The State Bank of Pakistan’s (SBP) policy rate has hit 15%. This is a decade after it last did so in 2008, and this time it happened almost instantly.There will indeed be a shock for the economy like no other. There are now murmurings in the banking industry, and all of them point towards the same thing — sometime in the next six months the auto-loans market will receive a stress test. How will this play out?

Because of rising inflation, and the spiking cost of borrowing money after the massive increases in the policy rate over the past one year, people that have had their cars financed by banks will suddenly find that their monthly payments have skyrocketed. How much, you ask? Profit calculates that customers with auto loans taken in 2021 on 5 year tenors could see a 30-35% increase in their monthly payments going forward.

General inflation has already led people to tighten their purse-strings, leading to low purchasing power. On top of this, when the banks come knocking with massive auto-loan bills, people will have difficulty repaying the loans, raising the spectre of rising defaults in consumer loans.

If this happens, it will not be the first time Pakistan’s auto-loans market has seen large scale defaults. The last time the auto loans were swept by a wave of defaults was in the aftermath of the financial crisis of 2008. Back then, according to a 2011 report of the State Bank of Pakistan (SBP), nearly 50% of all personal finance loans defaulted. The reason behind the default was pretty standard. There was an economic crisis led by inflation, interest rates were hiked rapidly to reach an all time high, the country was roiled by political turmoil, and fuel prices were high after being artificially deflated earlier.

