Ah, it’s that time of the year when you look back and reflect on performance and set targets for the future- resolutions. In a similar, but not so sentimental way, the State Bank of Pakistan (SBP) released its Annual Payment Systems Review for 2021-22 looking back at the way payments were made in Pakistan during the fiscal year.

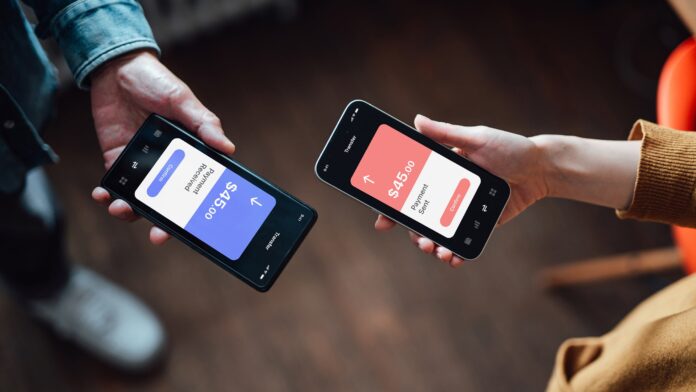

In a year where macroeconomic indicators haven’t been the most positive omen, the Annual Payment Systems Review for the year has given some hope to Pakistan while it battles low financial inclusion; stating that mobile phone banking increased by a whopping 100.4% to 387.5 million, while internet banking grew significantly by 51.7% to 141.7 million during the year.

The year in review

- By value, mobile phone banking and internet banking grew strongly by 141.1% and 81.1%, thus, reaching to Rs 11.9 trillion and Rs 10.2 trillion respectively. E-commerce transactions also witnessed similar trends as the volume grew by 107.4% to 45.5 million and the value by 74.9% to Rs 106 billion.

- During FY22, a total of 32,958 Point of Sales (POS) machines were deployed in the country which led to an expansion of its network by 45.8% to 104,865. The total number of transactions through POS, 137.5 million, was 54.5% higher than the previous fiscal year with transaction value reaching Rs 0.7 trillion growing by 56.1%.

To read the full article, subscribe and support independent business journalism in Pakistan

The content in this publication is expensive to produce. But unlike other journalistic outfits, business publications have to cover the very organizations that directly give them advertisements. Hence, this large source of revenue, which is the lifeblood of other media houses, is severely compromised on account of Profit’s no-compromise policy when it comes to our reporting. No wonder, Profit has lost multiple ad deals, worth tens of millions of rupees, due to stories that held big businesses to account.

Hence, for our work to continue unfettered, it must be supported by discerning readers who know the value of quality business journalism, not just for the economy but for the society as a whole.

(Already a subscriber? Click here to login)

Now another things is AI Based Motor Bikes with Stylish Features: Revoltmotors.org You can Check and Apply for Franchise.

It’s very good. Thank you. It’s easy to understand, easy to read, and very knowledgeable.

온라인 카지노

j9korea.com

It’s very informational keep it up bro