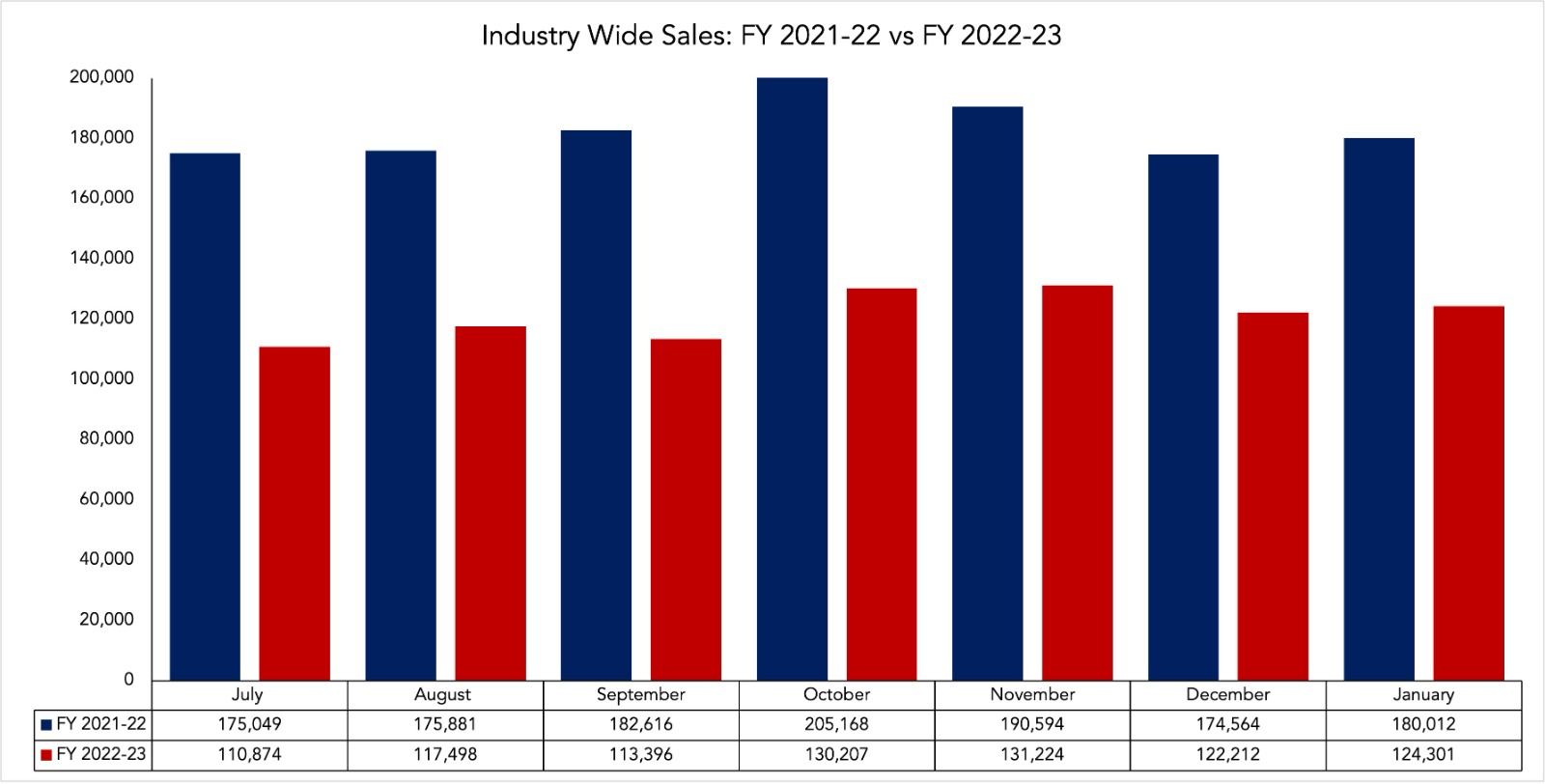

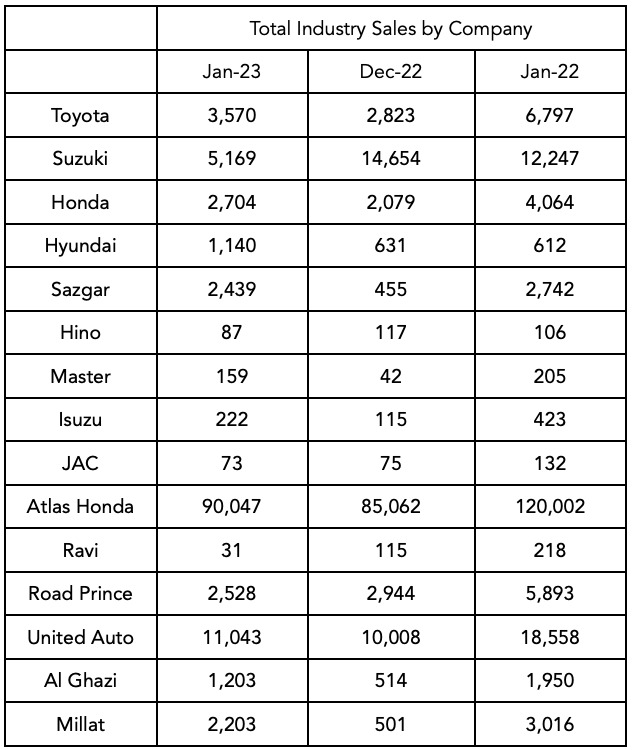

LAHORE: The Pakistan Automotive Manufacturers Association (PAMA) has released their sales for the month of January, and the results are not pretty. Month-on-Month (MoM) sales have recovered from the dip seen in December with total volume rising 2,089 units for a 1.71% increase. However, January’s figures remain depressed Year-on-Year (YoY) with total industry volume declining by 31%. Furthermore, 7MFY23 volume stands at 849,712 units sold in comparison to the 1,283,884 units sold over the same period last year for a 34% contraction.

Car Sales

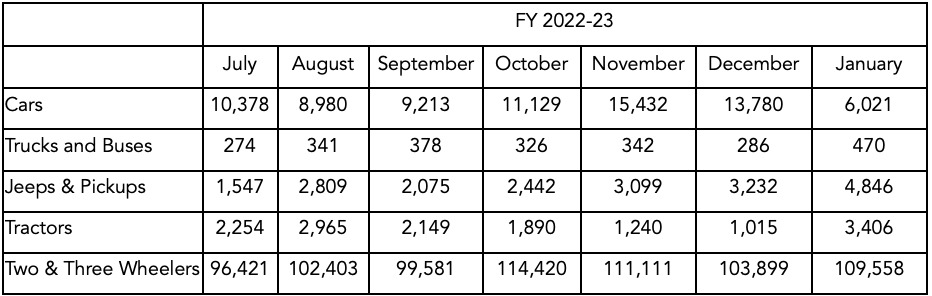

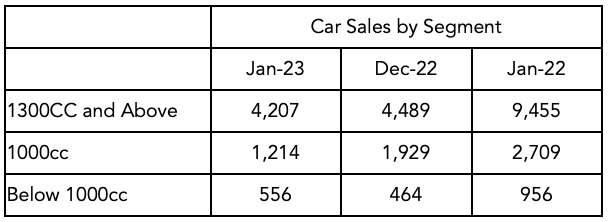

Car sales took the largest plunge on a both MoM and YoY basis across the industry with contractions of 56% and 65% respectively. Across the car segments, the 