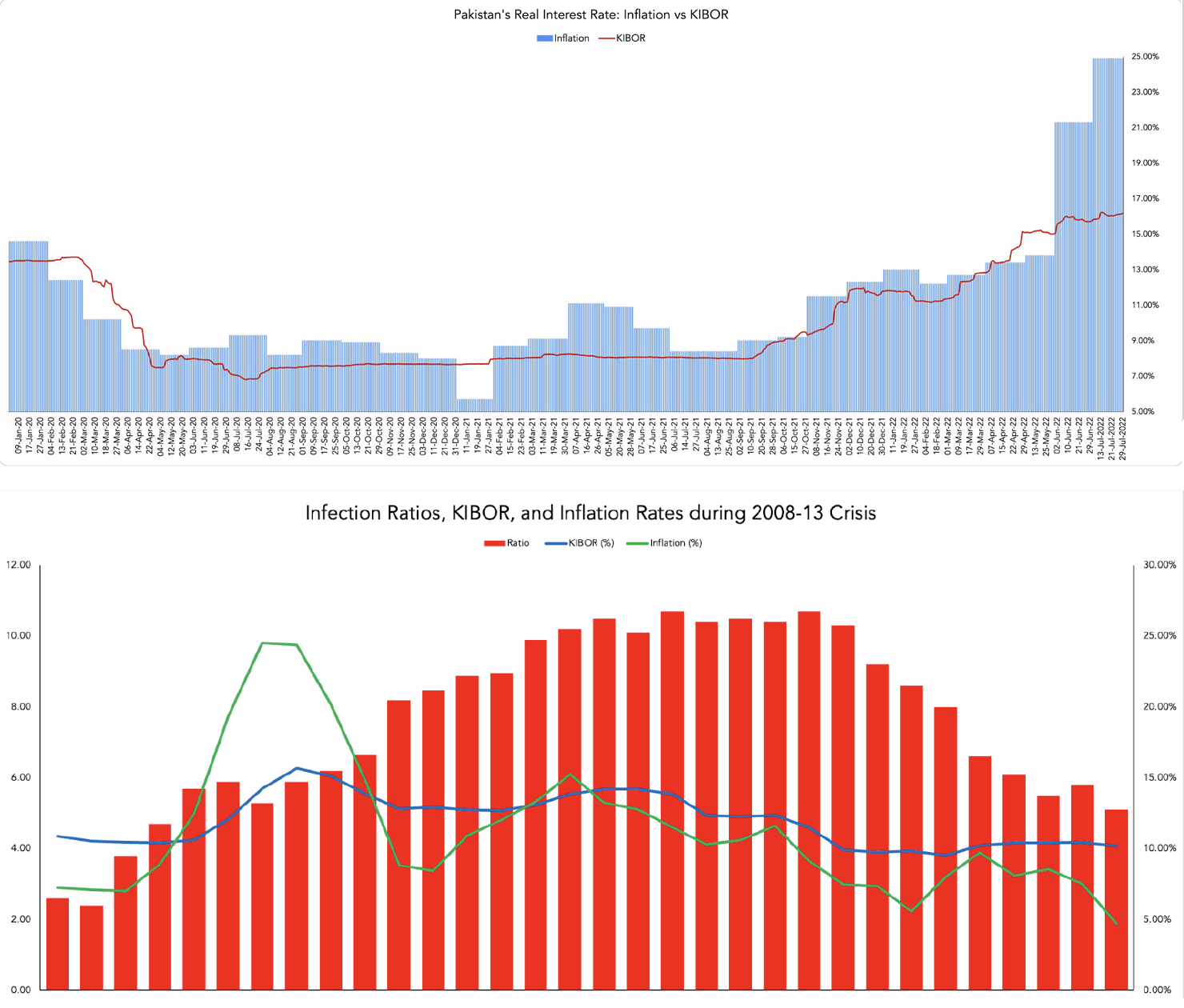

Interest rates have shot up in the past one year at a virtually unprecedented rate. From 7 percent last July, the key Policy Rate shot up to 15pc by July 2022. There have been two other episodes of sharply rising rates in the recent past. In 2018, for example, the policy rate shot up from 6pc to 13.25pc in a matter of 18 months, sharply slowing the economy and leading to a rising “infection ratio” in the banks as the cost of borrowed funds spiked with this rise.

Sound familiar? Yes, the set of circumstances that led to nearly half of all personal finance related loans defaulting in 2008 are eerily similar to the circumstances in the country right now. Profit spoke to bankers and investment professionals to determine whether the auto-loans market is once again headed towards a similar situation. Opinions were split. Some said it could happen within six months. Others said that while the circumstances were similar to 2008, market dynamics have changed since then, with banks becoming more prudent about who they lend to, which means defaults will happen but minimally. Profit investigates the state of the auto-loan market, to assess the likelihood of this happening all over again.

What’s the size of the pie?

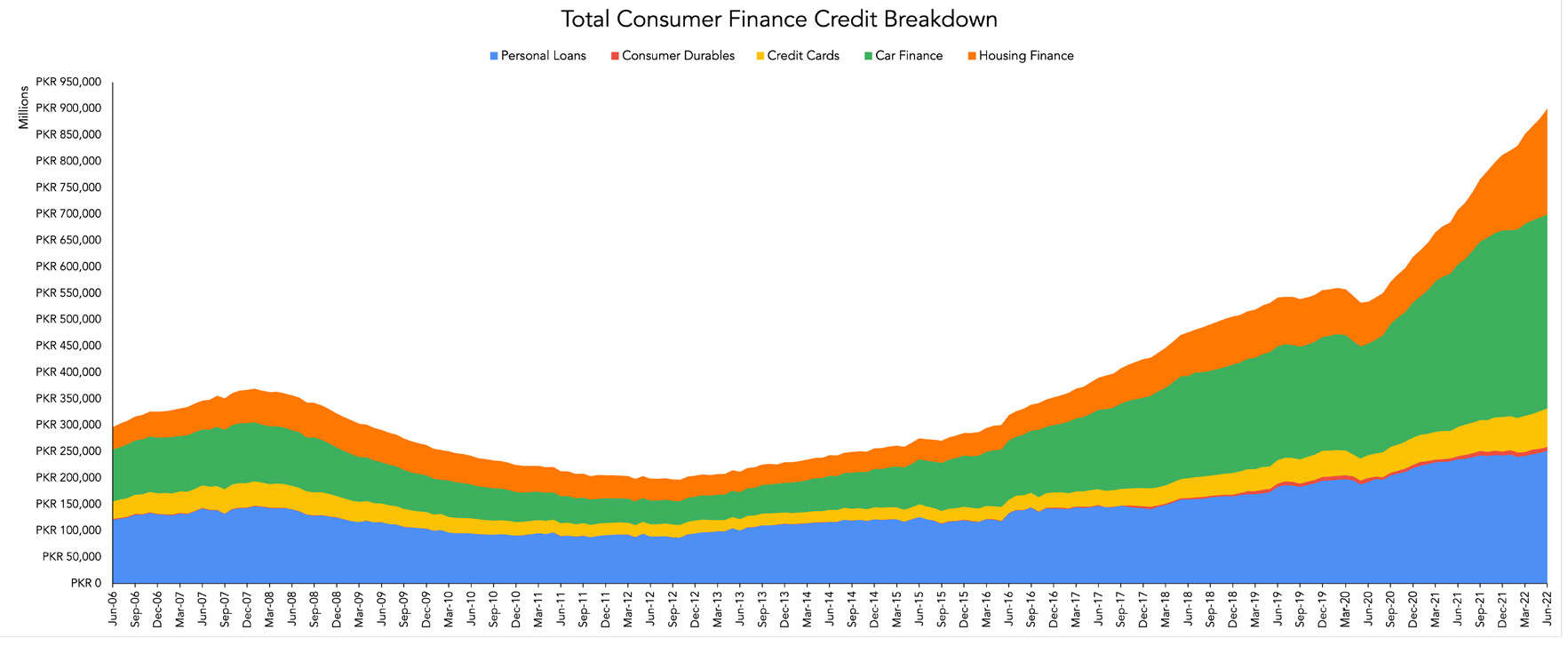

Over the course of the past 18 months, from January 2021 to June 2022, Rs 111 billion auto-loans have been dispersed by all banks for auto loans. In comparison, total consumer finance loans taken for housing in the same time period amounted to Rs 281 billion. On average, 40percent of all personal finance loans in the past year and a half were auto loans.

