A career in Chartered Accountancy is glamorised in our society to an extent that it has become a borderline obsession of the “Rishta Wali Aunties”. Yet, what is ignored the most in this whole debate is the fact that it is toilsome to qualify as a Chartered Accountant (CA).

There is a misconception that the only obstacle between one being an aspiring CA and a qualified one is clearing the exams but what differentiates them from each other is also the same thing that makes the whole process excruciating; “contractual labour”. This is a task that trainees are made to do during their qualification.

I would like to make it clear in the very beginning of this article that it is the training that makes a CA stand out amongst those with other finance qualifications. However, it should not be ignored how and in what environment this training is provided.

The focus of this scribe is the audit practices, where most CA trainees end up, and the anecdotes being provided will be from the Big four firms that most aspirants want to be inducted into.

The first thing as a trainee that hits you straight in the face is the realisation of how underpaid you are going to be and that too, for a long time to come. The minimum stipend as per the Institute of Chartered Accountants of Pakistan (ICAP) is shown in the graphic below.

Source: ICAP website

When it is compared to the minimum wage, which is currently PKR 25,000, the stipend looks even worse. And so one might ask, how this is permitted by law. The answer is quite simple; the contract CA students sign is one of training, they are not eligible to be paid a salary. They are instead, compensated through a stipend which doesn’t fall in the ambit of the aforementioned law. Basically what this boils down to is that institutions win and trainees lose.

What is even more interesting is the job description of trainees. It is to basically do whatever the firm wants you to do. This is more common in smaller practices where trainees are oftentimes asked to run errands for seniors.

However, even the big practices have the tendency to use their trainee staff as “unskilled labour”. When one is prepping for an interview at a big firm, they might as well bring their physical fitness certificates because believe me, you would need it for the job. The CA training is not just numbers flying around and catching fraud in fancy offices with corporates running for their lives when they see the auditors. Please don’t take inspiration from TV shows (case in point, Suits), you’ll be thoroughly disappointed.

The job also includes counting “Lays ke dabbay” at random Pepsi warehouses, running around the city with coordinates of telecom tower sites just to physically tag them, and even worse, stepping into a cold storage to count ice cream. (Sounds fun, but I promise it won’t be when you’re doing it for the 100th time).

One may argue that this happens in the corporate sector at the infant stages of a professional’s career, but this is a reality for most CA trainees in the first month of their training all the way to their fourth year.

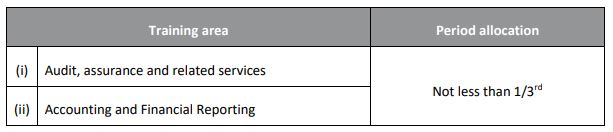

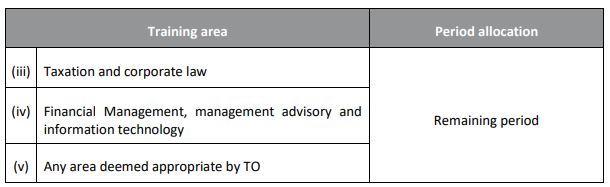

Furthermore, in the name of “Exposure”, trainees end up doing the same laborious tasks year after year and naturally this weakens their motivation. The Bye-Laws of ICAP oblige CA firms to rotate trainee staff between different departments yet in practice it is a rare occurrence.

Source: ICAP

What adds to the pain of a CA trainee is the ridiculous number of hours they are made to work – at times around 70 to 80 hours a week. To get some perspective, most of them are juggling between studying for their qualification and providing labour for their firms.

It must be both noted and appreciated that this rigorous training sets you up just right for a career in finance. Those associated with the profession are some of the highest paid amongst the workforce of the country. Yet, the ills of the industry need to be called out as they highlight our society’s tendency to accept unfair treatment just because, “Yahan per aisey hi hota hai”.

You have prepared a great content,

I have just discovered your site and you can believe that from this day on I will become one of your permanent visitors,

I hope you will bring us together with your more beautiful articles,

I greet you with love,

Goodbye, sir

Congrulatiıons dear article Ahtasam Ahmad, you are good!

The article is off the mark. The writer clearly doesn’t understand dynamics of CA training. There are many shortcomings and “exploitation” but picture being portrayed is simply not correct on many counts.

It’s true in many perspectives and the author himself has done his articles from big4.

Thank you, dear editor, for bringing this beautiful content to us,

I think that we need quality, enlightening and horizon-opening information in the Internet world more than ever,

I hope that your articles will continue to benefit your readers and site visitors,

I will always be following you,

Stay with love in Turkey, goodbye…

I congratulate you and your employees on this successful initiative and greetings

Thank you, dear editor, for bringing such valuable content together with us.

Perfect article thank you friends

Thank you for sharing this amazing content with us,

I will constantly visit your site in the hope of finding useful content,

Stay with love

Thank you Ahtasam Ahmad for this beatiful article

Thank you this beatiful article

Congrulatiıons dear article Ahtasam Ahmad, good website and good write!

Thank you very much for bringing this beautiful and meaningful content to us, please keep writing

Pakistani chartered accountants are the worst professionals there 90% earning are based on statutory audit or other statutory services which they get due to constitutional cover.I will be explaning every thing on facts.First of all Deloitte(one of big 4) has left the market beacuse there local firm is getting mostly statutory audit clients in which the margin of profit is low and risk is high for International brand.Secondly Icap itself is the institution and regulator of accountancy profession in Pakistan so its member are working for their own vested interests.Third in this article writer said that C.A training makes them excellent if this is the case they why most multi nationals have university graduates as thier CFO or company secretary?.last most important thing accountany is now the work of artifical intelligence like distributed ledger.

Thank you for this article