A recent conversation over what’s driving inflation got me thinking that Pakistan’s inflationary spiral is partly due to elite consumption and that there is a link between elite consumption and the government’s deficit spending through income distribution. The usual diagnosis that too much money circulating in the economy is repeated ad nauseam. This could be the case but it doesn’t really explain much – not to me at least. I like to look at the details so I thought I should look at the data and see what it throws up! My first inclination was to look at the consumption expenditure and currency in circulation in the economy. So I pulled out the data from the State Bank of Pakistan’s (SBP, Pakistan’s central bank) Handbook of Statistics on Pakistan’s Economy and Economic Surveys of Pakistan to look up the number for the past two decades. I specifically looked at nominal data i.e. numbers not adjusted for inflation or changes in price levels. The next thing to do was to scale it down by the nominal GDP number to get some perspective. The consumption expenditure in the economy is divided into two categories; household final consumption expenditure (HFCE) and general government final consumption expenditure (GGFCE). HFCE records all the consumption expenditure made by households on final goods and services and GGFCE records the same for the government.

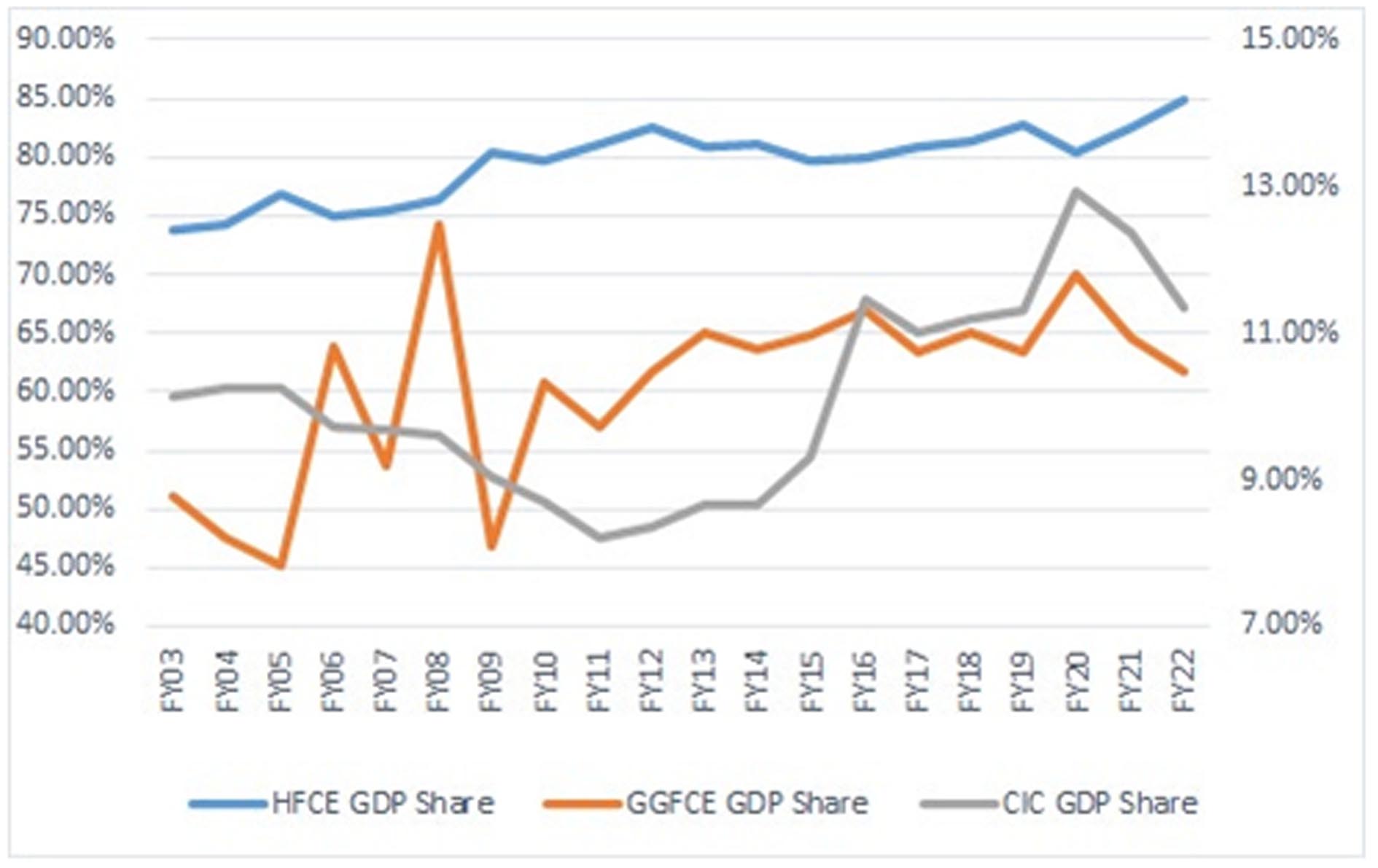

Scaling them down by the nominal GDP gives us figure 1 below. I also thought it would be interesting to see these expenditures side by side with currency-in-circulation (CIC). So I scale down CIC by GDP as well and include it in my graph. CIC is the money issued by the central bank minus what’s been removed by it from an economy. Think of CIC as the water left on the bath floor after taking a shower. You can mop it off but some is always left behind. How much you can clean depends on how good your mop is and how good you are at cleaning the floor! CIC is the same. When the economy (banks more specifically) demands money in the economy the central banks issues it to the banks. As the money is used up for transactions through cheques and cash, it starts to move into the system. It can stay there as cash or bank deposits. When the central bank wants to remove the money from the economy it mops up liquidity from the banking system and induce cash holders to deposit money in the banks. How well can the CB do its job depends on how well banked an economy is i.e. how much its citizens rely on the formal banking channels to carry out their transactions. Let’s return to figure 1 now.

Figure 1: Households and Government’s consumption expenditures as GDP shares with currency in circulation.

Figure 1 shows Household consumption share on the left vertical axis and government consumption and CIC shares on the left vertical axis. First up, we can see that GGFCE and CIC do not exhibit one relationship. They seem to move in opposite directions for the first ten years in our data (FY03 to FY13) after which they move in the same direction. This could be because of the dollar inflow in the first decade of the War on Terror (WoT). These inflows financed government spending and it didn’t need to borrow as much from the SBP to finance its expenditures. HFCE increases steadily from 73% to 85% in the two decades shown here. This is interesting and significant.