In short, the market is massive. As the graph of the SBP’s total credit in circulation data below shows, a majority of current loans in circulation are for cars. There are a lot of reasons for this. A house of one’s own and a car at the end of a salaried career is the height of most upper-middle class aspirations. In addition to this, in what is a peculiarity of our auto market, cars are considered both an asset class and a necessity in Pakistan. Since it is both a necessary means of transport in a country with no walkable cities or viable public transport, as well as a hedge against inflation, people will take out loans to get cars over anything else.

“You need electricity, right? No matter how expensive it gets you will pay for it because you need it. In the same way, no matter what the cost is, there is a general demand for vehicles which will not go,” says Pervez Shahid, former co-chairman of Bank Alfalah’s central management committee, a seasoned banking professional who was the boss at Bank Alfalah during the 2008 financial crisis and auto-loan default.

The problem is that the price of both cars and houses have seen an exponential rise in the past few years. As Pervez Shahid has explained, this has not killed the demand. It has only led to customers leveraging auto financing to bridge the gap between them and their desired vehicle. The problem is, with a global recession in full swing, people’s purchasing ability to buy luxury items like cars deteriorates. And if you are someone that had taken out a car loan back in December, the rising prices will by now be coming back to haunt you. But how does it work, and what are the signs?

The anatomy of default

“If you are early in your lease, that could effectively mean your monthly payment has increased significantly. At the same time the price of everything (including fuel and maintenance – which effectively increases your cost of vehicle ownership) has gone through the roof. Monthly budgets have gone completely out of whack. Some time in the next 6 months this will catch up and people will start defaulting on their car loans.” said Azam Khan, an investment professional, speaking to Profit.

Khan’s comments are scary but they encapsulate what loan defaults on the auto market look like. People that get their vehicles financed are weighed down by a recession and general inflation, and when their monthly payments increase they find themselves unable to pay. As we’ve mentioned earlier, people in Pakistan will pay their car instalments because the car is both a necessity and asset. However, defaults do occur when it is mathematically impossible for people to make their payments, and that is when banks start repossessing cars.

The common assumption is that you miss a payment and your car gets repossessed. Now that is not incorrect but it’s also an oversimplification. Profit looked at what happens during a default process so that you do not (hopefully) have to. In the SBP Fair Debt Collection Guidelines, banks begin the process of repossession if the client does not make contact 30 days past due (DPD). Once the car itself has been repossessed, they are auctioned off.

In the end, banks don’t lose out on this process at all. It is correct that banks would like to maintain relationships with their clients but on account of the relationship being severed, then liquidating the car is not a loss making venture for the bank either. The main loser in the situation is the borrower whose car and investment both go.