1000cc segment saw the greatest dip with an MoM contraction of 37% and a YoY contraction of 55%. The sub 1000cc segment in contrast saw a MoM increase of 20%, but was unable to beat its YoY number where it saw a dip of 42%

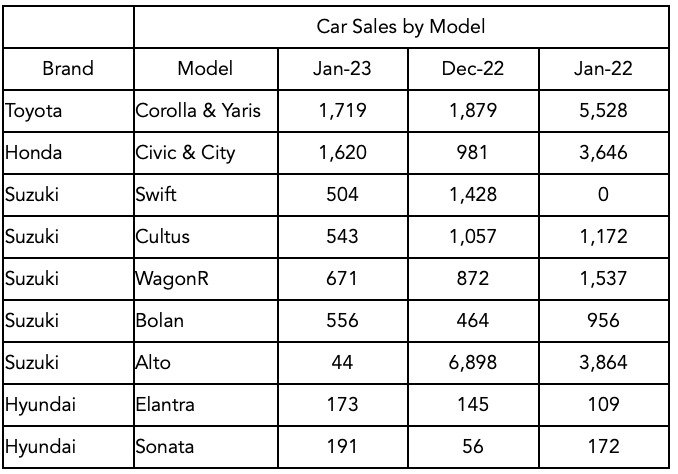

In terms of sales by model, the general decline in MoM and YoY sales is prevalent for almost every car. The aberrations to this trend are, at least on an MoM basis, Honda’s Civic and City, and Hyundai’s Elantra and Sonata. Honda does not provide disaggregated data for its two sedans, and therefore, a breakdown is not possible. Hyundai’s sedans, in contrast, both recorded MoM increases.

The most notable change is 99% MoM and YoY contraction in the sales of the Suzuki Alto. The car only recorded 44 units sold, amounting to, perhaps, the first time it sold below 100 units in a month since its launch.

