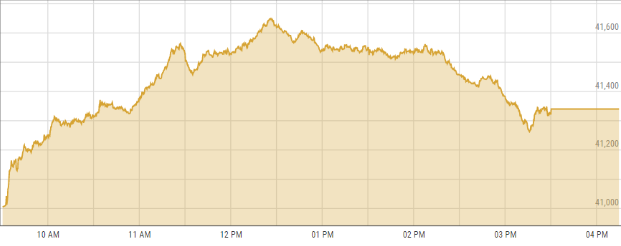

The Pakistan Stock Exchange’s (PSX) benchmark KSE-100 index remained bullish on the first working day of the week, Monday. It ascended by more than 600 points, propelled by the anticipation of an “investor-friendly budget” in the upcoming fiscal year of 2023-2024, which will be presented on June 9.

According to the PSX website, the index reached its pinnacle at precisely 12:26 pm, soaring up to 41,649.13 points, up 1.57 per cent or 643.98 points. The index opened at 41,005.15 and closed at 41,340.06, translating into an increase of 375.52 points or 0.92 per cent.

According to Topline Securities CEO Mohammed Sohail, the market rose on the expectation of an ‘investor-friendly budget’. He told Dawn, “The market rose on expectations of an investor-friendly budget, especially measures related to tax on reserves that may force listed firms to pay more to shareholders,”

What is this investor-friendly budget?

The Reform and Revenue Mobilisation Commission (RRMC), the government’s tax commission, chaired by Ashfaq Tola, has put forth intriguing proposals. One of these proposals includes an income tax of 5% to 7.5% on the accumulated profits (distributable reserves) of listed and non-listed companies. According to this commission, this single step could generate Rs338 billion in taxes in one year on a total value of Rs5.44 trillion of company reserves.

The Tola Commission has proposed imposing income tax at the rate of 5% for listed companies, and 7.5% for non-listed companies to be levied on distributable reserves of such companies. This tax, intended as an advance tax on dividends, would be applicable to the reserves of companies and would subsequently be adjustable against the tax imposed on actual dividend distributions. Notably, the concept of an advance tax on dividends already exists in the Ordinance governing Controlled Foreign Companies.

Additionally, the report released by the commission sheds light on an estimated windfall of Rs141 billion that could be obtained from listed companies that have refrained from distributing dividends in the past three years, despite amassing substantial reserves amounting to Rs2.8 trillion. Similarly, the reserves of non-listed companies have reached a notable value of Rs2.6 trillion, with the potential to generate an additional annual revenue of Rs197 billion at a tax rate of 7.5%.

However, the specifics regarding the scope of the advance tax implementation remain uncertain. It is yet to be clarified whether the tax will be imposed on the total reserves, the increase in reserves over the past three years, or solely on the earnings accumulated in the current fiscal year.

How have investors reacted?

As today’s performance of PSX also demonstrates, the investors have become bullish. “This has been a demand of many investors, as a large number of listed firms either don’t pay dividends or distribute a low amount. If these measures are taken, this will have positive implications for the local bourse that is trading at an unbelievably record low PE of 3x”, stated Nasheed Malik of Topline Securities in his analysis.

Speaking to Dawn, Topline Securities CEO Sohail said the proposed advance tax will be good for the stock market and the government, but hurt growth-oriented companies that need cash to fuel their expansion.

How have companies responded to this tax?

As the implications of the potential advance tax loomed over the horizon, numerous companies listed on the PSX announced their plans to convene board meetings for reasons other than financial results in the coming days. Their apparent objective was to prevent the possible expense arising from an advance tax that the government may impose in the 2023-24 budget on their reserves, which are retained profits from past years.

To evade the grasp of this impending advance tax, companies are likely to shield themselves through two distinct strategies: either, by issuing substantial one-time dividends to their shareholders, or, by augmenting their authorized share capital to accommodate the issuance of bonus shares. These bonus shares hold a distinct advantage over cash dividends, as they remain untaxed, unlike their counterparts which bear a 15 per cent tax burden. Mohammed Sohail, speaking to Dawn, opined that the government might also introduce a tax on bonus shares. “ That’s why these companies are in apparent haste to get the exercise done before the end of the fiscal year on June 30”, he added.

Moreover, recent examples have emerged where Gatron Industries (GATI) issued a 100% bonus shares. Few other companies like Tariq Glass, Adamjee Insurance, Faisal Spinning, Bhanero Textile, Gul Ahmed, Maple leaf, Kohinoor Textile, Gharibwal Cement etc) announced board meetings. The market anticipates similar one-time payouts or an increase in authorized capital, creating the necessary space to facilitate the issuance of bonus shares.

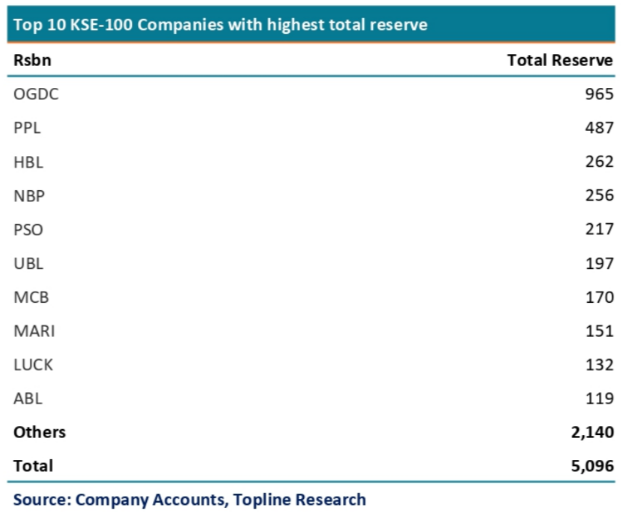

Companies with the highest total reserves on their balance sheets are Oil and Gas Development Company Ltd (Rs965 billion), Pakistan Petroleum Ltd (Rs487 billion), Habib Bank Ltd (Rs262 billion), National Bank of Pakistan Ltd (Rs256 billion) and Pakistan State Oil Company Ltd (Rs217 billion).