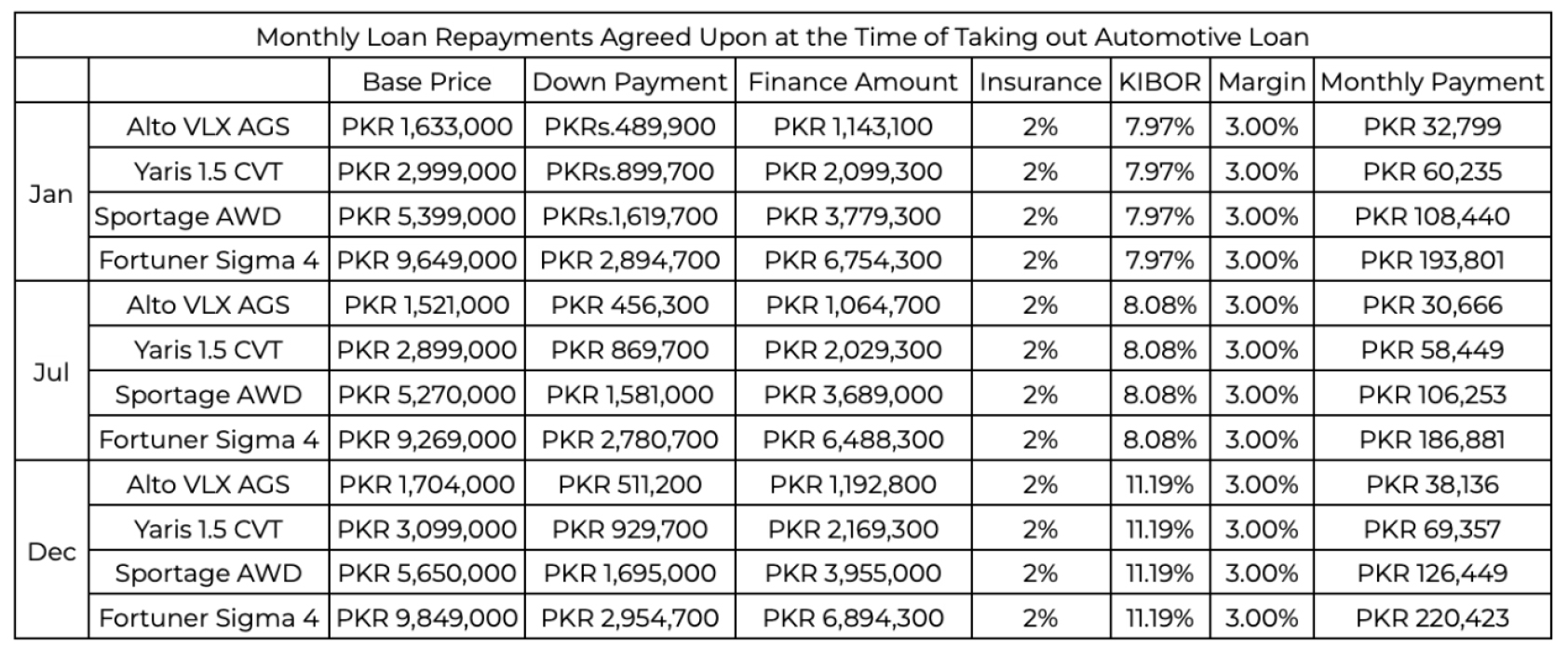

The reality is that the instalments have gone up significantly. Profit reconstructed potential auto loans for a Suzuki Alto, Toyota Yaris, KIA Sportage, and Toyota Fortuner. The payment schedule is based on a 5-year tenor. The prices used for the listed automobiles are the prices for the top variant on the last day of the respective month. The base year taken for the automotive loan is 2021.

Reconstructing the loans for multiple back dates spanning a greater number of calendar years is possible, however 2021 happens to see the greatest volume of increase in automotive credit looking at the aforementioned SBP credit data. For the sake of brevity and to avoid this becoming a complex jumble of numbers, the data from 2021 sheds more than enough light.

Why have these prices gone up the way they have? At the centre of the whole thing is a little something called KIBOR. For those uninitiated into the world of finance, the KIBOR (Karachi Interbank Offered Rate) is the rate at which money is borrowed by institutions in Pakistan. It is determined by the State Bank, which releases policy rates that then determine interest rates. The KIBOR hit a 13 year record high in April when the SBP raised it to 14.1%. There were speculations that it would at least go as high as 15% which it did in June. It is 16.31% as of the filing of this report. The changes in the above mentioned rates are staggering. The breakdown is below.

