KARACHI: The first day of business after the Eid holidays saw yields rising further still in government debt auctions, despite a 125 basis point hike in the policy rate on the last day before the holidays began.

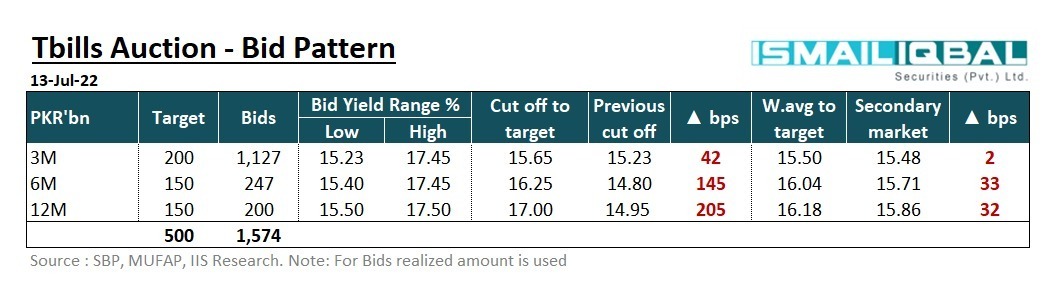

The SBP SBP raised Rs506bn against target of Rs500bn. The 3-month cut-off yields increased by 52bps, by 100 bps for 6 month, and 99 bps for 12 month.

The State Bank’s efforts to reign in the appetite of the banks for higher yields on government paper seemed to be in vain as the spread between the cut-off yield on all tenors and the policy rate rose despite the pre-Eid rate hike.

The auction saw heavy participation with Rs1,574 billion being offered against a target of Rs500 billion. Not only were the yields higher, but the vast majority of the bids were clumped around 3 month tenor, showing the reluctance of the banks to go far even with the higher yields.

With more than 70% of all bids clumped in the shortest 3-month tenor, the market consensus seemed to be that further rate hikes will be required before the market stabilizes.

Fahad Rauf, Head of Research at Ismail Iqbal Securities explains that the market had already built in the rate hike. “OMO effort to bring down yields has gone down the drain. Markets remain uncertain in the absence of forward guidance in the monetary policy statement,” explains Rauf.

“The government managed to raise significant debt against a meager target in the last auction, so it will be interesting to see if they reject this auction,” Rauf adds.

In the previous auction on June 30, the government set a target of Rs800 billion. However, it lifted Rs1.742 trillion against the target.

Inflation have not peaked yet.

Very interesting things going on in the financial sectors now that we are in a new era with an independent SBP