The IMF deal that came through

The IMF approved a 9-month Stand-By Arrangement (SBA) for Pakistan of $3 arab to support the country and stabilize its teetering economy. The economy has been hit by devastating floods ravaging the country, fiscal and external deficits, falling reserves and rampant inflation. This arrangement will provide some respite from the challenges that the country faces. This arrangement has come at a cost.

Measures to be taken by the government

The IMF has asked the government to carry out certain adjustments in terms of its own fiscal budget which has been presented for FY24 which will look to counter the fiscal deficit the country faces. The country has also been asked to carry out structural reforms which are in relation to the energy sector in terms of the cost of electricity and subsidies being given, better State Owned Enterprise (SOE) governance to lessen some of the burden on the resources of the country and to make the country more resilient to climate change. These are mostly areas where the government has substantial influence and control and can look to develop policies and guidelines which will enable it to meet these goals.

Tighter monetary policy measures

The IMF has also asked for an appropriately tight monetary policy which will look to counter inflation and work for the betterment of the masses. The IMF has asked for a data driven approach in order to tighten the monetary policy which will address much of the inflation that is prevalent in the country. In addition to that, the government has been asked to maintain a market determined exchange rate which will absorb any shocks that take place and limit shortages of Foreign Exchange in the country. This is one area where the government can face some resistance.

Autonomy of State Bank

Ever since the SBP Autonomy Independent Bill of 2021 was passed by the parliament, it has meant that the State Bank has policy and institutional autonomy which implies that monetary and exchange rate policies fall under the purview of the bank alone. The bank will be able to exercise this power by managing the currency reserves that the bank holds and the decision making is free from any influence of the Ministry of Finance and the federal government. The bank has the objective of maintaining inflation in line with the target set by the government. This bank is supposed to work with the government to achieve its goals, however, their decision making process is independent of any direct influence from the government.

Independence of SBP brought into question

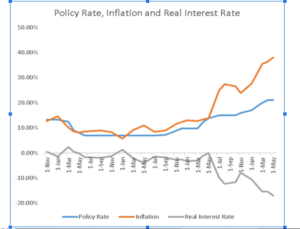

The independence of the SBP has been brought into question recently as an emergency Monetary Policy Committee meeting was held on 26th June 2023 and interest rates were increased by 100 basis points to 22%. The scheduled meeting of the MPC was held on June 12th 2023 where the interest rates were not changed but an emergency meeting was held later where the change was announced. There were rumors around the fact that the policy rate was changed with influence from the government in order to satisfy the IMF as a measure against inflation. The reason given in the press release of the MPC stated that as taxes were being levied in the budget, inflation was expected to increase and this was a measure to limit inflation taking place. In the staff report press release by the IMF, the SBP has agreed that they will be open to an increase in the policy rate further in the future with meetings scheduled in July and later in the year. The pledge is being made as a way to make real policy rate positive which was hovering around -17% in May 2023.

SBP has its own agenda

Experts in the industry feel that SBP is following through on its own mission and that any allegations of interference from the government are misplaced. Yousuf Farooq, Director Research at Chase Securities states that currently governments are borrowing around Rs. 70 to 80 kharabs and banks are prioritizing lending to governments over the private sector. “SBP has been injecting cash through Open Market Operations to fill the gap that exists in the economy which has led to a loose monetary policy despite the high interest rates” Farooq added. In such a condition, it is evident that the central bank will use the policy rate to control inflation. Numair Liaqat, Country Economist at International Growth Centre Pakistan feels that at this juncture, the government and SBP are working towards a common goal of combating inflation and the recent commitment by the central bank is following through on its own policies. He states that “In this case, I would say it’s less the government imposing its policies on the SBP but more the IMF pushing for monetary tightening i.e. increase in interest rates to reduce inflation and to support the rebalancing of external account.

Unsustainable policy rate

Another concern that is dogging the economy is the fact that the policy rate is 22% already which is an all time high and as inflation is persisting, there are chances that the policy rate will be increased in the July MPC. It is evident currently that the economy is seeing back breaking policy rate with industrialists decrying the sky high rates. With SBP pledging that further increases will be kept into consideration, this might prove to be a further jolt to the economy. Investors are worried that the rates are already high and a further increase will make people turn to bank deposits as they are providing much better returns. Farooq agrees that the current situation is unsustainable for businesses which are looking to grow and invest but at this point in time, the SBP has to address the bigger issue which is inflation. Another way the government can look to ease some of these demand pressures is to have a tighter fiscal policy and better tax management.

Mohammed Sohail, CEO of Topline Securities, feels that “the interest rates are high but they will stay at these levels for the short term”. The recent inflation figures show that inflation is on the downward trend and inflation is expected to fall in the coming few months further. In terms of investing in the stock market, the stock market is trading at a multiple of 3 and the rate increase taking place in June 2023 has been incorporated by the market. The recent rally in the market is based on the expectation that inflation will be controlled and are expected to fall in the next 6 to 12 months.