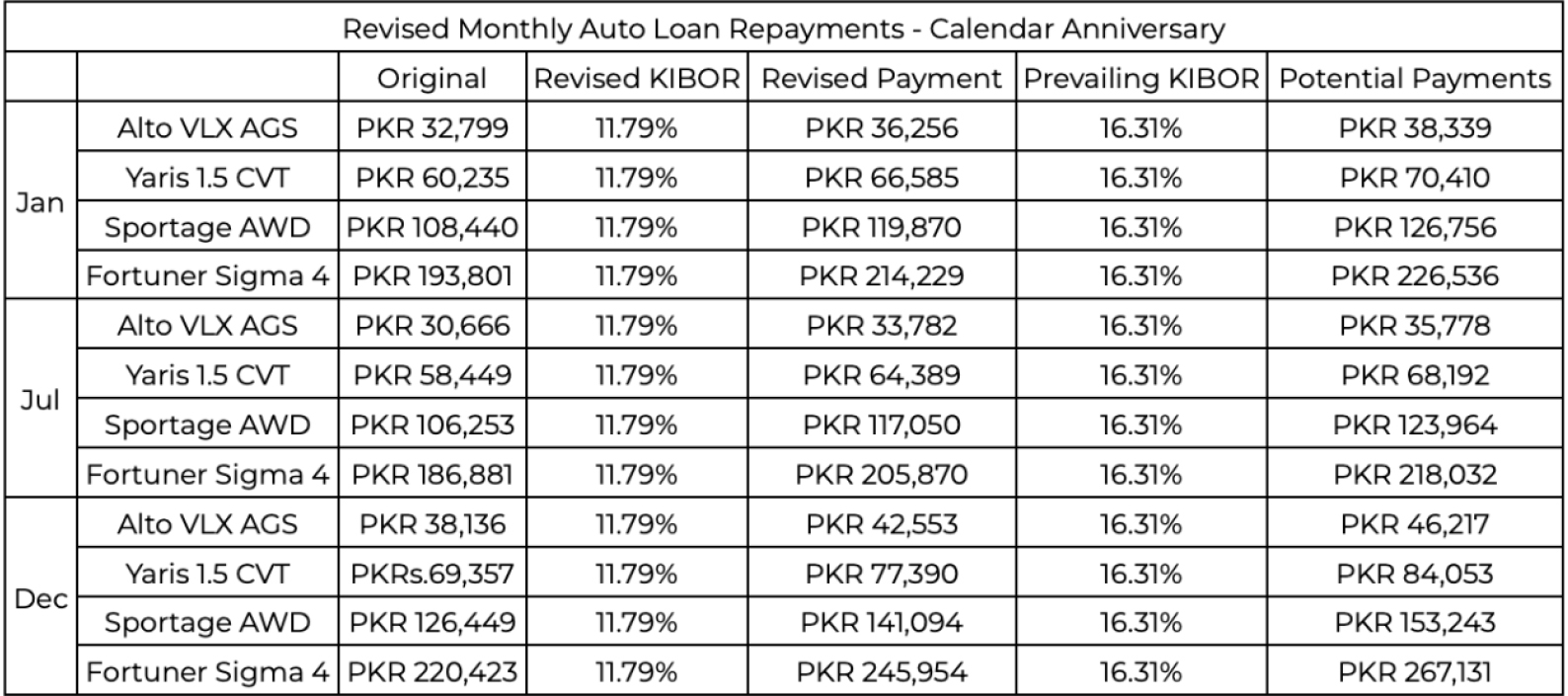

It is important to first understand that KIBOR changes lead to price revisions at different intervals during a customer’s loan; on the loan anniversary or calendar anniversary. The difference comes down to the product that one opts for. Profit is in no position to tell you which of the two you ought to get. However, Profit did do the maths on both types of the loans to see how much customers would have to pay more.

Let’s first look at outstanding customer loans that have the KIBOR rate fixed in accordance with their loan anniversary.

Profit also looked at the potential payments that customers would have to pay if the current KIBOR rate was levied on them. The thing is that, this KIBOR rate will most likely be levied on the customers that took out their loans last January and December. I’m being optimistic with this KIBOR rate, and you’ll see why shortly.

Now, onto customers with calendar anniversary automotive loans.

On first glance, customers with calendar anniversary loans seem to be insulated from the matter. For now, at least. Things, however, could get worse. The KIBOR is changing on a whim everyday, and with negative interest rates abound, the rates could get much worse.

Because we are still trading at negative interest rates, the SBP is still incentivising borrowing rather than saving. Odd considering the current economic decisions are aimed at dampening demand, right? Well the SBP knows this as well, and let’s just say that they have the ground for another hike if they so choose. Particularly given, how Pakistan is reinitiating its IMF program.

To catch up, your monthly interest loan payment is about to increase, if it has not already increased. Now ceteris paribus, the increase in the amount of what you have to pay is worrying but not apocalyptic. What is worrying, as Khan pointed out, is that the price of everything has increased.

“Inflation is obviously very high right now so people have to choose. They have to choose between consumption spending; things that are nice to have and things that they absolutely need. As a sector also, auto financing is largely skewed towards salaried customers who will feel the impact of the increase in taxation from July onwards. This double whammy will turn into a triple whammy in January when the KIBOR on the instalments is revised.” said Babbar Wajid, Head of Consumer Banking at Habib Metropolitan Bank, when asked about the matter.

Wajid in particular is referring to customers with automotive loans that are revised on calendar anniversaries. However, needless to say that is similarly applicable to customers availing loan anniversary products. They may be feeling it already looking at the aforementioned sample repayment structures Profit created.