Jeeps and Pickups Sales

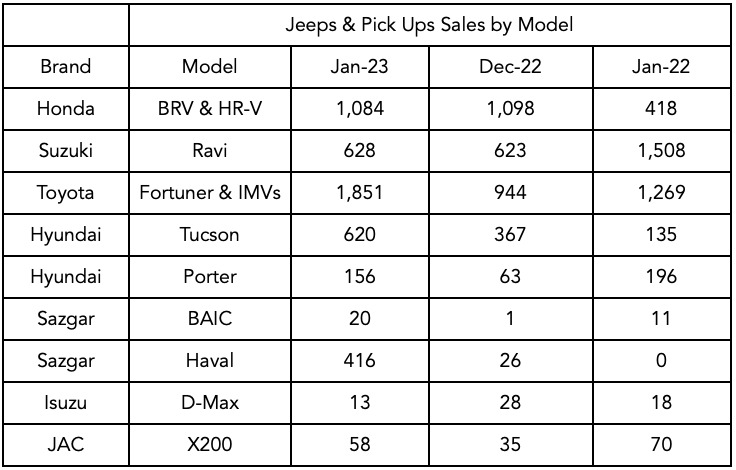

The Jeeps and Pickups segment recorded both an MoM and YoY increase. The former saw an increase of 50%, whilst the latter saw 34%. The only vehicle in the jeep and pickup category to see both an MoM and YoY decrease was the Isuzu D-Max which saw decreases of 54% and 28% respectively. Honda’s BR-V and HR-V vehicles saw an MoM decrease of just 1%. Honda does not provide disaggregated data for the two vehicles, and therefore, it cannot be estimated as to which vehicle accounted for how much.

Overall, both new and old, commercial and passenger vehicles saw increases across the lineup. The most notable MoM increases came for Sazgar’s BJ40 and Haval lineup, and Hyundai’s Porter. On a YoY basis, Tucson leads the way with a YoY increase of 359%.

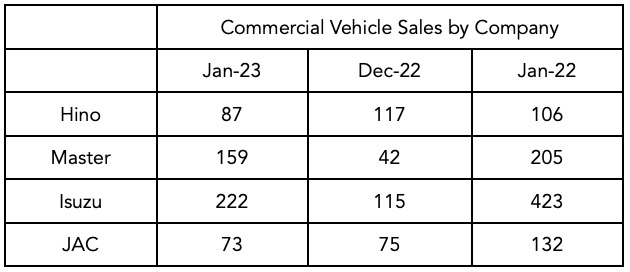

Commercial Vehicles Sales

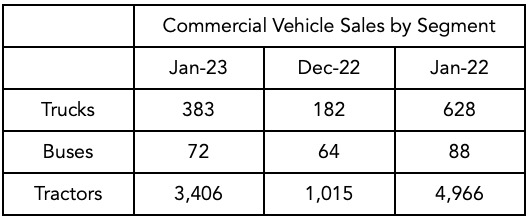

Sales across commercial vehicles all saw MoM increases on MoM and YoY declines. The largest MoM increase came in the Tractors segment, whilst the largest YoY dip was seen in the Trucks segment.

Across brands, the results were mixed on an MoM basis. In terms of YoY sales, all brands saw declines. Across the MoM increases, Millat Tractors saw the largest increase of 340% followed by Master Motors’ increase of 279%. Conversely, the lowest YoY decrease was seen by Hino which saw a contraction of only 18% whilst the largest contraction came was for Isuzu which saw a 40% dip.

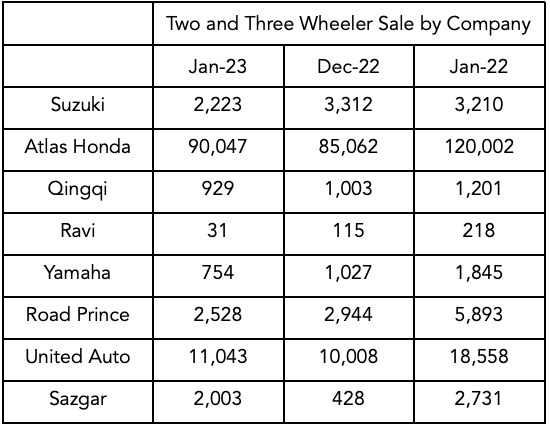

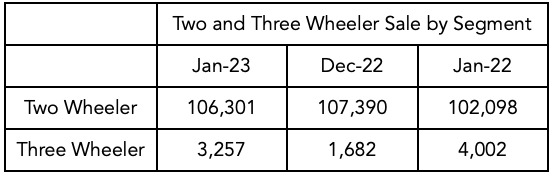

Two and Three Wheelers Sales

The Two and Three Wheeler segments combined recorded an MoM increase of 5% and a YoY decrease of 29%. When looking at the two segments separately, the results are serendipitously different. The Two Wheeler segment recorded an MoM decrease of 1%, and a YoY increase of 4%. The Three Wheeler segment, in contrast, recorded a 94% MoM increase, and a 19% YoY decrease.

Across the brands operating in the Two and Three wheeler space, the results differed on an MoM basis. They ranged from Sazgar seeing a 368% MoM increase to Ravi seeing a 73% contraction.