

The representative would paint a rosy picture, and make unreasonable assumptions about the future without fully apprising you of the risks. More importantly, the representative exploiting your lack of financial literacy would only mention in passing that a hefty commission would be charged from the premium that you would pay during the first three years – so much so that it may take you seven years just to break even in nominal terms. Such is the math of bancassurance.

Bank staff prey on the vulnerable, who just want to park their funds in a safe investment product, and only later find out that they are underwater till the seventh year or so. Savings schemes tied with a term life insurance are sold by insurance companies through banks under a nomenclature of bancassurance. Banks charge a hefty commission during the first year, often ranging between 60 to 80 percent, while the same reduces to 30 to 50 percent in second year, and a slightly lower number in the third year.

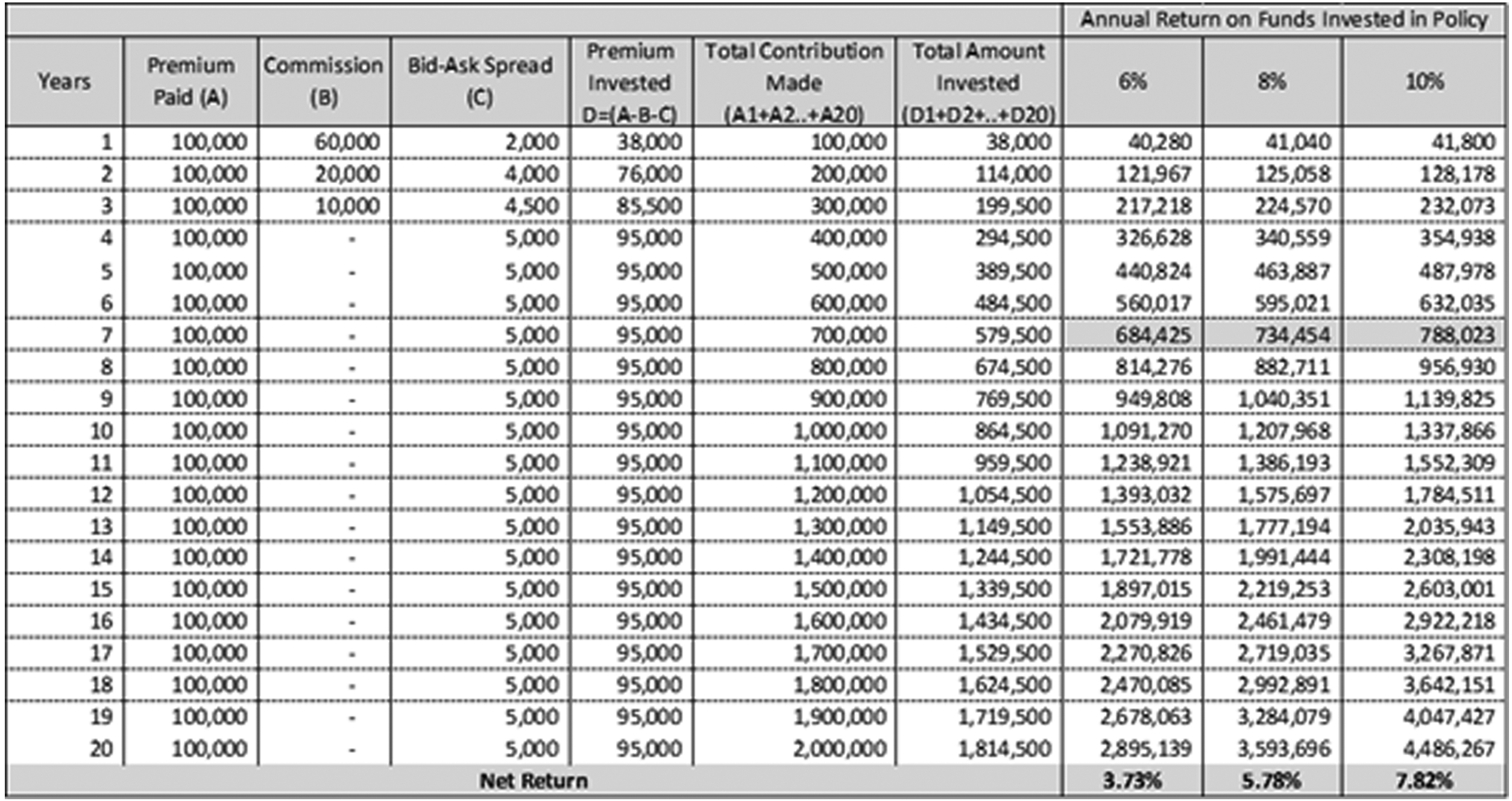

In-effect, if someone pays a premium of Rs. 100,000 during the first year, effectively only Rs. 20,000 to Rs. 40,000 is invested, while the remaining is deemed as income of the bank. The illustration below further clarifies the same, where a commission of 60%, 20%, and 10% is charged in the first three years respectively. Net return is actually what you get.

The policy holder keeps paying a premium every year, and if he is lucky finally breaks even around the seventh-year mark in nominal terms – may even remain underwater if market returns stay low. Most buyers of such policies do not understand the math behind this, and are vulnerable to the same. Most insurance policies sold are not even tailored to the life circumstances of policy holder. It is entirely possible that someone who has low risk tolerance unknowingly invests in a product which has high risk.

