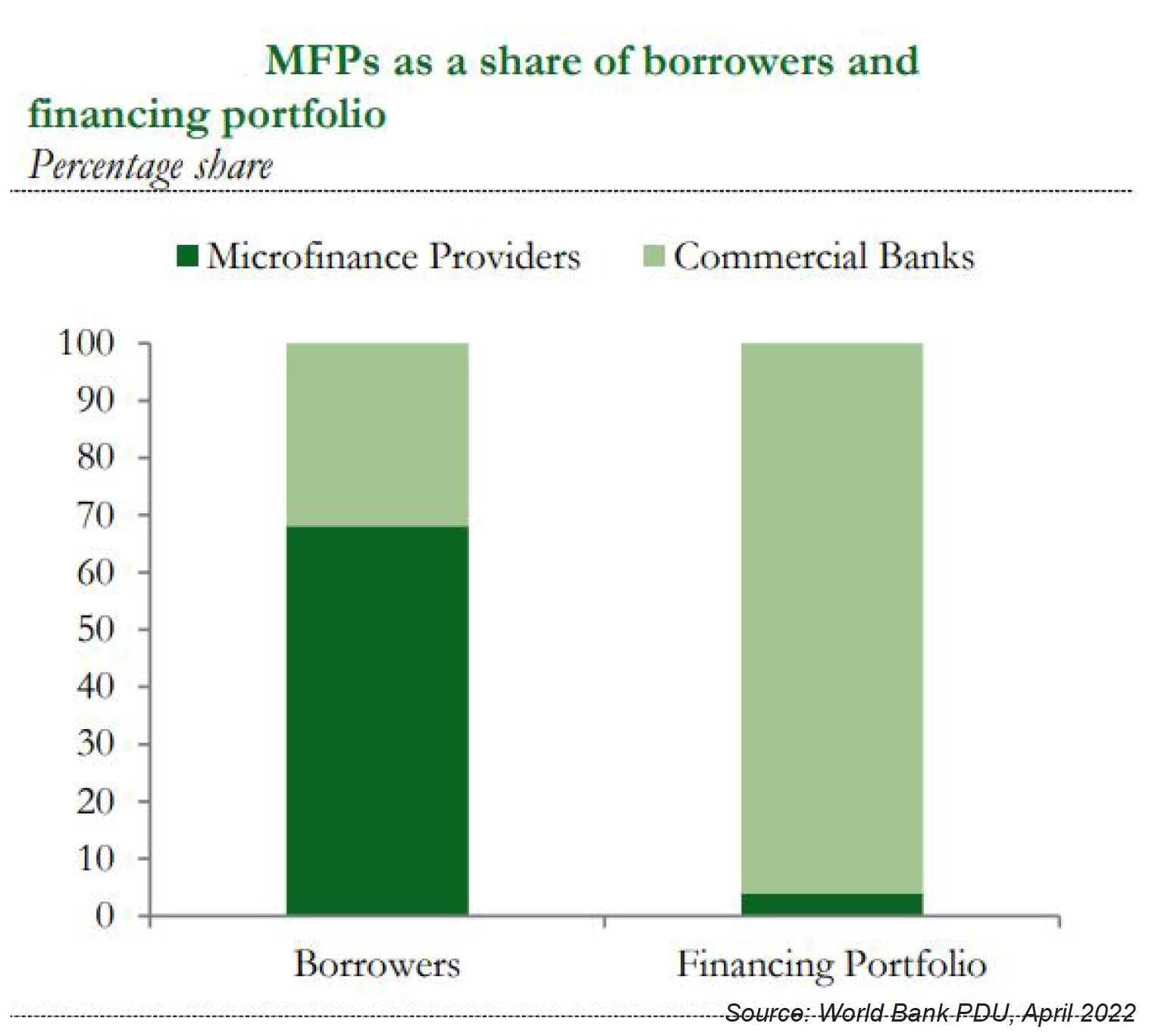

Pakistan’s microfinance sector has been the cornerstone of the country’s financial inclusion drive. The sector, in its true sense, offers retail financial services that commercial banks lay a claim to. As per the world bank development update for Pakistan, issued in April 2022, “ The sector caters to the financing needs of a significantly larger number of individuals/households and micro and small enterprises (8.1 million borrowers vs 3.8 million by banks). The microfinance sector, as such, plays a significant role in enhancing access to finance in Pakistan, both for households and small enterprises.”

