In a statement that reverberated within the world of accounting and finance, Warren Buffet once claimed that the “application and improvement of some modern accounting and financial techniques are fundamentally changing companies’ ability to make a profit.” For those unaware of the intricacies of the accounting world, this will mean very little. To those with some basic understanding, it may seem absurd that accounting practices could be impacting the profit of major companies. However, those aware of the nuances of accounting can truly appreciate the depth of this statement and the problem it refers to.

Accounting has become the language of the modern corporate world yet at times it is difficult for even some of the most well-versed individuals to apply modern financial reporting standards. One such accounting development has been the International Financial Reporting Standard (IFRS) 9. The Security Exchange Commission of Pakistan (SECP) and State Bank of Pakistan (SBP) have tried their hand at expediting the implementation of the accounting standard, but the lukewarm response from the industry and underlying economic factors have kept that from happening.

What is IFRS 9 and what does it mean?

IFRS 9, like its predecessor IAS 39, helps in laying out recognition and measurement criteria for financial instruments.

Financial instruments can be placed into two broad categories; financial assets and financial liabilities. The financial assets consist of primarily two instruments, Equity-based or Debt-based e.g. shares of a company and an investment bond. On the other hand, financial liabilities are obligations that would be settled through the payment of a financial asset. If a company owes its creditors money, basically, that’s a financial liability.

IFRS 9 was developed in the aftermath of the global financial crisis as regulators realised that the existing standard (IAS 39) doesn’t provide for the deteriorating quality of financial assets over a period of time. Therefore, it resulted in a “cliff effect” where a sudden shock of accumulated losses was realised in a certain financial reporting period which distorted investors’ decision-making. This was the case in the 2008 subprime mortgage crisis.

Therefore, the new standard presented an “Expected Loss” (Forward Looking) model to replace the existing “Incurred Loss” model under the IAS 39. Further, IFRS 9 has also laid out the criteria for the classification of different types of financial assets and liabilities.

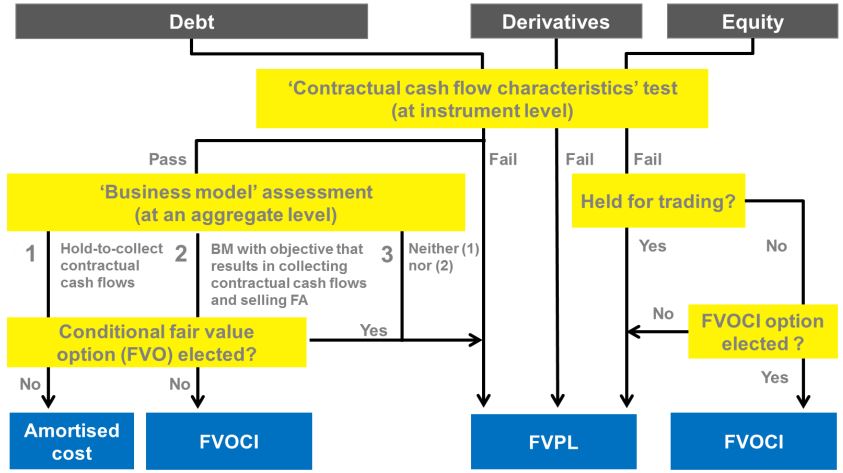

The classification of the financial assets is dependent on the nature of contractual cash flows and the business model of the entity that owns these assets. If the cash flows essentially represent two components, Principal and Interest, then the asset should be classified as a debt instrument. For instance, Market Treasury Bills (MTB) are highly liquid short-term, zero-coupon Government Debt Instruments which are sold at discount to face value and have tenors of up to 1 Year. MTBs offer a risk-free return on investment as these securities are issued by the Government of Pakistan. Although there is no interest payment on MTBs, these securities meet the Principal and Interest test because the principal amount (i.e. the fair value at initial recognition) would be accreted back to par using the effective interest rate method.

Based on the above, the MTB holder is being compensated by a margin; which in substance constitutes interest mainly to compensate for the time value of money and is not subject to any other risks or volatility unrelated to a basic lending arrangement.

However, once the type of the instrument is ascertained, the reporting standard makes it compulsory to assess the intended use by the entity to determine the measurement of the financial asset based on the intended purpose of owning the asset. The subsequent measurement can be one of the three; amortised cost which is equivalent to the asset’s cost of acquisition less their principal repayments and adjusted for any discounts, premiums impairment losses and exchange differences.

While the other two methods are based on fair value, one is routed through the profit and loss statement and the other one is routed through the other comprehensive income (OCI).

