On October 18, in a surprising turn of events, the CEO of U Microfinance Bank (Ubank) Kabeer Naqvi, decided to resign. Naqvi had been steering the ship at Ubank since 2015, serving as both president and CEO.

Just a day later on October 19, Mohamed Essa Al Taheri was announced as the acting president and CEO of UBank, according to a press release by the bank, Al Taheri has been associated with Ubank as a member of the board of directors.

With the leadership shift at UBank, a wave of online rumours and speculations surged regarding the financial stability of both UBank and UPaisa. Whispers grew louder, suggesting that their capital reserves were perilously teetering on the brink of negativity. The situation escalated so rapidly that a buzz swept through the digital realm, urging depositors to pull their funds from UBank. Immediately after, PTCL group, the parent company of UBank and UBank itself addressed the ongoing speculations through a press release, calling the claims baseless and unfounded.

But who exactly are these depositors? Let’s find out.

Ubank’s strategy

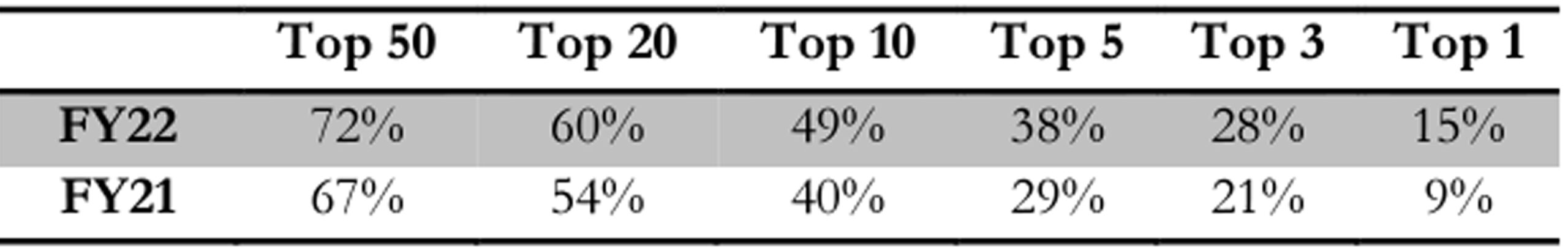

Under Kabeer Naqvi’s leadership, Ubank had a unique strategy for boosting its deposits. The focus was primarily on institutional deposits, with the top five depositors contributing a whopping 38% of the total deposits, and the top 10 accounting for nearly half.

In addition, the deposits were attracted under a quid pro quo arrangement. These deposits were in a sort of give-and-take arrangement, where any funds received from a financial institution were funnelled right back into the same institution. Furthermore, these deposited funds were heavily concentrated, ranging from 25% to a staggering 77% of the fund’s assets.

While the UBank credit rating highlighted the concentration risk, the rating reports of funds do not mention that UBank is the largest investor in these funds.

So what was happening?

Financial institutions such as Faysal Asset Management, NBP Funds, Allied Bank Limited (ABL) Funds, etc seemed to have discovered a perpetual motion machine to inflate their balance sheet and in turn balance sheet of Ubank as well.

In the Profit article “Grow your company size by 3 to 6 times in just months. At least two Pakistani companies have done this & you can too. Here is how”, we hinted that UBank and other financial institutions have discovered a method to inflate their balance sheets.