The multiplier effect of channelling financing to this segment should, theoretically, be higher compared to the upper-class clientele of commercial banks. The rationale behind this is that the lowest economic strata of the country have a greater propensity to consume local goods compared to those that are financially better off and have a higher consumption of imported goods (Cars, phones and the like).

However, the microfinance sector of late, has been challenged by systematic issues that have brought it to the verge of crisis. (Read more about it in Profit’s article: Microfinance Banks on the verge of crisis?)

While the bleak liquidity condition of major players in the industry was exposed by the pandemic, the devastation caused by recent flash floods will have a far greater impact and can push many in the sector to go down.

Financial Results

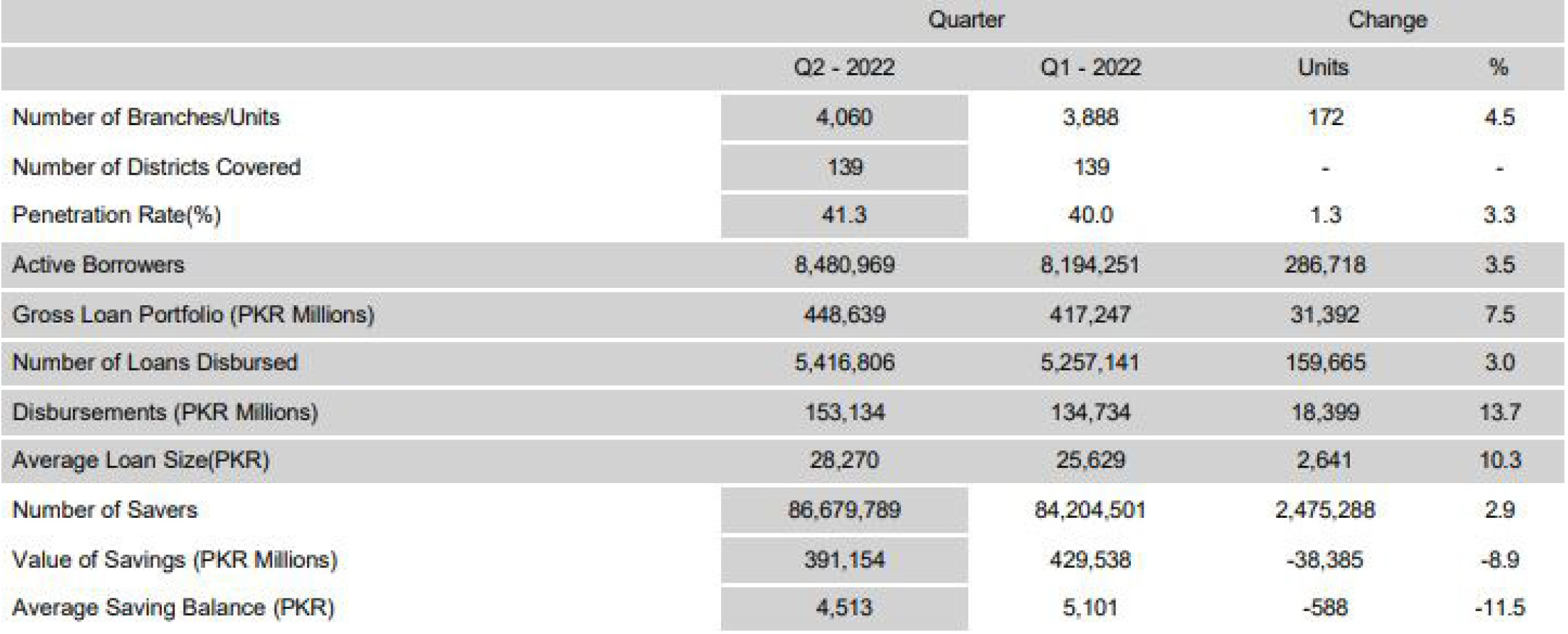

Recently, Pakistan Credit Rating Agency (PACRA) and Pakistan Microfinance Network (PMN) published the financial performance of the sector for the first half of the year. (The impact of floods is not yet accounted for in the results).