The Pakistani context

The Pakistani context

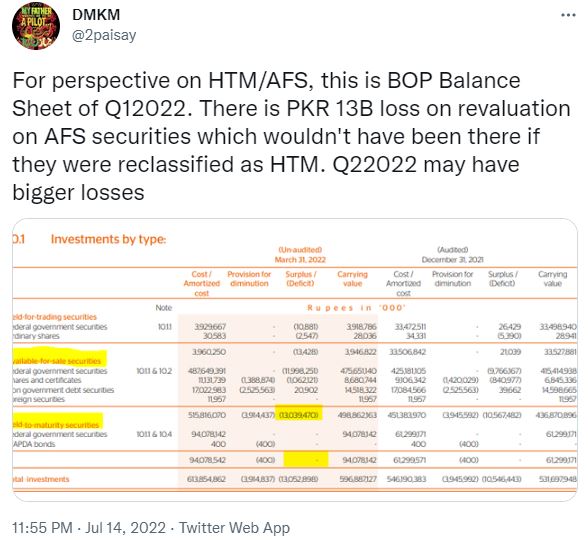

The Pakistani corporate circles are still apprehensive about the effects of the implementation of IFRS 9 on their bottom line. Specially, financial institutions are reluctant about the increased non-performing loan provisioning as the expected loss approach is adopted. Further, strict classification criteria won’t allow commercial banks to manoeuvre around any accumulated losses on investments to maintain profitability.

In addition to much more stringent criteria of providing for possible future credit losses in case of lending, Financial institutions will also need significantly more disclosures. (Read more about it in Profit’s article: IFRS-9 likely to revamp loan provisioning)

However, the new standard isn’t only a hard pill to swallow for lending institutions. More conventional businesses like those in the energy sector are also wary of its effect. HUBCO’s external auditor’s report for 2022 stated, “The company has applied to the SECP for further extension in the period of the exemption (from IFRS-9). In case such exemption is not extended, the Expected Credit Loss (ECL) model will be applicable on Company’s receivable from CPPA-G w.e.f July 1, 2022, resulting in recognition of an impairment charge of the Rs. 9,482 million against receivable from CPPA-G, based on the assessment carried out by the management of the Company.”

“In view of the significant delays in settlement of receivables, the materiality of these trade receivables and the potential impairment charge and the consequential impact on the liquidity and operations of the Company, we have considered this to be an area of higher assessed risk and a key audit matter.” The audit report further added.

Recently, the SECP has also extended the deadline for the adoption of IFRS 9 by Non-Banking Finance Companies (NBFCs). The official statement read, “SECP has extended the effective date for applicability of IFRS-9 for NBFCs and Modarabas till June 30, 2024. This extension has been granted in the wake of economic hardships and capacity issues being faced by the respective sectors in the post-COVID times.”

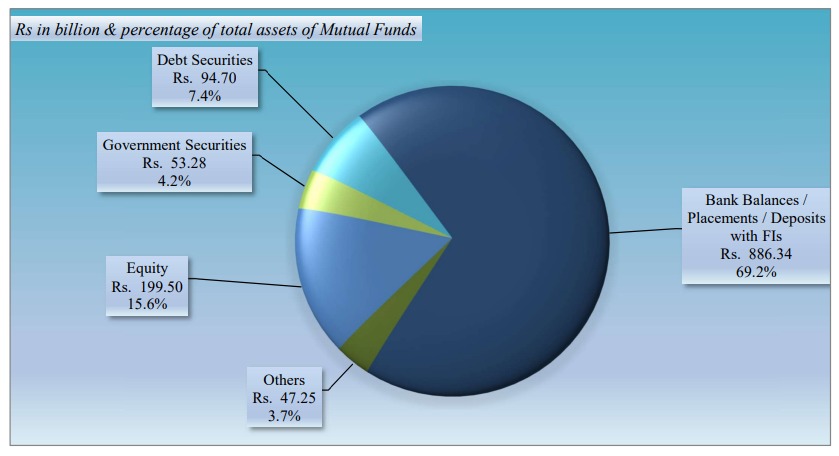

The largest player in the aforementioned sector are the mutual funds that have a significant portfolio placed with financial institutions and invested in debt securities.

Source: SECP

For these entities, IFRS 9 would mean an immediate impact on profitability if the quality of debt instruments falls below a certain point. For instance, if investments fall below the investment grade rating (BBB- or equivalent) from an external rating agency at the reporting date the funds would need to take a haircut in the form of impairment loss.

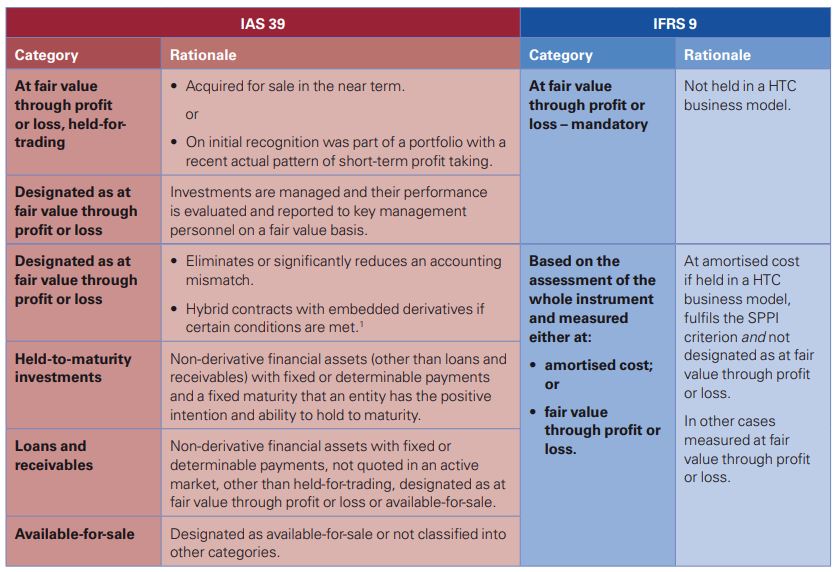

Alignment of IAS 39 categories for debt investments with IFRS 9 classifications

Source: KPMG

Further, another class of NBFCs, Private equity firms might face high variability in the portfolio value once the new standard is adopted.