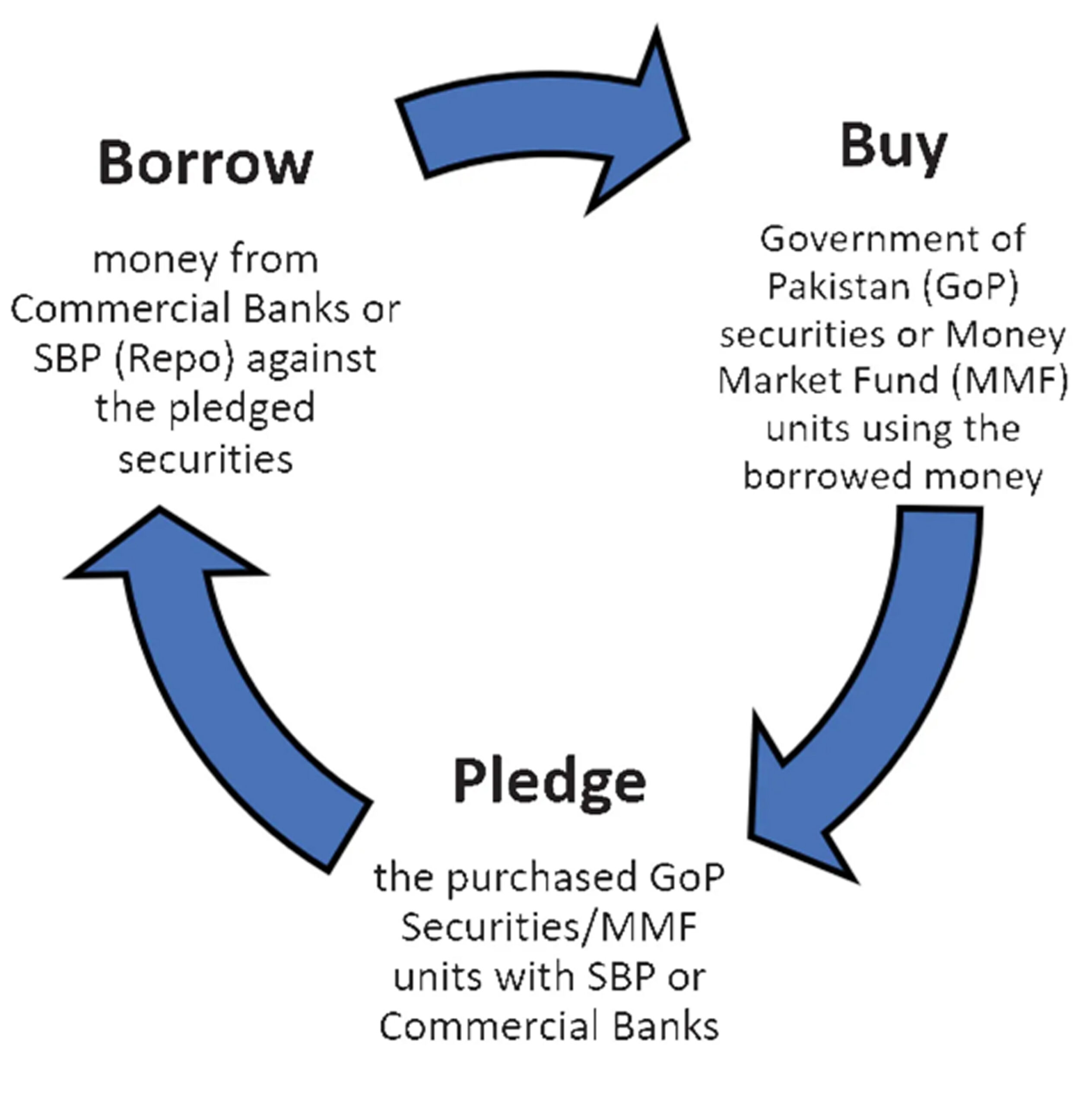

Here’s how that method would work. Let’s say Faysal Asset Management placed a deposit with UBank. UBank essentially used its deposits to purchase money market mutual funds or government securities (T-bills). Then, it pledged those very T-bills to the same banks or even a third-party bank, allowing UBank to borrow additional funds with a small margin. With the borrowed money in hand, UBank repeated the process of purchasing more T-bills.

This cycle continued, spinning a web of financial manoeuvring to such a degree that while the size of assets increased from Rs 10,458 crore in 2021 to Rs 22,130 crore in 2022, net assets declined from Rs 749 crore in 2021 to around Rs 709 crore in 2022, a decrease of Rs 40 crore.

The result? Ubank’s financial statements grew by three times within a year!

Where did the deposits come from?

But for all of this to happen, Ubank needed deposits.

Unlike other big telecom-based microfinance banks, like Telenor Microfinance Bank and Mobilink Microfinance Bank, that had set their sights on branchless banking, U Bank took a more conventional brick-and-mortar strategy.

