Fast Cables, one of Pakistan’s most well-known electrical cable manufacturers, is looking to raise Rs 3 billion on the secondary market through an Initial Public Offering (IPO). Fast Cable’s IPO comes during a time when a number of companies are looking to capitalise on the positive sentiment that is prevailing in the stock market.

Established in 1985, Fast Cables quickly emerged as a large player in the electrical wiring market by targeting both domestic and commercial customers directly. Up until this point there were very few companies that directly sold electrical cables to consumers who relied on contractors and wholesalers to get unbranded electrical wiring. Fast Cables shook things up in the country’s cable industry and soon bagged a number of large clients particularly in the oil, gas, and telecommunications sectors.

The company went public in December 2008 and is now finally looking to list itself on the stock exchange. The company has manufactured electric wires, conductors and cables with two manufacturing plants being operational. Their main plant is in Lahore.

Revenue and cost breakdown

The question is why is the company going for an IPO in the first place and why now? To understand this we must look closely at their business model The core business of the company is to produce a mix of low voltage cables, medium voltage cables and bare conductors. Around 70 percent of the revenue is derived from low voltage cables. The company saw a rise in sales of around 70 percent across the board between FY 2021 and FY 2022 as revenues increased to Rs. 23 billion from Rs. 14.2 billion.

In terms of the major costs for the company, raw material used in the production contributes to around 90.76 percent of the total cost of production for the company. The main raw material it uses is copper and aluminum which it imports from foreign vendors.

Technical aspects of the IPO

The company is looking to issue 83.5 million ordinary shares which will make up around 25 percent of the post-IPO paid capital of the company. The issue will be carried out with a book building method with a floor price of Rs. 36 per share and a maximum price of Rs. 50.4 per share.

The issue will be broken down as 75 percent of the issue will be given to the bidders while 25 percent will be offered to the retail investors. The manager and underwriter of the issue will be Arif Habib Limited. The date of book building still has to be released by the company after their prospectus has passed the stage of public comments being gathered by the PSX which ends on 17th of August 2023.

Sponsors of the company

Currently, the sponsors of the company are Mian Ghulam Murtaza Shaukat, Ms. Rubina Shaukat, Mr. Kamal Mahmood Amjad Mian and Ms. Mahlaqa Shaukat. The current shareholding of each of the sponsors is given below both pre and post IPO subscription.

Purpose of the Issue

The company is carrying out an IPO in order to acquire capital to utilize in acquisition of new land, construction of state of the art building, installation of new plant and machinery and repayment of debt. In case the company is able to get a strike price higher than Rs. 36, they will utilize these funds in working capital requirements.

Financial Performance of the company

The most recent financial performance of the company shows that revenues have increased steadily from Rs. 5.4 billion in 2018 to 23 billion in 2022 and 9 month unaudited performance has already reached the same levels of revenues for FY 2022-2023. Based on gross margin of 18.5 percent and operating margin of 13.5 percent, the company saw a profit of Rs. 1.3 billion for the most recent 9 months ended.

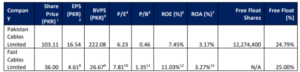

The earnings per share (EPS) of the company was Rs. 4.1/share for the year 2022 and was seen to be around Rs. 5.1/share for the 9 months ended 2023. The breakup value of the share stands at Rs. 29 as at 9 months ended for FY 2022-2023. The price being quoted for the share means that it is expected that the investors will invest in the company at a PE ratio of 8.78 based on EPS of 2022.

Competitor analysis

A competitor for Fast Cables Limited is Pakistan Cables (PCAL) which is already listed in the stock exchange. The revenue for FY 2021-22 for PCL was Rs 21 billion which is similar to Rs. 23 billion earned by Fast Cables. The profit for PCAL for the last year was 828 million while for Fast Cables it was Rs. 1 billion. EPS for PCAL came to around Rs. 23.27 per share while for Fast Cables it was Rs. 4.1/share. Based on market price at June end, the PE ratio for PCAL was around 6 while for Fast Cables it is around 8.78.