As per PACRA, the gross loan portfolio of the sector clocked around Rs 449 billion growing by 14% from December 2021. However, the credit quality deteriorated further with Non Performing Loans (NPL) surging to 6% from around 5% by the end of last year. Three-quarters of the lending portfolio was attributed to the Microfinance Banks (MFBs) while the NPLs for this segment were also above the industry average.

MFBs, the only deposit-taking entities in the sector, saw a 10% growth in the total number of accounts which reached 87 million by the end of June. Further, the value of total deposits grew by 6% to a total of Rs 447 billion. The growth can be attributed to the rise in interest rates which has enabled MFBs to attract institutional investors.

As per PACRA, “The share of current accounts remains low, despite having a significant mix of branchless/M-wallet deposit accounts. Interestingly, M-wallets account for 80% of the MFBs’ deposit holders but only 13% of the deposit value. This mismatch is justified based on the very low-ticket size of M-wallet deposit accounts.”

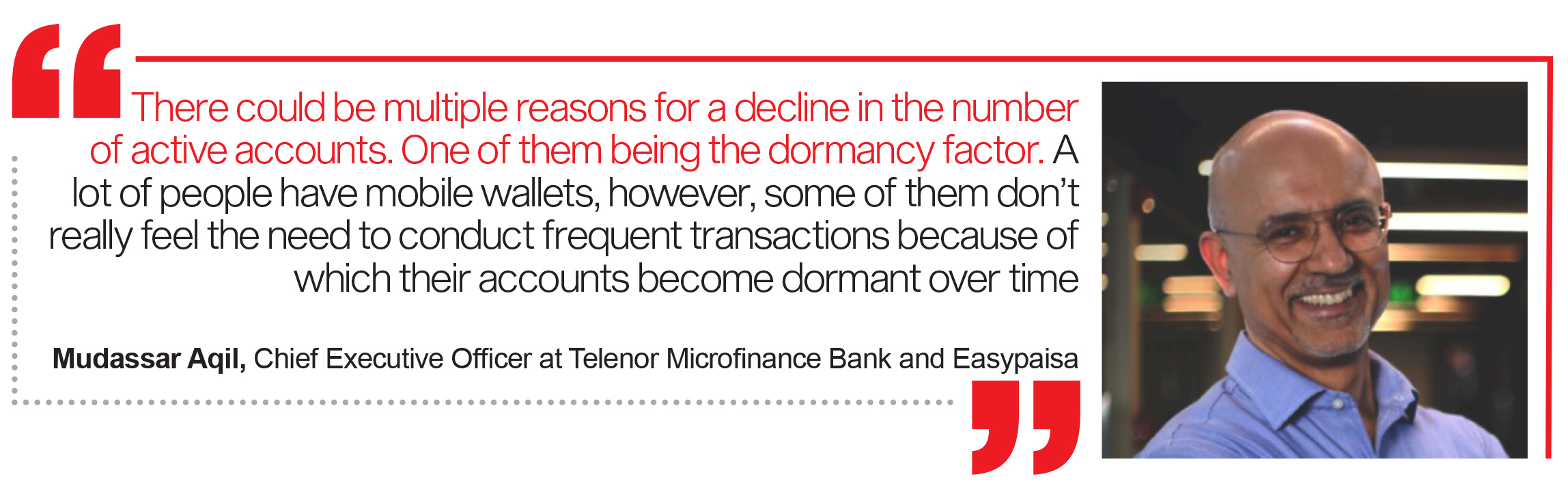

Therefore, the industry heavily relies on institutional investors for liquidity and has a volatile retail deposit base. Further, the SBP Branchless Banking (BB) Statistics for June, 2022 revealed that the number of active M-wallet users has decreased compared to the same period last year.