Naqvi had been spearheading an ambitious campaign to open new branches in urban cities like Karachi, Lahore and Islamabad. In a previous interview with Profit in June 2023, Naqvi said, “We did not try to turn it into a telecom company. We said that this is a bank, and its mission is microfinance. Just like a bank, its balance sheet will grow. It will have liquidity, strong cash reserves, a treasury function, Islamic banking, digital banking, and even conventional microfinance. It will also have an urban unit responsible for deposit mobilisation. If all these elements are in place, (only then) will this institution thrive and last for the next hundred years”. These new branches were essentially to bring in low-cost deposits.

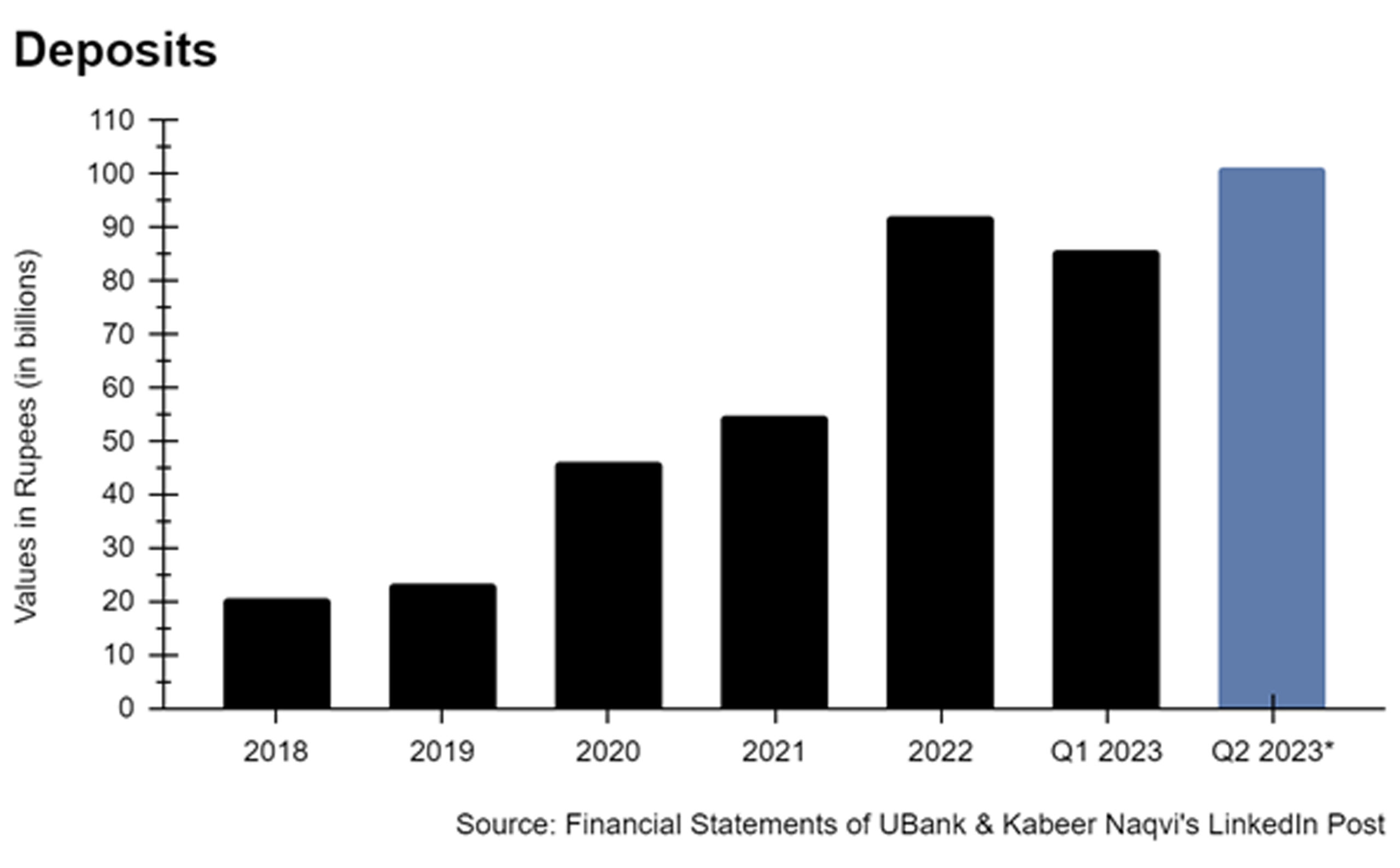

{Note: Ubank is yet to release its second quarter’s financial statement. The value for Q2 2023’s deposits have been taken from Kabeer Naqvi’s linkedIn post that said that UBank’s deposits have crossed Rs.100 billion}

