The SBP has issued final instructions on IFRS-9 for “ensuring smooth and consistent implementation of the Standard in the banking industry, with revised implementation timelines”.

“For banks having asset size of PKR 500 billion or above, as per their Annual Financial Statements, as of December 31, 2021, and for all the Development Finance Intuitions (DFIs), SBP has set the revised implementation date as January 1, 2023,” said the circular.

The SBP added that for all other banks and Microfinance Banks (MFBs), SBP has revised the implementation date of IFRS 9 to January 1, 2024.

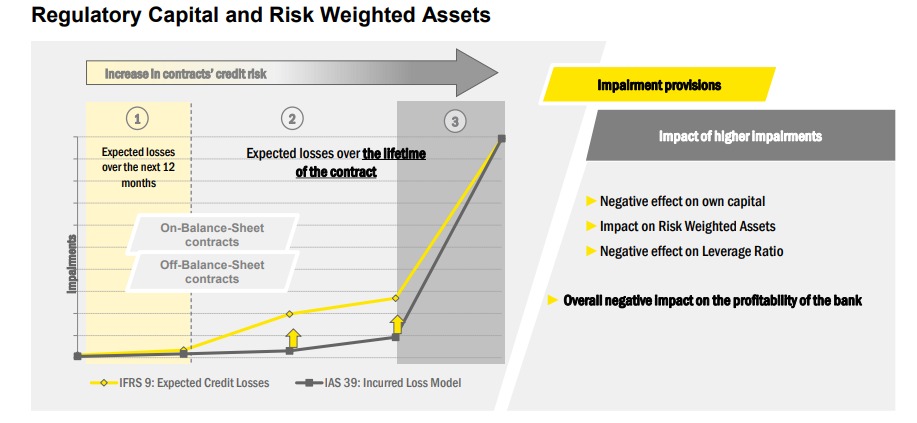

Implementing the aforementioned accounting standard would negatively affect the profitability of financial institutions due to an upward revision in loan default provisioning. Subsequently, the equity reserves on the balance sheet would also be impacted bringing down the balance sheet footing.

Earlier, for the implementation of IFRS-9 by banks, SBP had set a deadline of January 1, 2022, which has now been revised at the request of banks that are facing challenges in the implementation of the new standard.

The SBP says it has been consulting with the banking industry since early 2018 for the adoption of IFRS 9 in Pakistan.

As per a senior banking source, IAS 39 was never fully implemented as the SBP already had a straightforward method to allocate provisions. Some local banks with international operations and foreign banks operating in Pakistan were fully compliant. Laziness on part of the banks is primarily why banks did not implement IAS 39 or IFRS yet.

The source believes that this change in the accounting standards could leave roughly Rupees 40-50 billion impact on banks, although this is a very rough estimate.

What is IFRS9 and what does it mean?

IFRS 9 replaces IAS 39, in laying out recognition and measurement criteria of financial instruments.

Financial Instruments can be categorized into two broad categories; Financial Assets and Financial Liabilities. The financial assets consist of primarily two instruments, Equity-based or Debt-based e.g. Shares of a company and an investment bond. Financial liabilities on the other hand is an obligations that would be settled through payment of a financial asset. If a company owes its creditors money, basically, that’s a financial liability.

