The Federal Board of Revenue is set to collect an estimated Rs80 billion from Super tax and Rs120 billion from Poverty Alleviation tax which will be applicable on companies and individuals retrospectively.

As per sources, the tax would be charged on the income pertaining to the tax year 2022. “The financial sector including banks will have to pay the Super tax on the income declared for the tax year ending December 2021. While other companies that follow the regular tax year, spanning from 1st July to 30th June, would pay the Super tax for the tax year ending 30 June 2022.” Abdul Qadir Memon, a senior Chartered Accountant, told Profit.

But finance minister Miftah Ismail tells Profit that banks will be exempted from the retrospective effect since they closed their books by December 2021. Till the filing of this report, there was no clarity on how banks and other corporates whose tax year follows the calendar year will be treated under this new provision, with market sources saying they are included but the government saying they are not.

The common practice is to apply the amendments to the tax law, proposed in the budget, prospectively. However, the parliament has the prerogative to approve the application of any tax amendment retrospectively.

As per the proposed section 4C, “Tax shall be imposed for poverty alleviation for the tax year 2022 and onwards at the rates specified in Division IIB of Part I of the First Schedule, on the income of every person.”

The retrospective application will prevent the companies from passing on the tax incidence to the final consumer. As per Ashfaq Tola, President ICAP, “The applicability of the Super Tax (Poverty Alleviation Tax) would be in the tax year 2022, and the rationale behind it is to prevent the impact from being passed on to the final consumers.”

However, Tax Experts have clarified that the retrospective application is limited to Poverty Alleviation and Super tax. While other taxes including income tax on salary would be paid at the existing (old) rates for the tax year 2022.

The Finance Minister, Miftah Ismail, during the winding up of discussion on budget in the National Assembly announced to impose 10 percent one-time Super tax that will be applicable on companies in specified sectors including cigarettes, chemicals, beverages, liquefied natural gas (LNG) terminals, airlines, textile, automobile, sugar mills, oil and gas, fertiliser, steel, banking and cement.

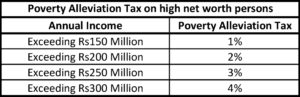

Further, a Poverty Alleviation tax would be imposed on high net worth individuals and companies. The tax is not limited to certain sectors, rather it would be applicable across the board.

The proposed tax of 10 percent for the specified sectors will be inclusive of the Poverty Alleviation tax. This would mean that companies that fall in the aforementioned, 13 sectors will have to pay an additional tax of 6% over and above the 4% Poverty Alleviation Tax.

The following list provides the details of the Companies affected by the imposition of 10% additional tax: Companies affected by the imposition of incremental tax 3

Why govt. first give relief to salaried person from last regime then now amended bill and salaried person will pay more tax then last tax regime tax. salaries person paying tax max of 35% on their gross income while companies paying 29% on their net income (after all expense deduction & salaries person paying on every expenditure in from of sales tax)wow. Budget preparation should made by an economist who also see the multiple impact eg if you give relief to salaried person in tax they either save the amount in the bank or make expenditure in both cases the amount rollover in year many times which give govt. more amount in form of taxes then one time tax deduction through salary.