The ‘08 example

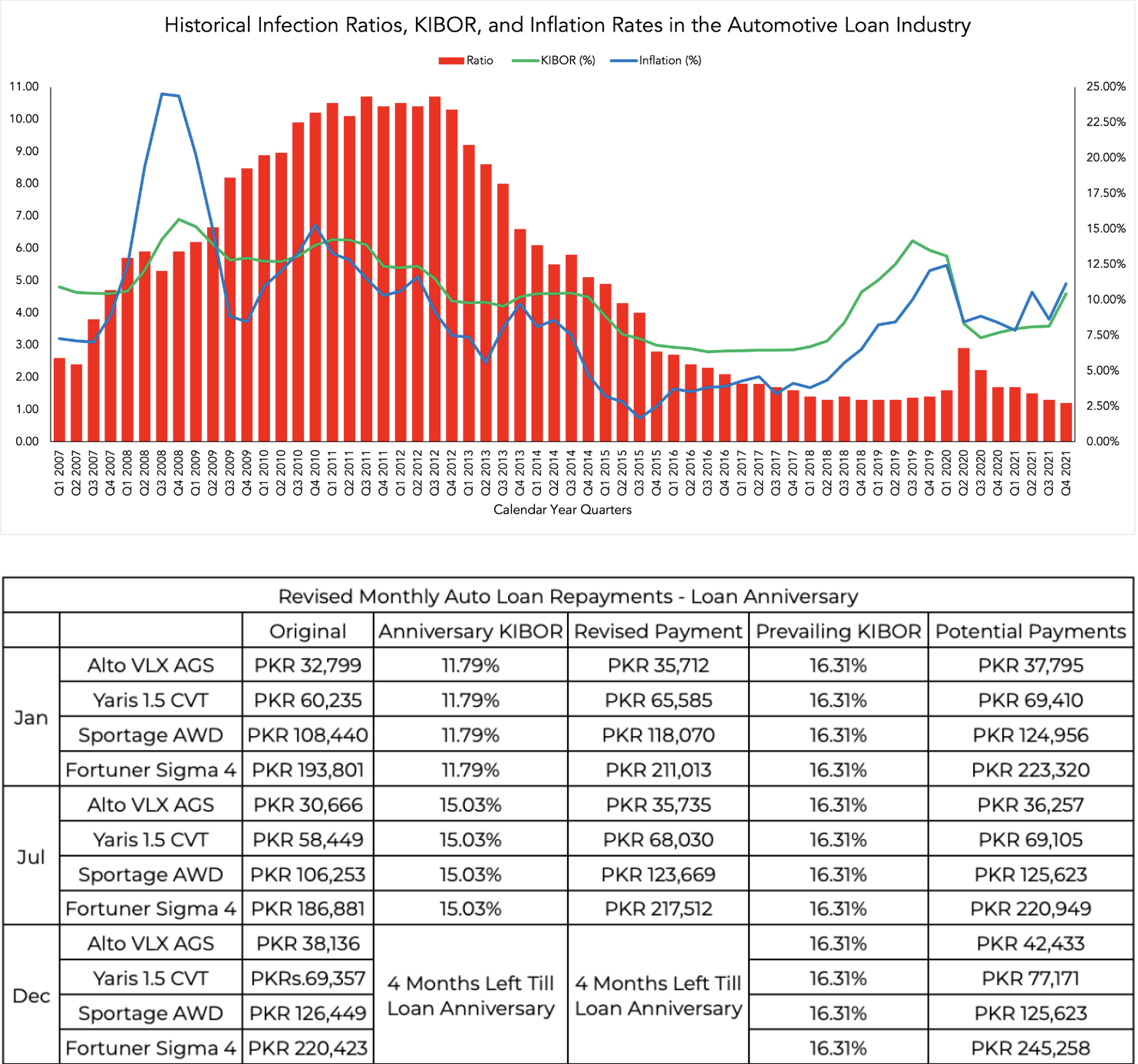

Let’s take a step back and try to get a hold of the larger picture. As we’ve mentioned before, a similar situation met the auto-loan industry back in 2008, and the crisis stretched over a five year period all the way to 2013. At the centre again was KIBOR and inflation.

So, what exactly happened back then? To put it simply, Pakistan, like much of the world, found itself in an economic crisis. Only our crisis also had the additional pain of a political crisis and a failure of wonky oil economics.

This in turn led to a spike in inflation and the cost of borrowing, which shall be henceforth referred to as the Karachi Interbank Offered Rate (KIBOR). What did the spike in these two do? Well, let’s do a deep dive into banking vernacular first so that the rest of the piece is more palatable.

Defaults are also known as non-performing loans (NPL); Loans that are subject to late repayment or unlikely to be repaid by the borrower in full. Subsequently, the ratio of NPLs to a total lending portfolio is known as the infection ratio. That’s all we’ll need.

What the two aforementioned increases did was it led to an increase in the infection ratio across banks’ auto lending portfolios. It actually set off a round of infection ratios that only started to taper off in 2014.