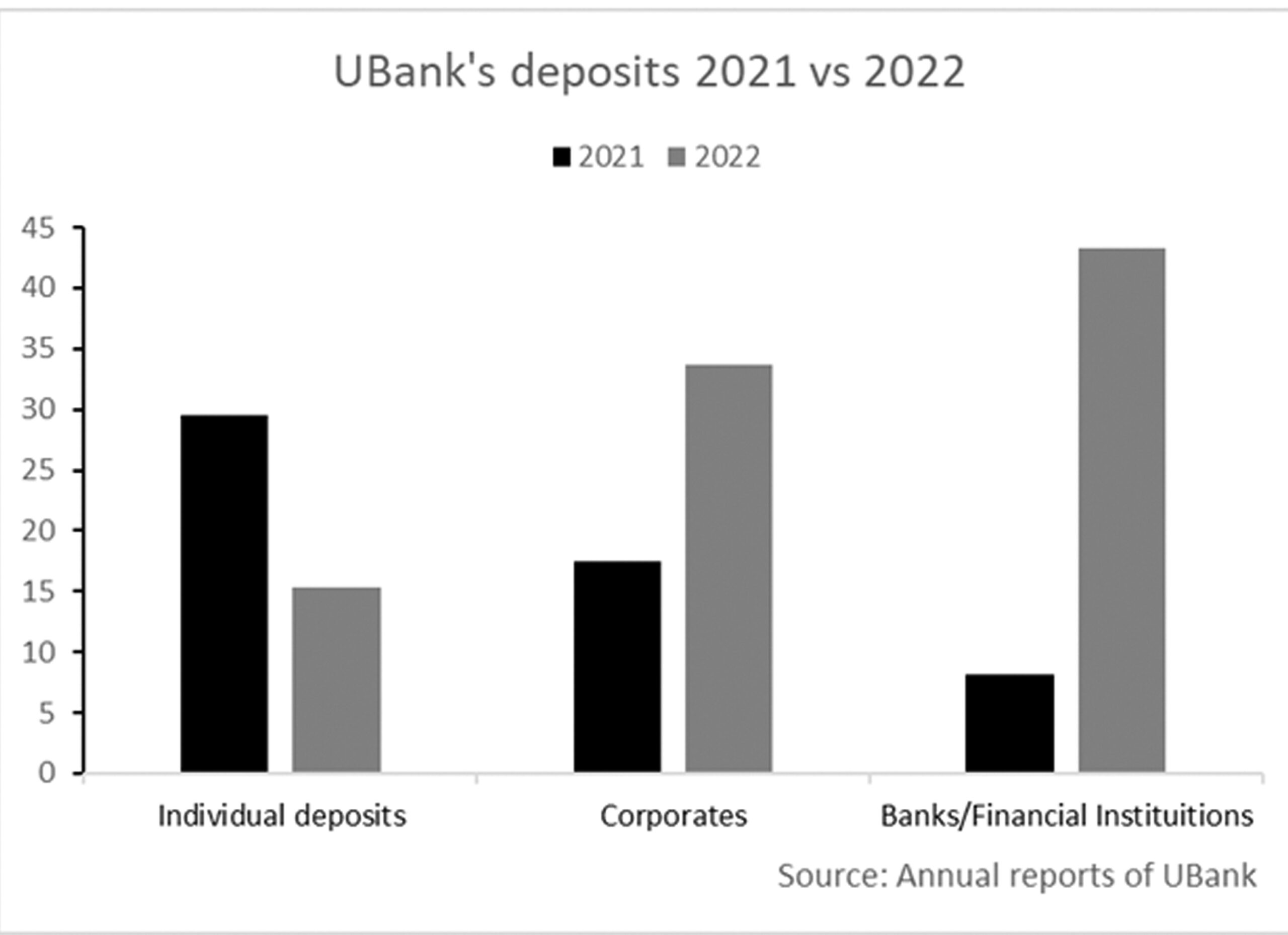

The deposits did increase but the bank mostly attracted high-cost deposits from other banks and firms.