Havaris Arshad, a Senior Chartered Accountant and Quality Assurance Inspector at the Audit Oversight Board explained to Profit, “IFRS 9 significantly reduces the ability of companies to measure equity investments at cost. In the case of private equity and venture capital, this would result in a shift to fair value measurement for many unquoted equity investments. This would lead to a need for detailed analysis at the end of each reporting period and subsequently, a possible downward revision in investments, particularly for those investing in startups and early-stage ventures.”

Challenges in Implementation

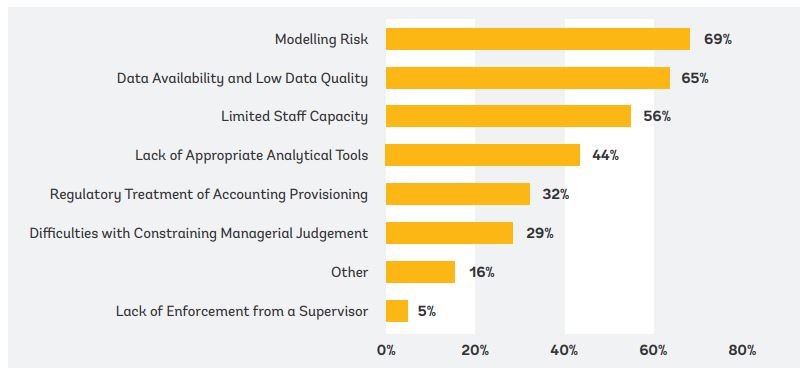

As per the World Bank’s survey, IFRS 9 in Emerging Markets and Developing Economies, “the main challenges highlighted by the survey are (a) data availability and low data quality that make it difficult to set up and apply expected credit loss models; (b) modelling risk and overreliance on managerial judgement; and (c) burden due to the involvement of several business areas, such as budgeting, information technology, risk, finance, governance, and processes. Supervisors indicated that banks, and especially small banks, faced challenges with using forward-looking information for modelling the probability of default (PD), the significant increase of credit risk (SICR), and other parameters used for calculation of the expected credit losses (ECL).”

Further, as per Talha Ahmed Shah, Chartered Accountant and Ex Senior Associate at PwC, “The application of IFRS 9 would lead to complicated outcomes as far as tax matters are concerned. The reason for it is the fact that tax profits are calculated differently from accounting profits. Certain items are deducted and added to accounting profits to reach the taxable profits. FBR, being a very litigious body, can challenge the treatment of IFRS 9 in individual company’s financial statements which would add to the inconvenience of those operating in the industry.”

However, the major concern remains the initial impact of implementing the standard. The framework of the standards has raised concerns about its financial impact being procyclical in cases of events like the pandemic or more recently, the floods. This defeats the purpose of introducing the standard in the first place.

Hence, regulators across the globe including Pakistan have provided some buffer to mitigate the impacts at transition and one-off events like the pandemic. For instance, the SBP has allowed Financial Institutions (FI) to add back the transitional adjustment amount in CET1 capital starting at 90%, falling to 10% in the final year throughout the transition period by recalculating it periodically to reflect the evolution of an FI’s ECL provisions within the transition period.

Yet, the most important cog in the regulatory machine remains the external auditors. The smooth implementation and adherence to the principles of IFRS-9 are heavily dependent on the competence of external auditors.

As stated in the aforementioned World Bank report, “In the wake of the IFRS 9 implementation, the Prudential Authority (PA) within the South African Reserve Bank (SARB) met with all the auditing firms that performed the audits of banks. The objective was for the PA to communicate its expectations, understand the challenges the firms faced, ascertain their readiness to audit banks and their application of IFRS 9, and encourage them to develop a “firm view” on the macroeconomic scenarios that banks would use in their ECL models.”

“Firm view refers to the audit firms’ internally developed, independent determination of the macroeconomic and other related forward-looking factors used in the computation of ECL. It was envisaged that this be a firmwide view, across its South African operations, to facilitate consistent application of the macroeconomic outlook across the firm’s audit engagements.” The report further added.

Transition to new accounting standards and the cost associated with it might seem unnecessary to some. However, it is a fact that adopting globally applicable reporting standards makes the financial statements of local companies more comparable to their foreign counterparts and also helps derive international investors’ confidence.

Interesting article, it’s true that the IFRS 9 and it’s adoption remains difficult for many companies in Pakistan.

A very insightful article to highlight a much valid point, however I would have appreciated if some recommendations for the solution were also presented here.

사설 카지노

j9korea.com