The past two decades also mark a shift in the government’s strategy to spur growth in the country. The Shaukat Aziz-led finance ministry (and later the government) in the early 2000s relied on creating a consumption-led growth boom by maintaining low interest and exchange rates financed by foreign inflows. Ever since, successive governments have tried similar strategies to cause short term growth in the economy without really thinking about its negative consequences.

For example, each one of this consumption led boom has followed a bust because once the foreign inflows (mostly aid and loans) dry up, the country runs into a balance of payment crisis i.e. it runs short of dollars to pay for its imports and service its debt. A balance of payment crisis quickly transforms into an inflationary crisis that makes the government run to the IMF. We saw this story from 2008 to 2013 and then more recently since Fall of 2021. An important part of this story is to understand the income distribution in the economy. People with higher incomes consume more.

Pakistan National Human Development Report 2020 calculates that Top 20% share in total national income is at 49.6% while the bottom 60% own 29.7% of the national income. Naturally consumption in the country is concentrated at the top. Burki et. al. shows that the top 10% captured 24% of the total income growth in Pakistan from 2001-02 to 2015-16 as opposed to bottom 50% that captured 32.4% in the same time period. This means that as the economy grows the rich keep getting richer while the poor continue to struggle.

When the government spends money in the economy to spur growth, that money changes into income for firm owners and workers. As we have seen that the rich own most of the income and benefit disproportionately from economic growth, we can safely assume that most of government expenditure is captured by the rich as income. The rich then go on and spend this new income on things that they like to consume – again safe to assume that these consist of luxury imported goods.

I would like to argue that the rich also have a high demand for money because of their desire to park their wealth in the real estate sector. We know this sector is largely undocumented i.e. the transactions documented here do not necessarily get recorded. Further, no taxes are paid either on the transactions or the profits earned by the seller and/or the broker. Both these factors – rich capturing a disproportionate income share and their consumption – can be inflationary if they remain unregulated. Taxing the rich is one way out. But more importantly we need to think seriously about distributing income in the economy in a more equitable manner.

We also need to ensure that growth in income is also equitably distributed. How do we do that will remain a million dollar question for some time to come!

ARE YOU A VICTIM OF CRYPTO SCAMS AND WANT TO GET BACK YOUR STOLEN CRYPTOS!!

Am here to testify the handwork of A Great Verified Hacker ( Mr Morris Gray )Who helped me recover back my lost funds from the hands of scammers who Ripped me off my money and made me helpless, I could not afford to pay my bills after the whole incident, But a friend of mine helped me out by given me the contact info of trusted Recovery Expert, his email: Morris gray 830 @ gmail . com contact him or chat him up on (+1- /607-69 )8-0239 ) and he will help you recover your lost funds If you have been a victim of any binary/ cryptocurrency or online scam, Mobile spy, Mobile Hack contact this Trusted and Verified hacker, He is highly recommendable and was efficient in getting my lost funds back, 11btc of my lost funds was refunded back with his help, He is the Best in Hacking jobs, contact him ( MORRIS GRAY 830 AT) GMAIL (DOT) COM…..!!!

Its really a good job.