This shows that deposits at UBank are not growing organically. This is because these are not sticky retail deposits. The deposits are hot money i.e., from financial institutions that are being used in the perpetual motion machine to inflate the books of both UBank as well as those asset managers.

According to the VIS credit report of March 31, 2023, UBank had a high concentration risk. The report said “Concentration risk emanating from deposits portfolio is high as the share of top-50 depositors was significant; moreover, the same is on a higher side in comparison to the majority of industry peers. Top 5 depositors including CDC-Trustee NBP FSIF, CDC Trustee Faysal IGF, DCCL Trustee JS MICR, CDC Trustee HBL and CDC Trustee FAYSAL accounted for 38% (FY21: 29%) of total deposit mix.”

“Although overall concentration amongst top deposits is high, comfort is drawn from satisfactory ADR (advance to deposit) ratio and sound long-standing customer relations with the major depositors. The decline in related parties’ deposits proportion to 7.0% (FY21: 10.5%) further adds to the withdrawal risk faced by the Bank. In addition, the proportion of institutional deposits is also sizable and has increased significantly to 83% (FY21: 46%) at the end of FY22. Therefore, in terms of granularity, Ubank compares unfavourably to other microfinance banks.”

Two things to note here:

- The top five depositors are asset managers NBP Financial Sector Income Fund (NBP FSIF), Faysal Income and Growth Fund (Faysal IGF), JS Microfinance Fund (MICR) followed by the two banks Habib Bank Limited (HBL) and Faysal Bank. They comprise 38% of the Rs 92 billion deposit base, meaning that Rs 35 billion are deposited by these five financial institutions. That would translate into an average of Rs 7 billion per institution.

- As per the last sentence, institutional depositors comprise 83% of the total deposits, up from 46% a year ago. This is hot money for the perpetual motion machine. While having such institutional deposits may be a cause for celebration for a money market fund or a hedge fund, this is a cause for concern for a microfinance bank. Ubank’s risk profile has gone through the roof.