On the flipside, if someone wants to invest in a mutual fund, the asset manager is required to conduct thorough risk assessment of the investor. Meanwhile, such assessment does not exist in the case of bancassurance other than some half-hearted circulars. Misrepresentation and mis-selling as rampant as representatives informally, and sometimes even formally promise returns which are well in-excess of the risk-free rate. Such promises cannot be made for mutual funds, other than for very specific schemes. Talking of risk-free rate, a policy holder would actually be better off just investing in a risk-free asset issued by the sovereign, which would yield a higher return than the policy, while also providing easy liquidity vis-à-vis an insurance policy.

It may seem a bit fatalistic, but the only time a policy is actually useful is when the policy holder dies, and a death benefit is distributed to the benefactors of the policy. If you’re not dying, chances are that investment in an insurance policy is a largely economically inefficient decision. But how does one hedge against dying? It can be done through a term life policy, but insurance companies don’t really like marketing that product because it doesn’t generate the kind of sweet commissions that a bancassurance styled product can generate.

Lately microfinance banks who are supposed to serve the most vulnerable segment of the population have also joined the fray and are aggressively selling badly structure life insurance policies to the most vulnerable and those with minimal financial literacy. Extracting heavy commissions from the most vulnerable segments of society may be acceptable from a purely capitalist context, but certainly not if one has an iota of morality.

A bancassurance product is essentially a savings product bundled with a term-life policy. Next time someone tries to sell you a bancassurance product, ask them if the investment team of the insurance company, or the senior management has also invested in the same product – high change that they haven’t.

One can replicate potential returns of bancassurance products, and get life insurance through investing in a mutual fund, and buying a term-life insurance policy separately. If structured well, just the tax credit from investment in a mutual fund can generate sufficient cash to pay for the term-life insurance policy. If a low-risk mutual fund is chosen, which invests in government securities, there is a negligible chance of any capital erosion, while your returns would be higher, as your full amount would be invested, during the first three years rather than a partial amount. Next time someone tries to sell you an insurance product, be very aware, do your due diligence, do your research, understand the product, understand the math – it is your precious money, do not be duped by men in suits.

I got scammed and lost over 150000 of 1st year premium of 250000.

The agent never told me, I will loose around 100k irretrievably in first year.

I filed complaint in Insurance Ombudsman but it was returned requiring too much paper work and legal procedures which isn’t fair

You invested for 10 years but backed out in 1 year. What were you expecting?

I will suggest you to pursue your complaint with insurance Ombudsman as well as with SECP. It’s worth and you’ll get your money back. I used to work with SECP long time ago and I have seen that in majority of instances the dispute is resolved in favour of the consumer. All you need to submit is a written, signed complaint and a copy of your policy’s cover letter.

I would like to get in touch with the writer Ammar H. Khan to share my real life documented story.

Bancassurance product is a long term Saving plan along with Insurance benefits, this product fulfills long term future needs via annual savings and if God forbid something happens to the breadwinner of the house, beneficiaries and dependents are paid a huge sum of money as life insurance coverage.

In recent Covid times where many people have lost their loved ones and those who used to bring income to run the house were majorly effected financially, how many of their relatives have helped them with instant financial solution? Very few probably.

We protect our cars, houses, businesses etc . by insuring them, but we hesitate protecting ourselves to provide financial support to our loved ones in case of demise.

Buying affordable product is probably the best option, first assess your financial suitability, then avail Bancassurance product.

Indeed. For protection, there is always term life insurance, available at a much lower cost. For long-term saving, one can always go for a low-cost mutual funds — fee for which is much lower than an insurance plan.

Agreed

Sir what is your comment on billions of Rs paid out in claims?

Banks make terms and conditions clear regarding Banca. Its a nightmare only for those who quit within a few years of policy. For anyone saving for 10 or more years, this opportunity is a good one.

If you’re saving for 10 years or more, you’re better off buying a 10-yr PIB and a term-life policy than this.

I believe before writing such article to defame Bancassurance industry, you need to first completely study the product’s Pros and Cons. My question to the writer is, why did you buy this product when you weren’t able to afford annual premium and continue till minimum product term of 10 years. You must’ve assessed your financial situation before getting into the contract of this product.

No. I did not by this product, I am smarter than that. The article is based on pure math, if you feel the math is wrong somewhere, please do let me know. Arguing on the basis of math does not defame any industry, unless the industry is doing something wrong.

What Math calculation? Can you please elaborate. Let’s say if a customer gets Bancassurance product worth 200k annual premium with life insurance worth 10Mn, if that person passes away within 2 to 3 years, customer would have paid around 400k-600k as premiums but the dependents get 10Mn funds.

The issue with banca is its mis-selling. It is sold as a deposit and saving product rather than an insurance policy. The writer is right in the context that banks sell this product to customers without assessing their risk profile and understanding their financial needs. But when the commission structures are so attractive these things are bound to happen.

Bank commission of 60%-80% in first year? I think you have not done your homework properly and you have written this article without studying Bancassurance product details.

You claim to be a Chief Risk Officer but you probably have not studied about Bancassurance product yet because the facts which you have mentioned in your article are completely incorrect.

Fantistic your Blog & content !

i reall like it

Pakistan Largest Property company info

is it practical to withdraw in 4th year as returns are low, committed cash value was 200k+ after paying 240K.

but its just 181K as of today so its lower than the mark mentioned.

I can afford premium but there are other products that offer better returns and liquidity options