“It is important to understand that the branchless banking industry is very different from the typical commercial banks because branchless banking services are purely digital and there are nearly zero barriers to churn. There could be multiple reasons for a decline in the number of active accounts. One of them being the dormancy factor. A lot of people have mobile wallets, however, some of them don’t really feel the need to conduct frequent transactions because of which their accounts become dormant over time,” Mudassar Aqil Chief Executive Officer at Telenor Microfinance Bank and Easypaisa, told Profit.

Microfinance Industry overview by Pakistan Microfinance Network

On the other side, the MFBs continue to beef up investment in the government’s risk-free securities with almost a threefold increase in the value of total investments over the past three years. By the end of June 2022, the investments for the banks stood at Rs 133 billion. The trend can be attributed to a hedging strategy against the increased risk of consumer lending.

“Conventional microfinance lending is an extremely risky business, and coupled with an aggressive growth strategy of expanding branch operations, we needed to hedge the risk. That is primarily what drove the investing spree,” Kabeer Naqvi, CEO of Ubank, told Profit in an interview.

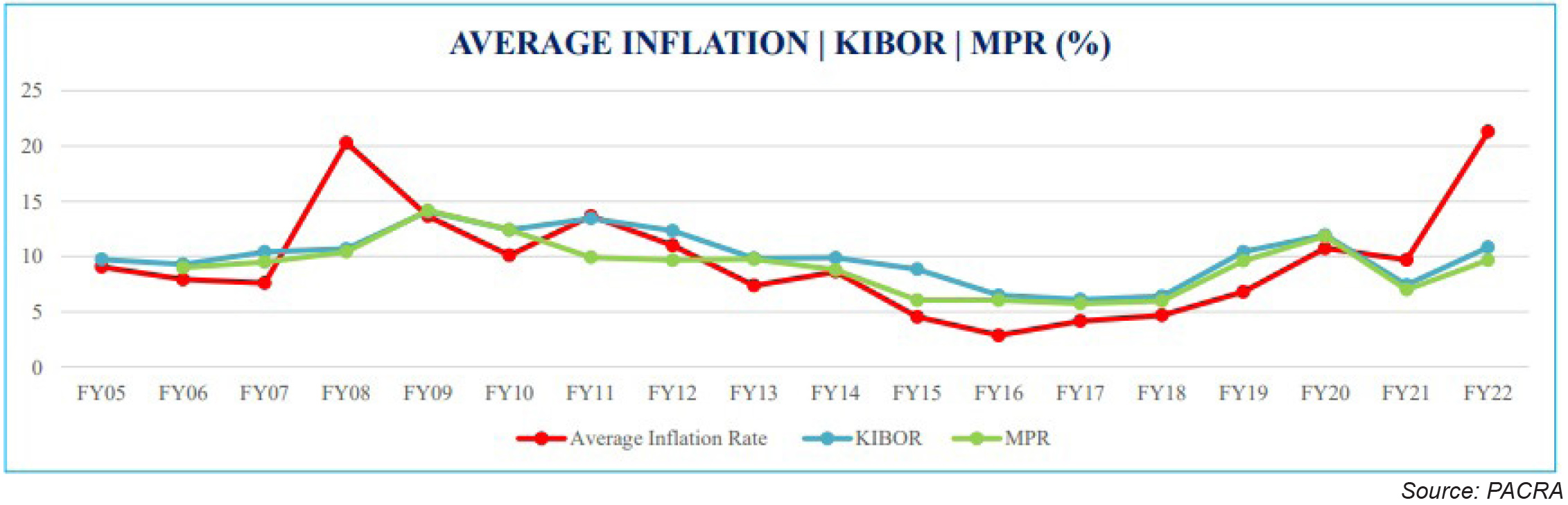

However, the bottom line for the sector remained negative for the third consecutive year. Telenor Microfinance Bank was the primary contributor to negative results, but the sector in general suffered from high administrative costs due to the surge in inflation and an increased cost of funds as a result of the recent interest rate hikes.