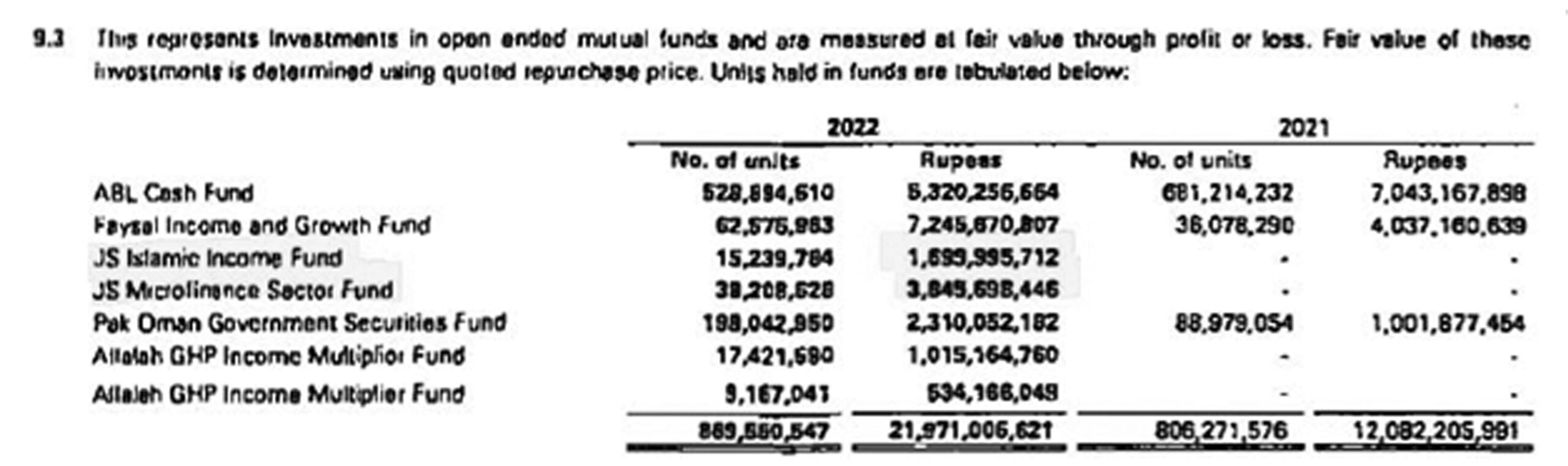

According to the annual report of 2022 of UBank, the microfinance bank had invested Rs 3.8 billion in JS Microfinance Sector Fund and Rs 1.7 billion in JS Islamic Income Fund.

The VIS report highlighted that MICR is one of the biggest depositors of UBank. In other words, JS funds are the largest depositors of UBank and UBank is the largest investor in JS Funds. UBank had invested Rs 5 billion in JS’s mutual funds including Rs.3.8 billion in JS Microfinance Sector Fund. In return, JS places the same funds back with UBank becoming one of its largest depositors, according to the VIS report.

The VIS report highlighted that MICR is one of the biggest depositors of UBank. In other words, JS funds are the largest depositors of UBank and UBank is the largest investor in JS Funds. UBank had invested Rs 5 billion in JS’s mutual funds including Rs.3.8 billion in JS Microfinance Sector Fund. In return, JS places the same funds back with UBank becoming one of its largest depositors, according to the VIS report.

Interestingly, according to JS funds manager report, JS MICR’s total assets at the end of 2022 were Rs 8.6 billion. This means that UBank’s investment accounted for 44% of the JS Fund. Similarly, Ubank’s investment of Rs 1.7 billion comprises 70% of the assets of JS Islamic Income Fund, as total assets at the end of 2022 for JS Income Fund amounted to Rs 2.6 billion.

It appears that UBank is the key sponsor of JS Microfinance and JS Islamic Income fund, financing 44% and 70% of their assets respectively.

Similarly, in the 2022 investment, UBank’s largest investment at the end of 2022 was at Faysal IGF, with an investment of Rs 7.2 billion. In other words, Faysal IGF accounted for around one third of Ubank’s total investments in mutual funds.

UBank had invested Rs 7 billion in Faysal IGF in Dec 2022 and in return, Faysal is the top five depositor most likely placing the same Rs 7 billion with UBank. That is not all. According to the fund manager report of Faysal IGF, the net assets of IGF are Rs.8.3 billion. At Rs 7.2 billion, UBank’s investment comprises 87% of IGF. At the end of March 2023, the total assets of Faysal IGF were Rs 9 billion. Assuming an average of Rs 7 billion placed by each of the top depositors, Faysal IGF had placed 78% of its assets with UBank.

Can you see the pattern here? Again, Faysal IGF is one of the largest depositors of UBank and in turn, UBank is the largest investor in Faysal IGF.

The last two of the top five depositors are HBL and Faysal Bank. Not only is Faysal Asset Management placing deposits with UBank, but Faysal Bank is also placing deposits with it.

We do not know what UBank is using these funds for, but it would be safe to assume that the relationship would be circular. Why would NBP, HBL, and Faysal place deposits with UBank unless there is some quid pro quo arrangement?

A senior official from one of the depositors told Profit that UBank was giving better rates than other microfinance banks. “We as asset management companies (AMCs) want to get the best returns for clients. So we give them placements. In return, to safeguard some of the concerns in the micro space (seeing Telenor, Khushali, Finca), UBank gave some deposits as well so that our confidence grows in them.” He further mentioned that extra AUMs also help. This resulted in a win-win for AMC that they get good deposit rates and AUMs and a win-win for UBank that it has enough deposits to lend (above and beyond their deposits back to the AMC) at higher spreads.

(Assets under management (AUM) is the total market value of the investments managed by a person or entity on behalf of investors. AUM fluctuates to reflect the flow of money in and out of a fund and the price performance of the assets).