Following 2014, the market has been relatively stable due to inflation and KIBOR never exactly hitting similar levels. There was a short-term spike in 2020 following a hike, though smaller than the one seen in 2008, which led to a rise in infection ratios again. This, however, only strengthens the hypothesis that there is a strong correlation between all the aforementioned aspects.

On a longer term horizon, the market has remained relatively stable on account of normalised KIBOR and inflation rates. Looking at the longer term horizon in conjunction with the SBP’s credit, we see it is during this time that the automotive lending space also picked up pace.

What’s the situation now? The KIBOR is at 16.31% as of writing and the Pakistan Bureau of Statistics reported inflation to clock in at 24.9% for July of this year. And this is why speculations are rife that we may be headed towards another round of defaults very soon.

Will 2023 be any different?

Well, maybe.

“I do not think defaults will take place. The basic reason for this is that if you bought a car 2-3 years ago then its price has more or less doubled. You would be much better off selling that vehicle or giving it to somebody else and still earning a premium than to go into default” said Parvez Ahmed Shahid, former Co-Chairman of the Central Management Committee at Bank Alfalah, to Profit when asked about the differences between the situation now and in 2008.

Shahid posits that vehicles have become an asset class between the 2008 crisis and now. Well, they indeed have.

Profit has already documented how automobiles are investments in the Pakistani market. It is common knowledge amongst anyone with an interest in the sector as to why automobiles are an asset class in Pakistan.

Read more: The lopsided market structure of the automobile industry

However, let’s do a quick recap on the context still. Just so the following points can be understood better. Automobiles for better or worse, depending upon who you ask, are almost entirely imported commodities in gross and net terms. As an imported commodity, its price is decoupled from the PKR and tied to global commodity prices or the USD for an umbrella term.

Given how the PKR is susceptible, if not guaranteed, to depreciate, vehicles thus act as an inflationary hedge. In a country as starved for investment avenues as Pakistan, the automobile sector provides a means to accrue wealth.

Furthermore, given that automotive companies operate on a Just in Time (JIT) model, there is an oversupply of vehicles in the market. This in turn also makes them a very liquid asset. A trip to Lahore’s McLeod or Lawrence Roads would give anyone unfamiliar with the entirety a live example. Maybe visit us whilst you’re there as well?

“Look at the increase in car’s price from 2008-11 and compare it with the past two years. You will see a fantastic increase percentage wise and nominally as well.” said Parvez further if asked if the prices of cars were the only difference between then and now.

Looking at Shahid’s statement, Profit looked at how much our aforementioned vehicles of choice have gained in value since our potential customers may have taken out their loans.

| Change in the Value of Cars in Auto Loan Sample | |||||

| Original | Current | Difference | Change | ||

| Jan | Alto VLX AGS | PKR 1,633,000 | PKR 2,223,000 | PKR 590,000 | 36.13% |

| Yaris 1.5 CVT | PKR 2,999,000 | PKR 4,259,000 | PKR 1,260,000 | 42.01% | |

| Sportage AWD | PKR 5,399,000 | PKR 7,250,000 | PKR 1,851,000 | 34.28% | |

| Fortuner Sigma 4 | PKR 9,649,000 | PKR 13,969,000 | PKR 4,320,000 | 44.77% | |

| June | Alto VLX AGS | PKR 1,521,000 | PKR 2,223,000 | PKR 702,000 | 46.15% |

| Yaris 1.5 CVT | PKR 2,899,000 | PKR 4,259,000 | PKR 1,360,000 | 46.91% | |

| Sportage AWD | PKR 5,270,000 | PKR 7,250,000 | PKR 1,980,000 | 37.57% | |

| Fortuner Sigma 4 | PKR 9,269,000 | PKR 13,969,000 | PKR 4,700,000 | 50.71% | |

| Dec | Alto VLX AGS | PKR 1,704,000 | PKR 2,223,000 | PKR 519,000 | 30.46% |

| Yaris 1.5 CVT | PKR 3,099,000 | PKR 4,259,000 | PKR 1,160,000 | 37.43% | |

| Sportage AWD | PKR 5,650,000 | PKR 7,250,000 | PKR 1,600,000 | 28.32% | |

| Fortuner Sigma 4 | PKR 9,849,000 | PKR 13,969,000 | PKR 4,120,000 | 41.83% | |

Across the aforementioned vehicles, the average increase in value is 40%. The question then is, how many other investments yield similar results? These results are also likely to be even higher if we used a 2-3 year horizon rather than just look at 2021.

Automobile customers, whether they know it or not, they probably do, are financing an asset at the end of the day. The asset also has the added utility of being, well, a car as well. There is supposedly very little incentive that customers with outstanding dues might have to forsake their car. Particularly, if they have already paid a substantial amount.

