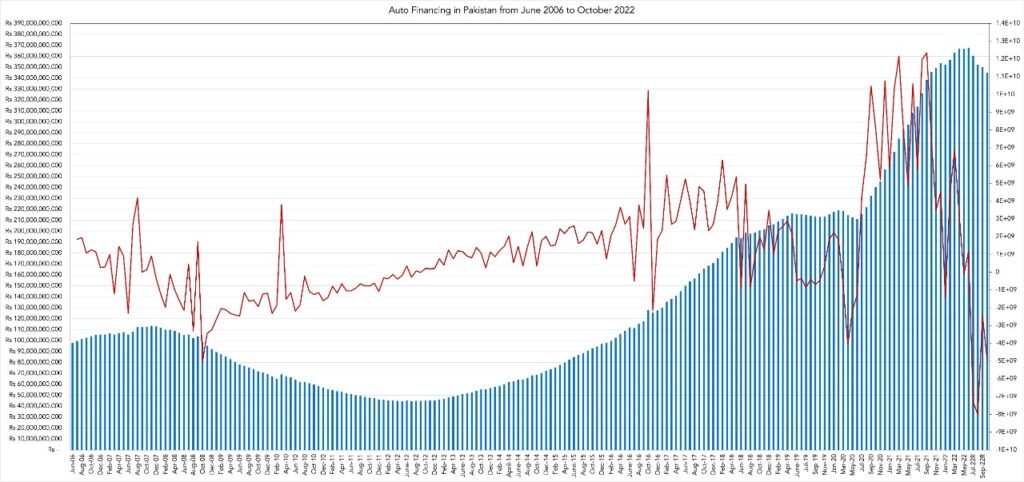

LAHORE: The State Bank of Pakistan (SBP) has released its credit data for the month of October, 2022, and the numbers do not paint a pretty picture for automotive loans. As per the central bank’s data, net automotive loans have reduced by 1.4% month-on-month (MoM) from September for a contraction of Rs 4.9 billion, contributing to a larger pattern of auto loans both defaulting and shrinking.

Month on month carnage

Outstanding automotive credit stood at Rs 345.186 billion in comparison to Rs 350.1 billion in September. The current MoM decrease marks the fourth month of the downward spiral for net automotive lending for FY 2022-23 with a total decrease of Rs 22.658 billion witnessed from July till October. This amounts to a 160% year-on-year decrease from FY 2021-22 over the same period.

It is pertinent to note that the negative value does not mean the banks did not engage in any lending. A negative value denotes that the number of loans that have matured exceeds the number of fresh loans that have been taken out.

“Auto production and financing remains impacted on supply and demand fundamentals, and require both time and a more conducive economic environment to recover. However, this isn’t Pakistan’s first economic cycle, and the nation continues to show economic resilience and its capacity to absorb shocks.” Babbar Wajid, Head of Consumer Banking at Habib Metropolitan Bank, told Profit.

“There are still pockets of unique clients targeting both new and used cars that offer great value for money. Non-resident Pakistanis also continue to get benefits from the Roshan Apni Car program. However, the uptake of auto financing is also linked to inflation-driven fears, which forces a large number of consumers to carefully re-assess economic choices, focusing expenses on essentials.” Wajid continued.