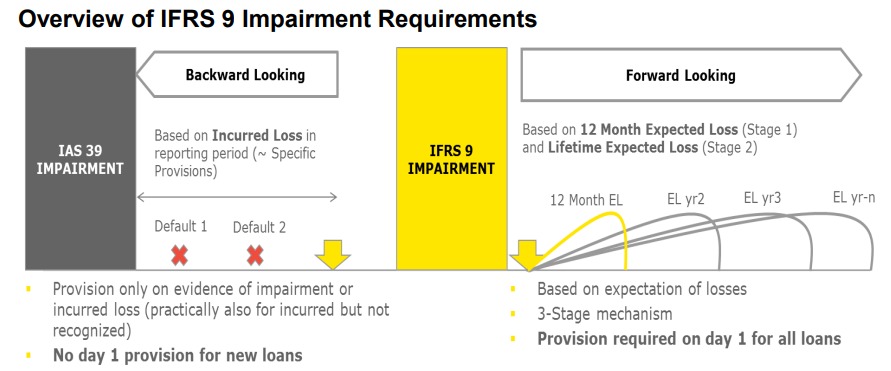

The global regulators and accounting standards board were of the opinion that IAS 39 was inconsistent with the way entities manage their businesses and risks, and deferred the recognition of credit losses on loans and receivables until too late in the credit cycle. Following the global financial crisis, addressing this became a priority.

IFRS 9 is a Global Standard issued by the International Accounting Standards Board (IASB). The Standard lays out the accounting treatment of classification, measurement of financial instruments, and impairment of financial assets.

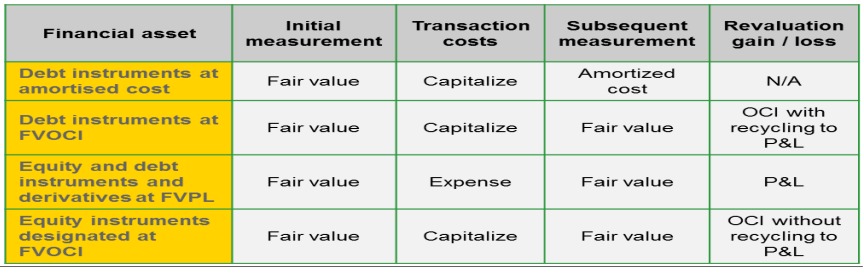

IFRS describes it as a standard that “requires an entity to recognize a financial asset or a financial liability in its statement of financial position when it becomes a party to the contractual provisions of the instrument. At initial recognition, an entity measures a financial asset or a financial liability at its fair value plus or minus, in the case of a financial asset or a financial liability not at fair value through profit or loss, transaction costs that are directly attributable to the acquisition or issue of the financial asset or the financial liability.”

Treatment of Financial Assets under IFRS-9

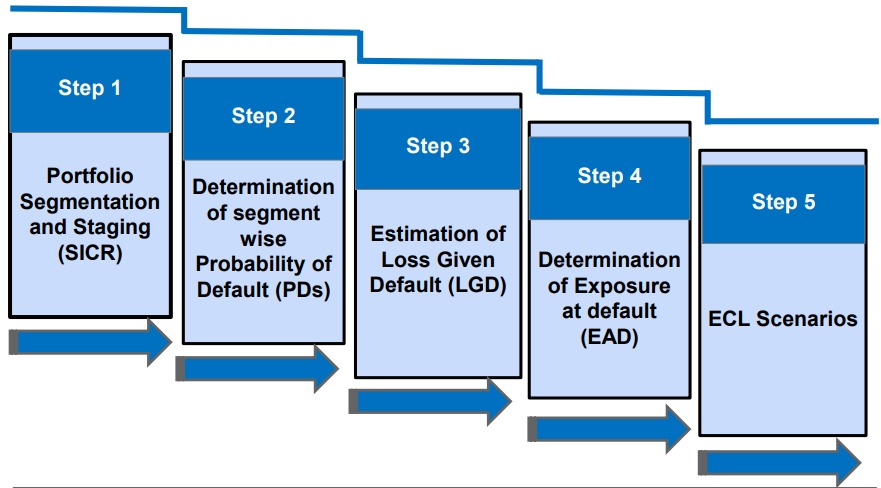

The SBP states that with the implementation of IFRS 9, the existing provisioning requirement, following incurred loss approach, will be replaced by Expected Credit Loss Provisions that will be based on expected losses on performing as well as non-performing portfolios.

“This approach is forward-looking and effectively measures the loan loss provisions based on credit risk models,” reads the circular.

