If there is one thing that’s hot in the cold of December, it is gold prices. Prices of the subcontinent’s favourite metal hit a record high of Rs 178,800 per tola, indicating an almost 11% increase since the start of December. This rise in prices has created a wave of hysteria and chaos for many Pakistanis. Desi families who traditionally give gold to their children at weddings are feeling helpless and don’t know how else to store their wealth. On the flipside, those who already have personal reserves for gold are finding silver lining in the situation. The Pakistani rupee is depreciating, but at least gold value is increasing!

But all that’s gold doesn’t necessarily glitter.

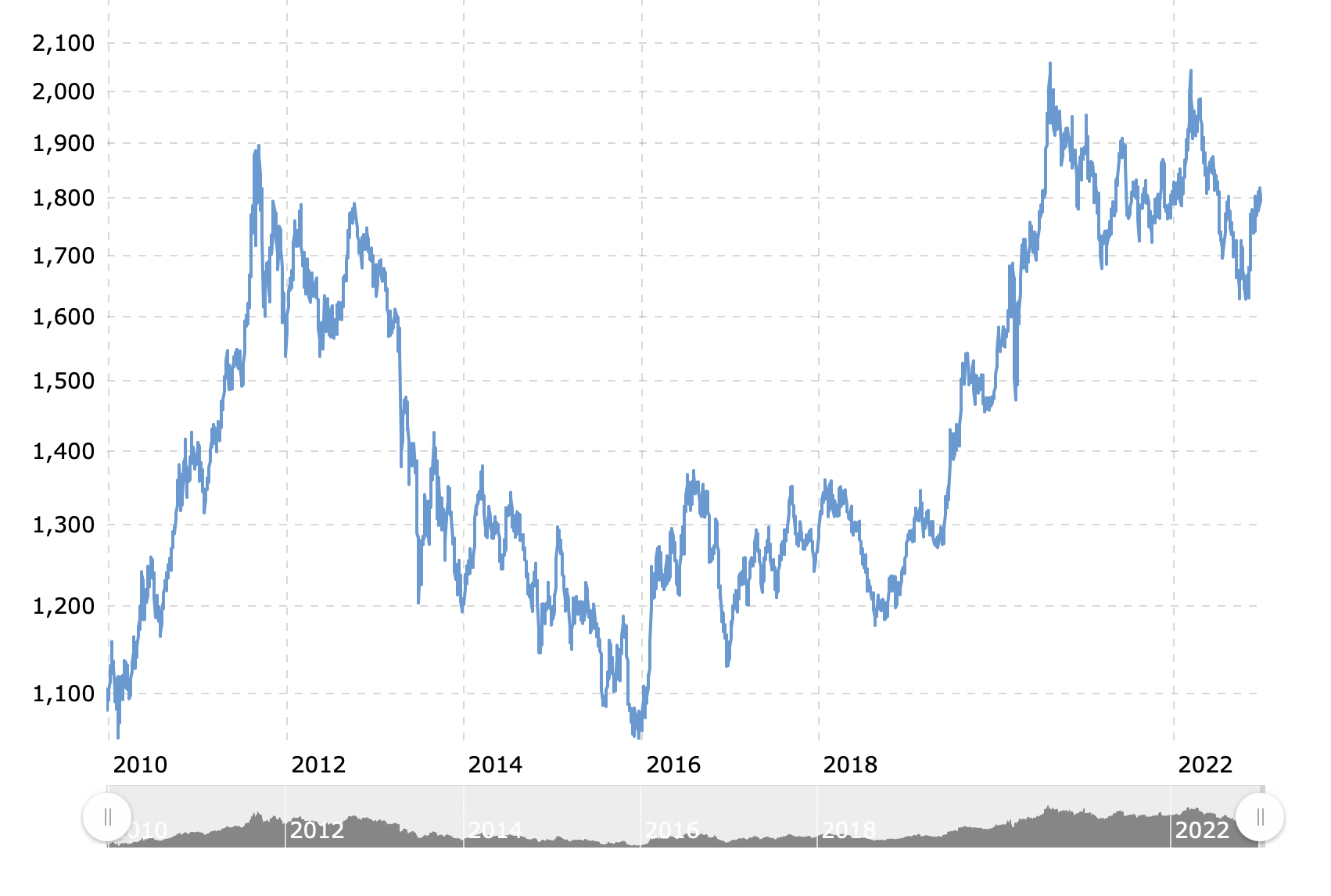

Contrary to popular belief, gold investments are not too great, and not as risk-free. Below is the chart of gold prices of the last hundred years. Because it’s a commodity against the US Dollar, its actual value is also determined by the US Dollar.

Source: Macrotends

If you look at the graph closely, you’ll realise that if you bought gold almost a decade ago in 2011, you are sitting at a loss of $113 today! Forget 10 years ago, compare the prices of 2020 of $2,018 to today’s $1,780 and you see a significant loss again. The graph shows exorbitant highs and lows just within a span of 10 years. The content in this publication is expensive to produce. But unlike other journalistic outfits, business publications have to cover the very organizations that directly give them advertisements. Hence, this large source of revenue, which is the lifeblood of other media houses, is severely compromised on account of Profit’s no-compromise policy when it comes to our reporting. No wonder, Profit has lost multiple ad deals, worth tens of millions of rupees, due to stories that held big businesses to account. Hence, for our work to continue unfettered, it must be supported by discerning readers who know the value of quality business journalism, not just for the economy but for the society as a whole.To read the full article, subscribe and support independent business journalism in Pakistan

Madam. Please give price in PKR not dollar. For US citizens S&P 500 invest is better than Gold. But for Pakistanis Gold is currently better than Stocks, Bonds because PKR devalue so quickly.

Ss

Below is the chart of gold prices of the “last hundred years”. where is that chart? it is from 2010

Errors like these make this article not worthy for our attention.

Unreliable.

It’s very good. Thank you. It’s easy to understand, easy to read, and very knowledgeable.

온라인 카지노

j9korea.com

Excellent blog, Thanks! Wish you the best of luck with yours as well!

“Opportunities are like sunrises. If you wait too long, you miss them.”

Gold may not be the best savings plan for individuals or the economy due to its limited intrinsic value and lack of income generation. It doesn’t provide interest or dividends, making it less effective for long-term wealth growth. Moreover, hoarding gold can divert resources away from productive investments, potentially harming economic growth. Additionally, its value can be volatile, subject to market fluctuations. Diversifying into other assets like stocks, bonds, or real estate may offer better overall financial security.