It was fast, almost rushed, the way the federal budget was presented and then approved in the National Assembly on Saturday, the 24th of June. Stuck in the confusion of the already presented budget and budget measures, all the stakeholders received a shock when the finance minister pulled up a pile of papers on the Assembly floors that day.

The house that was supposed to accept or reject the deliberated and debated budget from 2 weeks ago, was suddenly presented with another one proposing Rs 415 billion in additional taxes, and a number of new expenditures. A proverbial gun of IMF prior actions, was held to their foreheads as they acted to scour through these documents. The present members, then, without an ounce of deliberation approved the budget. After that they ironically made their way to the airport where a special flight was waiting for them to perform the holy pilgrimage of sacrifice and devotion.

There were bound to be irregularities in a budget approved in the absence of an opposition and the actual president. But let us first see how this budget is different from the one presented a fortnight ago? Why was there a need for a change and will the objective be achieved if these changes are made?

Some Background

Before the weekend had unfolded, the word on the block was that the IMF deal had fallen through. And it was not being said without due cause. After the budget was presented in front of the National Assembly on the 9th of June, the IMF representative for Pakistan, Ester Perez Ruiz, criticised the country’s budgetary preferences.

She said that Pakistan is missing “an opportunity to broaden the tax base in a more progressive way, and the long list of new tax expenditures reduces further the fairness of the tax system and undercuts the resources needed for greater support for vulnerable people.” The move was first followed by a stiff response by Ishaq Dar but in a later statement the government ensured that they would listen to the IMF.

But why is the IMF’s take on the budget important? To begin with, Pakistan has accounted for a huge amount of aid in both the versions of the next year’s budget, a majority of which is predicated on the Fund’s disbursement of its extended fund facility. If the IMF doesn’t mark a check on Pakistan, Pakistan’s bilateral creditors also would not come to our aid, as has been made clear.

Talking to Profit, Senior business journalist Khurram Hussain said that, “Pakistan possesses $4 billion in foreign exchange reserves and $4.7 billion in debt servicing payments between July and December, presuming all rollovers transpire smoothly”. He continues: “If we sustain a zero current account balance, signifying no inflows and no outflows of foreign exchange, then we will exhaust our foreign exchange reserves by or prior to December. The sole method to circumvent this is to get a bailout of somewhere between $4 billion to $5 billion in the ensuing few months.”

To orchestrate that amount without the IMF is almost unattainable under Pakistan’s current credit ratings. This rudimentary mathematical exercise is also predicated on the assumption that Pakistan receives rollovers for its bilateral obligations during this time.

One of our sources on the subject of anonymity added that the IMF wanted purview on the budget to ensure that it would incorporate debt servicing over the next two quarters and that one of the primary reasons for their disapprobation is that the presented budget did not account for this.

A week before the federal budget was presented, Senior Advisor to UNDP Pakistan and former Minister of State, Haroon Sharif, while talking to Profit said that “We don’t have an alternative to a longer term IMF program in the coming years. And if you need that program, the budget needs to be signed off by the fund.”

What is in the new Deal?

It was expected that the federal government would approve the budget before Eid, but such an extent of amendments was not foreseen. The government seems to be on a full path of commitment as it tries to do good with the IMF before Eid as well. And it finally happened. The step that had taken Pakistan months of deliberation, when the time came, got taken within a week. The restrictions on imports were lifted, taxes were hiked, the budget was changed, presented and approved, and finally on the second day of Eid, the IMF announced that even though the previous extended fund facility would not be extended, the fund would give Pakistan another $3 billion dollar worth of a short term loan program.

Revised Revenue Targets and Expenditure Allocations

While the IMF has provided respite to the current account’s crises with its announcement, it is important to have a look at our primary account that was changed for this deal. The government has set a new revenue target of Rs9.415 trillion for the Federal Board of Revenue (FBR), indicating an increase from the earlier target of Rs 9.200 trillion. The provincial share is also expected to rise from Rs 5.276 trillion to Rs 5.390 trillion in the upcoming fiscal year. To mitigate the impact on development budgets, salaries, and pensions of federal government employees, the government plans to reduce running expenditure by Rs 85 billion.

Impact on Budget Deficit

The ministry of Finance believes that the additional taxes, combined with expenditure adjustments, would lead to a reduction in the overall budget deficit. The measures, amounting to Rs 300 billion (Rs215 billion from taxes and Rs 85 billion from expenditure cuts), are expected to alleviate the deficit burden.

Key Tax Impositions

To achieve the revenue targets, the government has passed a revised version of the Finance Bill 2023-24. The bill proposes a number of measures despite the ones that were initially proposed in the Finance Bill 2023-24, that was presented on the 9th of June. These revised measures include:

- Increased Tax on High-Income Individuals: Individuals earning above Rs2.4 million annually will face an additional 2.5% tax.

- Federal Excise Duty on Fertilisers: A 5% Federal Excise Duty has been imposed on fertilisers.

- Property Transaction Tax: A 1% increase in tax on the sale and purchase of property has been introduced.

- Progressive Super Tax: The super tax has been made more progressive, now applicable to all sectors or categories rather than being confined to only 15 sectors. The tax rates range from 1% to 10% based on income brackets.

- Advance Adjustable Withholding Tax: Non-Active Taxpayer List (ATL) individuals making cash withdrawals exceeding Rs 50,000 from banks will face a 0.6% withholding tax, aiming to promote economic documentation and broaden the tax net.

- Withholding Tax on Bonus Shares: Shareholders will pay a 10% withholding tax on bonus shares issued by companies.

- Windfall Gain Tax: A proposal for windfall gain tax has been included in the Finance bill, targeting sectors that have earned exceptional profits due to external factors.