The senior official further mentioned that this is a good business model which only fails if you have too many non-performing loans (NPLs), otherwise spreads-wise and higher deposits make for good profits.

Profit also reached out to UBank but received no response till the filing.

The quid pro quo arrangement between depositors, specifically asset management companies (AMCs) rather than banks, works like this: AMCs deposit their funds with UBank in exchange for favourable interest rates. UBank then utilizes these deposits to purchase units of AMCs, ultimately boosting the Assets Under Management (AUM) for these companies. This setup creates a mutually beneficial scenario.

The key advantage here is that if an AMC wishes to withdraw their deposits, it won’t trigger a liquidity crisis for UBank. Why, you might ask? Well, even if UBank faces a temporary liquidity shortage, it can readily liquidate the units it holds from the AMC to meet its liquidity requirements. Consequently, there’s no cause for concern in this situation.

However, the situation differs when it comes to traditional banks. Banks typically receive deposits and lend out a substantial portion of these funds. If a large number of depositors suddenly decide to withdraw their money, which is commonly referred to as a bank run, the bank might face liquidity problems because it has lent out a significant portion of the deposited funds.

In the case of UBank, the deposits from AMCs would only pose a challenge if UBank had engaged in lending activities. Nevertheless, UBank has taken a prudent approach by safeguarding the deposited funds and not extending loans. Instead, it has chosen to reinvest these funds with AMCs. As a result, generating liquidity isn’t an issue for UBank in these circumstances.

It is also important to mention that as per a casual survey conducted by Profit, individual depositors have thus far not encountered any difficulties when withdrawing their deposits from UBank.

In a previous conversation with Profit, Naqvi had said that the increased borrowing was due to Ubank’s newly added treasury and corporate finance vertical. Through this vertical, UBank aims to be the first microfinance bank with an active treasury just like commercial banks. “It will provide UBank with arbitrage opportunities,” Naqvi said. The borrowing activities of UBank encompass syndicated loans, bilateral loans, and bonds, with Naqvi referring to it as a “beautiful bouquet”. Initial borrowing was secured against the loan book, while subsequent borrowing was supported by pledged investments, fostering stronger relationships with banks.

“I am building relationships with banks. And over time, they will start lending to me against my advances rather than government-backed securities. One or two banks are already comfortable enough with us to start doing this”, Naqvi added.

The VIS credit report also highlighted that while the microfinance bank had a high concentration risk, comfort was sought from “sound long-standing customer relations with the major depositors”.

Conclusion

What we have seen is that three of the top five depositors are mutual funds. The placements they have made with UBank appear as cash in Fund Manager Reports and not placement i.e., the asset managers can withdraw the money at short notice. Thus, at the first sign of trouble, these deposits could be withdrawn.

With the ongoing speculation about UBank’s equity, there’s a looming possibility that its deposits could decrease significantly. There is a possibility that in the December 2023 financial statements, UBank’s deposits will have been reduced by 38%, or even halved. This is because the top 10 institutional deposits account for 50% of UBank’s total deposits, and this could lead to a significant reduction from the celebrated Rs 100 billion figure touted by Kabeer Naqvi. There is also a possibility that by year-end, PTCL Group will restore confidence in UBank, and any deposits that left the bank will return.

The same senior official from one of the depositors of UBank commented that everything will be clear once UBank publish accounts which are expected around mid-November. Furthermore, the official mentioned that, in line with the statement by the CEO of PTCL, there is no requirement for an additional infusion of equity into UBank.

For now, the future of UBank remains shrouded in mystery, as the institution is yet to release its 2023 second-quarter financial statements. Thus we will have to wait till next year, when the year-end 2023 audited accounts of UBank are published, to see what happened.

*Additional reporting by Mariam Umar

loans chaya th

Excellent analysis on Ubank’s financial situation and upcoming expected outcomes.

Excellent ..

Thank you for sharing this content

The growth was basically nothing but window dressing. From 2nd quarter the bank started to reduce their securities portfolio and bank borrowings while showing an increase in deposits. Now I understand that it was nothin but a rerouting.

good

I need loan

by your report it seems that ubank is not a good investment opportunity for small investor looking to get better return on monthly basis as it is now offering 22.5 for an year on monthly basis.