Impediments to growth

The sector, which has historically experienced high growth rates is now at crossroads as two major calamities have induced severe distress on its asset quality in the past three years. Currently, serving around 41% of the potential market as per PMN, Microfinance Providers (MFP) are restrained by some impediments that are inherent to the industry.

“The cost of finance is a significant impediment to the growth of microfinance. Interest rates for some products offered by MFPs can be as high as 50%. The lack of collateral remains another significant challenge. Demand for finance, even when economic agents are financially literate and are not deterred by religious or cost-related reasons, has remained subdued due to the lack of collateral required by most institutions in the financial sector,” according to the World Bank’s Pakistan Development Update April 2022.

The primary form of collateralisation allowed to the MFBs is by securing loans against gold and to add to the problem, there is also a cap of 35% of the total portfolio on such collateralisation.

Moreover, the rapid growth in branch networks of MFBs has meant that the loan staff is managing credit portfolios far beyond their capacity. This goes against a sound risk management practice and leaves these institutions susceptible to credit risk due to control weaknesses and fraud. A lesson that Telenor Microfinance Bank learnt the hard way (Read More about it in Profit’s article: Losses continue for Telenor Microfinance Bank).

As per the World Bank’s development update for October 2022, “Financial institutions in Pakistan find it difficult to assess the repayment capacity and creditworthiness of potential borrowers in the presence of significant informational asymmetries owing to limited and underdeveloped credit infrastructure.” Therefore, MFPs are left with no options but to employ primitive credit risk assessment techniques like forecasted cash-flow analysis prepared by the loan staff.