Impact on Financial Institutions

Banks will also have to provide for possible future credit losses in the very first reporting period a loan goes on the books. This will be done regardless that the asset will be fully collectible. Banks will also need significantly more new disclosures.

Some banks may need new systems and processes to collect the necessary data. Moreover, IFRS9 also adds to the hedging requirements of banks.

The key change brought by IFRS 9 is in relation to the accounting provisions for loan losses which are required to be made using the expected loss model under IFRS 9.

Currently, loan loss provisions are made when there is objective evidence of impairment (i.e. incurred loss model). This is a fundamental shift in provisioning. The ECL model applies to debt instruments (such as bank deposits, loans, debt securities, and trade receivables) recorded at amortized cost or at fair value through other comprehensive income, plus lease receivables and contract assets.

Loan commitments and financial guarantee contracts that are not measured at fair value through profit or loss are also included in the scope of the new ECL model.

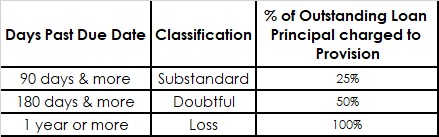

The Banking sector as well as other financial institutions charge their P&L with a non-cash expense under the heading of “provisioning for non-performing loans”. Currently, the following criteria is used to calculate the amount of loan provisioning in commercial banks.

However, the change in requirement would mean that banks would be providing for these loans from day one and that is likely to increase the amount of provisioning, resulting in lower profits. An example of this would be in the case of loss provisioning. Currently, most banks are able to recover loans before it falls into the “Loss” category (refer to the table above). However, under the new model, the day installment is missed, 100% provisioning would be required.

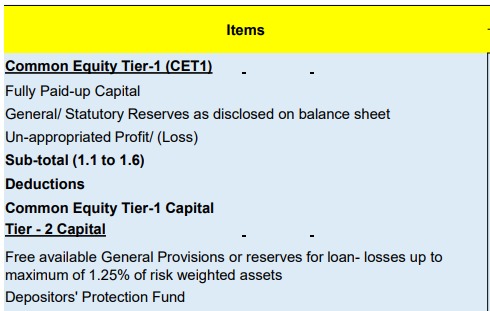

Further, the change would affect the capital adequacy of financial institutions. Banks, as per SBP regulations, are required to maintain a minimum capital adequacy ratio of 10%. The ratio is calculated by dividing the risk-weighted assets by the sum of tier-1 & tier-2 capital.

Example of items classified as Tier-1 & Tier-2 Equity

However, to mitigate the effect of IFRS 9 on capital adequacy, the SBP has provided a transitional arrangement.

“The transitional arrangement must adjust CET1 capital (Tier-1). Where there is a reduction in CET1 capital due to new provisions, net of tax effect, upon adoption of an ECL accounting model, the decline in CET1 capital (the “transitional adjustment amount”) must be partially included (i.e. added back) to CET1 capital over the “transition period” of five years.” IFRS 9 financial instruments application and instructions by SBP.

Additionally, the Banks and other financial institutions lack the required data for credit scoring of each individual customer. Blue Chip companies like Engro, Nestle, etc. are considered low risk by the banks. However, large, privately-owned companies like many in the textile industry are considered medium risk while lending to the general public is considered high risk. Therefore, it would be a laborious process to calculate provisioning for each borrower, especially those in the medium and high-risk category given the lack of detailed financial history available.

“The calculation of the ECL is a complex one including input of various economic indicators and manually performing those tasks will not be possible for the client base of the banking sector, therefore the sector will have to invest in new systems and establish new processes in line with the new standard.” Muhammad Havaris Arshad, Senior Chartered Accountant, and Manager PwC Pakistan.

Process for determining Expected Credit Loss

This was an exceptionally well written article. Thank you for this.

I dеfinitely loved every little bit of it and I have you book marked too check .

온라인 카지노

j9korea.com