- Energy Inefficient Fan Tax: A Federal Excise Duty of Rs2,000 per fan will be applicable on energy inefficient fans from January 1, 2024, with the intention of promoting energy efficiency.

The Non-tax revenues

Apart from the newly made changes in the finance bill there are also a number of other taxes that were a part of the government’s plans of an already ambitious Rs 9.2 trillion target.

JS Global’s recent report reveals a forecast for Pakistan’s non-tax collection in the upcoming fiscal year. This collection is projected to skyrocket, almost doubling compared to the previous year’s revised base.

In the front line of these revenues is the State Bank of Pakistan (SBP) profits, set to unleash an awe-inspiring triple-fold increase in profits year-on-year. It seems that the SBP has been piling up repurchase agreements at high interest rates. No wonder that the SBP profits in the last fiscal year matched the levels of their nine-month performance from the previous fiscal year. Attributed to the enormous policy rate that is currently in effect, the SBP has all the reasons to expect high profits.

But that’s not all; the government is set to project another boost in revenue, this time coming from the petroleum levy. A mind-boggling 60% YoY growth in this sector has been predicted based on the new finance bill. Even if the growth in petroleum, oil, and lubricant (POL) products remains in the low single digits the target is expected to be met. How? No one really knows.

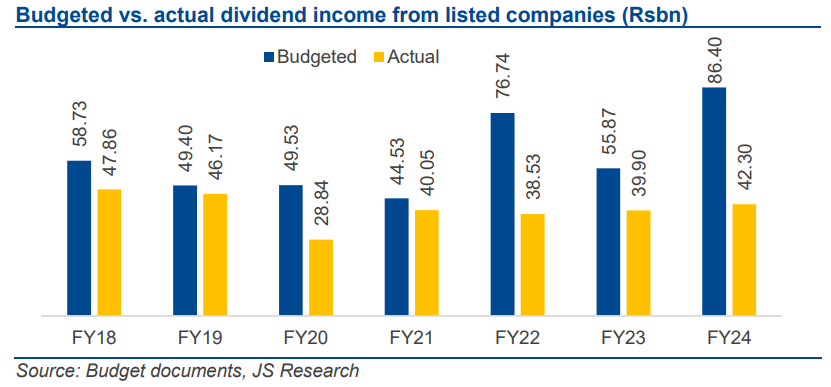

The government also plans on gaining dividend income from listed and unlisted corporations. In the upcoming fiscal year, a heart-pounding 50% YoY increase, totaling Rs 121 billion is projected. This sum constitutes a tantalising 1% of the Rs 12 trillion total revenue size. More than 70% of this dividend frenzy belongs to listed companies, with the crown jewel being none other than Oil & Gas Development Ltd (OGDC), commanding nearly 50% of the total dividends.

However, achieving this ambitious target might just be too difficult, as historical trends show dividends falling short of both corporate announcements and revised government budget figures. In the last fiscal year, the total collection from dividends of listed companies amounted to a mere Rs 27 billion, a stark contrast to the anticipated Rs 56 billion.

Other Key Budget Measures

Apart from the tax impositions, and non tax revenues the government has introduced additional initiatives to address various challenges. Alternative Dispute Resolution Committee (ADRC): The ADRC will be strengthened to resolve 62,000 tax cases worth Rs3.2 trillion pending in courts. A committee comprising retired high court judges, the Chief Commissioner, and a taxpayer nominee will decide these cases.

The proposed levy on diesel and MOGAS has been increased from Rs50 per litre to Rs60 per litre. An allocation of Rs 80 billion has been made to facilitate remittances from overseas Pakistanis, recognizing their importance as valuable assets to the country.

Not the end

The IMF has signed a new program and for now the pressures on the economy might subside. But is the amended budget sustainable? Despite its insistence upon not burdening the people and subsidising the poor, the IMF seems to be appeased with a far fetched budget. One that in no way, shape or form, has aimed to change the status quo. The new budget hence induces amongst the viewers, what is referred to in psychology as a framing bias. A wolf in sheep’s cloth, a monster in disguise, a discernible calamity showcased as relief.

Talking to Profit, an economist at LUMS, Dr. Ali Hasnain stated that, “The $3 billion Stand-By Arrangement (SBA) announced today only reduces the short-term risk of default, gives us time to hold elections in a stable economic environment, and design and build support for a long-term reform plan.”

“The FBR missed its tax collection target this year. The government presented a budget that had to be revised within two weeks. Taxation is more regressive than ever. The State Bank hiked policy rates in an emergency meeting two weeks after a regular meeting. Our balance of payments crisis and external debt are unsustainable. Pakistan Bureau of Statistics data is losing credibility.” added Dr. Hasnain.

As the sun rises on the Monday morning, the 2nd of July, numbers will follow each other to their stock market portals, expecting a bull-run. Many would aim to sell the dollars that they have been holding on to, for the good part of the last one year, and many more would seek solace in mere lunch time debates about how Pakistan has made it once again.

But have we truly made it? The dollar could weaken against the rupee, but only for the very short term; it will eventually gain lost ground again because the fundamentals have not changed. The stock market might have a bull run but will always be a single jolt away from crashing. “True change will likely come when the country’s economic team is held responsible for missteps, and will be built on a different politics from the one we are seeing today. For now, we live quite literally on more borrowed time.” says Dr. Ali Hasnain.

Therefore, it is important to realise that this is not a win, it is merely the aversion to a terrible loss. As the founder of Arif Habib Investments, Nasim Beg aptly puts, “One can only hope that all these individuals in leadership positions will discern the writing on the wall. They should sit down together and work towards a survival strategy in the immediate to midterm, and thereafter concur on structural changes to make the economy self-sustaining for the longer term.”