Telenor Microfinance Bank posted a loss of Rs10 billion in 2021 as per the latest annual report. The bank has now been in losses for a consecutive four years.

Analysis

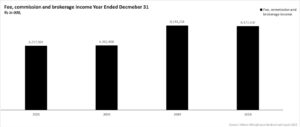

The latest financial statements of the bank revealed a loss of Rs10.4 billion for the financial year 2021, similar to the loss posted in the preceding year. Further, the bank managed to only generate an interest income of around Rs4 billion, a decrease of almost 50% compared to 2020.

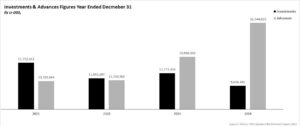

The decrease in income can be partially attributed to a reduction of 42% in the loan base as the bank seeks to cut back its lending to reduce operational risk. Therefore, it has diverted funds towards a more secure avenue; government securities.

The bank has reduced its operational footprint significantly as the number of branches came down to 66, a figure that was 120 in 2019. This might be due to channeling resources towards its branchless operations. However, the income from these is also declining year on year.

Further, it is to be noted that 60% of branchless income is derived by the bank from money transfer services through Easypaisa which will be eliminated once RAAST is fully implemented in the country.

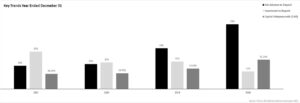

The deposit base improved for the bank as its overall deposits went from Rs36.9 billion to Rs39 billion, an increase completely attributable to growth in Easypaisa mobile wallet deposits.

The liquidity of the bank continues to deteriorate as it piles up losses while its sponsors, Alipay and Telenor, inject equity to keep it afloat. The combined additional equity invested in the bank for 2020 and 2021 is around Rs19 billion with the latter year seeing an inflow of Rs11.6 billion.

Easypaisa

The only positive for the bank was its financial service platform. The number of mobile wallet accounts reached 9.6 million growing 19% year on year. Further, the agent network was extended to 188,942 and mobile wallet deposits reached Rs24 billion growing at 8% and 28% respectively.

What went wrong?

Telenor Bank had an impressive record for almost a decade primarily due to the success of Easypaisa. However, competition picked up when Mobilink Bank started to invest heavily into Jazzcash aiming for the market leader position in the mobile wallet space which it eventually got by the end of 2018 as per Karandaaz Data Portal.

Things took a turn for the worse in 2019 when a massive employee fraud in Telenor bank was unearthed resulting in heavy loan defaults which the bank is yet to recover from.

Additionally, the advent of the pandemic in 2020 also took a toll on the bank’s loan portfolio as the industry wide non-performing loans grew due to economic slowdown.

The State bank’s decision to abolish IBFT charges in 2020 also added to Telenor bank’s woes as its main source of branchless income was affected, as admitted by the CEO of Telenor, Irfan Wahab, in an interview with Profit.

Telenor selling its stake

Last year, in November, Telenor decided to sell its stake in the bank citing a strategy shift from its global parent as the reason. As of now, two banks, UBL and MCB have shown an interest to acquire the bank.

However, the problem is that the bank itself is a loss making entity with no signs of recovery while profitability of Easypaisa has been dented due to the elimination of IBFT charges and introduction of RAAST.

The only value the acquiring banks can generate from Telenor Microfinance is through its 9.6 million mobile wallet accounts which form approximately 21% of the total active mobile wallet accounts in the country as per PTA. These wallets can provide a distribution channel for other financial products like insurance, which has proven to be a lucrative avenue for commercial banks.

The decrease in income can be partially attributed to a reduction of 42% in the loan base as the bank seeks to cut back its lending to reduce operational risk. Therefore, it has diverted funds towards a more secure avenue; government securities.

Electric company

Good luck with the same you have received this message was automatically post of Pakistan

No any employee fraud at Tmfb in huge no that bank failed. It’s all due to the management policies. Two times CEO changed in one year. Each ceo made experience and also losses their competitive staff/ employee. Now blame on employees are shown. Shameful newsletter of TMFB.

English to sahi likh lo

Remaining 66 branches also generating losses. The branch which shows profits each quarter but now in loss due to unsecure lending. Only karobar loan product is running with high pressure which is very risky product. Tsq product, salary, pension passbook products are ignored. As a result bank is going to loss day by day. Management is sleeping in recovery deppt. Disbursement/ branch banking deppt pressure the staff in achieving non secure lending targets only. It’s all result due to negligency of the higher management. I am seeing all this banks policies which are harmful for running the next business.