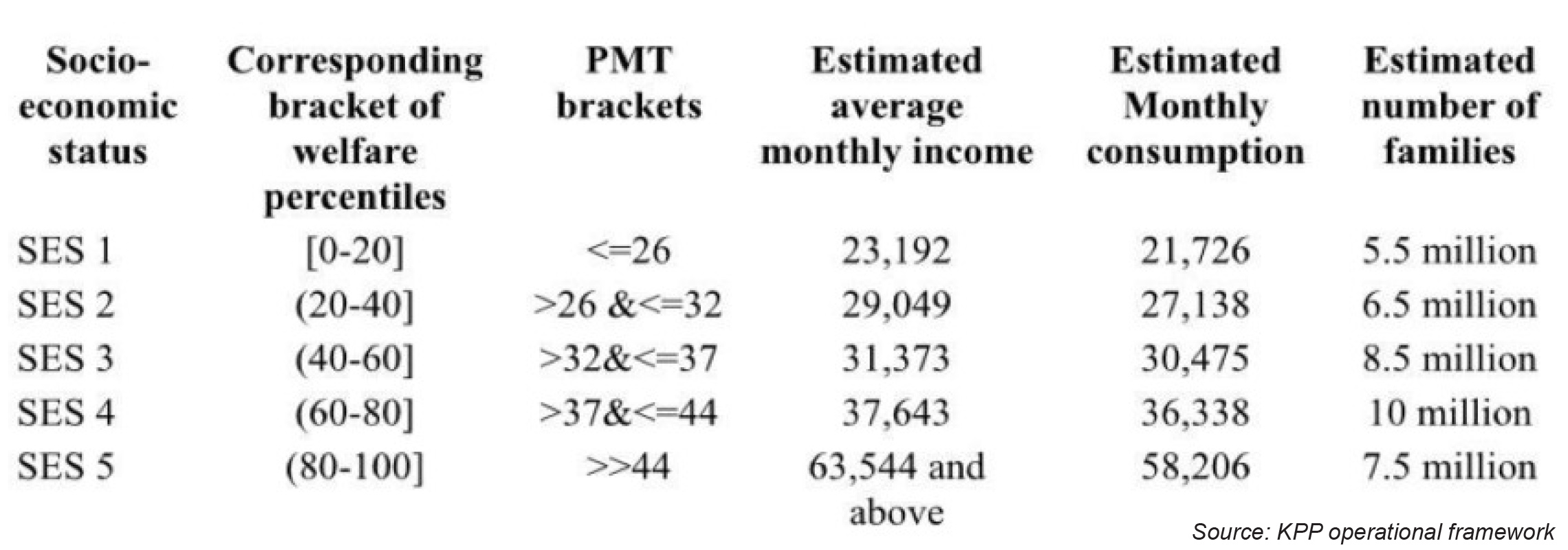

However, government-owned data sets like those of Nadra and Benazir Income Support Program (BISP) can offer a solution to this problem. BISP has a more sophisticated scoring model that was also used for risk assessment in the disbursement of microloans under the Kamyab Pakistan Program (KPP). (Read more about it in Profit’s article).

The way forward

The matter of immediate concern for the sector is the flood devastation. As per PACRA, 60% loan of the sector’s portfolio consists of Agri and Livestock lending. A senior microfinance banker, on the condition of anonymity, told Profit that approximately 50% of the portfolio would be affected as the magnitude of the crisis is unprecedented.

Therefore, it is likely that the State Bank of Pakistan (SBP) would again provide some regulatory relief in the form of a moratorium similar to the one allowed during the pandemic.

However, there needs to be some serious deliberation around the framework for rescheduling loans this time around as the portfolio pertaining to the last moratorium is still outstanding.

“Unlike the last time (during the pandemic), regulatory relief in the form of a moratorium should be on a case-to-case basis. Furthermore, where the primary source of income for the borrower, like livestock, is destroyed, the chances of any recovery are bleak and a straight write-off would be a more appropriate measure,” Ammar Habib Khan, Independent Analyst and Senior Economist told Profit.