“Absolutely” said Shahid when Profit asked if it’s a rational choice for an individual to retain their car through the loan.

Similarly, “The underlying asset will actually gain in value which means we’re less likely to see defaults and more likely to see contract terminations. I think this makes more economic sense for customers who are going through distress rather than have the bank run after the car” said Wajid when Profit asked what customers would choose between forsaking the car or continuing to pay.

Contract termination means the customer buys out the remainder of the contract.

Wajid and Shahid make valid and prudent statements. However, their assumptions rest solely on the financial position of customers.

The thing with the 2008 crisis is that the KIBOR and inflation were able to set off rounds of defaults for years to come because Pakistan, like much of the world, was reeling from the 2008 financial crisis.

Pakistan, like the world, may again be on the precipice of a global economic crisis. How different this crisis in the coming will be to the one in 2008 is anyone’s guess. However, going into the crisis, for customers to continuously service debt it is perhaps a necessity that they do not fall on any hard times. That doesn’t tend to be the case with economic crises but it is an assumption that we will have to rely on to forecast a sectoral apocalypse.

Saviour of Last Resort

It’d be remiss to not highlight, but does a default even matter if the bank renegotiates with the customer?

Banks, like any corporate entity, value the relationship with their clients. Maximising customer lifetime value is not only an aim but also Marketing 101. Therefore, banks are not actively rooting for customer’s to default at all. The entire lending model is based upon the assumption that the client will be able to provide the bank with a steady stream of cash flow for years to come. They’re really not in an industry where trust issues are fair game.

The SBP is cognizant of this as well. They’ve actually made it quite easy for banks to to renegotiate outstanding loans with customers. The SBP’s Prudential Regulations for Consumer Financing mandate that a loan has to exist for 9 months for it to be eligible for a refinancing scheme.

The only restrictions that the SBP has on refinancing are that it should not be “rescheduled/ restructured more than once within 12 months and three times during five year period.” Finally, the SBP only mandates that banks deem a loan to be a loss when a customer reaches 90 dpd within one year. Honestly, if you’re missing that many payments then you might have just taken the wrong loan.

Now I say this because it’s important. Another problem in 2008 was that the automotive loan market was effectively the wild west. It was a nascent industry and banks really just wanted to acquire as many clients as possible.

They have, however, learnt since then. “Banks’ expertise on the consumer lending side was very limited. It was a learning period for financial institutions. I don’t see a repetition of the mistakes then to happen now” said Shahid when Profit asked about whether banks were also cognisant of their mistakes.

“I don’t think banks are as ill-prepared as they were at the time and the portfolios are better managed and cleaner. There’s a lot more insight that goes into it and a lot more data now available with us with other banks to be able to help understand their client” said Wajid when asked if banks had matured and abandoned their old lending habits.

Pakistani banks have not undergone a stress test similar to the 2008 crisis to really test Wajid and Shahid’s claims. However, it would be incorrect to believe that banks have undergone that maturity. This is because their entire profitability model has changed after the 2008 crisis. Profit has documented the transition, however, it falls outside the scope of this particular piece.

Read more: Banks that don’t bank

However, the tldr is that banks do not actively seek out customers to lend to relative to their other divisions. Therefore, the customers that they do lend to are probably thoroughly vetted because that is at best an additional revenue stream for the bank. At least you now know why your local bank isn’t investing to reduce queue sizes.

The crux of the matter then is that the potential customers with outstanding dues are perhaps far more likely to be in a financial position to continue debt servicing despite additional strain in comparison to their counterparts in 2008. Particularly, because, again unlike their 2008 counterparts, they are financing an asset which may either allow them to weather the storm or get back on their feet whenever the economic turmoil does subside.

What can we expect ahead then?

It’d be good to end on a bright note and say defaults are not on the horizon.

Profit cannot say that. Well, because if nothing else then the SBP has not provided infection ratios for this calendar year and did not respond to Profit’s request. Understandable given the storm of problems they’re combating right now really.

Profit has already predicted more inflation for the remainder of the year that may even bleed into 2023. Just turning the tv alone is enough to ascertain the economic turmoil that not just Pakistan but the world is in. If there is to be a verdict given then it seems very likely that infection ratios i.e. defaults will increase. Whether they will be comparable to the ones seen during 2008-11, now that is something that really depends on how the economy plays out which is anyone’s guess really at this point.

Customers in the used car market in 2023 and possibly 2024 might just be the only beneficiaries of all this. They would benefit from banks auctioning off vehicles, so just maybe.

Good Information

I have perused every one of your posts and all are exceptionally enlightening. Gratitude for sharing and keep it up like this.

사설 카지노

j9korea.com