A mere fortnight short of a precise four-month period since the initiation of its sale, Shell Pakistan (SPL) has at last found a purchaser, enabling Shell Petroleum Company (SPCo) to bid a definitive adieu to Pakistan. The conclusion to this protracted narrative has been brought about by Wafi Energy, a Saudi-based oil marketing firm.

“SPCo, a subsidiary of Shell PLC, has agreed to sell its 77.42% majority interest in SPL to Wafi Energy,” stated the company. Wafi will also acquire 11.29% of SPL’s shares from additional shareholders as part of a tender offer.

“The sale is part of Shell’s strategy to high-grade its mobility network and was first announced on Capital Markets Day in June 2023. The sale is expected to complete by Q4 2024, subject to regulatory approvals. Upon completion, the Shell brand will remain in Pakistan through brand licensing agreements and customers will continue to have access to Shell’s premium fuel and lubricant portfolio. SPL remains committed to delivering safe, reliable operations,” the company added.

So, who exactly is Wafi Energy? A wholly-owned subsidiary of Asyad Holding Group, Wafi Energy is a fuel retailer in the Kingdom of Saudi Arabia. The company already enjoys a collaborative relationship with Shell, having signed a license agreement to operate mobility sites under the Shell brand within the kingdom.

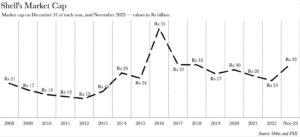

The weighted average share price of SPL over the 28 days preceding the public announcement of intention stood at Rs 155.51. This valuation pegs SPL’s market cap at Rs 33 billion at the time of the share price agreement.

“It’s commendable that we identified a foreign entity for this transaction, thus circumventing any outflow of foreign exchange and preserving our own foreign exchange reserves,” remarks Ahfaz Mustafa, CEO of Ismail Iqbal Securities.

Arif Habib Limited is the transaction advisor for the deal. Neither Arif Habib nor SPL have issued any response regarding the deal thus far.

Before we delve into what lies ahead, let’s take a moment to recapitulate the entire saga up until this point.

The Shell saga

Our story begins on June 14 when SPL disclosed that its parent company, SPCo, had resolved to sever its ties with Pakistan and extricate itself from the market. This publication has previously delved into the reasons behind SPCo’s decision in considerable depth.

Read more: Shell is exiting Pakistan. What does it mean and what could the transaction look like?

In essence, Shell was undergoing a realignment of its global operations. As part of this strategic shift, it was downsizing in certain markets and withdrawing entirely from others. Pakistan, as it happened, fell into the latter category. Thus, a relationship that had its roots in 1903 and included Mohammad Rafi crafting a jingle for the company, drew to a close.

Shell’s first — and to date, only — local bidder(s) emerged in the unlikely pairing of Pakistan Refinery and Airlink. The duo submitted a bid for the company on July 17, and this publication once again documented the rationale behind such disparate sectors converging.

Read more: Pakistan Refinery Limited, and Airlink make joint play for Shell

The news initially struck many as peculiar due to the unusual pairing. However, the nature of the two companies and their subsequent rejection by Shell provided a glimpse into what the final transaction might entail. Among the various financing options proposed by the two companies was the prospect of settling the entire transaction overseas, given that Airlink had subsidiaries abroad. This marked the first indication that an overseas settlement might be a more pragmatic approach to executing the deal, considering the arduous task of remitting money to SPCo amidst Pakistan’s perennial balance of payments crises.

The subsequent bid for the company arrived on October 16 from a British oil energy conglomerate: Prax. The bid was tabled on a Monday, following an entire weekend of speculation that Saudi Arabia’s Aramco might be interested in bidding for the company. Once again, this publication covered the details of both events.

Read more: A bid from Prax, and interest from Aramco; what’s going on with Shell?

It was in the wake of these developments that a consensus emerged: a foreign party would likely be SPL’s buyer. Fast forward to October 30 when SPL announced it had received interest from Wafi Energy. Merely 24 hours later, on November 1, SPL declared that it had entered into a share purchase agreement.

What happens next

Let’s address the proverbial elephant in the room: the pace of the transaction. The purpose of declarations of intent prior to actual share purchase agreements is to allow the acquirer to conduct necessary due diligence before placing a bid.

“The speed of the transaction is remarkable. However, given SPL’s status as a listed entity, its financial records are open to all. Moreover, Wafi operates in the same industry, so they would already have a sound understanding of the business landscape,” Mustafa elaborates in regards to Wafi having the time to conduct the necessary due diligence for SPL.

Now, onto what happens next.

The fact that neither the seller nor the buyer are Pakistani does not exempt them from Pakistani law. The transaction involves a Pakistani asset, and therefore, Pakistani laws will apply. So, which laws will govern the transaction moving forward? The Competition (Merger Control) Regulations (2016), and The Listed Companies (Substantial Acquisition of Shares) Regulations (2017), framed under the Securities Act (2015 to be precise.

A pre-merger clearance must be obtained prior to the consummation of a merger. These are typically processed within a stipulated timeframe by the Competition Commission of Pakistan (CCP). This process also encompasses two review phases.

“A Phase I review must be completed within 30 days,” states Salman Ijaz, Partner at KhanIjaz. “If the CCP determines that it needs to delve deeper and wishes to advance the application into a Phase II review, it must notify the parties within the same 30-day window,” he further clarifies. “Phase II reviews are exceedingly rare,” he notes. “A Phase II review grants the CCP an additional 90 days to scrutinise the application,” he adds.

“If they fail to reach a decision within those 90 days, a no objection is deemed to have been granted,” explains Ijaz. “While clearance must be obtained prior to the consummation of a merger, the CCP has also considered condonation applications in instances where parties have proceeded with transactions without adhering to the Competition Act and Merger Control regulations. However, this is certainly not best practice and should be avoided,” Ijaz cautions. “The final transfer of securities is set to occur 76 days post-public announcement of the offer,” Ijaz elaborates regarding The Listed Companies (Substantial Acquisition of Shares) Regulations 2017.

In terms of other intriguing tidbits, no court approval will be required for this matter. There’s no need for court approval because this is transpiring pursuant to a share purchase agreement, and because it is not occurring pursuant to a scheme of arrangement or merger.

As for potential major changes to Shell’s management structure in the near future, it seems improbable. Changes to the board typically occur after share transfers have been completed. The current share purchase agreement does not imply that shares have already been transferred; it simply signifies an agreement on terms for future share transfers.

Will we lose the Shell brand name at our local pump?

Firstly, while SPCo may be exiting Pakistan, SPL is not. The transaction merely alters the identity of the individual or company holding the majority shares in SPL. SPL’s contracts with third parties and its properties will remain intact. Whether the Shell brand name will persist is another matter, but it’s plausible that it might.

Wafi Energy garnered attention last year when it entered the Saudi mobility market via a trademark licensing agreement with Shell. It wouldn’t be entirely unexpected for the company to establish a similar arrangement with SPCo here as well.

The capital gains tax question

In terms of taxation, the only likely tax on the transaction is capital gains tax. However, capital gains tax is not applicable to transactions where the holding period surpasses six years, making its applicability to the SPL transaction seem improbable.