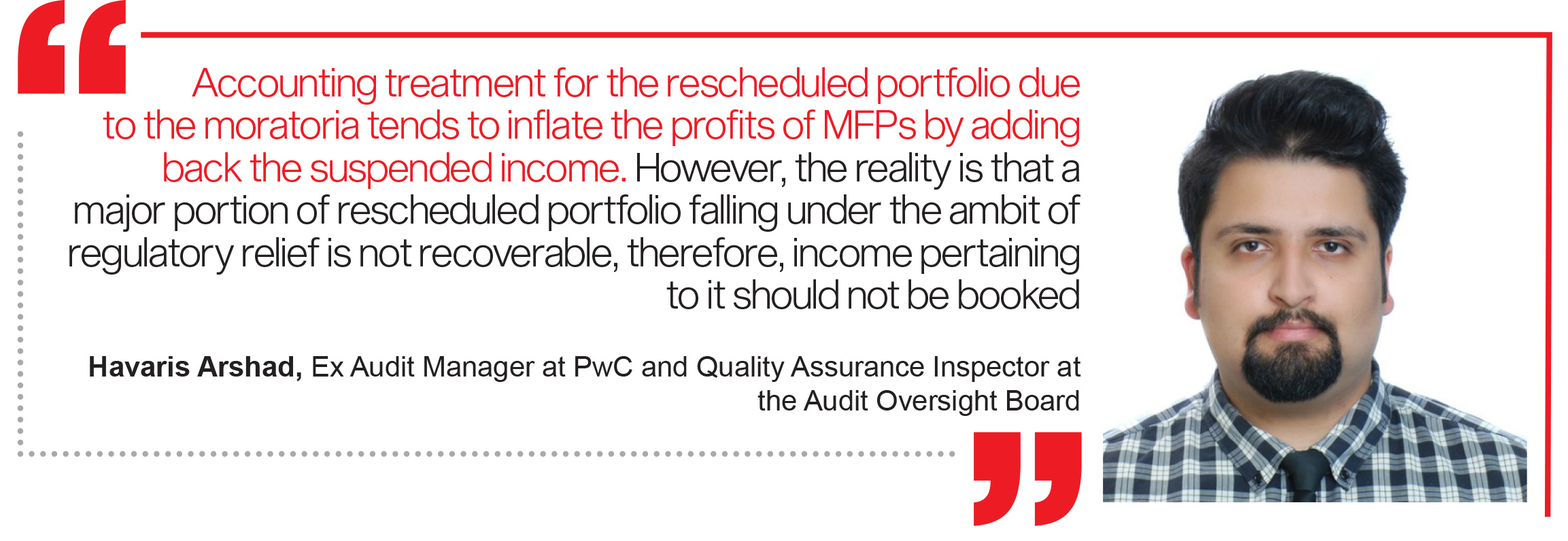

Also, the accounting of regulatory relief doesn’t provide an adequate representation of the reality and leads to the investors drawing false comfort.

As per the regulatory flexibility policy brief issued by the Center for Financial Inclusion in March 2021, “One aspect of the prudential flexibility measures that have not been widely addressed yet is the accounting treatment of the measures on Financial Service Providers (FSP). Policymakers did not expect the pandemic to last as long as it has, and year-end reporting has exposed challenges that should have been foreseen.”

“Historical experience shows that credit losses remain elevated for several years after recessions end. Accounting and legal processes tend to delay recognition of losses, and policy measures in response to the current situation will result in even slower loss recognition than usual. The result can be FSPs having to report incomes that are at least partially fictitious, and pay income taxes on them,” the regulatory policy brief added.

In order to acknowledge the issue, we need to first understand customary accounting treatment for NPLs. As per the MFB prudential regulations, After 30 days, overdue advances are classified as non-performing and recognition of unpaid service charges/income ceases. Further, accrued markup on non-performing advances is reversed (from the profits) and credited to a suspense account (a holding account on the balance sheet. Think of it as an escrow account).

However, during the pandemic, SBP allowed the MFBs to recognise such income. Suspended income was realised upon reverting of NPLs to normal classification.

“Accounting treatment for the rescheduled portfolio due to the moratoria tends to inflate the profits of MFPs by adding back the suspended income. However, the reality is that a major portion of rescheduled portfolio falling under the ambit of regulatory relief is not recoverable, therefore, income pertaining to it should not be booked,” said Havaris Arshad, Ex Audit Manager at PwC and Quality Assurance Inspector at the Audit Oversight Board.

Furthermore, there are calls from inside the industry for the regulator to directly provide liquidity support through access to credit discount windows in order to safeguard the 8.5 million customers of the sector. However, some analysts are of the opinion that such relief is not the responsibility of the regulator as the majority of players in the sector are profit-seeking and the institutional investors that hold large deposits with MFBs were, in the first place, attracted by the high yields. Therefore, they need to embrace the undoing of their own decision-making.

Though the magnitude of the crisis is yet to unfold, it is evident that MFPs would need to rethink their strategy if they are to ensure sustainability going forward. One such shift can be towards high-value productive lending (housing, tractors and so on.). Point in case, HBL MFB’s half-yearly results for 2022 show negligible movement in provisioning compared to year-end 2021. However, the loan portfolio grew from Rs 56 billion to 72 billion in six months. And the number of outstanding loans decreased indicating a strategic shift towards high-value lending.

Therefore, a change in the lending portfolio mix can help address the structural problems in the long run. Yet, seeking another bailout from the regulators and investors looks like the only option to tackle the impending crisis in the short run.

I once again find myself personally spending way too much time both reading and leaving comments

사설 카지노

j9korea.com