State Bank tightening the noose

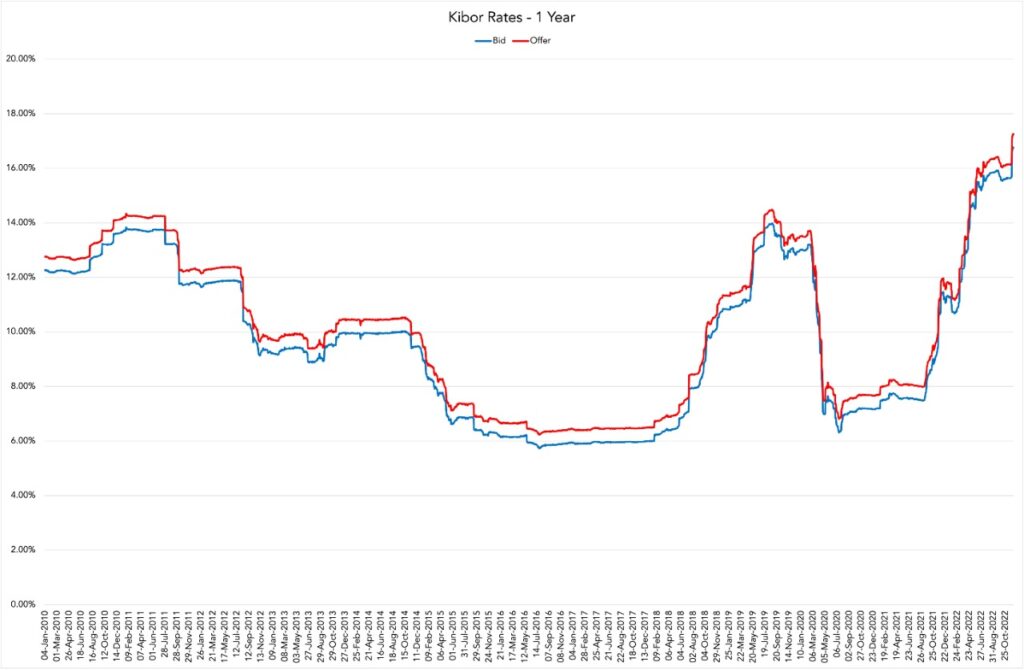

The State Bank’s recent policy rate hike by 100 bps to 16% has led to the Kibor to rise to a 12 year high. One of the main reasons for decrease in fresh automotive loans, alongside with the State Bank’s amended prudential requirements, was the prevailing cost of borrowing. This new increase is likely to increase the MoM net decreases that we see in the months to come.

“These suppressed financing volumes will continue as the new normal, till benchmark borrowing rates come down, consumer confidence rises, AND financing regulations are relaxed to earlier levels. In the larger scheme of things, this cooling off should help reduce inflationary and trade pressures on our economy.” Wajid told Profit.

Bleak prospects

Moving beyond the reduction in fresh loans being disbursed by banks, there is also the possibility that more customers are choosing to rid themselves of their outstanding payments. This is likely due to the increase in the cost of living and/or the possible increase in the cost of repayment that customers are likely to experience as a result of increase in KIBOR. Profit calculated that customers who took out auto loans in 2021 alone on floating finance rates would see a 30 to 35% increase in their monthly payments going forward, before the current increase in the policy rate.

Wajid estimated that ““The average auto loan has a life of 48 months. It’s an inverted curve so the principal repayments accelerate over time. The interest repayment is greater than the principal in the initial part of the loan but as the loan goes past 18-20 months then the principal portion decreases very rapidly”

Utilising the 18-20 month timeline, the current debt servicing, notwithstanding customers terminating their debt obligations earlier, is still for loans taken out in early 2021. If new loans do not increase then these dips will likely increase as the principal for the Rs 97 billion automotive loans will start being serviced.

“By and large we have to assume that autos and the rest in the next 12-18 months are going to remain suppressed, the way they are, unless something fundamentally changes.” Wajid told Profit.

I lost all my life crypto savings on my Trüst Wallet and I couldn’t explain if it was a phishing link I entered or so, but all I can say is my wallet was wiped. I read so much about Hack West who I decided to contact and trust me, Hack West didn’t disappoint. He recovered all the lost tokens as well as my coins (bitcoin and ethereum) worth about $231.000 as of then. His charge was moderate and he kept me informed about every step. You can reach Hack west via: Email: Hackwest at writeme dot com

WhatsApp: + 1 424 307 2638

Telegram: @Hackwest

The rupee’s depreciation, import restrictions on auto parts, delays in refunds of sales tax by the government

Good article! I read it today