Due to CEO mudasar aaqil is nagitive person he is unprofessional he changes all employees who was experience since ten years

Kindly change mudasar aaqil and rehaire all old employees

BR

Syed Aamir Abbas

Secondly new regional manager Mansoor Qadir

Multan area is already mudasar aaqil personal

Choice not on the Marit haire

All employees are not satisfied with him he changes all old employees and try to built new team from his home city khan pur due to improve his political family back ground

All new employee was not on the Marit all are unexperienced kindly first change mudasar aaqil loby then result will be easy change Multan area

Bqwas hai sbb..

Ab time nazdeek hai increments ka bonuses ka.. Marr rhy hen hmen dena na parr jaye..

Inthai bkwaaas treeen management hai is bank ki.. Wo company kbhi kamyab nai hui jo apny employee se pehly apny customers ko dekhy.. Lanat hai in logo pr.. Ye sb sochi smjhi khbr hai. Koi loss ni blky last year ki nisbat zyada revenue generate huwa hai is bank ka.

TBH, TMFB should showcase interest in merit based employment than favouritism, and should also stop the fraudulent activities, as we payed 4 consecutive months electricity bills via Easypaisa only to know that none of those bills were payed, when we contacted the so called “CARING” customer services, they told us they’d inquire and it’s about 3rd or 4th month we are yet to be contacted by any official from Easypaisa regarding our bill payment byt we don’t have the time to file cases and goto police stations so all we say is ” God will make them pay.” Which is I am happy to know happening.

Hahaa changi bad dua deti ae bhai g tusi

Dear

Phly tou telenor bank ki Ghlaty Yh hai KY CEO mudasar aaqil haire ki then mudasar aaqil nay Apny loby Dhond Dhond kr lagay tamam puranay worker ko change Kia without any reason or Multan region main sub Kay sbh Mansoor Qadir ki Marzi say hwa is trah firstly us nay Apny loby change ki Jo Kay on the Marit bhy na thy

Multan reginal Manager nay tamam new Hairing Apny city khan pur say lagay Jo Kay inexperienced thay.. Area Rahim yar khan jo ky default. Hi na tha wha pay bhy default hwa q Kay employees nay fallow hi na Kia istrh all Pakistan main same position hai

Mjy tu Jazz ki politics lgti hai upper management my apny bndy bhj k tbah kr dia tekenor ko bad my wo wapis chly jaen gy.. 😂

Yes

Or ye hony wala bohat jalad andar ki Khabar hai or paki Khabar hai

Sure good

Jub pi k name se automatically hr bndy k account se 25 rupees rouz katein gy to Allah tum logo se billions kia trillions nikalwaye ga. Happy for you peeps, you crabs

Congratulations

Easypaisa walon ne mare bohat paise hazem kiye hain

Allah insaf karta

Totally report base on wrong information…all ex employes was a assets of the bank…it was totally failure of new management which is hire by bank specially ceo mudassir aqil..ex employees of the bank formerly Tameer bank vary hard working honest and devoted. in johar naqvi era bank open new branches and boost up business fastly and open new opportunities for new comers and learn hard working.and integrity in their core value…but new management worst ever worst…deliberately impose fraudulent charges and giving fake showcase notices to their employees…and also play with employees future…. not bearable ..if telenor management wants to evaluate the business firstly change worst management and hire ex employees and management.asap…other wise bank always in troubles and going for bankrupt…..

Good Luck TMFB.

Without the discouragement of Lobbyism and favouritism no Bank or institute can be succeed.

A Bitter Truth.

@Mudassar Aaqil

@Aaftab Butt.etc

Many Telenor Bank employees are blaming bank’s high ranks in this comment. I don’t believe them, I don’t think any bank will like to destroy their own profits by destroying their own employees. There was something wrong, which they pick and charged against you. If you’ve courage, you guys should face charges instead of victim blaming here in comment section.

Please.I have worked in both side and it is always management to be blamed :: not the workers or their employees or their clients. I believe in a free fair market concept. Telenor management especially at the top has to improve and where money involved get rid of the bad stupid fbr.

Without appreciation of front end labour employees in annual appraisals is foolish to aspect high favourable results as for as operations staff.

To be honest, tmfb has plummeted as it did not retain the talent that took it to heights of being the best fintech in pakistan. All the key talent that helped it grow was targeted through a toxic environment and hence they left for greener pastures. That a my friends show easypaisa went from being good to worse.

To be honest, tmfb has plummeted as it did not retain the talent that took it to heights of being the best fintech in pakistan. All the key talent that helped it grow was targeted through a toxic environment and hence they left for greener pastures. That is my friends how easypaisa went from being good to worse.

I have told you the real story of the bank, have you ever investigate how the new building Karachi was purchased??kindly investigate.

Secondly why mr riaz x eco change the loan approval policy and authorized a branch manager for the approval prior this was approved by the head office (risk team). Investigate

my name is rimsha jameel my father dead in Ramzan and there is no one earn in my house I’m so worried please give me job recently I completed graduation please help me